COVER

NNPC Overshoots OPEC Quota, Increases Oil Output to 2.2mbd

By Tony Obiechina and Mathew Dadiya, Abuja

The Federal Government has disclosed that it has increased crude oil output from 1.77 million to 2.2 million barrels per day.

Recall that Nigeria had signed an agreement with members of the Organisation of Petroleum Exporting Countries (OPE) and some non-OPEC countries to curtail global crude oil output in a bid to address the declining price of crude oil in the international market.

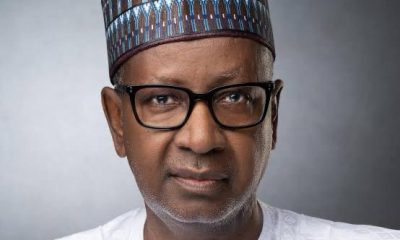

Group Managing Director (GMD), Nigerian National Petroleum Corporation (NNPC), Mallam Mele Kyari, who revealed this at the weekend, said that Nigeria’s December oil production was 2.

2 million barrels per day.Global energy data company, S&P Global Platts, reported that Kyari, who spoke at the Atlantic Council Global Energy Forum in Abu Dhabi, United Arab Emirates said: “You can produce condensate which is not part of the OPEC commitments. We are focusing our production to more gas-based reservoirs so that we can continue to grow our production while maintaining balance in the market.

“We have met our commitment by December. Nigeria was currently counting production of its new Egina grade as condensate”.

According to the report, Kyari, however, declined to say how much of that was crude and how much was condensate, but the GMD insisted that Nigeria was fully in compliant with its quota of 1.77 million barrels per day for crude oil.

Kyari explained that OPEC quotas only apply to crude oil production, not condensate, disclosing that Nigeria was shifting its upstream work towards natural gas liquids, NGL, and natural gas, to better comply with its crude production quota under the OPEC+ agreement.

Also, he disclosed that Nigeria was still on track to launch a new oil licensing round in the first half of 2020 for both offshore and onshore blocks.

Kyari, who declined to specify a particular date in the first half for the planned crude oil licensing round, added that Nigeria’s legislature was in the process of reviewing its petroleum law, which according to him, would take care of the concerns.

The Platts report quoted a source as saying that Egina crude has a gravity 27.5 API, significantly heavier than typical condensates, and a sulphur content of 0.17 per cent while it added that the oil is expected to have high yields of gasoil and distillates.

Despite the NNPC’s claim of abiding by the 1.77 million barrels deal, S&P Global Platts’ said in its latest survey of OPEC production, it estimated Nigeria’s December crude output at 1.84 million barrels per day, adding that starting this month, Nigeria’s quota drops to 1.75 million barrels under the OPEC+ coalition’s agreement to deepen its production cuts through March.

FG Reaps N5trn from Oil & Gas Sales in 2019

Meanwhile, a Data from the Central Bank of Nigeria (CBN) has revealed that the Federal Government earned N5.04tn from the sale of oil between January and November 2019.

According to the CBN economic report for November, the amount was lower than the N8.77tn revenue target provided for in the 2019 budget for the 11-month period.

A breakdown of the N5.04tn oil revenue showed that the sum of N363.9bn was generated from crude oil and gas exports, while the sum of N2.94tn was generated from Petroleum Profit Tax and Royalties.

A monthly breakdown of the oil revenue showed that N417.3bn was earned in January, while February, March, April, May and June had N479.5bn, N516.9bn, N472.4bn, N410.2bn and N336.6bn respectively.

For the months of June, the Nigeria National Petroleum Corporation made the sum of N336.6bn; July had N387.7bn; August, N484.8bn while September, October and November had N467.6bn, N577.3bn and N489.1bn respectively.

The decrease in oil revenue, relative to the monthly budget estimate, was attributed to shut-ins and shut-downs at some NNPC terminals.

The shutdown, according to findings, was due to pipeline leakages and maintenance activities.

The report read in part, “Oil receipt, at N489.08bn or 56.9 per cent of total revenue, was below both the monthly budget of N798.83bn and the preceding month’s receipt of N577.30bn by 38.8 per cent and 15.3 per cent respectively.”

