BUSINESS

Non-Interest Capital Market has Great Potential – SEC

By Tony Obiechina, Abuja

The Securities and Exchange Commission has said that the Non Interest

Capital Market has so much potential in Nigeria as it has the prospect

of attracting a large pool of untapped investor base who have apathy

to conventional instruments, to participate in capital market as well

as the existing investors who seek to diversify their portfolio.

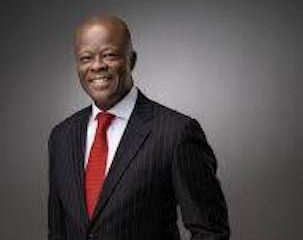

Director General of the SEC, Mr. Lamido Yuguda stated this at a Joint

IFSB/SEC Nigeria Virtual Seminar on Investor Protection and

Transparency in Islamic Capital Markets held Weekend.

Yuguda said the level of activity in Non-Interest (Islamic) capital

market that is currently being witnessed in Nigeria affirms the

overwhelming acceptance of NICM products by the investing public.

He stated that recently, the Market witnessed the entrance of

institutions offering Islamic capital market services/products and

also witnessed the issuances of FGN into the Sukuk market with latest

issuance of FGN SUKUK oversubscribed by over 400 per cent. This he

said, further buttressed the need to enhance the SEC’s investor

protection mechanism in order to ensure transparency in the market.

The SEC boss stated further that investor protection is the principal

plank of regulation and transparency, a building block that enhances

the growth of the capital market adding that the knowledge gap that

often exists between the market Players and investors demand for more

transparency, and the risks faced by investors requires reasonable

level of protection by the regulator in order to build confidence and

trust in the market.

According to him, “Capital markets all over the world thrive on trust,

it is believed that enhancement of investor protection and increased

transparency will have a multiplier effect on investments and

sustainable growth of the economy.

Additionally, in ensuring that investors are well protected, Yuguda

said a framework for complaint management was put in place to

fast-track and streamline the dispute resolution process in the

market. This is to foster and secure investors’ confidence in the

market.

“It is worthy to also note that the 10-year strategic Masterplan

(2015-2025) for the Capital Market includes a section on NICM that

recommends various initiatives aimed at developing this sector. While

some of these activities and programmes have been implemented, a lot

more work is ongoing to unlock the full potential of Non-interest

Capital Market.

“It is a well-known fact that the pandemic has brought about a new

normal to the global economies – including the Nigerian Capital

Market, hence this Seminar couldn’t have come at a better time. The

need to promote and increase awareness of investor protection

mechanism and transparency requirements are considered essential to

engendering investor confidence and trust in the financial system,

which is crucial for the growth and development of the market.”

With respect to NICM, he said the provision of two levels of shariah

review and certification is meant to further serve as added measure

towards investor protection. This is coupled with the requirement for

continuous review\certification of the shariah expert throughout the

tenor of the transaction.

He said, “We are happy to note that Non-Interest financial activities

are developing exponentially across all sectors of the Nigerian

Financial System. Indeed, we expect that the Market will soon witness

substantial investment from the pension industry which will be a game

changer that would spur more issuances of NICM by corporates and

other categories of issuers.”

Yuguda said the SEC Nigeria has not relented in its efforts to

discharge its primary mandate of regulating and developing the

Nigerian Capital Market; protection of investors has been one of our

key focus. Numerous initiatives being implemented in this regard

include the establishment of the National Investor Protection Fund

(NIPF) aimed at compensating investors who incur losses arising from

the insolvency, bankruptcy or negligence of a Capital Market Operator;

the e-Dividend registration and payment system, Dematerialisation and

Direct Cash Settlement system all aimed at ensuring an efficient

process of securities transaction and elimination/minimising cases of

unclaimed dividend.

The purpose of the seminar which is the second collaboration between

the SEC and IFSB in 2021, is to enlighten stakeholders on the

protections available to investors and of the level of transparency

inherent in the Non-Interest Capital Market (NICM).

Economy

Organise Informal Sector, Tax Prosperity Not Poverty, Adedeji Tasks Officials

The Chairman, Joint Tax Board (JTB), Dr Zacch Adedeji, has urged officials of the board to organise traders and artisans into a formal body before capturing them in the tax net.

