NEWS

NECO Digitises Recruitment of Examination Supervisors

The National Examinations Council (NECO) has digitalised the recruitment process for examination Supervisors and Assistant Supervisors.

The supervisors are for the Basic Education Certificate Examination (BECE) and the Senior School Certificate Examination (SSCE) Internal and External.

This is contained in a statement made available to newsmen in Abuja on Sunday by Azeez Sani, Acting Director, Information and Digital Communication of the council.

Sani said the digitalisation is to check sharp practices in the recruitment process and to enhance efficiency and effective service delivery.

He said the digitalisation process involved migration from the manual recruitment of Supervisors and Assistant Supervisors to Online system.

Sani said this would ensure that supervisors nomination form, appointment letters and supervisors e-photo Albums were generated on-line.

He also said the routine swapping of Supervisors and Assistant Supervisors during the Examination would be done online.

He urged interested qualified teachers with NCE, Degree Certificate, Masters Degree, PhD and Professors who are eligible to apply as Supervisors and Assistant Supervisors for BECE or SSCE Internal or External to do so.

It could be recalled that before the digitalisation system, recruitment of Supervisors and Assistant Supervisors was done manually by the Council.

Agriculture

Tiv Monarchs Give Herders Ten Days Ultimatum To Vacate Tiv Kingdom

By David Torough, Abuja

The Tiv Area Traditional Council during its emergency meeting held yesterday in the palace of the Tor Tiv in Gboko requested the Governor Hyacinth Alia led administration to create an enabling environment to allow herders’ peaceful exit of farmlands in Tiv Kingdom to facilitate resumption of farming activities.

Consequently, the Council directs political and traditional rulers in each local government area of Tiv Kingdom to peacefully engage the herders to ensure their exit from the local government areas to allow farming resumes.

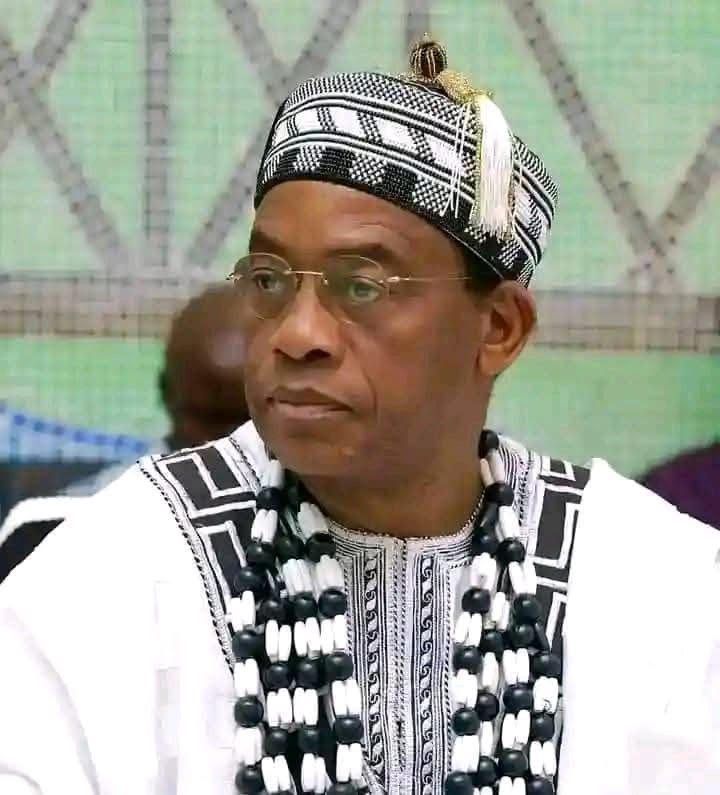

The Council which was chaired by the Tor Tiv himself, HRM Prof James Ortese Iorzua Ayatse CFR equally appealed to all herders in Tiv Kingdom in Benue State to vacate all Tiv lands before the end of May 2025 to allow farmers return and cultivate their farms in order to avoid the looming hunger in Nigeria.

According to a Communique signed by the Secretary of the Council Mr Shinyi Tyozua which deliberated particularly on the security situation in Tiv Kingdom the Council enumerated the communities worst affected to include those in Kwande, Katsina Ala, Logo, Ukum, Guma, Makurdi, Gwer West Gwer East and Buruku Local Government Areas.

The Council lamented that farming activities in the kingdom have ceased due to the occupation of farmlands by herders for grazing and attacks and killings of farmers who fled stressing that if the situation continues it will ultimately result to hunger in Tiv Kingdom and Nigeria as a whole.

