BUSINESS

Petrol Subsidy to Cross N300bn Next Month

By Joseph Amah, Abuja

It is projected that Nigeria may spend over N300 billion on petroleum subsidy bill next month as the landing cost of importing fuel skyrocketed amid the Russia-Ukraine crisis. Subsidy or under-recovery is the underpriced sales of premium motor spirit (PMS), better known as petrol.

The global prices of oil climbed above $100 per barrel due to disruption in global supply and potential talks on the ban of Russian oil by the European Union and the United States.

The higher the global oil prices, the more Nigeria will pay to import refined crude products — while the cost of subsidising petrol continues to erode revenue for Africa’s largest oil producer without functional refineries.In 2021, NNPC deducted N1.43 trillion which depleted Federation Account Allocation Committee (FAAC) revenue to N542 billion from a projected N2.51 trillion for the year.In its monthly presentation to the FAAC meeting in February, the Nigerian National Petroleum Company (NNPC) Limited had said it would deduct N242.5 billion from the federation for subsidy at March’s meeting.

The deduction, according to NNPC, includes N143.7 billion for January 2022 recovery outstanding and November spot arrears of N98.8 billion). At the March meeting, NNPC did not remit any money to the FAAC for onward distribution to the federating units –- an action that may cause fiscal stress to state and local governments and cut short developmental projects.

A monthly revenue document by agencies of government confirmed that NNPC did not remit any funds to the federation account in January and in February 2022.Further details showed that value-added tax (VAT) contributed the highest to the federation purse with N177 billion. The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) remitted 109 billion, FIRS (Oil tax collection) at N105.3 billion (non-oil) N90.9 billion, while customs contributed N124.2 billion. The document also revealed that the sum of N7.5 billion was recovered as excess bank charges for the month.

This year, the federal government has planned to spend up to N3 trillion to settle the petrol subsidy. President Muhammadu Buhari had asked the national assembly to approve N2.557 trillion budget for petrol subsidy in 2022 — extending the implementation of deregulation policy in the landmark Petroleum Industry Act (PIA) by another 18 months.

Agriculture

NNPC Foundation Empowers Vulnerable Farmers in Oyo, Osun

No fewer than 500 farmers on Tuesday benefited from the NNPC Foundation agricultural training initiative for vulnerable farmers in Osun and Oyo States.

The training, marking the flag-off in the South-West zone of Nigeria, was held at the Ilora Baptist Grammar School, Ilora, Oyo State.

The foundation manages the Corporate Social Responsibility (CSR) initiatives of NNPC Limited, focusing on education, health, environment and energy access to communities nationwide.

The Managing Director of the foundation, Mrs Emmanuella Arukwe, said the initiative demonstrated the commitment to food security and economic empowerment for Nigerian farmers.

Arukwe, who was represented by Dr Bala David, the foundation’s Executive Director, Programme Development, said the project aimed to build resilience, boost productivity and promote sustainable agriculture.

“We are training 6,000 farmers across six zones in climate-smart practices, modern techniques, quality inputs, and market access,” she said.

She, therefore, urged farmers to participate actively and embrace the opportunity to help secure Nigeria’s food and economic future.

Mr Olasunkanmi Olaleye, Oyo State Commissioner for Agriculture and Rural Development, commended NNPC Foundation for the training and empowerment programme.

Olaleye, who was represented by Mr Olusegun Ezekiel, the ministry’s Director of Regulation and Enforcement, said empowering vulnerable farmers was crucial in addressing national food security challenges.

He added that the initiative aligned with Oyo State’s agricultural transformation agenda of Gov. Seyi Makinde.

“We remain committed to supporting initiatives that uplift farmers and improve productivity and livelihoods,” Olaleye said.

He encouraged participants to make the most of the training opportunity to improve their practices.

He also called for future collaboration between the foundation and the ministry to achieve greater impact.

The training consultant, Prof. Daniel Ozok, described vulnerable farmers as smallholders with an under-five-hectare farm size, mainly made up of women, youth, and the elderly.

“These farmers are most affected by climate shocks, hence the need for focused training,” Ozok said.

According to him, training equips them with modern techniques and strategies for improved productivity and market access.

Some of the participants expressed gratitude to NNPC Foundation and promised to apply the knowledge gained from the training.

NAN reports that a medical screening exercise was organised by the foundation for participants on the sidelines of the training.

Training initiative would later be held for farmers in Ekiti and Ondo States on a date different from that of Ogun and Lagos States. (NAN)

Economy

Customs Zone D Seizes Contraband Worth N110m

The Nigeria Customs Service (NCS), Federal Operation Unit (FOU), Zone D, has seized smuggled goods worth over N110 million between April 20 till date.