Adedeji said that this was in line with the agenda of President Bola Tinubu not to tax poverty but prosperity.

The chairman stated this at the 157th Joint Tax Board meeting held in Ibadan, on Monday.

The theme of the meeting “Taxation of the Informal Sector: Potentials and Challenges”.

Speaking on the theme of the event, Adedeji stressed the need to evolve a system that would make the informal sector formal before it could be taxed.

Adedeji, who also doubles as the Chairman, Federal Inland Revenue Service, (FIRS), said “What I would not expect from the JTB meeting is to define a system that would tax the informal sector.

“The only thing is to formalize the informal sector, not to design a system on how to collect tax from market men and women.

“As revenue administrator, our goal is to organise the informal sector so that it can fit into existing tax law.”

Citing a report of the National Bureau of Statistics (NBS) in the first quarter of 2023, the chairman said that the nation’s unemployment index was attributable to recognised informal work.

Adedeji stated that workers in that sector accounted for 92.6 per cent of the employed population in the country as at Q1 2023.

“JTB IS transiting to the Joint Revenue Board with expanded scope and functions.

“We are hopeful that by the time we hold the next meeting of the Board, the Joint Revenue Board (Establishment) Bill would have been signed into Law by the President.

“The meetings of the board provide the platform for members to engage and brainstorm on contemporary and emerging issues on tax, and taxation,” he said.

In his address, Gov. Seyi Makinde of Oyo State, said the theme of the meeting was apt and timely, stressing that it coincides with the agenda of the state to improve on its internally generated revenue.

According to him, the meeting should find the best way forward in addressing the issue of the informal sector and balance the identified challenges.

“Nigeria is rich in natural resources, but it is a poor country because economic prosperity does not base on natural resources,”

Makinde also said that knowledge, skill and intensive production were required for economic prosperity, not just the availability of natural resources.

He stressed the need to move from expecting Federal Allocations to generating income internally.

“We are actively ensuring that people are productive and moving the revenue base forward,” Makinde said.

The governor said that tax drive should be done by simplifying tax processes, incentives for compliance like access to empowerment schemes and loans.

He urged JTB to deepen partnership and innovation in using data on tax to track and administer it.

Earlier, the Executive Chairman, Oyo State Board of Internal Revenue, Mr Olufemi Awakan, said the meeting was to address tax-related matters, evolve a workable, effective and

efficient tax system across the states and at the Federal level.

He urged participants to find amicable solutions to challenges of tax jurisdiction, among others.

Tax administrators from all the 36 states of the federation, who are members of JTB, were in attendance. (NAN)

Agriculture

Tiv Monarchs Give Herders Ten Days Ultimatum To Vacate Tiv Kingdom

By David Torough, Abuja

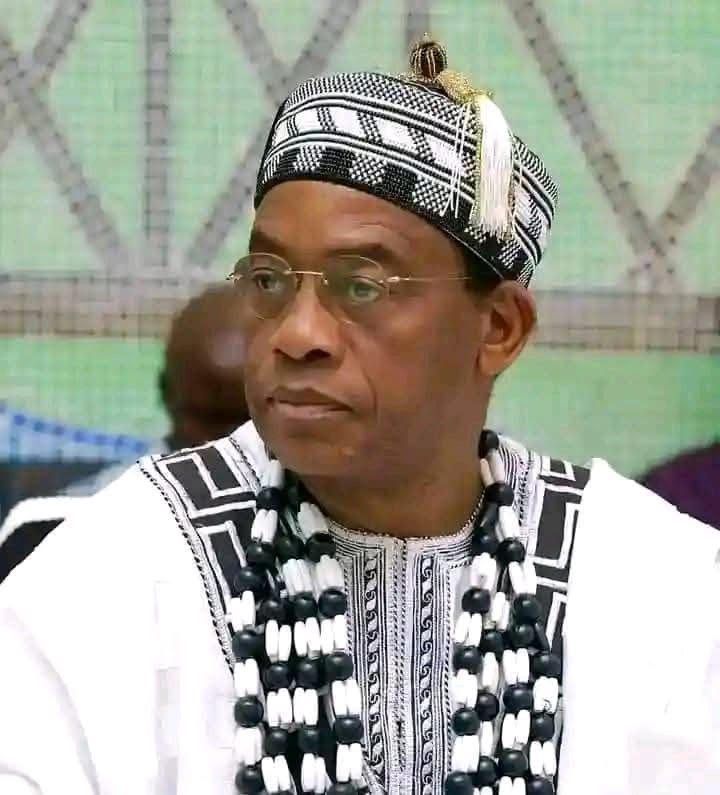

The Tiv Area Traditional Council during its emergency meeting held yesterday in the palace of the Tor Tiv in Gboko requested the Governor Hyacinth Alia led administration to create an enabling environment to allow herders’ peaceful exit of farmlands in Tiv Kingdom to facilitate resumption of farming activities.

