COVER

Dogara: Nation’s Problems, my Priority, not 2023

Former Speaker, House of Representatives, Hon Yakubu Dogara, has said his priority at the moment is solving the problems of the north than concern with 2023 elections.

He said there was no credibility in the reports by a section of the media that he was warming-up as possible running mate a presidential in 2023.

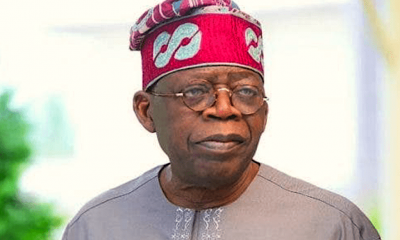

In a statement by his media aide, Turaki Hassan he said it has come to his notice that stories and images were being circulated on social media that he was running for the office of the Vice President with the National Leader of the All Progressives Congress (APC), Bola Ahmed Tinubu for 2023.

“In order to stop the further spread of this deliberate mischief whose objective is yet to be ascertained, the public is hereby, advised to disregard and totally discountenance the purported story and pictures for what they are – handiwork of mischief makers”.

Dogara disclosed that these stories and pictures that are being sponsored by officials of the Bauchi State government in their desperate bid to lend credence to the infantile delusions of their principal, captured in his ludicrous postulations that he left the PDP because he was “deceived” by the APC with the promise of a position in 2023 elections.

“2023 is still years away and, therefore, it is unnecessary, distracting and insensitive to start making unfounded declarations at this time when all hands ought to be on deck in tackling the challenges of our nationhood”.

“Furthermore, to our best knowledge, no political party sells nomination and expression of interest forms for the post of a running mate as he/she is only appointed or selected by a flag bearer. It is therefore preposterous for anyone to claim that someone is running for the position of VP when no flag-bearer has emerged”.

“Dogara is busy helping to rebuild and reposition the APC in Bauchi State and wishes to be allowed to focus on just that”, he statement added.

COVER

Another Blackout as National Grid Collapses Second Time in Two Days

By Mike Odiakose, Abuja

As Nigerians await full power restoration, the national grid has collapsed once again.The national grid collapsed on Tuesday, marking the 10th such incident since January 2024.It was confirmed that, as of 11 am on Thursday, the 22 power plants were only able to generate 2,323 megawatts of electricity, with generation dropping to 0.

00MW. The peak generation for the day was 3,743MW as of 10 am. The Ikeja Electricity Distribution Company reported a power outage at 11:29 am.“Dear Esteemed Customer, please be informed that we experienced a system outage today, 7 November 2024, at 11:29 hrs, affecting supply within our network.“Restoration of supply is ongoing in collaboration with our critical stakeholders. Kindly bear with us,” IKEDC said.The Transmission Company of Nigeria has yet to provide an update on the incident at the time of this report which marks the 11th of such occurrences in 2024.The country recorded more than 93 cases of grid collapse during the eight-year administration of former President Muhammadu Buhari from 2015 to 2023.This persistent grid collapse has led to frequent blackouts, impacting businesses and daily life across the country.Nigeria had, in the past decade, secured about 10 loans totaling about $4.36bn from the World Bank to address challenges in the sector but there has not been any significant improvement even with additional funds from multilateral and donor agencies.This has heightened speculations that a sizable chunk of the loans may not have been disbursed for the purposes for which they were obtained.The frequent fluctuations in power supply have continued to take a toll on industrial and domestic consumers leaving frustration and low productivity in the aftermath.The Bola Tinubu administration has continued to seek additional World Bank loans, securing $1.901 billion in new funds since he assumed office in June 2023.The administration has also been making frantic efforts to expand the nation’s energy options through renewable energy projects.The government has also initiated massive solar energy extension, especially to rural communities across the country to bridge the gaping power gaps.With a population estimated to be more than 200 million, Nigeria has not been able to exceed 5000 Megawatts at any period in the past 10 years despite assurances by successive administrations.More disturbing to Nigerians is the astronomical increase in electricity tariffs across the board, peaking above 400 percent with the last hike that was affected earlier in the year.COVER

FG Defends CNG Vehicle Safety Amid Malaysia’s Phase-out plan

By David Torough, Abuja

The Presidency has sought to allay concerns regarding the safety of Compressed Natural Gas-powered vehicles, recently introduced in Nigeria as an alternative to petrol-powered cars.The Special Adviser to President Bola Tinubu on Information and Strategy, Bayo Onanuga, dismissed these fears in a post on X on Thursday while responding to reports on Malaysia’s plan to phase out CNG-powered vehicles by 2025.