NEWS

Karimi Raises the Alarm over Rising Insecurity in Nigeria

From Joseph Amedu, Lokoja

Chairman, Senate Services, Sen. Steve Karimi has expressed concern over the spiraling insecurity in the country, which has threatened and diminishes the “good work” done by the administration of President Bola Tinubu in the last two years.

Karimi in an interview with DAILY ASSET cited the resurgence of killings across the Federation, especially in states like Benue, Plateau, Kogi, banditry in the North-West and the renewed attacks by Boko Haram in the North-East, saying they must be investigated immediately. “This rise in insecurity is all over the country; on all sides, even in the North-East, there is the resurgence of Boko Haram; at some point, everything became calm, but now they are coming back.“Check other parts of the country, there is kidnapping now on the rise again, whether in the South-West, South-South or South-East; it is happening all over the place.“Almost on a daily basis, there is one reported incident of banditry or another in the North-West.“I consider this resurgence an attempt by desperate groups and individuals to discredit the good work this government of President Bola Tinubu has done in the last two years, especially now that talks about 2027 elections have started”, Sen. Karimi said in a statement in Abuja.Karimi, who represents Kogi-West Senatorial District, commended security agencies for the sacrifices they had made so far in service to their fatherland to guarantee the safety of lives and property across the states.However, the lawmaker called on heads of the agencies to confront the new challenge squarely by thoroughly investigating the factors responsible for the “regrettable development” and proffer urgent responses.“This government worked so hard over the last two years to contain the porous security situation it inherited, including the scaling up of the defence and security budget.“At the National Assembly, there has been collaboration to ensure that the targets of the government are met through the existing Legislative-Executive harmony, which is to guarantee safety for all Nigerians.“This was achieved at some point. Unfortunately, there is this sudden resurgence, which is threatening to spoil the President’s records. I suspect sabotage that calls for immediate investigation”, Karimi added.The senator’s intervention came amid plans by the Senate to convene a National Security Summit as an expression of further legislative response to the renewed security challenges.NEWS

FG to Convert JD Gomwalk House to National Job Outsourcing Hub – Tijani

From Jude Dangwam, Jos

The Minister of Communications, Innovation and Digital Economy, Hon. Olatunbosun Tijani has disclosed that the federal government is set to convert the famous Joseph Gomwalk House Jos into a national outsourcing job hub in the country.Tijani during his inspection visit in Jos the Plateau State capital said installation of fibre cables and renovation works is expected to be completed in six months to come, adding that the centre is going to provide proper technical training for young people in the North Central region of Nigeria.

In his words, “As you know, we’re an extremely youthful country about 70% of our population is under the age of 30. For us, it’s a priority to ensure that we provide meaningful job opportunities for these young people.”While we’ve done extremely well with our 3 Million Technical Talent program, which focuses on training 3 million young people across the country, it’s also important that we find avenues to help them secure jobs. That’s why we’re in conversation with the governor of Plateau State, it’s one of the states we’re focusing on to see how we can accelerate the introduction of Business Process Outsourcing (BPO) jobs here.”Companies all over the world are looking to outsource job opportunities. Historically, they’ve done this with countries like India. But Nigeria actually has an advantage, we speak better English and we’re well-positioned to handle many of these jobs. That’s the direction we’re heading in,” he explainedTijani noted thus, “the goal of today’s visit is to assess the possibility of converting this historic building, the Standard Building, into one of the headquarters for BPO in the country. Our aim is to work with the state government to refurbish the building and then engage with companies that hire young people for BPO work.”Let me be clear, Plateau is not the only state we’re focusing on, we’re implementing this in a number of states. The federal government’s goal is to ensure that our programs reach everyone, everywhere.”Plateau State is unique, it stands out because education here is strong, the people are hardworking, and they speak high-quality English, an essential requirement for BPO jobs. Importantly, the governor is also forward-thinking. He’s been actively engaging with us to make this a reality in Plateau State, and we appreciate that kind of leadership.” He statedThe Minister commended the landmark development recorded in the state within the shortest possible time. “The structures on the Plateau under the Time administration are impressive. The governor is clearly committed to restoring Plateau’s glory, and that’s exactly what we need. This state has so much to contribute to national development.The Commissioner for information and communication Rt. Hon. Joyce Ramnap who accompanied the Minister on the inspection visit noted that the Plateau state government will continue to create an enabling environment for remarkable investment as they work closely with the federal government in the interest of Plateau people and the country at large.