COVER

Benue Leaders Looted Huge Minerals, Alia Tells the Diaspora

From Attah Ede, Makurdi

Benue State Governor Hyacinth Alia on Monday said lack of vision and underhand dealings by past leaders hindered Benue State from benefiting the Federal Government 13 percent derivation from solid minerals found in the state.

The governor made this known while addressing Benue diaspora community on a zoom meeting organised by the Mutual Union of Tiv in America (MUTA) and the Idoma Association in the United States of America.

He said meeting was to enable the two groups get firsthand information on the present administration’s general policy direction, security initiatives as well as the government’s drive in sectors such as agriculture, Mining, education, health, Banking and Finance as well as physical and digital infrastructure.

Speaking on the mining/extractive industry, the governor said although the state is blessed with mineral deposits, the mining sector remains one area that has not been properly tapped, adding that there was no coordination in the past, thereby allowing huge illegality in the sector.

Alia said, “It is only when we came in on May 29th, 2023 that we made the Benue people realize they have solid minerals.

“Is it that they never existed before we came in? No, they were there. But those who knew; those who were robbing us came in there and carted away what they wanted.

“It is so surprising to hear that it is our very own who were robbing us of the solid minerals. They knew the solid minerals existed there and invited the bad guys who came in behind closed those to rob us.”

The governor in a statement by his Chief Press Secretary, Tersoo Kula which was made available to newsmen in Makurdi, said the state government had placed a moratorium on Mining activities in the state in order to fish out the illegal miners, adding that traditional rulers have been warned not to sign MOUs with the miners as was obtainable in the past.

He said anyone found engaging aging foreigners who come from nowhere to start mining in the villages will not be spared.

He regretted that Benue as a state with 34 out of the 46 mineral deposits found in the country is not enjoying the 13 percent derivation like oil producing states because of lack of coordination.

According to the governor, the need for coordination in the sector is what gave birth to the Mineral Resources and Environmental Management Committee (MIREMCO) under his administration.

This he said will serve as a link between the state and the Federal Government in the area of policy and tackling of illegal mining, thereby protecting such solid minerals for the government and people of the state.

Speaking on the educational sector and the strategies the government has put in place to bridge the gap between the private and government institutions in the state, and on how he feel religious based organizations and private organizations can invest in the education system in the state, the governor said, “What was on ground upon my assumption of office was terrible.

“We met the Benue system in comatose but that of education was even worse and we are just trying to reinvent our educational system with the State Universal Basic Education Board (SUBEB) already geared with programmes to reinvent the educational sector in the state.”

He said his administration has created an agency, Benue Education Quality Assurance (BEQA) through which many discoveries.

“The schools are so saturated with ghost teachers, and the system is saturated with ghost schools.

“Immediately we came into office, we were able to save N1.2billion from ghost teachers.

“We went further and it was discovered that it was not only ghost teachers, but ghost schools as well.

“And the least we found was that the ghost schools had 95 ghost teachers and the minimum Grade level of the teachers in those schools was Grade level 10.

“Just imagine how much they packed! And if we unveil to you those who have been involved in this corrupt system, you will be so shocked to hear names. Yet, this had been going on and on for ages.”

While calling for investment in the educational system in the state, the governor said his administration intends to go back to the basics by granting independence to missionary schools, reintroducing more vocational centres across the state to enable the students acquire skills, as well as intensifying training for the teachers.

On Security, Peace and Wealth Creation as well as his plans for the return of the IDPs to their ancestral homes, Alia said the state has about 13 IDP camps and his campaign promises of returning them to their ancestral homes still stands, adding that his administration is making inroads to address the situation.

On whether the people have started returning back to their ancestral homes, the governor said that has not happened permanently but there is an improvement.

He said the security situation in the state is a combination of both herders and militia groups, especially in the Sankera axis of the state, accusing some elite of inviting the Fulanis back to the state with the notion that the Anti-Open Grazing law is no longer in force.

He called for more collaboration, partnership and investments to enable the government to revamp the Primary Health Care Centres and Clinics in the villages so that healthcare services can be easily accessed by the people of the state.

On Banking and Finance, the governor highlighted the need to drive the Banking Sector in the state, lamenting the absence of Benue indigenes in top banking positions in the country.

He said the state is suffering from the collapse of Lobi Bank, especially as it was aimed at helping local farmers and businesses to thrive, disclosing that the government is trying to see if there will be an alternative.

“Benue is near empty in this regard. There are no investments in the Banking Sector in the state at the moment.

“It is a challenge. Even to get loans, our people are not properly educated in this regard. And we need individuals who can come in and teach our people,” he stated.

