NEWS

Catholic Priest Killed by Gunmen in Anambra Buried Amidst Tears

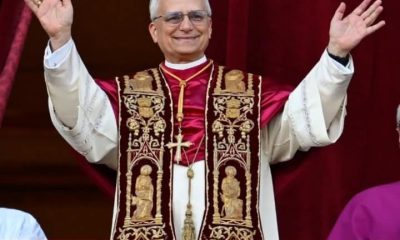

The remains of Rev. Fr. Tobias Okonkwo, a priest of the Catholic Diocese of Nnewi, in Anambra, murdered on Dec. 26 has been laid to rest amid tears.

He was buried on Thursday at Our Lady of Assumption Cathedral in Nnewi after a requiem mass at the cathedral.

Okonkwo, a pharmacist, was murdered by his assailants while leaving the premises of the School of Nursing, Midwifery, and Medical Laboratory Sciences, Our Lady of Lourdes Hospital, Ihiala, where he worked as a manager.

In his homily, the Vicar-General of the Catholic Diocese of Nnewi, Monsignor Anichebe Ezeobata, said that Okonkwo, who died in his prime, had carved out an impressive niche for himself.

The vicar general added that the priest had led an impactful pastoral life before his death, after being ordained in July, 2015.

He explained that the deceased finished his internship as a pharmacist in October 2024 and was posted to the School of Nursing, Midwifery, and Medical Laboratory Sciences, Our Lady of Lourdes Hospital, Ihiala as a manager.

The cleric said that the deceased was barely two months in office before he met his death.

Dignitaries who attended the burial mass were the 2023 Presidential Candidate of the Labour Party, Mr Peter Obi, as well as the former Commissioner for Economic Planning and Budget in Anambra state, Prof. Stella Chinyere Okunna among others. (NAN)

NEWS

Police Smash Mini Truck-snatching Syndicate

The Police Command in Enugu state has smashed an armed robbery and mini-truck snatching syndicate. The feat was achieved by the police operatives attached to the Ozalla Police Division, in collaboration with Neighbourhood Watch personnel on Sunday. The Command’s Spokesman, SP Daniel Ndukwe, said in a statement on Wednesday in Enugu said that one male suspect, Chinedu Onwuka, 35, has been detained in connection with the incidence.

“The operatives also rescued a male victim, who had been tied to a tree in the bush, and recovered his Daihatsu Hijet mini truck, locally known as “Diana”, which the suspect and his fleeing accomplices had stolen at gunpoint. “The suspect and his gang had hired the driver to transport bags of sand from the Ogbete area of Enugu metropolis to Umuatuaboma in Nkanu West Local Government Area. “However, along the Umuatuaboma–Obuofia Road, they diverted the vehicle into a bush at gunpoint, tied the driver to a tree, and fled with the truck. “A prompt response by the operatives led to the arrest of the suspect, while others escaped,” he said. The spokesman said that during interrogation, the suspect confessed to the crime and admitted to participating in a similar operation in April. He added that the suspect confessed to being paid ₦90,000 as proceeds from the sale of another snatched mini truck. “Investigations are ongoing to apprehend the fleeing suspects,” he said. Ndukwe said that the state’s Commissioner of Police, Mr Mamman Giwa, had reaffirmed the Command’s unwavering resolve to clamp down on unrepentant criminals of the state. He urged mini truck and other types of truck operators to remain vigilant and cautious about whom they accept conveyance jobs from and their destinations. (NAN)NEWS

Court Case Stalls Reps Hearing on Takeover of Benue, Zamfara Houses of Assembly

The House of Representatives Committee on Public Petitions has adjourned hearing in a petition seeking the National Assembly to takeover Benue and Zamfara State Houses of Assembly to May 28.The Chairman of the committee Rep. Bitrus Laori (PDP-Adamawa) gave the ruling on at the resumption of hearing on Wednesday in Abuja.

He said that the adjournment became necessary as the committee had been served court documents, notifying it that the matter is currently in court. Laori said that the detials is Suit No. FHC/MKD/CS/146/2025) filed on May 5, 2025 at Federal High Court, Makurdi Division and had been adjourned to May 19.The chairman also said that the leadership of the Benue State House of Assembly had also written a letter to the Senate and House of Representatives Benue Caucuses seeking an interaction over the matter.“In view of the court processes and the request of the Benue State House of Assembly leadership seeking to dialogue with Senate and House of Representatives Caucuses, the decision to continue sitting on the petition or not will be determined on the next adjourned date, May 28,” he said.Daily Asset reports that in Benue, the House of Assembly suspended 13 lawmakers for three months over their alleged opposition to the removal of the Chief Judge, Justice Maurice Ikpambese.The judge was accused of gross misconduct and corruption, sparking controversy and division within the assembly .While in Zamfara, the political crisis deepened in February 2024 when the Assembly suspended ten lawmakers.Of the 10 suspended lawmakers for allegedly convening an illegal plenary session, four are from the All Progressives Congress (APC) and six from the Peoples Democratic Party (PDP).Report says that the situation in Zamfara has since escalated into a leadership tussle, with two lawmakers, Mr Bilyaminu Moriki and Mr Bashar Gummi, both laying claim to the speakership.The Gummi-led faction reportedly held a parallel sitting during which they purportedly impeached Moriki.In response, the Moriki-led Assembly suspended 10 members aligned with Gummi, labeling the impeachment as invalid and accusing the group of conducting an illegal session.These crises form the basis of the petitions currently before the House of Representatives Committee on Public Petitions.Daily Asset observed that the governors and speakers of both State Houses of Assembly who were agains, invited last week did not appear.However, the petitioners, the Guardian of Democracy and Rule of Law represented by a lawyer, Mr Emmanuel Onwudiwe as well as the suspended members of Benue and Zamfara State Houses of Assembly were present. (NAN)NEWS

