COVER

FIRS Generates N4.9trn from Taxes in 2021

By Tony Obiechina, Abuja

The Federal Inland Revenue Service said it generated the sum of N4.9trn between January and November, 2021 from taxes for the Federation.

Out of the N4.9trn collected since the beginning of the year, 77 per cent representing N3.

77trn was from non-oil sources, while oil revenue is 23 per cent or N1. 23trnThe Service also unveiled its contact centre for taxpayers to access services of the agency by speaking with a call centre agent in various Nigerian languages to resolve identified challenges.

The Executive Chairman of FIRS, Mr. Muhammad Nami, stated this on Monday in Abuja at a National Symposium on “Taxation and Challenges of External Shocks: Lessons and Policy Options for Nigeria.

”The event was organised by the FIRS in conjunction with the Usmanu Danfodiyo University, Sokoto.

Nami said FIRS will henceforth go through the Ministry of Finance, Budget and National Planning to ensure that all government revenue is included in the accounting for taxes generated.

The FIRS system, he stated, will now simultaneously indicate the amounts invested by taxpayers in road infrastructure which is consistent with executive order 007.

The FIRS boss said, “For the country to achieve meaningful and sustainable growth in tax revenue, and minimize our dependence on oil revenue, there is the need for continuous reform of our operations and processes, of our human capital development, the adoption of technology, and the tax laws.

“These key areas have remained paramount to the current Board and Management of the Service. And the achievements we have recorded in improving and sustaining the revenue growth since 2020 to date irrespective of the challenges posed by the Covid-19 can be attributed to these reform initiatives”.

He said the system would also show the tax waivers granted pioneer companies, import and excise duties waived through the operations of the Nigeria Customs and all other revenues generated by Ministries Departments and Agencies (MDAs) on behalf of the Federal, State and Local governments in Nigeria.

According to him, the measures, when implemented, will align Nigeria with global best practices in reporting public finance and guarantee a more transparent and more accurate picture of the country’s Tax-to-Gross Domestic Product ratio.

The FIRS Boss said the move would also help ensure that all government revenue is included in the fiscal accounts and annual statistics of the FIRS.

David Adejoh, who represented the Secretary to the Government of the Federation, Boss Mustapha, said that the time has come for Nigeria to strongly harness all non-oil revenue sources, especially now that the rampaging COVID-19 crisis has crashed the demand for petroleum products.

“We need to seek other sources of revenue besides oil to avoid a looming fiscal crisis that can decapitate the economy.

“Tax Pro Max has really helped in revenue generation, but our tax to GDP ratio is still low at six per cent; lower than some African countries and efforts should be made to improve it”, he added.

In her keynote address on Taxation and the Challenges of External Shocks: Lessons and Policy Options for Nigeria, a former Executive Chairman, FIRS, Mrs Ifueko Omogui Okauru urged the FIRS to allow companies to carry out a self-audit and remit the taxes they feel is appropriate, while the agency works out ways to ascertain whether the money was inadequate or not.

According to her, this was better than not collecting any revenue whenever there is a tax dispute with evaders.

Meanwhile, the National Bureau of Statistics (NBS) says the total value-added tax

(VAT) collected on behalf of the federation decreased by N11.75

billion within three months to N500.49 billion in the third quarter of 2021.

This was contained in its latest report released yesterday.

VAT is a consumption tax that is administered by the Federal Inland Revenue Service (FIRS).

In the last quarter, VAT collection amounted to N512.25 billion.

Year-on-year, there was an improvement in the collection as the FIRS collected N496.39 billion, N512.25 billion and N500.49 billion in the

first, second and third quarters of 2021.

This is higher compared to the corresponding figures of 2020 at N324.58 billion, N327.20 billion and N424.71 billion, respectively.

It shows growth rates of 52.93 percent in Q1 2021, 56.56 percent in Q2 2021 and 17.84 percent in Q3 of 2021.

Further analysis shows that in Q3 2021, the manufacturing activity; information and communication activity; and mining & quarrying activity accounted for the top three largest shares of total revenue

collected sector-wise, representing 30.87 percent (N91.2 billion), 20.05 percent (N59.3 billion), and 9.62 percent (N28.4 billion),

respectively.

On the flip side, activities of extraterritorial organisations and bodies generated the least VAT in the quarter under review with N20.15

million. This was followed by activities of households as employers, undifferentiated goods and services (N90.83 million) and water supply, sewerage, waste management and remediation activities (236.75

million).

Nigeria had raised its VAT rate from 5 percent to 7.5 percent in 2020—but the International Monetary Fund (IMF) had also advised that the

rate should be increased to at least 10 percent by 2022.

