COVER

Rivers Assembly Accuses Fubara of Stalling Budget Process

By Joel Oladele, Abuja

Amid the ongoing political crisis rocking Rivers State, the House of Assembly has accused Governor Siminalayi Fubara of deliberately stalling the 2025 budget process, igniting fears over the state’s financial future.

With accusations flying and public morale at stake, lawmakers are urging citizens to pressure the governor into following due process rather than playing the victim in this escalating political feud.

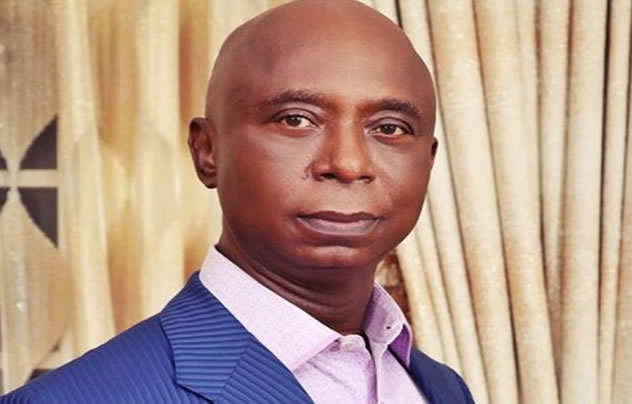

The Martin Amaewhule-led House, which is loyal to the former governor and the Minister of the Federal Capital Territory, Nyesom Wike, made the accusation yesterday, through its Chairman, House Committee on Information and spokesperson, Dr Enemi George, in Port Harcourt, the state capital yesterday.

The Lawmakers asserted that the governor’s inaction is frustrating the implementation of the Supreme Court ruling mandating him to re-present the 2025 Appropriation Bill for legislative approval.

George urged the public to pressure the governor to follow due process in presenting the 2025 Appropriation Bill, rather than attempting to gain public sympathy by portraying lawmakers as obstacles.

He challenged the governor to produce an acknowledged copy of the letter he claimed to have sent to the House.

He said, “Last week, we were told that on his way to Ogoni for a programme, the governor made a stopover at the gate of the House of Assembly Quarters to grant an interview to the press.

“In that interview, he claimed that he had sent a letter to the House of Assembly indicating his intention to visit and present the appropriation bill, a claim we found rather astonishing as no such letter was received by the House of Assembly.

“His aides later alleged that they forwarded a letter through Whatsapp to some members of the House, which was also awkward, unprofessional and embarrassing.”

George added, “As I speak, the social media space is awash with stories about a purported letter from the governor to the House of Assembly expressing his intention to visit the house to present the appropriation bill for the year 2025.

“Nothing can be farther from the truth. We want to state categorically that there is no such letter before the House of Assembly nor any of its staff.

“We challenge the governor and his aides to produce an acknowledgement copy of such a letter or any evidence that such a letter was sent or received by the House of Assembly. It is absolutely untrue and unfortunate. The general public must as a matter of importance ignore such claims.

“It is now very obvious that if at all there was such a letter, the intended recipient was not the legislature, but the public, and the clear intention was to play to the gallery, whip up public sentiment, demonize the House of Assembly and set the public against us. This is demeaning, denigrating and perilously unfortunate.”

George further said the governor frustrated all the House’s efforts to work with him to resolve the lingering crisis immediately after the Supreme Court judgment, particularly on the aspect of presenting the Appropriation Bill in the interest of the state.

George stated, “Recall after the recent Supreme court judgment on the budget of our state, it became absolutely necessary for the Governor of Rivers State, His Excellency, Sir Siminalayi Joseph Fubara, to present the appropriation bill to the legislature for consideration and passage.

“Also recall that immediately after the judgment, this house wrote to the governor, calling on him to immediately present the budget for speedy consideration.

“It was our hope that by the 15th of March, 2025, we would have concluded the process of passing the appropriation bill into law, so as to give us enough time to approach the Federal Government to release funds meant for our state which have been seized by the judgement of the Supreme Court.

“This we did in the interest of our dear state and in pursuit of peace, recognising that no government can function optimally without a harmonious co-existence between the executive and the legislature.”

According to George, House staff members who attempted to deliver the letter to the Government House were assaulted and turned away.

