COVER

2023: INEC Warns Judges against Partisanship

By Jude Opara, Abuja

Ahead of the 2023 general elections, the Independent National Electoral Commission (INEC) has urged the judiciary to ensure that Nigerians were not disappointed with their actions, especially with regards to pre and post election litigations.

INEC Chairman, Prof.

Mahmood Yakubu gave the charge in his opening remarks at the Capacity Building Workshop for Justices and Judges on Election Matters yesterday.Yakubu noted that while politicians by the nature of their interest are always partisan, both INEC and the judges must ensure that they were neutral in all their activities.

“The job of the politician is intensely partisan. Our work (the judiciary and INEC) requires absolute neutrality.

We will not disappoint Nigerians”.The INEC boss further noted that the import of the workshop is to sensitize the judges on what is expected of them adding that similar exercises in previous elections to a great extent reduces the number of post election litigations.

He said it is gratifying that the judiciary and the Commission are collaborating to ensure that the forthcoming general elections were conducted in line with the letters of the Electoral Act 2022.

“Some of you here may recall that prior to the 2019 General Election, a similar workshop was held in which the Commission interacted with the judiciary on the adjudication of post-election disputes. The workshop in no small measure led to a better appreciation of the electoral processes, reduction in the spate of conflicting judgements as well as consequential reduction in the number of elections nullified and/or overturned after the election. I am glad that the judiciary and the Commission are once again collaborating on the eve of the forthcoming General Election. Let me therefore express our profound appreciation to the Chief Justice of Nigeria, Hon. Justice Olukayode Ariwoola GCON, and other heads of courts for the sustained collaboration with the Commission.

“I have no doubt that this workshop will enhance the understanding of INEC’s processes, especially the innovations introduced pursuant to the enactment of the Electoral Act 2022 which came into force on 25th February 2022.

“The new Electoral Act contains 80 new provisions intended to improve our elections and address some of the lacunae in the repealed Electoral Act 2010 (as amended), provide legal backing to the technological innovations introduced by the Commission overtime and the extension of timelines for the nomination of candidates and for other electoral activities. Similarly, the new Electoral Act confers exclusive jurisdiction to hear pre-election cases on the Federal High Court with regard to candidate nomination in order to reduce forum shopping by litigants, abuse of court process and reduction in the spate of conflicting judgements by courts of coordinate jurisdiction. We are reassured by the inspiring speech by My Lord the President of the Court of Appeal for the elaborate steps taken against conflicting judgement by Courts of coordinate jurisdiction”.

Yakubu particularly noted that a similar workshop organized ahead of the 2019 general election ensured a sharp reduction in the number of cases arising from that election and consequently a reduced number of elections nullified by the Election Petition Tribunals, comparing with the 2015 exercise.

“For instance, 30 elections were upturned by the Tribunals in 2019 as against over 100 in a previous election. Even so, in 23 out of 30 constituencies (i.e. 76%) the elections were only set aside in some polling units and not the wholesale nullification of elections in entire constituencies.

“We have studied the judgements of the Tribunals arising from both the 2019 General Election, the off-cycle Governorship elections and the bye-elections conducted so far. We identified areas where we need to do more to reduce litigations. As a result, we are witnessing increasingly less Court cases challenging the conduct of elections by the Commission”.

However, the Chief Electoral Umpire regretted that cases arising from the conduct of primaries for the nomination of candidates by political parties is on the increase, with about 600 cases relating to the conduct of recent primaries and nomination of candidates by political parties for the 2023 General Election.

“Only two weeks ago, one political party served about 70 Court processes on the Commission in one day seeking to compel us to accept the nomination or substitution of its candidates long after the deadline provided in the Timetable and Schedule of Activities for the 2023 General Election had elapsed. Some of the cases will go up to the Supreme Court. The implication is that we are still dealing with issues of nomination of candidates thereby eating into vital rime for preparation of and procurement of sensitive materials for the materials. It also means that the Courts will be dealing with the same issues long after the General Election”.

Yakubu also reassured the judiciary that INEC will continue to abide by Court orders, even as he appealed against the issuance of conflicting and even frivolous court orders by some judges.