Consequently, the Council directs political and traditional rulers in each local government area of Tiv Kingdom to peacefully engage the herders to ensure their exit from the local government areas to allow farming resumes.

The Council which was chaired by the Tor Tiv himself, HRM Prof James Ortese Iorzua Ayatse CFR equally appealed to all herders in Tiv Kingdom in Benue State to vacate all Tiv lands before the end of May 2025 to allow farmers return and cultivate their farms in order to avoid the looming hunger in Nigeria.

According to a Communique signed by the Secretary of the Council Mr Shinyi Tyozua which deliberated particularly on the security situation in Tiv Kingdom the Council enumerated the communities worst affected to include those in Kwande, Katsina Ala, Logo, Ukum, Guma, Makurdi, Gwer West Gwer East and Buruku Local Government Areas.

The Council lamented that farming activities in the kingdom have ceased due to the occupation of farmlands by herders for grazing and attacks and killings of farmers who fled stressing that if the situation continues it will ultimately result to hunger in Tiv Kingdom and Nigeria as a whole.

Agriculture

Ondo Govt. Destroys 200kg Seized Cocoa Adulterants

The Ondo State Government, on Thursday, destroyed 200kg adulterants used for adulteration of cocoa beans, seized from a merchant in Ondo West Local Government Area of the state.

Mr Segun Odusanya, Permanent Secretary in the Ministry of Agriculture and Forestry (Forestry and produce sub section), supervised the destruction of the 200kg bags of seized adulterants.

Odusanya explained that the destruction was part of government efforts to ensure that the state maintained quality cocoa production in the country.

“Mr governor, Lucky Aiyedatiwa, has reiterated the commitment to ensure the state remains the highest producing state with good cocoa quality

“Anyone caught engaging in illegal activities will be prosecuted accordingly.

“Moreover, this action was embarked on to warn cocoa merchants, who intend to engage in illegal activities, to rethink before getting into it.

“We are going to seal any store caught in such illegal activities, the products will be burnt while the merchant will be prosecuted according to the laws of the land.

“If we are saying we are the highest cocoa producing state and we continue to encounter this scenario, it will give us a bad publicity.

“The bad publicity will be in the country and extend to the international market, and we don’t want that,” he said.

The permanent secretary, therefore, commended Aiyedatiwa for graciously approving the recruitment of 60 new staff to checkmate the activities of cocoa merchants in the state.

“Mr governor has supported us, he has said we should recruit more people to guide against any adulteration and ensure we have a good quality cocoa beans.

“I must commended our task force committee for ensuring that the state holds its position in the country and the international market,” he said.

Earlier, Mr Tunji Akinnadeju, a Director of Produce (DP3) in the Grading and Allied Department of the ministry, said the adulterants were intercepted at Ondo West Local Government Area of the state.

Akinnadeju said that the owner of the adulterants took to his heels at the time of arrest.

“As we all know that cocoa is being sold in weight and after adding all these things, it will be sold at high prices, which is not good enough.

“So, doing that will bring a lot of damage to the image of the state and the country at large in the international market,” he said.

Also, Mr Sunday Adegbola, a Director of Produce Licensing in the ministry, said the merchants’ actions could affect people during consumption of the cocoa products, if care was not taken.

Adegbola, who pledged that the ministry would not rest until the state was free from adulterated cocoa beans, said the nefarious action could be attributed to the price tag at the international market.

“It is the price at the international market and the price is better for the farmers, not for the people who use adulterants.

“With this action, many people will drink cocoa as a chocolate powder and other materials from cocoa beans which has been adulterated.

“The consumption of these chemical products will also affect humans,” he said. (NAN)