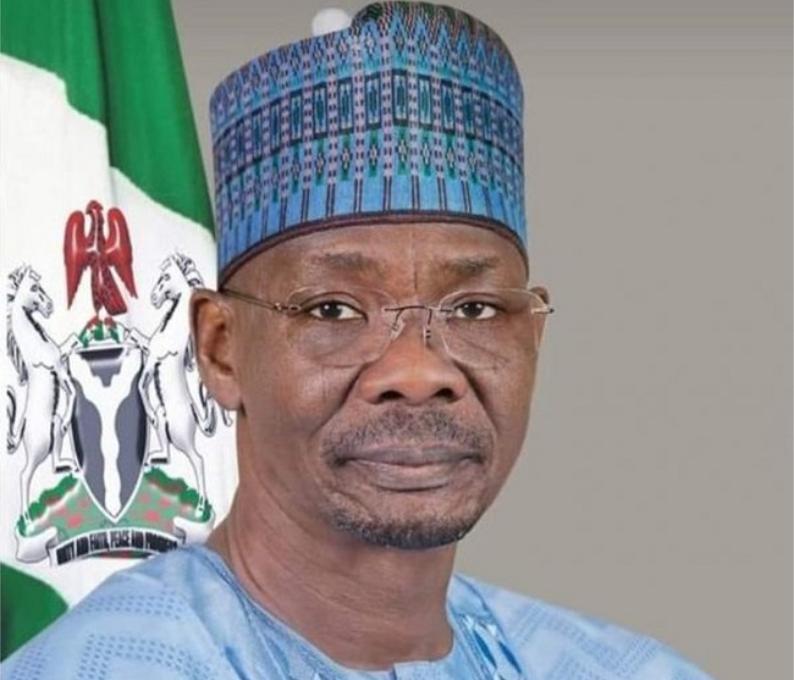

The Comptroller of Customs, Abubakar Umar, said this at a news conference on Tuesday in Bauchi.

He listed the seized items to include 11,200 litres of petrol; 192 bales of second hand clothing, 140 cartons of pasta, 125 pairs of jungle boots, 47 bags of foreign parboiled rice and 9.

40 kilogramme of pangolin scales.Umar said the items were seized through increased patrols, intelligence-led operations, and strengthened inter-agency collaboration.

The comptroller said the pangolin scales would be handed over to the National Environmental Standards and Regulations Enforcement Agency (NESREA) for appropriate action, while the seized petrol would be auctioned, and the proceeds remitted to the federation account.

He attributed the decrease in smuggling activities of wildlife, narcotics, and fuel to the dedication and professionalism displayed by the personnel in line with Sections 226 and 245 of the NCS Act 2023.

The comptroller enjoined traders to remain law abiding, adding the service would scale up sensitisation activities to combat smuggling.

“We remain resolute in securing the borders and contributing to Nigeria’s economic development,” he said.

The FOU Zone D comprises Adamawa; Taraba, Bauchi, Gombe, Borno, Yobe, Plateau, Benue and Nasarawa. (NAN)

Economy

Trade Tensions: Global Economy Stands at Fragile Turning Point -UN

The UN Department of Economic and Social Affairs (UN DESA) has said that the global economy stands at a fragile turning point amid escalating trade tensions and growing policy uncertainties.UN DESA, in a report published on Thursday, stated that tariff-driven price pressures were adding to inflation risks, leaving trade-dependent economies particularly vulnerable.

It stated that higher tariffs and shifting trade policies were threatening to disrupt global supply chains, raise production costs, and delay key investment decisions – all of this weakening the prospects for global growth. The economic slowdown is widespread, affecting both developed and developing economies around the world, according to the report.For instance, in the United States, growth is projected to slow “significantly”, as higher tariffs and policy uncertainty are expected to weigh on private investment and consumer spending.Several major developing economies, including Brazil and Mexico, are also experiencing downward revisions in their growth forecasts.China’s economy is expected to grow by 4.6 per cent this year, down from 5.0 per cent in 2024. This slowdown reflects a weakening in consumer confidence, disruptions in export-driven manufacturing, and ongoing challenges in the Chinese property sector.By early 2025, inflation had exceeded pre-pandemic averages in two-thirds of countries worldwide, with more than 20 developing economies experiencing double-digit inflation rates.This comes despite global headline inflation easing between 2023 and 2024.Food inflation remained especially high in Africa, and in South and Western Asia, averaging above six per cent. This continues to hit low-income households hardest.Rising trade barriers and climate-related shocks are further driving up inflation, highlighting the urgent need for coordinated policies to stabilise prices and protect the most vulnerable populations.“The tariff shock risks hitting vulnerable developing countries hard,” Li Junhua, UN Under-Secretary-General for Economic and Social Affairs, said in a statement.As central banks try to balance the need to control inflation with efforts to support weakening economies, many governments – particularly in developing countries – have limited fiscal space. This makes it more difficult for them to respond effectively to the economic slowdown.For many developing countries, this challenging economic outlook threatens efforts to create jobs, reduce poverty, and tackle inequality, the report underlines. (NAN)