While regretting that most big towns in the state don’t have banks, the governor said it is the plan of the present government to take the Novus Microfinance Bank to be in villages, where certain government grants can be obtained through the bank by the time it is properly set up.

On digital and physical infrastructural development in the state, Alia equally told the Benue Diaspora that immediately he came into office, he declared, “There was no maintenance on the few existing ones that were put in place.

“It is now that our government is doing everything to turn Makurdi from a glorified village to a Capital City.

“The government is doing very deep investments in lighting and road infrastructure to ensure that what is done lasts for a long time.”

COVER

Nigeria Non-oil Exports Hit $3.225bn in Half-year 2025 – NEPC

The Nigerian Export Promotion Council (NEPC) has announced that the country’s non-oil exported products in the half-year of 2025 were valued at 3.225 billion dollars.Director-General of the council, Nonye Ayeni, disclosed this to newsmen while presenting a report on the first half of 2025 Non-Oil Export Performance, in Abuja on Sunday.

Ayeni said that the report was aimed at providing a comprehensive overview of the council’s achievements, challenges and prospects. “I am pleased to inform you that non-oil products exported in the first half of 2025 were valued at 3.225 billion dollars.“This shows an increase of 19.59 per cent as against the sum of 2.696 billion dollars recorded for the first half of the year 2024.“The volume also increased to 4.04 million metric tonnes, compared to the 3,83 million metric tonnes for the same period of 2024,” she said.The director-general recalled that in April, Nigeria’s non-oil products exported in the first quarter of 2025 recorded a significant value of 1.791 billion dollars.She said that the figure represented a 24.75 per cent increase over the 1.436 billion dollars reported in the first quarter of 2024.Ayeni said that the volume also increased to 2.416 million metric tonnes, representing a 24.3 per cent increase from the 1.937 million metric tonnes recorded in the first quarter of 2024.She further stated that a total of 236 different products were exported in the first half of the year.This, the director-general said, represented an increase of 16.83 per cent compared to the 202 distinct products exported in the first half of 2024.She said that the products exported included agricultural commodities and extractive industries as well as manufactured and semi-processed products.“However, it is pertinent to state that the non-oil export of Nigerian products is gradually diversifying from traditional agriculture exports to semi-manufactured products,” she said.Ayeni noted that based on the data received from Pre-shipment Inspection Agents (PIAs), of the top 20 products exported in the first half of this year, cocoa beans was the highestShe said that the product had 34.88 per cent value in terms of total export compared to 23.18 per cent for the same period in 2024.“Urea/fertiliser came second with 17.65 percent as against 13.78 per cent for the first half of 2024,” she added.The director-general said that African Continental Free Trade Area (AfCFTA) had helped in providing wider market access and tariff relief for Nigerian exporters.She also said that the council had some export intervention programmes, such as capacity-building on quality and standards, packaging and labelling, export documentation and certifications.“During the period under review, the council also facilitated market access and market linkage programmes for our exporting companies, thereby, giving their products more visibility in the global market.“The growth in value-added exports improved earnings, as more exporters are now imbibing the culture of value addition to their products.“The rising demand from emerging economies, such as India, Brazil, Vietnam and Africa have, however, increased Nigeria’s non-oil export volumes and diversity,” she said.Ayeni expressed the council’s commitment to working with the Ministry of Industry, Trade and Investment and other relevant stakeholders to sustain the strong performance by increasing the volume and value of non-oil exports from Nigeria.The efforts, she said, were in alignment with the President Bola Tinubu-led administration’s Renewed Hope Agenda and the policy drive of the ministry. (NAN)COVER

FCTA Vows Continuous Illegal Demolition in Abuja

By Laide Akinboade, Abuja

The Federal Capital Territory Administration has pledged to sustain the demolition of shanties and parks serving as hideouts for criminals in the Federal Capital Territory.The FCT minister’s Special Assistant on Public Communications and Social Media, Lere Olayinka, in a statement yesterday said the exercise was “a targeted public safety intervention based on credible intelligence and not an act of persecution against anyone.

