BUSINESS

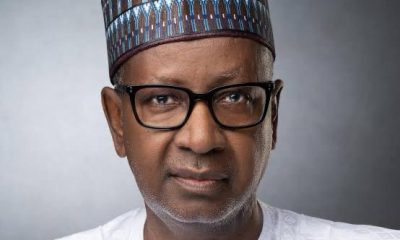

No Complacency as NNPC Transform to Limited Company — Kyari

The Nigerian National Petroleum Company Limited (NNPC Ltd.) has given assurance to its investors and stakeholders that the days of complacency were over.

The assurance came following the repositioning of the company to focus on profitability and value addition to its shareholders.

The GMD/CEO of the NNPC, Malam Mele Kyari, gave the assurance at the opening ceremony of the 2022 edition of the Nigerian Oil and Gas (NOG) Conference and Exhibition which held at the International Conference Centre, Abuja.

Declaring the conference open, Kyari who was represented by NNPC Chief Financial Officer, Mr Umar Ajiya, called on operators in the nation’s oil and gas industry to focus more on gas development.

Kyari said emphasis should be on gas-to-power, gas-to-industry and gas-for-export projects and activities.

He explained that with the reality of the global energy transition and Nigeria’s commitment to use gas as its transition fuel, value now lies in gas development.

The NNPC GMD/CEO also said that the Petroleum Industry Act (PIA) had also provided ample incentives for investors in the gas sector.

Kyari urged delegates and exhibitors to use the opportunity provided by the conference to network and brainstorm on solutions to the challenges brought about by the global energy transition and the Russian-Ukraine war.

He also urged them to find better ways to maximise the potentials inherent in the nation’s abundant gas resources.

Meanwhile, the NNPC Ltd. within the week called on its partners and operators in the oil and gas industry to beef up investment in order to close the yawning energy supply gap in the country.

The GMD/CEO of NNPC Ltd., Malam Mele Kyari, made the call at the NNPC Spotlight Session of the just concluded 21st Nigerian Oil and Gas Conference and Exhibition which held at the International Conference Centre, Abuja.

Speaking at the conference with theme, “Funding the Nigerian Energy Mix for Sustainable Economic Growth”, Kyari said there was a huge gap in the Nigerian energy market with 80 per cent of citizens lacking access to clean cooking gas and 48 per cent lacking access to electricity.

“That gap is huge and we cannot fill it with the scale of investment we are doing in the renewable.

“This is critical for us and we will continue to emphasise that our key role is to be able to bring gas and make it available to everyone.

“The fact that energy transition is unfolding to everyone means we must invest in it and we are seeing a great resistance across the globe on funding fossil fuel until the Ukrainian challenge came up.”

According to Kyari, NNPC is currently engaging with partners and multilateral institutions that are involved in energy transition to find ways of resetting financing strategies in a manner that will enable energy companies and institutions to collaborate for investment in order to eradicate energy poverty.

On the new role of NNPC as a limited liability company, Kyari said that NNPC had been positioned as the company with the largest capital base in Africa to serve as a reliable partner to all willing investors.

“In this regard, NNPC Ltd. offers a lineup of investment opportunities that guarantee positive returns across the energy value chain.

“On July 19, 2022, Mr President will unveil the new NNPC Ltd. to the world. I am inviting you to that epoch-making event in the history of our company,” he said.

Also speaking at the conference, Chairman of Board of Directors, NNPC Ltd., Sen. Margery Chuba-Okadigbo said that the mandate of the new NNPC was clearly spelt out in the Petroleum Industry Act (PIA) 2021.

According to her, the PIA is a testament to the Federal Government’s commitment to put in place the right environment for the advancement and development of oil and gas industry.

“NNPC limited is a commercially oriented and profit driven company which creates opportunities for improved indigenous participation.

“The new entity presents opportunities for enhanced revenue and returns on investment.”

She stated that the effective implementation of the PIA would stimulate sustainable social impact through the creation of quality jobs for the teeming youth and consequently change the social perception of the industry.

In the meantime, the Group General Manager of the National Petroleum Investment Management Services (NAPIMS), Mr Bala Wunti, disclosed that Nigeria needed about 800 billion dollar-worth of investments to meet the crude oil production target of four million barrels per day.

Wunti made the disclosure in Abuja during a panel session at the just concluded 21st Nigerian Oil and Gas Conference and Exhibition with the theme, “Funding the Nigerian Energy Mix for Sustainable Economic Growth”.

He said the money must be channeled into exploration and production, midstream conversion capability and requisite downstream infrastructure.

Speaking on the theme, “Energy Transition: Making Nigeria the Preferred Africa Energy Investment Hub”, the NAPIMS boss said Nigeria had abundant crude oil and natural gas resources which can only translate to value for the country if properly harnessed and produced for the benefit of the people.

He said that the time had come for the country to look inwards and develop its huge oil and gas potentials by restructuring the industry to attract the much-needed investments across the oil and gas value chain that would create wealth and prosperity for the people.

He called for stronger partnership and collaboration among stakeholders in the oil and gas sector, particularly in the area of finance, project execution, and technology development.

