Oil & Gas

NNPC, JVPs Sign Gas Supply Agreements on NLNG Train 7, Others

The Nigeria National Petroleum Petroleum Corporation (NNPC) and its joint Venture (JV) partners have signed the first basic 20-year term of Gas Supply Agreements (GSAs) for the NLNG Train 7.

They also signed 10-year term of GSAs for Trains 1, 2 and 3.

The JV partners are Shell Petroleum Development Company of Nigeria (SPDC), Total Exploration and Production Nigeria (TEPNG), Nigerian Agip Oil company Limited (NAOC) and Oando PLC.

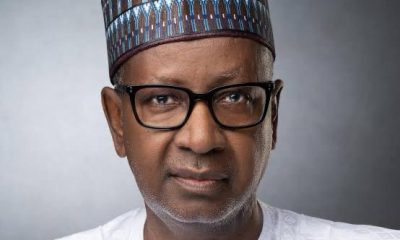

The Group Managing Director of NNPC, Malam Mele Kyari, said that the agreement signalled commitment of all to the gas project in the country.

He said the GSAs bring NLNG closer to taking Final Investment Decision (FID) which signalled the commencement of the project.

He said that with the agreement, the FID on train seven would be taken latest Dec. 20.

“The Train 7 project will ramp up NLNG’s production capacity from 22 Million Tonnes Per Annum (MTPA) to around 30 MTPA.

“The project will form part of the investment of over19 billion dollars including the upstream scope of the NLNG value chain, thereby boosting the much needed FID profile of Nigeria.

“The project is anticipated to create over 10,000 new jobs during its construction phase and on completion help to further mop more gas that would have been flared and diversify the revenue portfolio of Nigeria,” he said.

The Managing Director of Shell, Mr Osagie Okunbor, said that delivering gas to train 7 was an important part of the project.

He said Nigeria at this point should not be talking about train 7 but should be looking at train eight to train 12.

“But what we have done here today is very significant and we believe that more will be done in the future,” he said

Also, Patrick Olima of Total assured that the company would be committed to the supply of gas as signed in the agreement.

“We are committed in doing business in Nigeria just like we have done with Egina FPSO, we will do same with this project,” he said.

Mr Wale Tinubu, Managing Director of Oando, reiterated that his company would be committed to the agreement.

“We are happy to be part of this process,” he said.

In his remarks, Mr Tony Attah, the Managing Director of NLNG, said that signing of the agreement was a great moment for the NLNG.

He said that with FID on train 7, Nigeria was moving in the right direction.

“What we have done today is among the top three things needed before the FID is taken; without this, financiers will not come for train 7.

“We are happy with the commitment of the partners that have signed this agreement today; this agreement will further consolidate our relationship.

“We need to move fast as a country to maintain a strong position in the global space.

“Nigeria at this stage should not be talking only about train 7 but we should be talking about Train 12,” he said.

He added that with full implementation of the GSA would spur NLNG to build more trains.(NAN)

Oil & Gas

Lawyers Integral to Optimal Regulatory Compliance in Oil Business – NMDPRA

The Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) said the role of legal practitioners is critical across the midstream and downstream energy business value chain in the promotion of optimal regulatory compliance.

Chief Executive, NMDPRA, Farouk Ahmed said this on Monday in Abuja at its 2025 General Counsel and Legal Advisers Forum for Midstream and Downstream Petroleum Companies in Nigeria.

The forum has its theme as ‘Advancing a Collaborative Compliance Culture in Nigeria’s Midstream and Downstream Petroleum Sectors’.

Ahmed was represented by Ogbugo Ukoha, Executive Director, Distribution System, Storage and Retailing Infrastructure, NMDPRA.

He said that the sector’s complexity required a unified compliance culture, rooted in robust and enabling legal frameworks, transparency, accountability and shared responsibility.

“The scope of operations of the sector covers hydrocarbon processing, wholesale marketing, transportation, storage, distribution and retail, and its complexity requires more than technical efficiency.

“The role of legal practitioners is critical across the midstream and downstream energy business value chain.