COVER

NDLEA Arrests Drug Kingpin after Three-year Manhunt

By David Torough, Abuja

Operatives of the National Drug Law Enforcement Agency (NDLEA) have arrested a notorious drug kingpin, Sunday Ibigide, in Delta State, three years after he went into hiding. The 36-year-old suspect was nabbed while attempting to distribute 250 blocks of cannabis (skunk) weighing 138 kilograms, using his distribution bus.

According to NDLEA spokesperson Femi Babafemi, Ibigide had been on the run since March 19, 2022, when he was linked to a seizure of 24. 137kg of cannabis and 10 grams of molly. He was eventually apprehended on August 10, 2025, along with an accomplice, Clement Osuya (27).In a separate operation, NDLEA agents, supported by the military and local vigilantes, raided three cannabis farms in Enugu Ezike, Enugu State. The operation led to the destruction of 37,500kg of cannabis grown across 15 hectares and the arrest of six suspects. An additional 74.5kg was recovered for prosecution.Still in Enugu, patrol officers on August 16 intercepted 20,700 pills of tramadol and cocodamol from one Emmanuel Ayogu (53) and arrested two others, Nsubechukwu Achidde (24) and Osiaja Frank (41), with 27.6kg of skunk at New Market.In Lagos, operatives arrested a mother and son duo, Muyibat Mumuni (52) and Faruk Mumuni (25), with 298 blocks of “Ghana Loud” cannabis weighing 149kg at Mushin on August 13. Another suspect, Emmanuel Samuel, was caught in Ajah, Lekki, with 8.5kg of Canadian Loud.In one of the largest interceptions this year, NDLEA at Onne Port, Rivers State, recovered 875,000 bottles of codeine syrup (worth over N6.1 billion) and 3.5 million pills of tramadol and benzhexol (valued at N1.7 billion) during a joint examination of five containers with Customs and other security agencies on August 13 and 14.Other major operations included: Edo State: 432kg of cannabis recovered along Warake–Auchi Road, and 130kg seized in Sobe, Owan West LGA.Kano State: Two suspects, Tahiru Manga (25) and Ibrahim Audu (47), caught with 92kg of cannabis on Zaria–Kano Road.Gombe State: 128,000 tramadol capsules seized from Sani Mohammed (32) on August 11.Kogi State: 337,800 tramadol capsules recovered from a commercial bus driven by Sulaiman Oyedokun (47).Taraba State: 11,250kg of cannabis destroyed in Tanmiya forest on August 12; 29,840 tramadol capsules seized in Wukari.Kaduna State: Four suspects arrested with 22,640 tramadol/rohypnol pills and 111.1kg of cannabis.Lagos–Badagry Highway: 4,320 ampoules of ketamine injection intercepted on August 11, with one suspect, Akeem Adegun, arrested.Meanwhile, the agency intensified its War Against Drug Abuse (WADA) campaign through outreach to traditional rulers, including former Head of State Gen. Abdulsalami Abubakar, the Emir of Borgu, Emir of Lafia, and Shehu of Borno.NDLEA Chairman/CEO, Brig. Gen. Mohamed Buba Marwa (Rtd), praised operatives across Delta, Rivers, Enugu, Lagos, Kogi, Kano, Edo, Gombe, Taraba, Kaduna, and Seme Commands for their commitment. He urged continued vigilance and adherence to the agency’s balanced approach to drug control.COVER

SEC Holds Summit on Municipal Bonds, Sukuk, Sept 29

By Tony Obiechina, Abuja

The Senate Committee on Capital Markets and Institutions in collaboration with the Securities and Exchange Commission is set to hold a national stakeholders summit on Municipal Bonds and Sukuk for Local Government Infrastructural Development next month.According to the Chairman, Senate Committee on Capital Market and Institutions, Osita Izunaso, the summit themed “$1 Trillion Nigerian Economy: Infrastructure Financing through the Capital Market”, scheduled for September 29, in Uyo, will bring together key players from government, regulators, investors, and the private sector to explore how municipal bonds and Sukuk can unlock new funding for roads, healthcare, housing, water, education, and transport at the local government level.