”According to him, security agencies, including the NDLEA and DSS, had identified several locations and facilities in the city as safe havens for criminal activities, notably the Banana Green Belt from the Central Mosque area towards Wuse Zones 3 and 1 and the Area 10 corridor. “In these areas, innocent citizens are assaulted by assailants who then seek refuge within the surrounding Banana Green Belt/vegetation cover to escape arrest,” he said.Olayinka disclosed that the demolition of shanties at Jazz and Blues Entertainment, Panorama Recreational Park, Wuse Zone 3, was part of the clean-up, following evidence of sustained criminal activity tied to organised networks operating within the FCT.“The intelligence obtained and verified through several surveillance and undercover investigations of these locations, amongst which was the Jazz and Blues Entertainment at Panorama Recreational Park, Wuse Zone 3, was that a segment of the park containing shanties and batchers had evidence of sustained criminal activity tied to organized networks operating within the FCT,” the statement partly read.Olayinka noted that the FCTA had issued multiple contravention notices between February 2024 and July 2025, which were ignored by the park’s management.“While the FCTA acknowledges and respects the military service of Air Commodore Balogun, it reiterates that national service is not a licence for any individual to harbour criminal elements,” he added.Olayinka stressed that the main facilities at the park, including the football field, gymnasium and viewing platforms, were unaffected.He said the city-wide clean-up, which began on August 6, would be extended to other districts in the coming weeks to build a city where residents will be safe to live, work and recreate.Police Arrest Three over 2024 Murder, Robbery in AbujaOperatives of the Federal Capital Territory (FCT) Police Command have arrested three suspects in connection with the murder of Azubuko Nwakama, a staff member of Liberty Radio, who was attacked and robbed at Panteka Market in Mpape on June 14, 2024.The Command’s spokesperson, Josephine Adeh disclosed in a statement that the arrests followed months of sustained investigation and surveillance by detectives attached to the Mpape Division.“Following the incident in June 2024, detectives from Mpape Division immediately launched a comprehensive investigation,” she said.The suspects reportedly robbed the victim of his mobile phone and other valuables before stabbing him. However, efforts to trace the stolen phone proved difficult for months, as the device remained switched off.According to the police, the breakthrough came on August 2, 2025, when the phone — a Redmi 13C — was switched on and tracked to one Mutari Lawal, 32, of Kano State.“Upon arrest, Mutari confessed to the crime and revealed the identities of his accomplices: Dan’Asabe Ibrahim, 22, from Zamfara State, and Danjuma Ibrahim, 18, both with no fixed address in Mpape,” the statement noted.Lawal reportedly admitted he took the phone to Kano, where he kept it powered off for over a year. He returned to Abuja and switched it on only after attempting to wipe its data and insert a new SIM card.The Commissioner of Police, FCT Command, CP Ajao Adewale, commended the officers for their professionalism and perseverance, stressing that justice has finally caught up with the suspects.He also warned criminal elements in the territory to either “repent or relocate,” as the law will eventually catch up with them.“The long arm of the law is patient, persistent, and resolute,” the CP declared.The FCT Police Command reiterated its commitment to public safety and urged residents to remain vigilant and report suspicious activities via its emergency numbers: 08032003913, 08028940883.…Nab Herder with Ammunition, Six Suspected Robbers in NasarawaThe Nasarawa State Police Command has arrested a herder in possession of an AK-47 magazine loaded with six live rounds of ammunition, along with six individuals suspected of involvement in robbery and kidnapping across parts of the state.The Police Public Relations Officer (PPRO), Ramhan Nansel disclosed this in a statement issued yesterday in Lafia.According to him, the arrests followed credible intelligence from a concerned citizen, leading operatives of the Doma Division, led by the Divisional Police Officer, to raid a known criminal hideout in Yelwa Ediya, Doma Local Government Area.The suspects arrested include Dardau Shehu, Yunusa Malami Hashimu, Musa Abubakar, Ibrahim Musa, and Mohammed Musa, all residents of Yelwa Ediya Village.During preliminary interrogation, the suspects reportedly confessed to their involvement in the abduction of a local councillor (name withheld) on May 26, during which two mobile phones, an Infinix Note 30 (valued at N250,000) and a Tecno phone (valued at N20,000) were taken.They also allegedly admitted to staging a roadblock along the Doma–Yelwa road on July 19, 2025, around 9:00 a.m., during which they dispossessed one Ibrahim Haruna of a Bajaj motorcycle valued at N970,000. The motorcycle was later sold, with one of the suspects reportedly involved in arranging the sale.“Officers recovered N100,000, identified as proceeds from the sale, which had been concealed in the bush. A Bajaj motorcycle was also recovered during the operation,” the PPRO stated.In a separate incident, officers from the Keana Division arrested a herder accused of discharging a firearm during a dispute with local farmers at Gidan Zaki Hassan, Kuduku, in Keana LGA.The suspect, identified as 20-year-old Suleman Mohammadu, was arrested with support from community members. An AK-47 magazine containing six live rounds was recovered from him.The Commissioner of Police, Shettima Jauro Mohammed, has directed that all suspects be transferred to the State Criminal Investigation Department (SCID) for further investigation and possible prosecution.CP Mohammed reaffirmed the Command’s commitment to ensuring public safety across the state and called on residents to remain law-abiding and cooperate with law enforcement by providing timely and credible information.CAS Vows to Crush Emerging Security ThreatsThe Chief of Air Staff (CAS), Air Marshal Hasan Bala Abubakar yesterday reaffirmed that protecting the lives and property of Nigerians remained a non-negotiable priority for the Nigerian Air Force and vowed that the security forces would crush the emerging security threats in the North-West and the country in general.This was contained in a statement in Abuja by the Director of Public Relations and Information, Headquarters, Nigerian Air Force, Air Commodore Ehimen Ejodame.According to the statement, the Air Chief made the declaration on Sunday during his operational assessment visit to Kebbi.This includes high-level engagements with senior military commanders, heads of other security agencies, and an inspection of key military infrastructure, underscoring the Nigerian Air Force’s readiness to respond swiftly and decisively to emerging threats in the North-West.“Our commitment is clear: we will locate and root out all criminal elements threatening the peace and safety of law-abiding citizens. Nigeria must be secure for development to thrive,” the CAS declared.The CAS, who also held a meeting with the State Governor Mohammed Nasir Idris and members of the Kebbi State Executive Council, emphasised the strategic importance of Kebbi in Nigeria’s security architecture.According to him, “Kebbi shares international borders with the Republics of Benin and Niger and has vast rural terrains that demand heightened security vigilance, what affects Kebbi affects the entire North-West, and by extension, the peace and stability of our nation.”The CAS further praised the readiness of troops and effectiveness of security infrastructure in the state, saying, “I am highly impressed with what I saw on the ground”.“Our platforms are well-positioned and capable of reaching every part of the state swiftly. Intelligence, surveillance, and reconnaissance operations will be intensified.”The CAS also commended the inter-agency synergy among security outfits operating in Kebbi, saying, “I commend the dedication of our colleagues in the Nigerian Army, the Nigerian Police, Department of State Services, Nigerian Security and Civil Defence Corps, and others”.According to him, “Their tireless efforts are making a difference, and we will continue to support them with air power and strategic coordination.”The statement added that Governor Mohammed Nasir Idris, expressed profound appreciation to the Nigerian Air Force and other security agencies for their tireless commitment to safeguarding lives and property across the state and pointed out that despite emerging threats and the complex security environment in the North-West, Kebbi had remained largely peaceful, an achievement he attributed to the vigilance and sacrifices of the nation’s security forces.Governor Idris reaffirmed his administration’s unwavering support for the Nigerian Air Force and all sister agencies, stating, “We are fully committed to working hand in hand with our security institutions to ensure Kebbi remains a bastion of peace and stability.”It stated that the operational visit reaffirmed NAF’s strategic commitment to national defence through the employment of air power, intelligence, and partnerships with stakeholders at all levels to ensure the protection of lives and properties of Nigerians.