COVER

Security Bars Natasha from National Assembly Despite Court Advisory

By Eze Okechukwu, Abuja

Security operatives at the National Assembly yesterday prevented suspended Senator Natasha Akpoti-Uduaghan from gaining entry into the complex, sparking heated confrontations between her supporters and guards.Akpoti-Uduaghan, who represents Kogi Central, had arrived at the Assembly premises accompanied by supporters, insisting on resuming legislative duties based on a Federal High Court advisory, which urged the Senate to reconsider her suspension.

However, security personnel at the gate blocked her access, maintaining that the Senate had not authorized her return.Also barred was human rights activist Aisha Yesufu, who arrived ahead of the senator to show support. The presence of security reinforcements heightened the tension as exchanges grew heated between the senator’s camp and Assembly operatives.Addressing reporters at the scene, Akpoti-Uduaghan reiterated her stance that her six-month suspension was unjust and politically motivated. She vowed to pursue further legal action, stating:“My suspension is wrong. And such injustice will not be sustained. The recommendation itself is faulty. I’ll consult my legal team and likely proceed to the appellate court to seek interpretation. I am a law-abiding citizen.”Her suspension, handed down on March 6 over alleged misconduct and refusal to comply with a new seat assignment during plenary, was expected to last six months. The Senate had offered to lift the suspension earlier if she submitted a formal apology—a step she is yet to take.The controversy deepened after Senator Akpoti-Uduaghan declared her intention to resume legislative duties, citing a ruling by Justice Binta Nyako, which advised the Senate to amend its Standing Orders and review the disciplinary action against her. The court, however, did not issue an enforceable order mandating her reinstatement.Reacting to her attempted return, the Chairman of the Senate Committee on Media and Public Affairs, Senator Yemi Adaramodu, dismissed her claims, stating there was no valid court order compelling the Senate to recall her.“The court gave a non-binding advisory and did not find the Senate in breach of any constitutional provision. It even imposed a N5 million fine on Senator Akpoti-Uduaghan for contempt and demanded a public apology—conditions she has yet to fulfill,” Adaramodu noted.He warned that any attempt to “forcefully storm the Senate” would be considered disruptive and a violation of legislative protocols.“The Senate will, at the appropriate time, consider the court’s advisory on her suspension and communicate its decision. Until then, she is advised to stay away and allow due process to prevail,” he added.The senator’s suspension followed a plenary incident in which she refused to take her reassigned seat, claiming the move violated her legislative privileges. Her refusal led to a motion of disciplinary action, which was adopted by majority vote.With legal battles still unfolding, Senator Natasha’s political standoff with the Senate leadership continues to generate public interest and legal scrutiny.COVER

Senate Approves $21.5bn External Borrowing Plan, Local Debts for FG

By Eze Okechukwu, Abuja

The senate has approved President Bola Tinubu’s external borrowing plan of $21.5 billion for the 2025–2026 period, paving the way for the funding of key national development projects by the Federal Government.The approval followed the presentation of a report by the Chairman of the Senate Committee on Local and Foreign Debts, Senator Aliyu Wamakko (APC, Sokoto) during plenary yesterday.

