COVER

Tinubu Declares State of Emergency in Rivers amid Political Turmoil

By Joel Aladele, Abuja

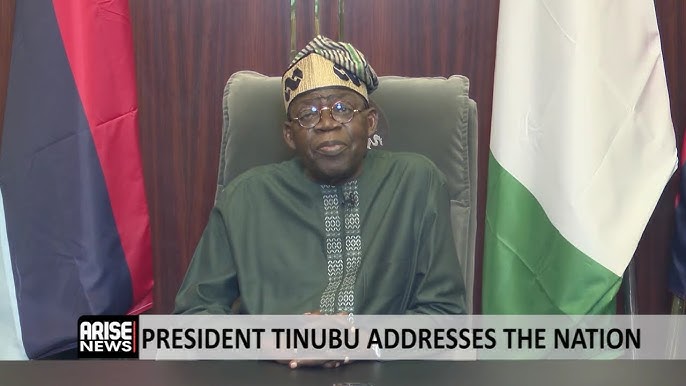

In a move aimed at restoring order and governance in Rivers State, President Bola Tinubu yesterday declared a state of emergency, citing severe political instability and unprecedented challenges to democratic processes.

Tinubu made the proclamation during a nationwide broadcast, suspending Governor Siminalayi Fubara; his deputy Ngozi Odu and all the members of the House of Assembly for an initial six months.

Consequently, Vice Admiral Ibokette Ibas (Rtd) has been appointed as the state’s interim military administrator, tasked with steering the region back to stability.

The president cited Section 305 of the 1999 Constitution while making the proclamation.

The section interprets a state of emergency as a situation of national danger, disaster or terrorist attacks in which a government suspends normal constitutional procedures to regain control.A state of emergency allows the President to immediately make any desired regulations to secure public order and safety.

For about two months, there seemed to be no end in sight in the protracted feud and power tussle between the Minister of the Federal Capital Territory (FCT), Nyesom Wike and his estranged ex-political godson Fubara over the control of the political structure in the oil-rich Rivers State.

Pipelines have reportedly exploded in the state as the political tension heightened, with civil servants threatening mass protests against the Martins Amaewhule group in the House of Assembly loyal to Wike.

According to the President, the latest security reports made available show that “between yesterday and today there have been disturbing incidents of vandalisation of pipelines by some militant without the governor taking any action to curtail them. I have, of course given stern order to the security agencies to ensure safety of lives of the good people of Rivers State and the oil pipelines.”

In view of the development, Tinubu therefore declared Fubara, his Deputy and elected lawmakers suspended for six months.

“With all these and many more, no good and responsible President will standby and allow the grave situation to continue without taking remedial steps prescribed by the Constitution to address the situation in the state, which no doubt requires extraordinary measures to restore good governance, peace, order and security.

“In the circumstance, having soberly reflected on and evaluated the political situation in Rivers State and the Governor and Deputy Governor of Rivers State having failed to make a request to me as President to issue this proclamation as required by section 305(5) of the 1999 Constitution as amended, it has become inevitably compelling for me to invoke the provision of section 305 of the Constitution of the Federal Republic of Nigeria, 1999 as amended, to declare a state of emergency in Rivers State with effect from today, 18th March, 2025 and I so do.

“By this declaration, the Governor of Rivers State, Siminalayi Fubara, his deputy, Ngozi Odu and all elected members of the House of Assembly of Rivers State are hereby suspended for an initial period of six months.

“In the meantime, I hereby nominate Vice Admiral Ibokette Ibas (Rtd) as Administrator to take charge of the affairs of the state in the interest of the good people of Rivers State.

He, however, said that for the avoidance of doubt, the declaration did not affect the judicial arm of the state, which shall continue to function in accordance with their constitutional mandate.

“The Administrator will not make any new laws.

‘He will, however, be free to formulate regulations as may be found necessary to do his job, but such regulations will need to be considered and approved by the Federal Executive Council and promulgated by the President for the state.

“This declaration has been published in the Federal Gazette, a copy of which has been forwarded to the National Assembly in accordance with the Constitution.

“It is my fervent hope that this inevitable intervention will help to restore peace and order in Rivers State.

“It will awaken all the contenders to the constitutional imperatives binding on all political players in Rivers State in particular and Nigeria as a whole,” he said

The President’s action followed a Supreme Court ruling that deemed Governor Fubara’s actions unconstitutional, declaring, “A government cannot be said to exist without one of the three arms that make up the government of a state under the 1999 Constitution as amended.” The court found that Fubara’s unilateral decision to demolish the state legislature — a move made over a year ago — effectively rendered the governance structure in Rivers non-existent. The court’s judgment emphasized the need for immediate restoration of constitutional order in the state, further complicating the already fraught political landscape.

On May 18, 2004, President Olusegun Obasanjo declared state of emergency on Plateau State, suspending the elected Governor Joshua Dariye and the State House of Assembly in the process, also citing Section 305 of the 1999 Constitution. He accused the governor of failing to act to end a cycle of bloodletting violence between the Plateau State’s Muslim and Christian communities that claimed over 2,000 lives since September 2001.

