Economy

NCC, CBN Approve Refund Framework for Failed Airtime and Data Transactions

By David Torough, Abuja

In line with the consumer-focused objectives of the Nigerian Communications Commission (NCC) and the Central Bank of Nigeria (CBN), the two regulators have drawn up a framework to address consumer complaints arising from unsuccessful airtime and data transactions during network downtimes, system glitches, or human input errors.

The framework is the outcome of several months of engagements involving the NCC, the CBN, Mobile Network Operators (MNOs), Value Added Service (VAS) providers, Deposit Money Banks (DMBs), and other relevant stakeholders.

According to the NCC, these engagements were prompted by a rising incidence of failed airtime and data purchases, where subscribers were debited without receiving value and experienced delays in resolution.

“The Framework represents a unified position by both the telecommunications and financial sectors on addressing such complaints. It identifies and tackles the root causes of failed airtime and data transactions, including instances where bank accounts are debited without successful delivery of services. It also prescribes an enforceable Service Level Agreement (SLA) for MNOs and DMBs, clearly outlining the roles and responsibilities of each stakeholder in the transaction and resolution process,” a statement by Head of Public Affairs of NCC, Nnen Ukoha said.

Under the new framework, where a purchaser is debited but fails to receive value for airtime or data—whether the failure occurs at the bank level or with an NCC licensee—the purchaser is entitled to a refund within 30 seconds, except in circumstances where the transaction remains pending, of which the refund can take up to 24 hours.

The framework further mandates operators to notify consumers via SMS of the success or failure of every transaction. It also addresses erroneous recharges to ported lines, incorrect airtime or data purchases, and instances where transactions are made to the wrong phone number.

Director of Consumer Affairs at the NCC, Mrs. Freda Bruce-Bennett in a comment on the development said the framework also establishes a Central Monitoring Dashboard to be jointly hosted by the NCC and the CBN. According to her, the dashboard will enable both regulators to monitor failures, the responsible party, refunds, and track SLA breaches in real time.

“Failed top-ups rank among the top three consumer complaints, and in line with our commitment to addressing these priority issues, we were determined to resolve it within the shortest possible time,” she said.

“We are grateful to all stakeholders—particularly the Central Bank of Nigeria and its leadership—for their tireless commitment to resolving this issue and arriving at this framework, and for ensuring that consumers of telecommunications services receive full value for their purchases.

“So far, pending the approval of management of both regulators on the framework, MNOs and banks have collectively made refunds of over N10 billion to customers for failed transactions” she explained .

Mrs. Bruce-Bennett further noted that implementation of the framework is expected to commence on March 1, 2026, once the two regulators have made final approvals, and technical integration by all MNOs, VAS providers and DMBs is concluded.

Business News

Budget Office Defends Tax Reform Acts, Seeks Due Process

By Tony Obiechina, Abuja

The Budget Office of the Federation has reaffirmed the integrity of Nigeria’s newly enacted Tax Reform Acts, cautioning against what it described as governance by speculation and unverified claims following allegations of post-passage alterations.

In a statement on Wednesday, the Budget Office said it had taken note of concerns raised by the Minority Caucus of the House of Representatives, stressing that the sanctity of the law is central to constitutional democracy and not a mere procedural formality.

According to the Office, any suggestion that a law could be altered after debate, passage, authentication, and presidential assent without due process would strike at the core of the Republic and undermine citizens’ right to be governed by transparent and stable laws.

However, it warned that democratic integrity is also endangered by the careless amplification of unverified claims. “A nation cannot be governed by insinuation or sustained on circulating documents of uncertain origin,” the statement noted, adding that public confidence, once shaken by speculation, is often difficult to restore.

The Budget Office emphasized that both government and citizens share a common interest in truth, clarity, and due process, noting that public finance depends heavily on trust in the legality and clarity of fiscal laws. It welcomed the decision of the National Assembly to investigate the allegations, describing institutional inquiry, not conjecture as the appropriate response to claims of illegality.

On public access to the law, the Office agreed that Nigerians and the business community are entitled to clear and authoritative texts of all laws they are required to obey. It clarified, however, that the authenticity of legislation is determined by certified legislative records and official publication processes, not by informal or viral reproductions.

The statement also underscored the importance of separation of powers, warning that claims suggesting Nigeria is being governed by “fake laws,” if not backed by established facts, risk eroding confidence in democratic institutions.

At the same time, it stressed that legislative scrutiny should not be dismissed by the executive, noting that oversight is a constitutional duty, not an act of hostility.

From a fiscal perspective, the Budget Office said legal certainty is essential for revenue projections, macroeconomic stability, budget credibility, and investor confidence. While it is not the custodian of legislative records, it maintained that uncertainty around operative tax provisions directly affects economic planning.

To restore confidence, the Office proposed a set of measures, including the publication of verified reference texts in a single public repository, orderly access to Certified True Copies for stakeholders, clear public explanations where discrepancies are alleged, and strict alignment of all implementing regulations with authenticated legal texts.