Tinubu had asked the National Assembly to endorse the borrowing to finance critical sectors including infrastructure, security, education, health, agriculture and human capital development. Also approved were a ¥15 billion Japanese loan, a €65 million grant, and additional domestic borrowing of N757 billion through federal bonds to offset pension arrears as of December 2023.The senate further gave the nod to the President’s request to raise up to $2 billion through foreign-currency denominated instruments in the domestic market.Senator Wamakko said the loan request aligns with the already approved Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) for the 2025 budget cycle.“The Committee recommends approval, as the borrowing plan is within the framework passed by the National Assembly,” Senator Wamakko said.Backing the motion, Senator Solomon Adeola (APC-Ogun) noted that the loans were embedded in the 2025 Appropriation Act, adding, “With this approval, all revenue sources, including loans are now in place to fund the budget.”Senator Sani Musa (APC, Niger East) stressed that the loans would be disbursed over six years and assured that Nigeria had not defaulted on its debt obligations.“No economy grows without borrowing. This follows global best practices,” Senator Musa said.Senator Adetokunbo Abiru (APC, Lagos East) said the facilities complied with the Fiscal Responsibility Act and the Debt Management Act, explaining, “These are long-term, concessional loans with favourable terms, some spanning up to 35 years.”However, Senator Abdul Ningi (PDP, Bauchi Central) raised concerns over the absence of repayment details and how the loans would directly impact constituents.“We must tell Nigerians exactly how much is borrowed in their name and for what purpose,” Ningi said.Senator Victor Umeh (LP, Anambra Central) threw his weight behind the plan, commending the $3 billion earmarked for the eastern rail corridor.“For the first time, I’ve seen such allocation for the eastern rail line—this alone justifies my support,” Umeh said.Deputy Senate President Jibrin Barau (APC, Kano North) who presided over the session, praised the Committee’s work and assured that the plan reflects national inclusiveness.“With this approval, implementation of the 2025 budget can begin in full. The funds must be strictly used for capital and development projects,” Barau said.Senate Summons NNPCL Boss to Appear within 24HrsThe Group Chief Executive Officer (GCEO) of the Nigerian National Petroleum Company (NNPCL), Bayo Ojulari for the fourth consecutive time failed to appear before the Senate Committee on Public Accounts to respond to questions from the audit report of the organization.Ojulari who said his non-appearance yesterday to honour the invitation was sequel to his sudden invitation by President Bola Tinubu Tuesday sent the Chief Financial Officer (CFO) Dapo Segun of the National Oil Company to represent him during the session with the senate.The Senate, through its Committee on Public Accounts which is investigating queries raised against the National Oil Company in the audit reports of 2017 to 2023 however expressed their concerns following the non-appearance of the NNPCL Boss physically to answer relevant questions in connection with the audit report of the organization and gave him 3:00pm prompt today as ultimatum to show up or face the resultant effect.The Committee Chaired by Senator Aliyu Wadada Ahmed (Nasarawa West), had after three earlier invitations sent to Ojulari to appear before it for explanation on N210 trillion unaccounted from 2017 to 2023 extended the fourth invitation to him penultimate Thursday.But at its sitting on Tuesday when the Committee’s Chairman asked the Clerk, Mohammed Sani Abdullahi whether NNPCL ‘s GCEO was around, the Clerk responded that he sent a letter for explanation on his absence.Ojulari as contained in the letter dated 22nd July 2025 and read by the Committee’s clerk said an urgent invitation he got from President Bola Tinubu at about 1:00pm prevented him from honouring the Committee’s invitation.However, being the fourth time, the NNPCL’s GCEO failed to appear before them, members of the Committee one after the other in their separate comments expressed reservations on the sincerity of the reason given by Ojulari.Specifically , Senator Victor Umeh (LP , Anambra Central) in his remarks said though intervention of Presidential call , reduces his anger against the NNPCL boss but using Tinubu as an excuse for failing to appear before the Committee should not be allowed to continue.Senator Joel Thomas Onowakpo (Delta South) in his comment, accused Ojulari of not taking the invitation of the Committee as a priority.”To me , the NNPCL boss thinks that he is bigger than this committee and will not need a soothsayer to tell us that he will never honour our invitation except we invoke our powers to compel him “, he said .Similarly, Senator Aminu Abbas of Adamawa Central said Ojulari was disrespectful to the Committee, forgetting that no GCEO is bigger than the National Assembly.”For failing to honour invitations of this Committee four different times, he should be ordered to appear before it tomorrow unfailingly”, he said.Accordingly, the Committee as declared by its Chairman, senators Wadada, resolved that Ojulari should appear before it today by 3:00pm prompt or risk an issuance of a warrant of arrest against him.Reps Approve N105bn RMAFC 2025 Budget ProposalThe House of Representatives Committee on Finance on Tuesday approved the sum of N105.14 billion for Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) operations for the 2025 fiscal year.The Committee adopted the RMAFC 2025 budget proposal during the budget defence session with the management of RMAFC led by the Chairman, Mohammed Shehu.Presenting the RMAFC 2025 budget proposal earlier, Shehu said that of the N105.14 billion, the sum of N20.6 billion is for personnel, while the sum of N8.9 billion is for overhead.According to the document made available to the Committee, projected sources of income from January to June 2025 from 0.5 per cent non-oil Federation revenue stands at N37,203,901,732.52, while the projected income from July to December 2025 stands at N67,937,025,011.56.The RMAFC helmsman said that the sum of N75.5 billion, which represented 71.8 per cent of the total budget, was earmarked for capital estimates.He commended the committee for championing the recent amendment of the RMAFC Act, saying that it had positioned the commission to function better.The Chairman of the committee, Rep. James Faleke (APC-Lagos), said that the committee had gone through the budget and was satisfied with the estimates.He said that the committee, through its oversight function, will ensure full implementation of the budget.Faleke said that the assembly will be going on its annual recess within the week, saying that the committee, upon return, expects between 30 to 40 percent implementation.Following the adoption, the bill will be presented to the Committee of the Whole for third reading and onward transmission to the President for assent.COVER