Similarly, President Goodluck Jonathan also declared a State of Emergency in some local governments in Borno and Plateau States in 2011 before full declaration in Borno, Adamawa, and Yobe States.

Too Early to Comment on Presidential Declaration – Rivers Govt

Meanwhile, the Rivers State Government has stated that it is too early to make comments on the presidential declaration of a state of emergency in the state.

President Bola Tinubu in a nationwide broadcast, yesterday, had suspended the Rivers State Governor, Sir Siminialayi Fubara, his Deputy, Prof. Ngozi Nma Odu, as well as the members of the State House of Assembly.

When contacted immediately after the declaration by the president, the Commissioner of Information and Communications, Joseph Johnson, said it was too hasty for the government to take any position.

Johnson said: “The president has made a declaration and what do you think we can say. I think it is too hasty to make any comment about it.”

COVER

Zenith Bank Profit before Tax Hits N351bn in Q1 2025

By Joel Oladele, Abuja

Zenith Bank Plc has recorded a 10% Year on Year (YoY) increase in Profit Before Tax (PBT), which stood at N351 billion as against N320 billion recorded in Q1 2024. Relative to the same period, Profit After Tax (PAT) also rose 21% to N312 billion.

The bank announced its unaudited results for the first quarter ended March 31, 2025, with a double-digit growth of 22% in Gross Earnings, from N781 billion reported in Q1 2024 to N950 billion in Q1 2025. From the unaudited statement of account submitted to the Nigerian Exchange (NGX) on Wednesday, the growth in the topline was driven mainly by a 72% increase in the Group’s interest and similar income which rose from N489 billion in Q1 2024 to N838 billion in the period under review.The growth in interest income was on the back of the sustained high-interest rate environment. However, non-interest income declined by 67%, with the increase in other operating income outpaced by the drop in trading gains.The profitability was further enhanced by a decline in the cost of funds, which stood at 3.9% in Q1 2025 versus 4% in Q1 2024. The cost of risk dropped to 1.8% against the 2.8% reported in March 2024. These reductions reflect the Bank’s proactive deposit mix optimisation, improved asset quality and enhanced risk management, contributing to overall earnings resilience. Net interest margin (NIM) improved to 10.3% in Q1 2025, up from 8.3% in Q1 2024. Return on Average Equity (ROAE) and Return on Average Assets (ROAA) both declined YoY to 29.4% and 4.0%, respectively.This decline reflects the impact of the recent industrywide recapitalization exercise, which expanded the Bank’s shareholding base.Gross loans reported a measured growth of 1% from N11 trillion in December 2024 to N11.08 trillion in March 2025, as the Bank cautiously grows its loan book.Customer deposits grew by 3% from N21.96 trillion in December 2024 to N22.68 trillion in March 2025. Total assets increased by 8% to N32.42 trillion within the same period.Prudential ratios remained well above the minimum regulatory requirement. At the end of Q1 2025, Capital Adequacy Ratio (CAR) and Liquidity Ratio stood at 24% and 60% respectively, while Coverage Ratio remained strong at 217.2%, demonstrating the Bank’s enduring ability to maintain a robust and liquid balance sheet.As the Bank pursues enhanced profitability, its focus on cost efficiency, delivering superior customer experience, and a strategic improvement on digital adoption remain at the forefront of its blueprint. In addition, the Bank is well-positioned to deploy further capital to expedite its ongoing expansion plans as it seeks to create enhanced shareholder value and go for growth.Zenith Bank’s track record of excellent performance has continued to earn the brand numerous awards including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the fifteenth consecutive year in the 2024 Top 1000 World Banks Ranking, published by The Banker Magazine. The Bank was also awarded the Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020, 2022 and 2024; and Best Bank in Nigeria for four times in five years, from 2020 to 2022 and in 2024, in the Global Finance World’s Best Banks Awards.Further recognitions include Best Commercial Bank, Nigeria for four consecutive years from 2021 to 2024 in the World Finance Banking Awards and Most Sustainable Bank, Nigeria in the International Banker 2023 and 2024 Banking Awards. Additionally, Zenith Bank has been acknowledged as the Best Corporate Governance Bank, Nigeria, in the World Finance Corporate Governance Awards for 2022, 2023 and 2024 and ‘Best in Corporate Governance’ Financial Services’ Africa for four consecutive years from 2020 to 2023 by the Ethical Boardroom.The Bank’s commitment to excellence saw it being named the Most Valuable Banking Brand in Nigeria in the Banker Magazine Top 500 Banking Brands for 2020 and 2021, Bank of the Year 2023 and 2024 at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards and Retail Bank of the Year for three consecutive years from 2020 to 2022 and in 2024 at the BAFI Awards.The Bank also received the accolades of Best Commercial Bank, Nigeria and Best Innovation in Retail Banking, Nigeria, in the International Banker 2022 Banking Awards. Zenith Bank was also named Most Responsible Organisation in Africa, Best Company in Transparency and Reporting and Best Company in Gender Equality and Women Empowerment at the SERAS CSR Awards Africa 2024; Bank of the Year 2024 by ThisDay Newspaper; Bank of the Year 2024 by New Telegraph Newspaper; and Best in MSME Trade Finance, 2023 by Nairametrics.COVER

Access Holdings Posts N182.75bn Profit in First Quarter

Access Holdings Plc said it generated N182.75 billion profits after tax for the first quarter of 2025, as against N159.29 billion recorded in the first quarter of 2024.The group disclosed this in its unaudited financial statement for the period ended March 31, 2025, which was released through the Nigerian Exchange Ltd.