Giving a breakdown of the investments required, Wunti said that the country needed about 400 billion dollars in the upstream and midstream segments of the value chain, while another 250 billion dollars investment would be required in the downstream sector across the country in order to ensure energy sufficiency.

International oil companies (IOCs) operating in Nigeria including Shell, Chevron, TotalEnergies, and ExxonMobil in the week under review expressed their frustration over the escalating oil losses in the Niger Delta due to the activities of oil thieves.

Speaking at the industry leaders’ panel session at the 2022 edition of the Nigerian Oil and Gas Conference and Exhibition, the CEOs said the unrelenting menace of crude oil theft had led to a decline of the nation’s daily oil production from 1.8million barrels per day in the last three years to just a little over one million barrel per day.

Firing the first salvo on the topic: “The Future of Nigeria’s Energy Sector in the PIA Era”, the Chairman of Shell Companies in Nigeria and Managing Director of Shell Petroleum Development Company, Mr Osagie Okunbor, warned that the new marginal field licensees that would operate Oil Mining Leases (OMLs) 53 and 57 may experience difficulties evacuating their crude oil.

Okunbor said that two of the most important oil pipelines in the country were currently shut down with hundreds of thousands of barrels a day shut-in.

“In three to five years, we were brought down from 1.8 million barrels. So it is an existential issue for us.

“We need to address it; if we do not address it, we cannot do all the new oil development issues, and that will continue to occur.

“But what is really going to move the needle for us in terms of bridging this gap of hundreds of thousands of barrels a day is solving the evacuation problem.”

He tasked stakeholders and participants at the conference to put heads together to seek ways to deal with the challenge.

Managing Director of Chevron Nigeria Limited and Chairman of the Oil Producers Trade Section (OPTS), Mr Rick Kennedy, said while the industry stakeholders collaborate to fine-tune the Petroleum Industry Act (PIA) in a manner that offers encouragement to all players, it was also imperative for the oil theft challenge to be addressed by all parties.

On his part, the Executive Director at ExxonMobil Nigeria, Mr Oladotun Isiaka, who represented the Managing Director, Mr Richard Laing, also said stakeholders should work together to tackle the oil theft challenge as it was impacting negatively on investments in the upstream sector.

The Managing Director of TotalEnergies E&P Nigeria Limited, Mr Mike Sangster, called for further dialogue between the industry stakeholders and the authorities on the PIA.

The TotalEnergies boss called for the constitution of another working group made up of persons from the authorities and the industry in order to find ways to address some of the issues.

Agriculture

Sallah: Ram Traders Lament Rising Preference to Cows

Some ram traders in Lagos State have lamented the preference for cows to rams by Muslim faithful this 2025 Eid Kabir celebration.

The traders disclosed this in interview on Thursday in Lagos.

The traders said that most people prefer to buy cows than rams because of the size and the fact that five families could buy and share for the celebration.

“A ram trader, Mr Ibrahim Hassan, at the Lawanson area of the state, said patronage has been decent, but with an interesting twist.

“The patronage this year is not bad, but I have noticed that people are buying more cows than rams. I believe the reason behind this shift is that cows are more economical and offer better value for money.

“When families or even groups of friends come together, they can share a cow and still fulfil the sacrifice. That way, instead of each person buying a ram for over N500,000, they split the cost.

“The cheapest cow you can get right now is around N800,000, while the cheapest ram starts at about N550,000. Prices also vary depending on the size and weight of the animal.

“I have contacted my sources for more cows, but the market price has gone up since last week. It’s a volatile market, and prices can change quickly,” Hassan said.

Also, Mr Shakiru Gbadamosi, another ram seller at Lawanson, said he noticed that “people are weighing their options this Sallah, and they have been buying more of cows”

“I was surprised to see some buyers turning to cows, and this trend has been on for weeks. Although many still prefer rams for Sallah because it’s about tradition and religious significance.

“The ram is the symbolic animal for the sacrifice, and that’s not something easily replaced.

“Prices have gone up this year, a decent ram now costs between N550,000 and N700,000 depending on the size and breed. But despite that, the demand remains steady.

“Some people have been buying younger rams because they are less expensive but still acceptable.

“The younger rams are sold for between N130,000 and N250,000,” Gbadamosi said.

A buyer, Mr Folajimi Aderibigbe, who confirmed the trend, said buying a cow seems like a better option.

“We are a family of eight, and instead of buying two small rams, we joined with my brother-in-law and bought a cow. It cost us N950,000, but we split it. Everyone still gets to perform their sacrifice and save money.

“Traditionally, rams are the preferred animal for Eid Kabir (Sallah). However, economic realities have changed things, and we must find a way to adapt,” he said.

In a related development, vegetable oil traders said they have observed increased patronage due to the Sallah celebration.

Mrs Linda Nwachukwu, a cooking oil trader at the Lawanson Market, said the demand for cooking oil had increased because of preparations ahead of Sallah.

“The celebration usually increases the demand for groundnut oil. Consumers have been stocking up oil since last week, especially now that there are few days to Sallah.

