Economy

FG Reveals Spending Plan for $22.7bn External Loan

By Orkula Shaagee, Abuja

The $22.7 billion requested by President Muhammadu Buhari in the three-year External Borrowing Plan would be invested in infrastructural development, the Federal Government has said.

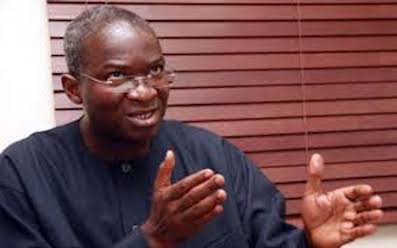

Minister of Works and Housing, Mr Babatunde Fashola and his counterparts in the Ministry of Finance, Mrs Zaynab Ahmed and that of State, Transport, Ms Gbemisola Saraki disclosed this at a public hearing before the joint house committees yesterday.

The house committees are Aids, Loans and Debt Management, and Rules and Business.

According to the Debt Management Office, Nigeria’s Total Public Debt Portfolio as at June 30 stood at $83.

88 billion (₦25.7 trillion).The 8th National Assembly had received the proposed projects for 2016 to 2018 Medium Term (Rolling) External Borrowing Plan put at 30 billion dollars.

The ministers, however, presented the same proposal at 22.7 dollars and gave reasons why the country should have funds as soon as possible.

They emphasised that the loans would promote infrastructure development and job creation.

The Minister of Finance said Nigeria that the country had a revenue generating challenge and stressed the need to invest in sustainable projects that would generate revenue.

Ahmed said the loan would be “strictly for infrastructure development.

“So that we can address the deficit that we have. We know we must comply with some criteria; every Kobo borrowed will be judiciously used,” she said.

On his part, the Minister of Works and Housing said Nigeria’s debt portfolio and debt service were being considered.

Fashola emphasised that investing in capital projects were needed to help the country achieve a self-sustaining economy.

“As we cannot ignore the concerns about debts, so we cannot ignore the concerns and demands for the provision of life sustaining infrastructure.

“We have passed budget of several hundreds of billions, but the reality is that over four years, we have never received full funding for any budget. And the reason is simple, there is a deficit, and we cannot finance it.

“Some of the roads we are investing in will last for upwards of 20 to 30 years if well maintained and not abused. For rail assets, usually the tracks will last for at least 100 years. Power plants like the Mambilla will be there for many decades.

“So, we will be spending today’s money to secure tomorrow’s assets that will sustain our growing population and growing economy.”

The Minister of State for Transport also said there was the need to complete Kano-Lagos and Niger Delta coast rails.

Economy

Minister Says Upgrading MAN to Varsity will Unlock Maritime Opportunities

Mr Adegboyega Oyetola, the Minister of Marine and Blue Economy says upgrading the Maritime Academy of Nigeria (MAN), Oron to a university, will unlock opportunities in the maritime economy.

Oyetola made the expression at the 2024 MAN cadets graduation ceremony in Oron, Akwa Ibom on Saturday.

Represented by Mr Babatunde Bombata, the Director, Maritime Safety and Security, the minister said the Federal Government was working assiduously to unlock opportunities within the marine and blue economy.

He said that the ministry was already collaborating with the Ministry of Education and the Nigerian Universities Commission to ensure MAN’s seamless transition to a university.

“It is our hope that this upgrade will unlock new opportunities for advanced learning, cutting edge research and innovation within the marine and blue economy fields,” he said.

Oyetola urged the graduating cadets to be innovative, resourceful and forward looking in their future endeavours.

“The maritime and blue economy sectors are filled with opportunities, so your contributions to the sector will be instrumental in ensuring a brighter future.

“The government is committed to fostering excellence and innovation in these fields, and we eagerly anticipate the positive impact you will make in your careers,” he said.

He further said that the Federal Government was working on developing a national policy on marine and blue economy.

“This policy will serve as a strategic framework to drive economic diversification, attract investments, create jobs and youth empowerment.

In his remarks, Gov. Umo Eno of Akwa Ibom, said the state government would continue to collaborate with the academy to develop the maritime sector.

Represented by the Commissioner for Internal Security and Waterways, Gen. Koko Essien, (Rtd), Eno urged the graduating cadets to utilise their training in developing the maritime sector.

“I am hopeful that you will utilise the training you have acquired here to further your career as seafarers and in the development of our blue economy,” he said.

Eno commended the Acting Rector, Dr Kevin Okonna and his management team for their commitment towards repositioning the academy for greater results.

Earlier, Okonna said that graduates of the institution had contributed immensely to the growth of Nigeria’s maritime and blue economy.

“Today, we have an opportunity to celebrate a new set of well-trained personnel to the maritime and allied industries.

“We pride ourselves as the pioneer maritime training institution, this is because of the institution’s contributions to national development,” he said.

The acting rector urged the graduating cadets to made effective use of the knowledge gained during their training to make meaningful impact on the growth of the maritime sector.

Report says that awards were given to graduating cadets who distinguished themselves in character and learning. (NAN)

Economy

Investors Gain N183bn on NGX

The Nigerian Exchange Ltd. (NGX) continued its bullish trend on Wednesday, gaining N183 billion.

Accordingly, the market capitalisation, which opened at N59.532 trillion, gained N184 billion or 0.31 per cent to close at N59.715 trillion.

The All-Share Index also added 0.31 per cent or 303 points, to settle at 98,509.

68, against 98,206. 97 recorded on Tuesday.Consequently, the Year-To-Date (YTD) return increased to 31.

74 per cent.Gains in Aradel Holdings, Zenith Bank, United Bank For Africa(UBA), Oando Plc, Nigerian Breweries among other advanced equities drove the market performance up.

Market breadth closed positive with 34 gainers and 17 losers.

On the gainers’ chart, Africa Prudential, Conoil and RT Briscoe led by 10 per cent each to close at N14.30, N352 and N2.42 per share, respectively.

Golden Guinea Breweries followed by 9.95 per cent to close at N7.18, while NEM Insurance rose by 9.74 per cent to close at N10.70 per share.

On the other hand, Julius Berger led the losers’ chart by 10 per cent to close at N155.25, Secure Electronic Technology Plc trailed by 9.52 per cent to close at 57k per share.

Multiverse lost 7.63 per cent to close at N5.45, Haldane McCall dropped 6.07 per cent to close at N4.95 and Honeywell Flour shed 5.62 per cent to close at N4.70 per share.

Analysis of the market activities showed trade turnover settled lower relative to the previous session, with the value of transactions down by 49.44 per cent.

A total of 320.10 million shares valued at N6.48 billion were exchanged in 7,943 deals, compared with 939.41 million shares valued at N12.81billion traded in 9,098 deals posted in the previous session.

Meanwhile, ETranzact led the activity chart in volume with 70.27 million shares, while Aradel led in value of deals worth N1.22 billion.(NAN)

Economy

Yuan Weakens to 7.1870 Against Dollar

The central parity rate of the Chinese currency renminbi, or the Yuan, weakened 22 pips to 7.1870 against the dollar on Monday.This is according to the China Foreign Exchange Trade System.In China’s spot foreign exchange market, the Yuan is allowed to rise or fall by two per cent from the central parity rate each trading day.

The central parity rate of the Yuan against the dollar is based on a weighted average of prices offered by market makers before the opening of the interbank market each business day. (Xinhua/NAN)