On the other hand, first and second quarter 2021 Company Income Tax (CIT) collections were N392.65 billion and N472.07 billion,

respectively, higher than the corresponding quarter of last year.

By the third quarter of 2021, this has increased to N472.52 billion, yet higher than Q3 of the previou

COVER

FG, States, LGCs Share N1.818trn June Revenue

By Tony Obiechina Abuja

A total sum of N1.818 trillion, being June 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.The revenue was shared at the July 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja, in a statement by Bawa Mokwa Director of Press and Public relations in the Office of the Account General of the AGF during the weekend.

The N1. 818 trillion total distributable revenue comprised distributable statutory revenue of N1.018 trillion, distributable Value Added Tax (VAT) revenue of N631.507 billion, Electronic Money Transfer Levy (EMTL) revenue of N29.165 billion, Exchange Difference revenue of N38.849 billion and N100 billion Augmentation from Non-Mineral revenue.A communiqué issued by the Federation Account Allocation Committee (FAAC) indicated that total gross revenue of N4.232 trillion was available in the month of June 2025. Total deduction for cost of collection was N162.786 billion while total transfers, interventions, refunds and savings was N2.251 trillion.According to the communiqué, gross statutory revenue of N3.485 trillion was received for the month of June 2025. This was higher than the sum of N2.094 trillion received in the month of May 2025 by N1.390 trillion.Gross revenue of N678.165 billion was available from the Value Added Tax (VAT) in June 2025. This was lower than the N742.820 billion available in the month of May 2025 by N64.655 billion. The communiqué stated that from the N1.818 trillion total distributable revenue, the Federal Government received total sum of N645.383 billion and the State Governments received total sum of N607.417 billion.The Local government Council received N444.853 billion, while the sum of N120.759 billion (13% of mineral revenue) was shared to the benefiting State as derivation revenue.On the N1.018 trllion distributable statutory revenue, the communiqué stated that the Federal Government received N474.455 billion and the State Governments received N240.650 billion.The Local Government Councils received N185.531 billion and the sum of N118.256 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.From the N631.507 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N94.726 billion, the State Governments received N315.754 billion and the Local Government Councils received N221.027 billion.A total sum of N4.375 billion was received by the Federal Government from the N29.165 billion Electronic Money Transfer Levy (EMTL). The State Governments received N14.582 billion and the Local Government Councils received N10.208 billion.From the N38.849 billion Exchange Difference revenue, the communiqué stated that the Federal Government received N19.147 billion and the State Governments received N9.712 billion.The Local Government Councils received N7.487 billion, while the sum of N2.503 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.The communique stated that the Federal Government received a total sum of N52.680 billion, the State Governments received N26,720 billion and the Local Government Councils received N20.600 billion from the N100 billion Augmentation.In June 2025, Companies Income Tax (CIT), Petroleum Profit Tax(PPT), Electronic Money Transfer Levy(EMTL) increased significantly while Oil and Gas Royalty, Value Added Tax( VAT), Import Duty, Excise Duty and CET Levies decreased considerably.COVER

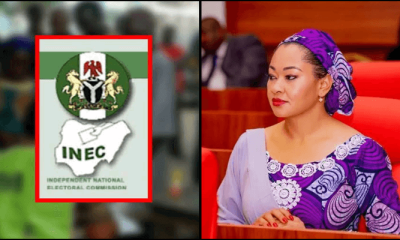

Senate, Natasha Thread Words over Resumption as Court Ends Suspension

By Eze Okechukwu, Abuja

The Senate has warned suspended Kogi lawmaker, Senator Natasha Akpoti-Uduaghan to desist from forcefully resuming her legislative duties on Tuesday until the expiration of her suspension.Chairman of the Senate Committee on Media and Public Affairs, Senator Yemi Adaramodu gave the warning in a statement issued on Sunday.