Heirs Insurance Posts N61bn Gross Written Premium

Heirs Insurance Group has announced its audited financial results for the year ended December 31, 2024, showing strong year-on-year growth across business lines and metrics.The insurance group reported a combined Gross Written Premium of N61bn in 2024 for its life and general insurance companies, indicating a 70 per cent increase from the N35.

8bn recorded in the previous year. Heirs Insurance Group is the insurance subsidiary of Heirs Holdings, the pan-African investment company, with investments across 24 countries and four continents. The insurance group also recorded a combined insurance revenue of N31.4bn, which is about 53 per cent higher than N20.5bn in 2023. Profit Before Tax rose from N4.8bn in 2023 to N11.2bn, more than double the previous year’s figure, and representing a 133 per cent year-on-year growth, and the group paid about N10.4bn in claims during the year under review compared to N4.18bn. Its total assets grew by 66 per cent, rising from N55.8bn in 2023 to N92.9bn in 2024.Analysing the financial performance of the entities that make up the group indicated that Heirs Life Assurance reported an 85 percent increase in Gross Written Premium from N23.87bn in 2023 to N44.22bn in 2024. Insurance revenue rose by 109 per cent to N15.1bn from N7.3bn in 2023 as its profit before tax grew to N5.5bn, up from N1.88bn, indicating a 193 per cent increase. Claims paid by Heirs Life also rose to N5.67bn, a 120 percent increase from N2.5bn paid to customers in 2023.Heirs General Insurance also maintained a strong growth trajectory as its Gross Written Premium rose by 42 per cent to N16.9bn from N11.9bn in 2023. Insurance revenue hit N14.3bn, a 19 per cent increase from the N12bn recorded in 2023, and profit before tax grew by 104 per cent, rising from N2.4bn in 2023 to N4.9bn in 2024. HGI also demonstrated strong claims responsiveness, with claims paid amounting to N4.7bn, up 25 per cent from N3.7bn in the previous year.The insurance broking and risk management consulting firm in the group, Heirs Insurance Brokers, posted growth as well. Its revenue grew by 54 per cent from N1.28bn in FY2023 to N1.97bn in 2024, driven by increased client acquisition and retention. Profit Before Tax rose by 53 per cent fromN528.59m in the prior year to N805.91m in 2024, highlighting strong cost discipline and operational efficiency.In a statement accompanying the financial results, the group said it had achieved year-on-year growth due to its strong leadership and corporate governance and a focus on driving digital innovation to make insurance simple and accessible.It added, “Beyond technology, the group drives advocacy across all customer clusters, aligning with its purpose to improve lives and transform Nigeria. Its Essay Championship drives insurance literacy among young students and the school ecosystem, and its travel festival advocates for more inclusive policies to enable cross-border travel, among many other initiatives.”Heirs Insurance Group serves both corporate and individual customers across Nigeria.