The lawmakers then resorted to using a courier service, but the governor still did not respond.

He added, “The governor did not heed to our call, nor did he demonstrate any intention to.

“Recall again that the judgment of the Supreme Court invalidated the appointment of most of the commissioners of the state. To bridge this gap and avoid a vacuum, this house immediately wrote to the Governor to submit the list of commissioners for immediate screening.

“Our letter was again rejected at the government house and we once again resorted to delivering the mail through a courier service. Rather than heed our call, the governor instructed them to go to court against us, which they have now done.

“The governor went further to instruct all ministries, agencies and departments of government not to receive any correspondence from the Rivers State House of Assembly nor communicate with us in any manner”.

George said the governor must be reminded that the House of Assembly is not an appendage of the executive and its members are not his slaves, bondservants and serfs.

“We are an independent arm of government in line with the principles of horizontal separation of powers as expressed in Section 4, Section 5, and Section 6 of the Constitution of the Federal Republic of Nigeria, 1999 as amended.

He said the Assembly was the worst hit in the ongoing crisis, lamenting that the lawmakers had suffered untold hardship insisting that the governor must be stopped from extending such punishment to Rivers people.

George said, “This Assembly has borne the brunt of this crisis. We have endured immense hardship. We have been battered almost beyond our carrying capacity. We have been punished unduly and unfairly for trying to perform our constitutional duties.

“Our governor must not extend this punishment to Rivers people. No, please no. We must not allow it.

“We have seen hell: Our hallowed chamber was burnt down by the governor. The House of Assembly Complex was brought down by the Governor, totally demolished alongside our personal effect and belongings.

“Our Speaker’s residence was brutally attacked. Our residential quarters was brutally invaded by the governor.”

He warned that the governor’s actions could negatively impact the livelihoods of Rivers people.

COVER

SEC Warns against Investing in Punisher Coin

The Securities and Exchange Commission (SEC) has cautioned Nigerians against investing in a cryptocurrency called Punisher Coin, also known by the symbol $PUN.In a statement issued Sunday in Lagos, SEC said the presale was unauthorised and lacked regulatory approval, resembling a Ponzi scheme.

According to the statement, the promoters of $PUN are not registered to operate in any capacity within Nigeria’s capital market. The Commission said: “Our attention has been drawn to online promotions of an unauthorised presale for a cryptocurrency called Punisher Coin, also known as $PUN. “Of particular concern is an article by Daily Trust E-Paper titled: ‘Cryptos to Buy: Why Punisher Coin Could Join Avalanche and Chainlink.’”SEC clarified that Punisher Coin and its promoters are neither registered nor approved to promote, launch, trade, or solicit investment from the Nigerian public.Preliminary investigations indicate Punisher Coin is a ‘meme coin’ — a type of digital asset often lacking tangible utility or a supporting project.Further findings confirm $PUN is indeed a meme coin, typically without real-world value, purpose, or technical foundation backing its existence.The value of such coins is usually driven by hype, social media trends, or promotional efforts by its creators and community.This makes them vulnerable to ‘pump and dump’ schemes — fraudulent tactics used to inflate and then crash a coin’s market price.In such schemes, promoters spread false hype, creating buying pressure, then sell off their holdings at the peak, leaving others with losses.After the promoters sell and stop hyping, the coin’s value usually plummets, causing unsuspecting investors to lose money rapidly.SEC noted these coins’ value is largely based on manipulation, not substance, with price swings driven by excitement and misleading claims.The public is therefore strongly warned against participating in the presale of Punisher Coin, as any investment is entirely at one’s own risk.The Commission urges investors to verify the legitimacy of any digital asset, its promoters, and platforms before committing funds.Verification can be done via SEC’s official portal: https://home.sec.gov.ng/fintech-and-innovation-hub-finport/registered-fintech-operators.(NAN)COVER

Farmers-Herders Crisis: FG Unveils Plan to Revive 417 Grazing Reserves

By David Torough, AbujaThe Federal Government has announced a comprehensive plan to rehabilitate 417 grazing reserves across the country as part of efforts to end the long-standing clashes between herders and farmers.Senior Special Assistant to the President on Livestock Development, Idris Ajimobi, revealed that the government was working closely with both local and international partners through the newly created Ministry of Livestock Development to realise the initiative.