While insisting that no valid court order mandates her immediate recall, Adaramodu emphasised that the Senate remains committed to due process and the rule of law. He said, “The Senate of the Federal Republic of Nigeria wishes to reaffirm, for the third time, that there is no subsisting court order mandating the Senate to recall Senator Natasha Akpoti-Uduaghan before the expiration of her suspension.”The clarification followed media reports quoting the embattled lawmaker as saying she would return to the Senate on Tuesday, allegedly based on a judgment by Justice Binta Nyako of the Federal High Court in Abuja.However, Adaramodu said the Senate had previously issued two public statements after the court ruling and the release of the Certified True Copy of the Enrolled Order, making it clear that no positive or mandatory directive was issued against the Senate regarding her recall.“Rather, the Honourable Court gave a non-binding advisory urging the Senate to consider amending its Standing Orders and reviewing the suspension, which it opined might be excessive.“The Court, however, explicitly held that the Senate did not breach any law or constitutional provision in imposing the disciplinary measure based on the Senator’s misconduct during plenary,” he said.The Senate further noted that the same court found Akpoti-Uduaghan guilty of contempt and imposed penalties, including a N5m fine payable to the Federal Government and a mandatory apology in two national newspapers and on her Facebook page, a directive that has reportedly not been complied with.“It is therefore surprising and legally untenable that Senator Akpoti-Uduaghan, while on appeal and having filed a motion for stay against the valid and binding orders made against her, is attempting to act upon an imaginary order of recall that does not exist,” the Senate spokesman added.He warned that any move by the suspended lawmaker to “storm the Senate next Tuesday under a false pretext” would be premature, disruptive, and a breach of legislative order.“The Senate will, at the appropriate time, consider the advisory opinion of the court on both amending the Standing Orders of the Senate, her recall, and communicate the same thereof to Senator Akpoti-Uduaghan.“Until then, she is respectfully advised to stay away from the Senate chambers and allow due process to run its full course,” the statement concluded.I’ll resume on Tuesday – Natasha Akpoti-Uduaghan Dares SenateSuspended Kogi Central Senator, Natasha Akpoti-Uduaghan, has vowed to resume her duties in the Senate on Tuesday.Akpoti-Uduaghan said her resumption was in line with a court decision.She disclosed this in a chat with journalists while in her constituency for a training programme on Saturday.The embattled lawmaker said the suspension limited her from performing her legislative duties.Natasha disclosed that she has officially informed the Senate in writing about her intentions to resume.She noted that despite the controversy surrounding the ruling of the Abuja Federal High Court, she will resume on Tuesday.“I have pretty much two months more before the six months expire. However, I have written to the Senate again telling them that I’m resuming on the 22nd, which is on Tuesday, by the special grace of God.“I will be there, because the court did make the decision on that,” she said.COVER

Dangote Refinery Targets 700,000bpd Capacity

By David Torough, Abuja

The Dangote Petroleum Refinery is undergoing a major capacity upgrade to increase its output from 650,000 to 700,000 barrels per day (bpd), according to Alhaji Aliko Dangote, President of the Dangote Group. The expansion, currently underway at the Lekki Free Zone in Lagos, is expected to be completed by the end of 2025.

Dangote, who spoke during a recent facility tour with stakeholders and journalists, explained that the upgrade is aimed at maximising the refinery’s potential, despite ongoing modifications slowing its ability to operate at full capacity this year. “As of July, our Residue Fluid Catalytic Cracking (RFCC) unit is running at 85 per cent capacity. Once modifications are complete, we expect to exceed the original design and hit 700,000bpd,” he said. The RFCC process converts heavy crude residue into valuable lighter fuels such as gasoline, diesel, and LPG.Dangote disclosed that the refinery sourced 19 million barrels of crude oil from the United States between June and July 2025 alone. “We bought 10 million barrels in July, which accounts for about 55 per cent of our current crude needs,” he said.He also reflected on the journey of building the $20 billion refinery, revealing it began after the late President Umaru Musa Yar’Adua halted his attempt to purchase Nigeria’s state-owned refineries in 2007.“Had I known the complexity and challenges involved, I might never have started. But we pushed through the setbacks, and today we’ve proved that nothing is impossible,” Dangote remarked.He further noted that most African nations are still dependent on imported refined fuels, with the exception of Algeria and Libya. “We needed to change that narrative. Only one refinery is currently operating in South Africa. So, we decided to take the risk,” he added.Dangote criticised what he described as “foreign sabotage through importation,” claiming some external forces use large volumes of imports to undermine domestic industries in Africa.In a related development, Nigeria has secured over $20 billion in new investment commitments from China to support key sectors of the economy, including agriculture, mining, steel, energy, and automotive manufacturing.Director General of the Nigeria-China Strategic Partnership (NCSP), Joseph Tegbe disclosed the breakthrough over the weekend, noting that the funding was the result of sustained bilateral engagements following the elevation of Nigeria-China ties to a Comprehensive Strategic Partnership.“These are real commitments, not just pledges,” Tegbe said. “We’re talking about tangible projects that will create jobs, boost local production, enhance food security, and make Nigeria a leading manufacturing hub in Africa.”Tegbe added that the NCSP is driving efforts to ensure the success of Forum on China-Africa Cooperation (FOCAC) projects in Nigeria, while also leveraging Chinese expertise and financing to reposition the country’s industrial base.The partnership also aims to open Asian markets to Nigerian-made goods, enhancing exports and creating value-added supply chains in line with President Bola Tinubu’s Renewed Hope Agenda.“We’re not only building bridges with investors; we’re delivering results that will transform Nigeria’s economy for generations to come,” Tegbe said.