“They help to promote optimal regulatory compliance to set rules and standards of operations in our complex operational and volatile market environment,’’ he said.

Ahmed said that strategic and pragmatic solutions would be established from the forum to enhance performance of the sector towards creation of shared value for investors and the extensive market of Nigeria and the region.

He said that the Petroleum Industry Act (PIA 2021) had fundamentally restructured Nigeria’s petroleum industry by delineating regulatory responsibilities of the industry into the Upstream, midstream and downstream Petroleum operations.

According to him, the Act prescribed that all operations in the midstream and downstream sectors could only be conducted under appropriate licenses, permits and authorisations granted by the NMDPRA.

He said the PIA also mandated NMPDRA to make regulations concerning midstream and downstream petroleum operations in consultation with its licensees and stakeholders.

“As a result of the feedback received from our stakeholders on the need to strengthen regulatory compliance through simplified regulations, NMDPRA is implementing an inclusive stakeholder process of streamlining the gazetted and published regulations.

“This process will mitigate the complexities of navigating and implementing numerous regulations; eliminate inconsistencies and repetitions across multiple regulations; streamline regulatory processes for ease of business; and encourage investments in the industry.

“Kindly use this forum to critically review and make recommendations on the above.

This will enable us to improve the overall compliance of operators and the performance of the regulatory instruments (Legal frameworks and licenses) in the midstream and downstream sectors,” He said.

He said that NMDPRA would continue its commitment to effective stakeholder collaborations that would foster ease of doing business, investor confidence and sustainable operations.

Deputy Speaker, House of Representatives, Benjamin Kalu said that the PIA as a testament to the foresight and dedication of the National Assembly, had fundamentally reshaped Nigeria’s petroleum sector.

Kalu was represented by Ugochinyere Ikenga, Chairman, House Committee on Petroleum Resources, Downstream.

He said that the act had proven how strategic legislation could serve as a potent catalyst for compliance, investment attraction, and robust sector growth.

“For the PIA to remain truly effective, adapting to a dynamic global energy landscape and addressing unforeseen challenges, there must be an institutionalised robust mechanism for its continuous refinement.

“This is precisely where the invaluable insights of our nation’s petroleum experts and our general counsels, the legal architects and navigators of this complex framework, become indispensable.

“For or further synchronisation and effective post-legislative scrutiny, we must actively solicit and integrate your concerns.

“We envision a future where the National Assembly’s specialised committees regularly invite you professionals to public hearings and dedicated technical working groups,” he said.

Kalu said that this proactive engagement would transform abstract legal principles into tangible operational realities, furnishing us with the real-world data and case studies needed to truly understand the PIA’s strengths and weaknesses.

“Your feedback will illuminate where the PIA might be technically challenging, where legal interpretations create bottlenecks, or where new global trends necessitate legislative evolution,’’ he said.

Oil & Gas

OPEC Launches Campaign for Sustained Global Upstream Investment

Torough David, Abuja

The Organization of the Petroleum Exporting Countries (OPEC) has launched a global investment drive seeking attention to creating value in the upstream oil and gas industry.

The Organization is calling for urgent and sustained investment in the global upstream oil sector, warning that a cumulative $14.

9tn will be required between 2025 and 2050 to meet projected demand and prevent a future energy crisis.This investment figure, equivalent to $574bn annually, represents the bulk of the $18.2 trillion in total oil-related investments needed over the 25-year period.

The OPEC had projected that $18.2tn investment would be required to meet global oil demand between 2025 and 2050, as it dismissed the notion of a looming peak in fossil fuel consumption as a “fantasy.

”According to the 2025 World Oil Outlook of OPEC, oil demand is projected to rise from 103.7 million barrels per day in 2024 to 116.5 mb/d by 2045 and peaking at around 123 mb/d by 2050, an 18.6 per cent increase over 26 years.

It also noted the need for continued investments in various segments of the sector to meet this demand.

