COVER

Recapitalisation: SEC Charges Banks to Strengthen Corporate Governance

Securities and Exchange Commission (SEC) has called on banks to reinforce their corporate governance principles and risk management frameworks to boost investor confidence during the ongoing recapitalisation exercise.

Dr Emomotimi Agama, Director-General, SEC, said this at the yearly workshop of the Capital Market Correspondents Association of Nigeria (CAMCAN) held in Lagos.

The theme of the workshop is: “Recapitalisation: Bridging the Gap between Investors and Issuers in the Nigerian Capital Market”.

Agama, represented by the Divisional Head of Legal and Enforcement at the SEC, Mr John Achile, stated that the 2024–2026 banking sector recapitalisation framework offers clear guidance for issuers while prioritising the protection of investors’ interests

He restated the commission’s commitment towards ensuring transparency and efficiency in the recapitalisation process.

The director-general stated that the key to bridging the gap between issuers and investors remained the harnessing of innovation for inclusive growth.

In view of this, Agama said, “SEC, through the aid of digital platform, is exploring the integration of blockchain technology for secure and transparent transaction processing to redefine trust in the market.”

He added that the oversubscription of most recapitalisation offers in 2024 reflects strong investor confidence.

To sustain this momentum, the director-general said that SEC had intensified efforts to enhance disclosure standards and corporate governance practices.

According to him, expanding financial literacy campaigns and collaborating with fintech companies to provide low-entry investment options will democratise access to the capital market.

He assured stakeholders of the commission’s steadfastness in achieving its mission of creating an enabling environment for seamless and transparent capital formation.

“Our efforts are anchored on providing issuers with clear guidelines and maintaining open lines of communication with all market stakeholders, reducing bureaucratic bottlenecks through digitalisation.

“We also ensure timely review and approval of applications, and enhancing regulatory oversight to protect investors while promoting market integrity,” he added.

Agama listed constraints to the exercise to include: addressing market volatility, systemic risks, limited retail participation as well as combating skepticism among investors who demand greater transparency and accountability.

He said: “We are equally presented with opportunities which include leveraging technology to deepen financial inclusion and enhance market liquidity.

“It also involves developing innovative financial products, such as green bonds and sukuk, to attract diverse investor segments.

“The success of recapitalisation efforts depends on collaboration among regulators, issuers, and investors.”

Speaking on market infrastructure at the panel session, Achile said SEC provides oversight to every operations in the market, ranging from technology innovations to market.

He stated that the commission is committed to transparency and being mindful of the benefits and risks associated with technology adoption.

Achile noted that SEC does due diligence to all the innovative ideas that comes into the market to ensure adequate compliance with the requirements.

On the rising unclaimed dividend figure, Achile blamed the inability of investors to comply with regulatory requirements and information gap.

He noted that SEC had done everything within its powers to ensure that investors receive their dividend at the appropriate time.

He, however, assured that the commission would continue to strengthen its dual role of market regulation and investor protection to boost confidence in the market.

In her welcome address, the Chairman of CAMCAN, Mrs Chinyere Joel-Nwokeoma, said banks’ recapitalisation is not just a regulatory requirement, but an opportunity to rebuild trust, strengthen the capital market, and drive sustainable growth.

Joel-Nwokeoma stated that the recent recapitalisation in the banking sector had brought to the fore the need for a more robust and inclusive capital market.

She added that as banks seek to strengthen their balance sheets and improve their capital adequacy ratios, it is imperative to create an environment that fosters trust, transparency, and cooperation between investors and issuers.

The chairman called for collaboration to bridge the gap between investors and issuers to create a more inclusive and vibrant Nigerian capital market.She said: “we must work together to strengthen corporate governance and risk management practices in banks, enhance disclosure and transparency requirements for issuers.” NAN