The group also increased its profit before tax from N202. 74 billion in 2024 to N222. 78 billion in 2025.However, its total asset declined from N41.498 trillion in 2024 to N30.085 trillion in 2025.Meanwhile, its earning per share rose from N4.35 in 2024 to N4.88 in 2025.BUA Foods Declares 24% Revenue Growth in Q1BUA Foods Plc, diversified and leading food business, says the company’s revenue grew by 24 per cent to N442.1 billion in the quarter of 2025, up from N356.9 billion in the corresponding period of 2024.Dr Ayodele Abioye, the Managing Director, BUA Foods, made this known in a statement on Thursday in Lagos.Abioye said the company’s gross profit increased by 39 per cent to N160.91 billion, total equities improved by 29.2 per cent to N554.34 billion and its profit after tax rose by 124 per cent to N125.28 billionHe noted that the development showed robust growth across key financial indicators, driven by substantial increases in revenue from flour, which soared 145 per cent to N176.2 billion.He added that pasta rose by 12 per cent to N41.5 billion, and rice recorded a remarkable increase of 1,617 per cent to N13.02 billion.Abioye, however, noted that sugar revenue saw a slight 11 per cent quarter-on-quarter decrease to N211.3 billion when compared to its 2024 figure of N238.2 billion.“Total operating expenses for the period increased by 56 per cent to N22.39 billion from the Q1 2024 of N14.37 billion due to increases in selling and distribution expenses which rose 13 per cent to N11.08 billion.“In spite of the increase in operating expenses, BUA Foods achieved a substantial growth of 124 per cent in profit after tax to N125.28 billion in Q1 2025, compared to N55.82 billion in Q1 2024.“Consequently, Earnings per Share (EPS) also saw a significant increase of 125 per cent to N6.96 from N3.10 in the corresponding period,” he said.Abioye expressed pleasure of beginning 2025 on a strong note, as the business continued to demonstrate resilience and adaptability amidst a still-evolving macroeconomic landscape.He said in spite of operating in a high-cost environment, its proactive supply chain measures and improved internal efficiencies enabled the company to sustain strong operational momentum.He said the company remained focused on deepening market penetration and accelerating innovation to meet changing consumer needs.“With a stabilising economy and growing emphasis on food security, we are confident that our unique and integrated business model, strong financial position, and robust execution will continue to enhance our strategic growth and create lasting value for all stakeholders throughout 2025,” he said.(NAN)COVER

SEC Discovers another Ponzi Scheme, Warns Public against Risks

By Tony Obiechina, Abuja

The Securities and Exchange Commission (SEC) has uncovered another suspected illegal investment platform identified as TOFRO.COM (Tofro), warning Nigerians against falling for their antics to obtain money through promises of usually high returns.

The Commission raised the alarm in a notice issued yesterday and made available to journalists. The warning is coming barely a month after the alleged N1. 2tn digital trading fraud perpetrated by the embattled Crypto Bridge Exchange (CBEX) trading platform that reportedly affected over 600,000 Nigerians.In the notice, SEC warned that the suspected investment platform holds itself out as a cryptocurrency trading platform, adding that such an investment scheme is not registered by the Commission.SEC stated that based on its investigations, Tofro’s operations exhibit the typical indicators of a fraudulent Ponzi scheme, including the promise of unusually high returns, heavy reliance on a referral system to sustain pay-outs and failure to honour withdrawal requests from subscribers.Consequently, the SEC strongly advised Nigerians to be wary about investing with Tofro, noting that any person who places such investment with the entity, does so at their own risk.The notice further reads, “The attention of the Securities and Exchange Commission has been drawn to the activities of an online platform known as TOFRO.COM (Tofro), which holds itself out as a cryptocurrency trading platform.”The Commission hereby informs the public that the Tofro is NOT REGISTERED by the Commission either to solicit investments from the public or operate in any other capacity within the Nigerian capital market.”Investigations have revealed that Tofro’s operations exhibit the typical indicators of a fraudulent Ponzi scheme, including the promise of unusually high returns, heavy reliance on a referral system to sustain pay-outs and failure to honour withdrawal requests from subscribers.”Accordingly, the public is strongly advised to be wary about investing with Tofro, as any person who places such investment with the entity, does so at his/her own risk.”The Commission similarly reminds potential investors of the need to VERIFY the registration status of investment platforms via the Commission’s dedicated portal: www.sec.gov.ng/cmos before transacting with them.”The SEC Director-General, Emomotimi Agama had said it is crucial that Nigerians understand the dangers of putting their hard-earned money into ventures that are not registered or regulated by the SEC.