Economy

Fidelity Bank Issues Largest Ticket Tier II Local Bonds

Fidelity Bank Plc says it has successfully issued 10 years N41.21 billion in fixed rate unsecured subordinated bond at 8.5 per cent coupon rate due 2031.

Mr Mustapha Chike-Obi, Fidelity Bank Chairman, disclosed this in a statement made available to the News Agency of Nigeria (NAN) on Sunday in Lagos.

Chike-Obi said that the bond issuance which was fully subscribed given that total investor interest and commitments in the bonds were N56.

6 billion.According to him, the transaction underscores the bank’s capacity to successfully execute debt capital market transactions.

Recall that in December, the bank announced plans to issue fixed income securities with 10-year tenor to support the growth and development of Small Medium Enterprises (SMEs), retail business as well as its technology infrastructure.

The bank conducted the debt issuance under its registered N100 billion bond issuance programme.

The bonds are unsecured and subordinated, which will qualify as Tier II Capital in line with the Central Bank of Nigeria Guidance Notes on Regulatory Capital for commercial banks in Nigeria.

Chike-Obi said: “The bond issuance further demonstrates our confidence in Nigeria’s debt market.

“It also validates the continued investor confidence in our corporate strategy and aspirations, strong corporate governance structure and solid and stable executive management team with robust history of superior financial performance and returns,” Obi explained.

Mrs Nneka Onyeali-Ikpe, the bank’s Chief Executive Officer, said proceeds from the transaction would be utilised to support growth in the issuer’s risk assets in SME and retail business and investments in technology & retail infrastructure.

Onyeali-Ikpe added that this was in line with the bank’s Tier I aspirations.

According to her, the bank’s business fundamentals have remained strong in spite of the challenging economic environment occasioned by the coronavirus pandemic and the attendant recession.

“The successful bond issuance highlights the confidence in the Fidelity brand, as well as our capability to expand our funding sources, and deliver innovative financial services to our esteemed customers,” she said.

She said that the issue was assigned a rating of A- by Agusto, and A by Datapro and will be listed on both the Nigerian Stock Exchange and FMDQ Securities Exchange Ltd. (NAN)

Economy

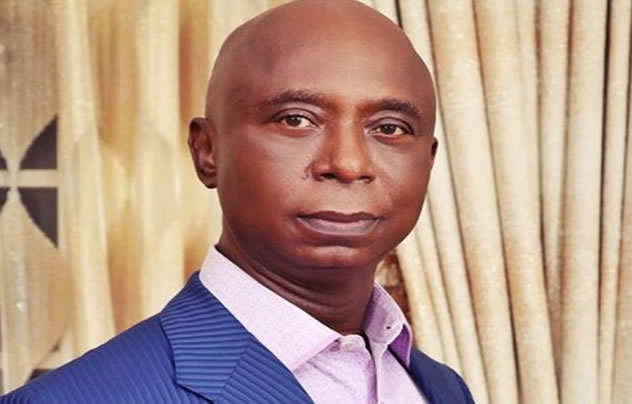

Tinubu’s Democracy Speech Reflects Ambitious Vision – LCCI

The Lagos Chamber of Commerce and Industry (LCCI) says President Bola Tinubu’s Democracy Day speech reflects an ambitious and optimistic vision for Nigeria.

In a statement in Lagos on Thursday, the Director-General of LCCI, Dr Chinyere Almona, said the speech showed government’s appreciation of democracy, economic development, security and social cohesion.

Almona said that the President’s focus on economic growth, improving security, and increasing funding for education, healthcare, and infrastructure promised improved economic performance in the near future.

“We join all Nigerians to celebrate the peaceful transition and commitment to democratic values in the past 26 years.

“A stable political environment is very crucial for business success and for attracting investments.

“Government must stay committed to executing all its proposed programmes and ongoing reforms to ensure Nigerians reap the benefits of democracy without further delay,” she said.

The director-general also urged the government to ensure clear and consistent communication about economic reforms and policies to businesses and the general public.

This, she stated, would reduce uncertainty, build confidence and establish transparent mechanisms for tracking and reporting progress made through reforms.

Almona also called for targeted support for businesses to reduce their cost burdens relating to energy, logistics and regulatory compliance.

She said that LCCI recommended non-cash interventions that could ease the harsh production environment.

Almona also advocated expansion of social safety net programmes to support households affected by high living costs and inflation.

She also called for a more collaborative environment among government, businesses, the civil society and labour unions to ensure fair and timely negotiations on wages and working conditions.

She said that the government must implement programmes that would support strategic sectors pivotal to job creation, tax revenues and infrastructure development.

According to her, the oil and gas, power, and agriculture sectors require special attention as they offer catalytic support to the economy.

“As Nigeria reflects on the progress made and the path ahead, we urge government to remain steadfast about implementing all the required reforms toward a more sustainable and resilient economy.

“We call on government to work toward a nation built on the rule of law, justice and social cohesion even in our diversity and political sophistication,” she said. (NAN)

Economy

World Bank Cuts Global Growth Forecast to 2.3% for 2025

Global economic growth is projected to slow to 2.3 per cent in 2025 due to mounting trade tensions and persistent policy uncertainty, according to the World Bank’s latest Global Economic Prospects report.

A statement from the bank’s Online Media Briefing Centre on Tuesday noted that the new forecast was nearly half a percentage point lower than the rate projected at the beginning of the year.

The report indicated that the slowdown would mark the weakest non-recessionary global growth since 2008.