Addressing calls for suspension of the tax reforms, the Budget Office cautioned against allowing prudence to slide into paralysis. It argued that properly implemented tax reform is necessary to reduce dependence on borrowing and inflationary financing, while easing indirect burdens on vulnerable citizens.

“Where clarification is required, it must be provided; where correction is required, it must be effected; where investigation is required, it must proceed,” the statement said, adding that governance and reform should not be stalled by unresolved conjecture.

The Office concluded by describing taxation as a democratic covenant that binds citizens and the state, insisting that compliance depends on transparency and trust. It called on political actors to protect institutions as much as positions, urging citizens and businesses to rely on verified sources and resist the spread of unauthenticated information.

The statement was signed by Tanimu Yakubu, Director-General of the Budget Office of the Federation, who reaffirmed the agency’s commitment to fiscal transparency, institutional integrity, and reforms that advance national prosperity while safeguarding citizens’ rights.

Economy

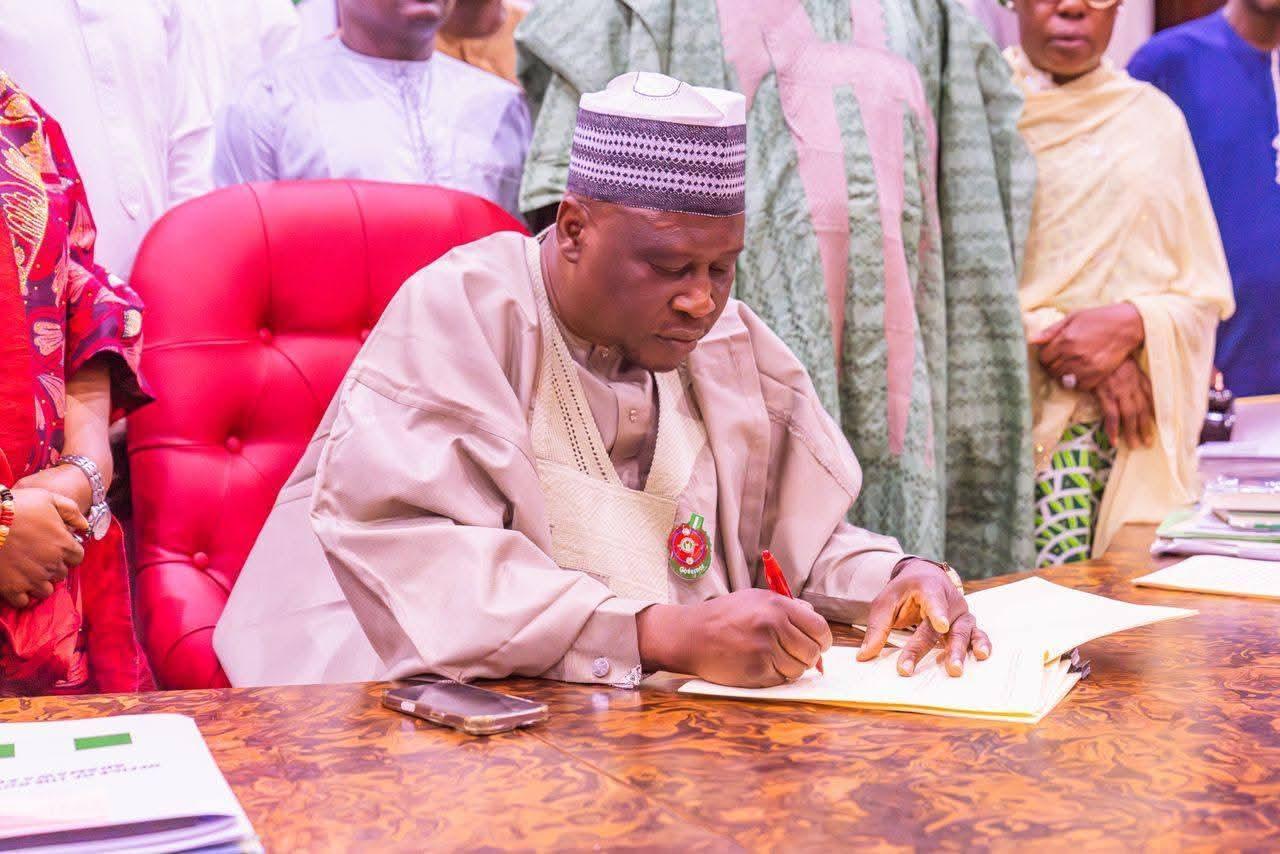

Fintiri Signs ₦583.3bn Adanawa 2026 Budget into Law

From Yagana Ali, Yola

Adamawa State Governor Ahmadu Umaru Fintiri has signed the ₦583.3 billion Appropriation Bill for the 2026 fiscal year into law, following its passage by the State House of Assembly. The budget, christened the “Budget of Sustainable Growth and Economic Renewal,” allocates ₦209.