“Cooking oil prices have risen, but it is cheaper than last December, a 25-litre container cost N110,000, a price that persisted until April 2025.

“A recent price adjustment, just three weeks ago, sets the current rates for groundnut oil at N78,000 for 25 litres, N35,000 for 10 litres, and ₦18,500 for five litres.”

“This is unusual, groundnut oil prices normally surge in December and then decrease by January or February, but it stayed high for a long time,” she said.

Another trader, Mrs Imoleayo Fakunle, said she buys in larger jerrycans and sell in measured portions to customers who cannot afford bigger sizes.

“Not everyone can buy 25 litres or even afford the branded ones, so as a vendor, what I do, is to buy in larger containers and sell in small portions.

“Groundnut oil is expensive, but it is essential. A lot of customers have been buying the measured portions, and they are always happy that they can save money.

“Despite rising prices, customers prioritise the essential ingredient for their celebrations,” she said.

Mrs Taraoluwa Alausa, a consumer at the Idi-Araba Market, said she had learned to prioritize when buying cooking oil since the increase in the price of groundnut oil.

“I purchase measured portions of oil specifically for frying and use a good branded oil for general cooking.

“Lately, I have become more conscious about the type of oil I use. I want something natural and less processed. It’s a bit pricier, but I think it’s good for healthy living.

“However, for this celebration, there is going to be an exception because I will be frying with the measured portions I bought. This way, I can save more and even fry more,” Alausa said. (NAN)

Economy

Eid-el-Kabir: Ram Sellers Decry Low Patronage as Prices Soar in Ile-Ife

The Chairman, Ram Sellers’ Association, Odo-Ogbe Market, Ile-Ife, Osun, Alhaji Akeem Salahudeen, has complained of low patronage, attributing it to high cost of rams and the economy situation in the country.

Salahudeen stated this in an interview on Wednesday in Ile-Ife.

He said that the big sized ram which was sold between N550,000 and N620,000 last year are now being sold at the rate of N800,000 to N1.

2 million.He added that the medium sized ram which was sold between N300,000 and N350,000 last year is now going for between N450,000 and N550,000.

According to him, small sized ram sold for N200,000 and N230,000 last year now attracts N300,000 and N450,000 this year.

He attributed the increase in the prices of rams in this year’s Sallah to the insecurity in the North, which he claimed had disrupted the supply chain.

“They said the worsening insecurity in the North has forced some sellers to import rams from neighbouring countries like Niger, Mali and Chad, which they said contributed to the high prices,” he emphasised.

At Sabo Cattle Market in Ile-Ife, Alhaji Saheed Yaro, said that the price of rams has surged as the small sized ram which was sold at N150,000 and N180,000 last year, is now being sold between N250,000 and N350,000.

Yaro added that the price of medium sized ram which was between N185,000 and N260,000 last year now goes for between N350,000 to N450,000.

Accordingly, the big sized ram sold between N480,000 and N500,000 last year is now between N550,000 and N780,000.

At Boosa Cattle Market located at Modakeke, Mr Musa Salami stated that prices of rams have witnessed sharp increase with a medium sized ram which was for N170,000 to N200,000 last year is now at N250,000 to N300,000.

Salami stated further that the big sized ram that was sold at N350,000 and N400,000 is now being sold at N600,000 to N750,000.

He added that he brought 150 rams a week ago, but has been able to sell only 15, explaining that many customers turned back on hearing prices without buying.

He noted that customers who usually bought rams from him over the years are now complaining about costs.

NAN reports that ram sellers expressed concern over low patronage in many markets, saying that customers were lamenting the high cost of the animals.

A civil servant, Mr Bayo Olabisi, said that most workers in the state cannot afford to buy rams for this year’s Eid-el-Kabir due to the high prices and the economic hardship.

Olabisi added that the present economic hardship has been taken a toll on the workers, especially with the high transportation and other costs following the removal of fuel subsidy by the government.

“In fact, I visited three places where they sell rams, but I couldn’t buy any because I can’t afford to buy.

“When I priced a medium sized ram, the seller told me N250,000, the same size of ram I bought for N150,000 last year.

“I would rather use part of my salary to buy half bag of rice and two chickens for my family.

“For Allah has said that if you can’t afford ram, you should not borrow or buy on credit because there’s no reward on that,“ he said. (NAN)

Oil & Gas

NNPC Ltd. Disclaims Fake Financial Scheme

The Nigerian National Petroleum Company Limited (NNPC Ltd.) has disowned a fake AI-generated video circulating on social media featuring a cloned voice of the Group CEO, Mr Bayo Ojulari, promoting a fictitious poverty alleviation scheme.

The Chief Corporate Communications Officer, NNPC Ltd.

, Olufemi Soneye in a statement on Thursday clarified that the company had no such investment initiative.Soneye urged the public to disregard the video, originally shared by an account named Mensageiro de Cristo on Facebook.

“NNPC Ltd. has warned the perpetrators to cease their fraudulent actions or face legal consequences,” he said. (NAN)