“The turmoil has resulted in growth forecasts being cut in nearly 70 per cent of all economies, across all regions and income groups,” the report states.

In spite of the gloomy outlook, a global recession is not anticipated. However, if current projections hold, average global growth in the first seven years of the 2020s would be the slowest of any decade since the 1960s.

Indermit Gill, the World Bank Group’s Chief Economist and Senior Vice-President for Development Economics, warned of deepening stagnation in the developing world.

“Outside of Asia, the developing world is becoming a development-free zone. It has been advertising itself for more than a decade,” he said.

Gill noted that growth in developing economies had declined steadily, from 6 per cent annually in the 2000s, to 5 per cent in the 2010s, and to under 4 per cent in the 2020s.

This trend mirrored the slowdown in global trade, which fell from an average of 5 per cent in the 2000s to under 3 per cent today. Investment growth had also weakened, while debt had surged to record levels.

The report projected that growth would slow in nearly 60 per cent of developing economies in 2025, averaging 3.8 per cent before a modest rise to 3.9 per cent in 2026 and 2027.

The report added that more than a full percentage point below the average of the 2010s.

“Growth in low-income countries is expected to reach 5.3 per cent in 2025, a 0.4 percentage point downgrade from earlier forecasts.

“Tariff hikes and tight labor markets are expected to keep global inflation elevated, with a projected average of 2.9 per cent in 2025, still above pre-pandemic levels.”

The World Bank warned that slowing growth would hinder efforts by developing economies to create jobs, reduce poverty, and close the income gap with advanced economies.

“Per capita income growth in these economies is forecast at 2.9 per cent in 2025, 1.1 percentage points below the 2000–2019 average.

“Assuming developing countries (excluding China) maintain a GDP growth rate of 4 per cent the forecast for 2027, it would take them about two decades to return to their pre-pandemic growth trajectory.”

Still, the report noted that global growth could rebound more quickly if major economies reduced trade tensions.

It said that resolving current disputes and halving tariffs could boost global growth by 0.2 percentage points over 2025 and 2026.

In response to rising protectionism, the World Bank urged developing economies to diversify trade, pursue strategic partnerships, and engage in regional agreements.

Given constrained public resources and growing development needs, policymakers are encouraged to mobilise domestic revenue, prioritise spending for the most vulnerable, and enhance fiscal management.

To drive sustainable growth, the report emphasised the need to improve business environments, expand productive employment, and align workforce skills with market demands.

Finally, it highlighted the importance of global cooperation in supporting the most vulnerable economies through multilateral initiatives, concessional financing, and targeted relief for countries affected by conflict.(NAN)

Economy

Eid-el-Kabir: Ram Sellers Decry Low Patronage as Prices Soar in Ile-Ife

The Chairman, Ram Sellers’ Association, Odo-Ogbe Market, Ile-Ife, Osun, Alhaji Akeem Salahudeen, has complained of low patronage, attributing it to high cost of rams and the economy situation in the country.

Salahudeen stated this in an interview on Wednesday in Ile-Ife.

He said that the big sized ram which was sold between N550,000 and N620,000 last year are now being sold at the rate of N800,000 to N1.

2 million.He added that the medium sized ram which was sold between N300,000 and N350,000 last year is now going for between N450,000 and N550,000.

According to him, small sized ram sold for N200,000 and N230,000 last year now attracts N300,000 and N450,000 this year.

He attributed the increase in the prices of rams in this year’s Sallah to the insecurity in the North, which he claimed had disrupted the supply chain.

“They said the worsening insecurity in the North has forced some sellers to import rams from neighbouring countries like Niger, Mali and Chad, which they said contributed to the high prices,” he emphasised.

At Sabo Cattle Market in Ile-Ife, Alhaji Saheed Yaro, said that the price of rams has surged as the small sized ram which was sold at N150,000 and N180,000 last year, is now being sold between N250,000 and N350,000.

Yaro added that the price of medium sized ram which was between N185,000 and N260,000 last year now goes for between N350,000 to N450,000.

Accordingly, the big sized ram sold between N480,000 and N500,000 last year is now between N550,000 and N780,000.

At Boosa Cattle Market located at Modakeke, Mr Musa Salami stated that prices of rams have witnessed sharp increase with a medium sized ram which was for N170,000 to N200,000 last year is now at N250,000 to N300,000.

Salami stated further that the big sized ram that was sold at N350,000 and N400,000 is now being sold at N600,000 to N750,000.

He added that he brought 150 rams a week ago, but has been able to sell only 15, explaining that many customers turned back on hearing prices without buying.

He noted that customers who usually bought rams from him over the years are now complaining about costs.

NAN reports that ram sellers expressed concern over low patronage in many markets, saying that customers were lamenting the high cost of the animals.

A civil servant, Mr Bayo Olabisi, said that most workers in the state cannot afford to buy rams for this year’s Eid-el-Kabir due to the high prices and the economic hardship.

Olabisi added that the present economic hardship has been taken a toll on the workers, especially with the high transportation and other costs following the removal of fuel subsidy by the government.

“In fact, I visited three places where they sell rams, but I couldn’t buy any because I can’t afford to buy.

“When I priced a medium sized ram, the seller told me N250,000, the same size of ram I bought for N150,000 last year.

“I would rather use part of my salary to buy half bag of rice and two chickens for my family.

“For Allah has said that if you can’t afford ram, you should not borrow or buy on credit because there’s no reward on that,“ he said. (NAN)