It noted that of the total investment requirement, upstream operations, including exploration and production, are expected to gulp the lion’s share at $14.9tn, or $574bn per year, as producers scramble to ramp up supply. Midstream and downstream investments will require $1.3tn and $2tn, respectively.

“Cumulative oil-related investment requirements to meet projected demand are assessed at $18.2tn over the period between 2025 and 2050.

“This is marginally higher than projected in the WOO 2024, as despite the outlook period being one year shorter, this Outlook has also seen long-term oil demand revised upwards, and liquids supply has followed.

“Total upstream investment requirements make up the bulk of the needed capital expenditure, now projected at $14.9tn, or $574bn per annum. Downstream and midstream investment requirements are projected at $2tn and $1.3tn, respectively,” the report said.

OPEC Secretary-General, Haitham Al Ghais, said continued investments are essential to guarantee future energy security and affordability, especially in the Global South.

“There is no peak oil demand on the horizon,” Al Ghais declared in the report’s foreword. “Efforts to rapidly phase out fossil fuels are unrealistic and disregard energy security, affordability, and socio-economic realities of billions still lacking basic energy access,” he said.

Oil & Gas

FG Declares End to Dormant Fields on Oil Production

By David Torough, Abuja

In a renewed push to meet its OPEC production quota and 2025 budgetary targets, the Federal Government yesterday declared an end to the era where oil companies acquire field licenses and leave them dormant.

The government warned that it would no longer tolerate operators lacking the technical and financial capacity to develop oil fields, stressing that such licenses would be withdrawn.

Minister of State for Petroleum Resources (Oil), Senator Heineken Lokpobiri issued the warning at the ongoing 2025 Nigeria Oil and Gas Energy Week in Abuja.

Lokpobiri said the government was determined to maximize oil production by ensuring that only serious investors retain access to Nigeria’s hydrocarbon resources.

The conference had the theme: “Accelerating Energy Progress Through Investment, Global Partnerships and Innovation”.

Lokobiri stated that, “In our ongoing drive to boost national oil production, the Federal Government remains resolute in ensuring that maximum value is derived from upstream assets currently held by operators.

“This objective has taken on greater urgency as global financing for oil and gas projects continues to tighten, making it increasingly difficult for all operators to secure the capital needed to develop these assets.

“It is no longer acceptable for critical national resources to remain in the hands of companies that lack the technical or financial capacity to optimize them or worse, those who use such licenses merely as a lever to access scarce capital, only to divert it to unrelated ventures.

“Our oil and gas industry has witnessed far too many cautionary tales of this nature, and we must now draw a clear line”.

He said the government has engaged an international consultant to evaluate the 273 fees and rates faced by oil companies in the country to align them with international best practices.

Also, the Minister of State Petroleum Resources (Gas), Ekperikpe Ekpo said Nigeria had proven gas reserves of over 200 trillion cubic feet, yet value would only be created when resources were developed and utilised.

Ekpo said that through the Decade of Gas initiative, the country was focused on translating its vast gas wealth into tangible socio-economic benefits.

This, he said, included driving industrialisation, expanding power generation, increasing domestic Liquefied Petroleum Gas (LPG) usage, deepening gas-to-transport adoption, and growing gas export capacity.

Group Chief Executive Officer of NNPC Ltd, Engr. Bashir Bayo Ojulari disclosed that the Ajaokuta-Kaduna-Kano (AKK) Gas Pipeline has successfully crossed the River Niger, boosting the hope of the project’s completion by Q4 2025.

Ojulari, who described the development as a significant milestone, said the feat was achieved through effective and innovative contract reengineering and industry collaboration.

He also disclosed that for the first time in a long while, the nation enjoyed 100% crude oil pipelines availability throughout June 2025.

He said the feat which was possible through the industry-wide security interventions led by the NNPC helped to boost crude oil production.

He however called for more investments to boost production, adding that NNPC Ltd has been able to turn the narrative around by consistently meeting its cash-call obligations to Joint Venture operations.

He said the Petroleum Industry Act (PIA) has placed NNPC Ltd in a good position to live up to its responsibility of leading the industry in financing projects.