These instruments, Izunaso stated, offer sustainable, market-based alternatives to traditional funding and have been successfully deployed globally.The Chairman stressed that empowering local governments through the capital market will reduce reliance on federal allocations, promote fiscal independence, create jobs, and accelerate Nigeria’s progress toward a $1 trillion economy.Also commenting on the workshop, Director General of the Securities and Exchange Commission, Dr. Emomotimi Agama stated that Nigeria’s infrastructure gap demands capital market solutions like bonds and Sukuk which provide long-term funding with stable investor returns.He said, “Infrastructural gap in Nigeria can be met effectively through Capital Market Funding adding that the summit is one of the ways to create awareness for stakeholders on some of the benefits of municipal bonds and sukuk among others”.According to the SEC DG, bonds are essentially long-term debt instruments in any structured economy geared primarily to guarantee access to potential resources for the government or company’s infrastructure / developmental purposes and also provide an outlet for investors to enjoy stable returns.Agama stated that the Nigerian bond market has become more popular as the same is being embraced by Governments and corporate institutions to raise funds for crucial projects and business expansion/working capital requirements respectively.“In view of the paucity of revenue to finance necessary developmental infrastructure and services in the country in recent times, the government at all levels need to take advantage of the opportunity available in the capital market through the issuance of bonds to access funds for developmental purposes” he stated.The summit’s primary goal is to explore how Nigeria can build a robust municipal bond and Sukuk market to support local government infrastructure.By gathering key stakeholders from the public and private sectors, the summit will aim to: Educate stakeholders about the benefits and potential of municipal bonds and Sukuk as effective financing tools for local governments: Identify and address challenges faced by local governments in accessing capital markets for infrastructure financing.The event also seeks to create a comprehensive strategy for developing a well-functioning municipal bond and Sukuk market in Nigeria that is adaptable to the country’s local government framework and Promote collaboration among government agencies, financial institutions, investors, and other market participants.This will help to create a sustainable financing ecosystem for local governments and provide actionable policy recommendations and regulatory reforms that would enable and facilitate the issuance of municipal bonds and sukuk by local government.COVER

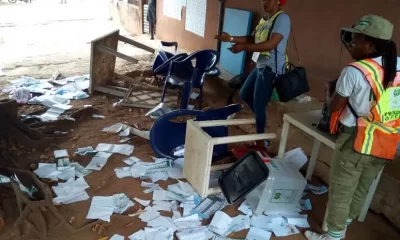

APC Dominates By-elections as Tinubu Praises Winners, INEC

The All Progressives Congress (APC) has emerged the biggest winner in Saturday’s by-elections, clinching 12 out of 16 seats contested across 12 states, according to results released by the Independent National Electoral Commission (INEC).The elections, held to fill vacant seats in federal and state assemblies, saw the All Progressives Grand Alliance (APGA) secure two victories in Anambra, the Peoples Democratic Party (PDP) retain a seat in Oyo, while the New Nigeria Peoples Party (NNPP) won in Kano.

President Bola Ahmed Tinubu congratulated all winners, commending INEC for conducting what he described as largely peaceful and credible polls. He also praised APC’s new National Chairman, Prof. Nentawe Yilwatda, for delivering the party’s first major electoral triumph under his leadership.“Chairman Nentawe Yilwatda has demonstrated capacity and unity of purpose. Our Renewed Hope agenda is not just a slogan, it is a promise of a more secure and prosperous Nigeria,” Tinubu said in a statement signed by his spokesman, Bayo Onanuga.However, the elections were not without controversy. Both APC and PDP demanded cancellations in parts of Kano over alleged irregularities, while PDP chapters in Edo and Jigawa outrightly rejected APC’s declared victories, citing vote-buying, intimidation, and alleged sabotage of the Bimodal Voter Accreditation System (BVAS).Despite disputes, APC leaders, including governors in Edo and Kaduna, described the outcome as a reflection of growing confidence in Tinubu’s government and state-level leadership.INEC has declared elections in parts of Zamfara and Enugu inconclusive, leaving some contests yet to be decided.