COVER

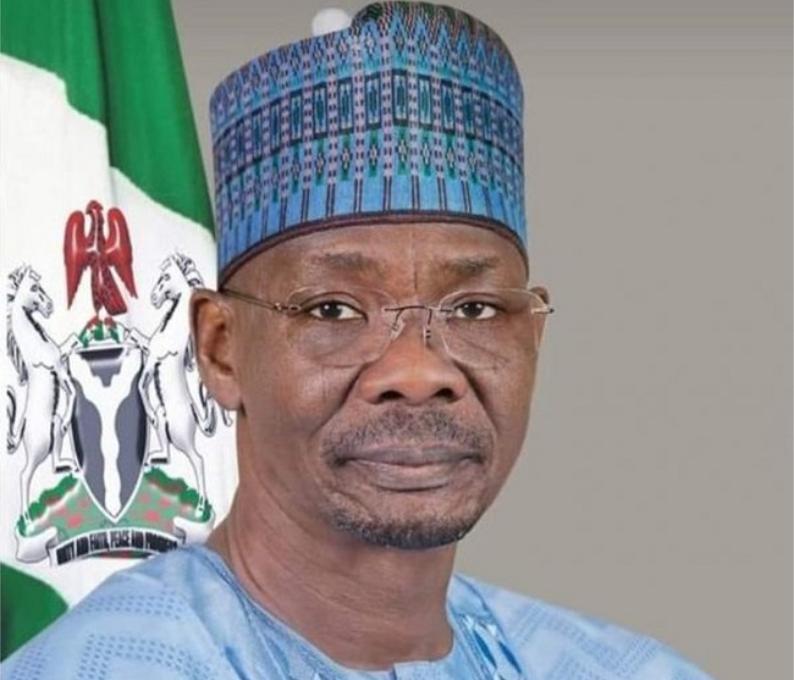

Nasarawa Gov, Others, Woo Dangote at Trade Fair

Nasarawa State Governor, Abdullahi Sule has urged Dangote Industries Limited to consider investing in more sectors of the State economy.The Governor, who spoke at the ongoing Nasarawa Trade Fair Exhibition said Nasarawa is home to solid mineral resources, adding that the strategic partnership between the duo will speed up Nigeria’s industrialization project.

Sule, who was represented by the Commissioner for Trade, Industry, and Investment, Hon. Muhammed Sani Otto, commended the Dangote Group for its outstanding performance at the Nasarawa Sugar Company Limited (NSCL).He expressed confidence that, given this success, the company would be a valuable partner in exploring additional investment opportunities within the state.In his remarks at the Dangote Special Day, Chairman of the Nigeria Association of Small-Scale Industrialists (NASSI), Nasarawa State Chapter, Nidan Sambo Manasseh, said the Trade Fair which was sponsored by the Dangote Group has been very impactful.The Chairman advised Dangote Group to scale up its investments in the State by considering other sectors.He added: “The Nasarawa Trade Fair Exhibition (NASTFE) is a vital catalyst for the State’s economic transformation. This strategic initiative by NASSI directly aligns with Governor Abdullahi Alhaji Sule’s vision to stimulate investment and unlock significant growth.”The Permanent Secretary, Ministry of Trade, Industry and Investment Hajiya Khadija Oshafu Nuhu said the state is strategically open for business, and that Dangote Group can be part of the compelling opportunities abound in the state.A statement from the Dangote Group’s Chief Branding and Communication Officer, Anthony Chiejina, said: “Nasarawa State is central to our overall investment in Nigeria. It is home to Dangote’s Nasarawa Sugar Company Limited (NSCL). The sugar project, when completed, will be one of the biggest sugar investments on the African continent.”The statement quoted the Senior Special Adviser to the Dangote Group’s President, Fatima Wali Abdurrahman, as saying that: “We are not taking this partnership for granted. Our Strategic Business Units (SBUs) are participating.According to her, some of the Strategic Business Units that are participating from the Dangote Group are: Dangote Fertilizer Limited (DFL), Dangote Peugeot Automobiles Nigeria Limited (DPAN), Dangote SinoTruck, Dangote Sugar Refinery, Dangote Salt (NASCON) and Dangote Cement Plc.COVER

Nigeria Airports Rank Below Global Standards, Says Keyamo

By David Torough, Abuja

The Minister of Aviation and Aerospace Development, Festus Keyamo disclosed yesterday that Nigeria’s airports were below international standards, while hinting at the expansion of Old Murtala Muhammed International Airport.Keyamo admitted while quoting a commendation tweet by a Nigerian in diaspora, Dipo Awojide with the username @ogbenidipo, who hailed the improved passenger experience and recent improvements at the MMIA in Lagos.