64 billion (35. 94 percent) to recurrent expenditure and ₦373. 69 billion (64.06 percent) to capital projects.Addressing attendees at the signing ceremony, Governor Fintiri outlined key priorities, including strengthening infrastructure, expanding education and healthcare services, enhancing job creation, and supporting citizens’ welfare. “The budget was prepared after wide consultations and reflects the aspirations and needs of communities across the state,” he said.

On security, the Governor announced plans to deploy trained forest guards to Hong Local Government Area to address emerging challenges. “We will continue to prioritise security as a foundation for development,” he added.

Governor Fintiri also pledged to improve working relations with the media and achieve milestones in education, infrastructure, and other sectors through the budget’s implementation. “We are committed to translating these allocations into tangible improvements for our people,” he said.

Present at the ceremony were Deputy Governor Professor Kaletapwa George Farauta, Speaker of the Assembly Mr. Bathiya Wesley, Majority Leader Hon. Kate Raymond Mamuno, and other lawmakers. The Secretary to the State Government, Barrister Awwal Tukur, was also in attendance.

The budget signing underscores the administration’s focus on addressing pressing needs while fostering economic growth and social development in Adamawa State.

Economy

Tinubu Applauds $1.26bn Financing For Lagos-Calabar Coastal Highway

By Tony Obiechina, Abuj

President Bola Tinubu has praised the Federal Ministry of Finance for successfully closing USD 1.26 billion in financing for the execution of Phase 1, Section 2 of the Lagos–Calabar Coastal Highway, marking a significant milestone in the delivery of Africa’s most ambitious and transformative infrastructure projects.

Tinubu applauded the Ministries of Finance and Works and the Debt Management Office for working together on the transaction, adding that the federal government will continue to explore creative financing to fund critical projects across the country.

“This is a major achievement, and closing this transaction means the Lagos-Calabar Coastal Highway will continue unimpeded.

Our administration will continue to explore available funding opportunities to execute critical economic and infrastructural projects across the country,” the President said in a statement by Presidential Spokesman, Bayo Onanuga.Phase 1, Section 2 covers approximately 55.7 kilometres, connecting Eleko in Lekki to Ode-Omi, key economic corridors and significantly enhancing national trade efficiency and logistics connectivity. The successful financing follows the earlier closing of the USD 747 million financing for Phase 1, Section 1, and demonstrates the scalability and bankability of the Lagos–Calabar Coastal Highway project.

The financing was fully underwritten by First Abu Dhabi Bank (FAB), with risk mitigation support provided by the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), marking ICIEC’s first Nigerian transaction since the country’s institutional and regulatory reforms. The structure reflects growing confidence in Nigeria’s reformed investment climate and its capacity to deliver infrastructure.

SkyKapital acted as Lead Financial Advisor, coordinating structuring, lender engagement, and execution. Environmental and Social advisory services were provided by Earth Active (UK), ensuring complete alignment with the IFC Performance Standards, the Equator Principles, and international ESG best practices. Hogan Lovells, as International Counsel, and Templars, as Nigerian Legal Counsel, led the legal advisory services.

Describing the transaction as a “defining moment in Nigeria’s infrastructure journey”, Minister of Finance and Coordinating Minister of the Economy, Wale Edun, said the fund will be deployed responsibly and judiciously to deliver on the project within timelines.

“The signing on December 19, 2025, of USD1.26 billion financing for Phase one — section two of the Lagos-Calabar Coastal road marks a defining moment in Nigeria’s infrastructure journey, following the successful closing of the USD 747 million financing for Phase one section one on July 9, 2025. Collectively, these landmark transactions firmly establish the Lagos-Calabar Coastal Highway as one of the defining flagship projects of President Bola Ahmed Tinubu’s Renewed Hope agenda, embodying the administration’s commitment to bold, transformational infrastructure.

“This financing is particularly notable as it represents, for the first time, a truly underwritten transaction of this magnitude for a Nigerian road infrastructure project. The facility was fully underwritten by First Abu Dhabi Bank (USD 262 million) and Afreximbank (USD 500), with partial coverage provided by ICIEC, making it the largest ICIEC-supported transaction since the institution’s creation,” Edun said.

Construction is being executed by Hitech Construction Company Limited, whose rapid progress on site and early opening of key road sections have drawn commendation from lenders for engineering excellence, operational discipline, and execution speed.

In line with the Federal Government’s commitment to transparency and fiscal discipline, a comprehensive Value-for-Money (VfM) assessment was conducted by SkyKapital in close coordination with the Federal Ministry of Works and independently reviewed and confirmed by GIBB.

The successful close of Phase 1, Section 2, represents a clear step-change in market confidence. It demonstrates Nigeria’s ability to move decisively from vision to execution and from reform to delivery under the Renewed Hope Agenda of President Bola Tinubu.