COVER

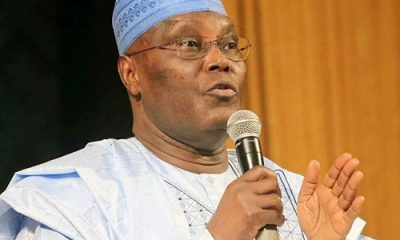

Atiku, Falana Condemn NYSC Over Withheld Corps Member Certificate

By David Torough, Abuja

The National Youth Service Corps (NYSC) has come under heavy criticism from former Vice President Atiku Abubakar and human rights lawyer Femi Falana, SAN, over the alleged withholding of a discharge certificate from Lagos-based corps member, Ushie Rita Uguamaye, popularly known as “Raye.

”Raye, who completed her one-year service in Lagos, claimed she was denied her certificate after officials accused her of missing April clearance. She insisted she was present for the exercise but was repeatedly told to wait by her Local Government Inspector (LGI), who eventually seized her file and refused to clear her.Atiku, in a statement on X, described the situation as “Unacceptable” and warned that punishing citizens for criticising government policies would erode public trust in national institutions.He urged the NYSC to act swiftly, questioning whether the action was politically motivated given Raye’s previous viral criticism of economic hardship under President Bola Tinubu’s administration.Falana also condemned the decision, calling it an “Illegal act” not sanctioned by any court, and likened it to past abuses under military rule. Citing Section 39 of the 1999 Constitution, he reminded the NYSC of the President’s Democracy Day speech encouraging constructive criticism and urged the immediate release of Raye’s certificate.However, NYSC has denied any political motive. Spokesperson Caroline Embu said Raye was one of 131 corps members sanctioned for failing April biometric clearance, leading to a standard two-month service extension in line with NYSC by-laws. The scheme maintained the measure was procedural and not targeted at silencing dissent.The standoff has sparked fresh debate about the NYSC’s disciplinary process, freedom of expression, and whether the system is vulnerable to political interference.