The UK-based Nigerian tweeted that his recent experience at the airport is the easiest it has been for him in 15 years, while acknowledging the visible improvement. “Kudos @fkeyamo, Lagos airport has changed for good.“Aircraft to the welcome area looks cleaner and the security area is well designed. My bag came out in 10 minutes.“Exit to the parking area is way better. I say this as someone who has been travelling for over 15 years.“This is the easiest it has been for me in Lagos,” the tweet partly reads.Awojide highlighted that there are some cultural issues to tackle, but acknowledged the significant improvement by the federal government,” the tweet reads.Reacting to the extolling post, the minister appreciated the X user for his impressive feedback but stressed that airports in the country are below global standards.“Thank you, @OgbeniDipo for your compliments. But our airports are still far away from global standards, I must admit. We are just making the best of the situation as we found it,” he said.Keyamo noted that the situation is being managed, but barely, and revealed that the old MMIA terminal, built in 1977 for 200,000 passengers annually, now handles three million passengers at the airport and 15 million nationwide each year, putting immense strain on the facilities.He reassured Nigerians that major upgrades are forthcoming under President Bola Tinubu’s administration.The minister specified that a total rebuilding of the Old MMIA in Lagos will be facilitated to meet modern standards and accommodate approximately 20 million passengers annually.“Hence, over the years, the facilities almost collapsed! But thanks to President Bola Ahmed Tinubu, @officialABAT, we are about to embark on a total rebuilding of the old MMI Airport in Lagos to meet modern standards, with a projection of about 20 million passengers per annum.“We will unveil the full details before Nigerians in the next few weeks. Thanks.” Keyamo concluded. Air Peace Aircraft Collides with Antelope on Abuja RunwayAn Air Peace aircraft was grounded at the Asaba International Airport in Delta State after it collided with a large antelope while taxiing on the runway.The impact decimated the animal and rendered the aircraft on the ground, causing flight disruptions.Director of Public Affairs & Consumer Protection at the Nigerian Civil Aviation Authority, Michael Achimugu, who confirmed the incident on Sunday, via his official X account, clarified the implications of such occurrences.According to him, “Monitoring reports yesterday indicated that an Air Peace aircraft ran into a large antelope, decimating the animal and leaving the aircraft AOG (aircraft on ground).”He added that as a result of this incident, flights meant to be operated by this aircraft would naturally be disrupted, even though engineers are on the ground to assess and fix the plane. Passengers waiting would naturally be infuriated.“Incidents like this are literal illustrations of the disruptions NOT caused by the airlines (domestic or international),” he said.Achimugu emphasised that while such events are beyond the control of the airline, they do not absolve operators from their responsibilities to passengers.“This explainer is for illustration purposes, not to excuse airlines when they fail to do their duties to passengers,” he said.“Even with situations like this, the airline still owes its passengers the information, refund, and other forms of care they are entitled to, and can still be sanctioned if they fail to provide the same,” Achimugu added.The agency also noted that efforts are currently underway to repair the aircraft and resume normal operations.COVER

Nigeria Pays off IMF’s $3.4bn Covid Loan, Exits Debt List

By Andrew Oota, Abuja

The Minister of Finance, Wale Edun has confirmed Nigeria’s exit from the International Monetary Fund (IMF) loan of $3.4 billion.Nigeria had borrowed $3.4 billion from the IMF during the Covid-19 pandemic.According to the minister, “the loan had been repaid on the agreed terms.

””The West African nation now has no outstanding IMF debt, though the Fund expects it to honor some additional payments of roughly $30 million a year in Special Drawing Rights charges, ” IMF resident representative for Nigeria Christian Ebeke said in a separate statement. ”Still, the repayment is a mark of the country’s improved financial position, with the central bank’s net foreign exchange reserves, reaching a three-year high last month.”Nigeria has sought to improve local dollar liquidity after years of running a fixed exchange rate regime that burdened the economy of Africa’s largest oil producer, with a wildly overvalued local currency.”President Bola Tinubu’s free-floated the Naira after taking office in 2023 as part of a broader campaign of economic reform, contributing to the currency losing more than 70% of its value against the dollar.” He said.The Senior Special Assistant on Digital and New Media to President Bola Tinubu, O’tega Ogara had earlier hinted about the debt repayment.The IMF, in the credit outstanding list covering May 1 to May 6, 2025, disclosed that over 90 countries owe $117.79 billion, noting that Nigeria was not among the indebted nations.The IMF published the list on Tuesday.The institution revealed that it disbursed SDR 2.45 billion to Nigeria in 2020, saying repayments were made between 2023 and 2025.It noted that SDR613.62 million was made in 2023, SDR1.22 billion in 2024, while SDR613.62 million was paid in 2025.The development was also confirmed by Tolu Ogunlesi, the former Special Assistant on Digital and New Media to ex-President Muhammadu Buhari, via a post on his X (formerly Twitter) account on Thursday, May 8.Ogunlesi, who was serving his second term when the loan was obtained, stated: “This US$3.4 billion (equivalent to 2.454.5 billion SDR; amounting to 100% of our SDR quota) Covid-19 assistance from the IMF to Nigerian governors, under the IMF’s Rapid Financing Instrument (RFI), has now been fully repaid, in line with the terms of the agreement.“A repayment period of 5 years, meaning 2020 to 2025, and a moratorium of 3.25 years, meaning that we had a grace period until Q3 2023 before we had to start repaying.“So, repayment schedule: 2023-2025.“PBAT has kept to the terms, and as of May 2025, the loan has been fully repaid. Naija no dey carry last, and we no dey default.“This is what the repayment looks like, from the @IMFNews website: Outstanding as at June 30, 2023: 2,454,500,000.“Dec 31, 2023: 1,840,875,000; June 30, 2024: 1,227,250,000; March 31, 2025: 306,810,000; May 07, 2025: 0.”