Oil Firms Owe Nigeria $6bn in Taxes, Falana Cries out

Human rights lawyer and Senior Advocate of Nigeria, Femi Falana has raised serious concerns over the country’s weak tax enforcement system, revealing that oil and gas companies owe Nigeria a staggering $6 billion in unpaid taxes.

Falana, who spoke yesterday during a paper presentation titled “Tax Law and Administration: Challenges of Compliance” at the ongoing 27th Annual Tax Conference of the Chartered Institute of Taxation of Nigeria (CITN) in Abuja, criticised the federal government for allowing such massive revenue losses while continuing to borrow to fund national budgets.

He described the situation as evidence of poor financial accountability and called for greater transparency and representation in the country’s tax system.

The prominent human rights lawyer criticised the Nigerian tax system describing it as lacking the foundational principle of “taxation with representation.”

During a panel discussion on tax policy and public accountability, Falana said Nigeria’s approach to taxation is riddled with inefficiencies, opacity and mismanagement that undermine public trust and discourage compliance.

Drawing historical parallels, Falana referenced the American and French revolutions, which were sparked in part by taxation without representation.

“In Nigeria, we cannot perform taxation without representation. If you want me to pay taxes, then why? Where is the representation, the justification, or the return to the people?”, he asked.

Falana lamented the proliferation of taxes in Nigeria, pointing out that some fiscal policies list as many as 60 different taxes, far beyond the original 25 outlined.

“No government needs 60 taxes,” he argued, describing the current framework as excessive and burdensome.

He also spotlighted glaring issues in revenue transparency and accountability, using Lagos State as an example, Falana claimed that taxes collected from buses and motorcycles alone amount to over N1.3 billion annually, yet there’s little clarity on how these funds are utilised.

Citing a September 2023 report, Falana revealed that oil and gas companies allegedly withheld $6 billion (about N64 billion) in taxes due to the government within a year.

“Shockingly, two months later, the federal government approached the National Assembly to borrow N2.1 billion to fund the national budget.

“How do you explain that? We’re losing billions to tax evasion, yet borrowing to survive,” he queried.

Falana also condemned the government’s silence over a COVID-19 era N3.4 billion loans allegedly used without due process.

“Nobody has challenged it,” he said, questioning how public funds are managed.

He stressed that taxes are meant to provide public services such as security, schools, hospitals but today, many Nigerians see no benefit from what they pay.

Also speaking on the panel, Rakiya Ahmed, Executive Chairman of the Zamfara State Internal Revenue Service, echoed similar concerns.

She noted that Nigeria’s historic reliance on oil revenue led to underdevelopment in tax systems.

“Because of our weak revenue from oil, we are now forced to focus on taxation,” she said.

Ahmed identified several structural challenges to tax compliance, noting key among them is the perception of corruption and a lack of transparency.

“When citizens do not see any return on their taxes, they’re less likely to comply,” she said, stressing the importance of a strong social contract between the government and taxpayers.

She also criticised the complexity of Nigeria’s tax laws, which she said discourages voluntary compliance.

“There are so many laws, and constant amendments confuse taxpayers,” she said.

Ahmed called for increased use of technology in tracking and enforcement.

She noted that Zamfara is one of the first states, after the FIRS, to deploy a data analytics system that revealed a supposed low-income taxpayer with hundreds of millions in their account.

This, she said, shows how data can help expand the tax net to include high-net-worth individuals who often escape scrutiny.

Ahmed highlighted taxpayer education as a major factor in boosting compliance, especially in rural areas.

“When taxpayers understand their obligations and see the benefits, they are more willing to comply,” she said.

She advocated for grassroots collaboration with traditional rulers, unions, and community leaders to enhance outreach and build trust.

The panelists agreed that while tax reforms are underway, the Nigerian government must address the trust deficit, simplify the tax code, use technology to track evaders, and, above all, demonstrate that tax revenues are used for the public good.

Without visible and accountable returns, they warned, compliance will remain elusive and public resentment will grow.