Ajimobi, who spoke at the weekend in Ibadan, stated that the plan is to revive at least two to three grazing reserves in different parts of the country within the next 12 to 18 months as a pilot phase of a broader rehabilitation programme.“The target is to revive all the grazing reserves as much as possible,” he said. “Some have unfortunately become overrun by aggressive weeds, making them inhabitable for livestock, but a large number—about 400—are still functional and require minimal upgrades to return to standard.”According to him, engagements with local and foreign stakeholders are already underway to assess investment interests and collaboration opportunities. “There is interest from all over, and we are speaking with partners to identify who can come in where,” he added.The initiative is a key part of President Bola Tinubu’s strategic response to the decades-old herders-farmers conflict, which has disrupted livelihoods and strained rural economies across the country.Ajimobi also highlighted early achievements of the Ministry of Livestock, noting that beyond reviving grazing reserves, the ministry is focused on addressing the root causes of the conflict—chiefly, the lack of access to clean water, food, and healthcare for livestock.“We are going back to the drawing board to identify all the sources of the problem and address them,” he explained. “We must engage the people, sensitise them, and carry them along because we cannot do it alone.”As part of broader reforms, the ministry is also working to improve the quality of Nigerian beef and dairy products by supporting farmers with better inputs and sustainable practices. The goal, Ajimobi noted, is to boost local production and reduce dependence on imported dairy.“We want to get to a stage where every Nigerian child gets a pack of milk a day,” he said. “To achieve this, we need to increase our local production and work together in a collective effort.”The Federal Government’s revival of grazing reserves has been welcomed by stakeholders, with hopes high that the initiative will help bring lasting peace to affected communities and modernise Nigeria’s livestock industry.COVER

UN Hails Adesina’s Leadership in Africa’s Sustainable Development

The United Nations (UN) Secretary-General António Guterres has praised African Development Bank (AfDB) Group President, Dr Akinwumi Adesina, for his efforts in ensuring the economic transformation of Africa.The bank said in a statement yesterday, that Guterres relayed the message at the Bank’s 2025 Annual Meetings in Abidjan, Côte d’Ivoire.

First elected as president of the Bank Group in 2015, Adesina will conclude his decade-long tenure at the end of August. Guterres lauded Adesina’s transformative impact, saying: “Your vision and dedication to just and sustainable development have changed countless lives across Africa.”The secretary-general also reiterated Adesina’s strategic leadership in implementing the ambitious High 5s development agenda of the bank.The High 5s are; to light up and power Africa, Feed Africa, Industrialise Africa, Integrate Africa and improve the quality of life of Africans.“Under President Adesina’s stewardship, the AfDB achieved remarkable institutional expansion, tripling its capital base during his tenure.“This growth enabled the Bank to respond effectively to urgent crises, including the COVID-19 pandemic, while simultaneously advancing long-term sustainable solutions.“The Bank’s progress in critical areas, including clean energy development and climate-resilient agriculture sectors are vital to Africa’s sustainable future and climate adaptation efforts,” he said.The UN chief commended Adesina’s pioneering work on the IMF’s Special Drawing Rights (SDRs), which had opened new avenues in financing for development.He said: “This innovative approach addresses the pressing needs of countries facing multiple challenges, including debt burdens, climate-related shocks, and severely limited fiscal space.“Your advocacy was instrumental in securing their re-channeling through multilateral development banks, helping direct and use global resources where they are most needed,” he said.Guterres also praised Adesina’s contributions to advancing inclusive development and achieving meaningful progress on both the UN Sustainable Development Goals and the African Union’s Agenda 2063.While expressing the UN’s appreciation, Guterres said the AfDB President’s efforts had been instrumental in building a more fair and just financial system for all.“The United Nations thank you and look forward to building on your remarkable record in the years ahead,” he said.The Bank Group’s 2025 Annual Meetings had the theme “Making Africa’s Capital Work Better for Africa’s Development.”The meeting was attended by several heads of state and government including the host, President Alassane Ouattara, Ghana’s President John Mahama and Azali Assoumani of the Union of the Comoros.More than 6,000 delegates from various parts of the world also attended the event. (NAN)