The Malaysian government announced plans to phase out CNG vehicles and end the sale of natural gas vehicles by July 2025. According to local media sources, Malaysia’s Minister of Transport, Anthony Loke, made this announcement at a press conference on Monday.He explained that the decision was intended to protect road users and the public from the potential hazards posed by ageing CNG tanks.Loke was quoted as saying, “These NGV tanks have a safe usage lifespan of approximately 15 years, and if they are not replaced, they become unsafe to use and may fail at any time.” From July 1, 2025, CNG-powered vehicles will no longer be registered or allowed to operate in Malaysia.However, Onanuga clarified that Malaysia’s policy was focused on the safety of Liquefied Petroleum Gas (LPG), not CNG.He added that Nigeria chose CNG specifically for its safety and cost-effectiveness, with plans underway to develop domestic tank manufacturing capacity.Onanuga wrote, “Some clarification on Malaysia’s plan to phase out CNG-powered vehicles:“The Malaysian issue relates to the safety of LPG, not CNG. In the original report, Transport Minister Anthony Loke stated, ‘There are also some car owners who have modified their vehicles using liquefied petroleum gas (LPG) cylinders, which are very dangerous.’“NGV covers both CNG and LPG. Nigeria, in its transition, has adopted CNG only, not both, due to valid safety and cost concerns regarding LPG.”Onanuga further noted, “Malaysia’s programme for CNG-powered vehicles struggled, achieving only a 0.2% conversion rate over 15 years. By contrast, nations like India, China, Iran, and Egypt have seen considerable success.”He added that Malaysia faced difficulties in replacing 15-year-old tanks due to limited manufacturing capacity, while Nigeria, in its first year of adopting CNG, is already addressing this.Malaysia introduced CNG for taxis and airport limousines in the late 1990s, while Nigeria began its own CNG initiative in 2024 as an alternative transportation fuel.COVER

Zenith Bank Upgrades Infrastructure, Assures of Exceptional Service

By David Torough, Abuja

Zenith Bank Plc has assured its teeming customers of exceptional service delivery and improved customer experience following the successful completion of its Information Technology Infrastructure Upgrade.

The Group Managing Director/Chief Executive of the bank, Dr.

Adaora Umeoji in a statement expressed her immense gratitude to all customers of the bank for their patience and support during its recent IT infrastructure migration to a new and more robust operating system.Umeoji emphasized that the bank was committed to delivering unparalleled service experience, saying “We undertook such an extensive endeavor in other to better position Zenith Bank Plc for improved service delivery to all our valued customers and provide memorable banking experiences at all our touchpoints,” adding that the bank now has one of the best technology infrastructure in the Nigerian banking industry, and is well positioned to ensure customers experience exceptional service delivery going forward.

Zenith Bank has continued to distinguish itself in the Nigerian financial services industry through superior service offering, unique customer experience and sound financial indices.

The bank has remained a clear leader in the digital space with several firsts in the deployment of innovative products, solutions and an assortment of alternative channels that ensure convenience, speed and safety of transactions.

The bank’s track record of excellent performance has continued to earn the brand numerous awards including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the 15th consecutive year in the 2024 Top 1000 World Banks Ranking, published by The Banker Magazine. The Bank was also awarded the Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020 and 2022; and Most Sustainable Bank, Nigeria 2023 and 2024 in the International Banker Banking Awards.

Further recognitions include being recognised as Best Bank in Nigeria for the fourth time in five years, from 2020 to 2022 and in 2024, in the Global Finance World’s Best Banks Awards; Best Commercial Bank, Nigeria for four consecutive years from 2021 to 2024 in the World Finance Banking Awards. Additionally, Zenith Bank has been acknowledged as the Best Corporate Governance Bank, Nigeria, in the World Finance Corporate Governance Awards for three consecutive years, from 2022 to 2024, ‘Best in Corporate Governance’ Financial Services’ Africa for four consecutive years from 2020 to 2023 by the Ethical Boardroom.

The Bank’s commitment to excellence saw it being named the Most Valuable Banking Brand in Nigeria in the Banker Magazine Top 500 Banking Brands for 2020 and 2021; Bank of the Year for 2023 and 2024, and Retail Bank of the Year for three consecutive years from 2020 to 2022 and in 2024 at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards. The Bank also received the accolades of Best Commercial Bank, Nigeria and Best

Innovation in Retail Banking, Nigeria, in the International Banker 2022 Banking Awards, Bank of the Decade (People’s Choice) at the ThisDay Awards 2020, Bank of the Year 2021 by Champion Newspaper, Bank of the Year 2022 by New Telegraph Newspaper, and Most Responsible Organisation in Africa 2021 by SERAS Awards.