COVER

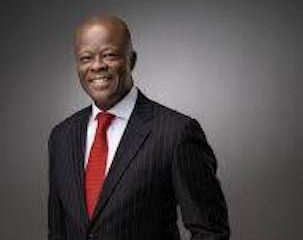

Our Mission is to Make Benue People Feel The Positive Impact of Taxation-Ayabam

Mr. Andrew Ayabam is the current Chairman of the Benue State Internal Revenue Service Board(BIRS). He served first as chairman of the board between 2010 to July 2012 in the administration of the former governor, Gabriel Suswam. His two years of service at the board earned him much accolades because of his unequaled performance in revenue collection and administration.

Excerpt.

You are returning to this office for the second time after you left a couple of years ago can you tell us what the motivation is for the second coming?

The motivation has been always to excel, regardless of the circumstances. So that keeps me wanting to move on. For me it is also, a personal challenge to always put myself on sound footing and to be sure of what I am doing. So it is like a self challenge as well.

So if you are challenged by the inner passion to excel, what constitutes your vision going forward, the targets that are set before you on this assignment?

My targets are clear and they are also partly included in my contract or terms of engagement. That I should reorganize BIRS, bring it out from the woods and ensure that BIRS performs its role providing the much needed revenue for His Excellency Governor Samuel Ortom to deliver on his campaign promises which is to provide infrastructure and key social services needed by the Benue people for which they elected him into office.

Between the time you left and now, has there being anything fundamentally different in the operation of BIRS from the place you left about six or seven years ago?

Yes, significantly so. First let me reiterate this, staff or the people are the most important elements in any organization. I have met now on return, a very low staff morale and I met a situation where staff were not really exposed or trained on their jobs because of lack of experience to some of the issues in tax administration. Collection of revenue has not also performed as it should this time if that tempo we left behind was sustained. I also acknowledge that some staff, the good hands may have retired and left the system but am worried that not much was impacted on the upcoming or those who took over from them. This is not to say that there are no good hands within the service, but there is a lot that needs to be done to step up their morale and encourage them to delivery at the pace that we expect them to deliver now.

Flowing from that, one of the things that earned you more accolade from Benue people was the employment you offered graduates, the young people, you gave them employment opportunity. Given the present situation you have found on ground, do you have plans to still engage fresh hands, am sure some young graduate are looking forward to your second coming to get a job?.

We have been overwhelmed by this expectation that jobs will be available on my return. Without prompting, a whole lot of Benue youths have been coming forward to drop their CVs, so we are forced to create an opportunity for them to submit their applications to send in their CVs online, so we are able to manage the crowd that troop into BIRS daily. Certainly we will have to engage new and experienced hands. So we are adopting a two pronge approach to those issues. One, to get some of our experienced staff who were engaged by the State Government and posted to other agencies, we want to bring them back on at least an ad-hoc basis because of the type of training they enjoyed and experience they had that time. We want them to bring that to bear on the challenges we are having now. So will be using some of those and also, we will be enjoying new hands to add energy and vigour in the entire process of revenue collection. Staff engagement also serves as an added advantage, that of dissemination of needed information to the people. Because they are among the people, they are in a better position to preach taxation to the people and the people would learn better and faster from those kinds of engagement with our youth. We hope that we will build a sustainable BIRS with the young people because they lead their tomorrow right from today.

Talking about employing more hands, how many young graduates are we looking at?

That is not fixed. When the need arises we will increase. We are going to be doing it in phases because we are depending on our cost of collections to fund and sustain that activity. It is a contract employment. So if the revenue improves, the cost of our collection improves, we will continue to engage base on the needs and of course as we are able to sustain. If His Excellency who is people oriented thinks that we should have a fixed amount to fund that kind of activity we will be glad and we are hoping that he would also come up with such idea so that many more Benue youths are taken off the streets.

Benue people like most Nigerians are not enthusiastic about payment of taxes, how are you able to build that interest, or how are you going to encourage people to pay tax?

There are two things here, first, the people that were engaged live amongst our people so they are able to sell that message better. And it is in doing the job that their salaries are being paid. So there is a benefit derived directly from the process of recruitment, so people take that as an impact of taxation itself, so they are encouraged to pay, and because they have relatives or friends that work there, they are encouraged to pay tax. They are more or likely to buy into this message and deliver on that expectation. Secondly, we massively at that time and of course what we are going to revisit again, we went out to publicize government projects funded with tax money. When people see what government is doing with their money, they are more or likely to voluntarily pay their taxes. So His Excellency has taken over that challenge and he made quite a number of pronouncement since we assumed office, and deliberately telling the people where the money is going and we are going to be announcing these projects with the governor and the team when these projects are been executed so that through that way people are better encouraged to pay their taxes and do what they have to do to make the government to work.

Can you tell us how many people pay tax in Benue?

Well, that’s another challenge that we are having to rebuild. We hardly have had any active or realistic database to do that. Part of my new assignment and responsibility is to ensure that we build a robust data base so that government knows exactly what it is doing. We are going to be working with a couple of agencies to ensure that this happens. The most realistic will be to use the voter register because the general principle of eligibility lies or apply for voting as well. So we are going to be using that for the first time ever. From there we will now get a more realistic population or eligible data and from there also would now be able to tell how many of those eligible to pay tax are actually paying taxes and then we will give you precisely how many we are chasing into the tax net, but using the country’s average, if that applies here then about 13% of the state population which is about 5 million.

Now the taxable items, your tax sources or tax heads, do you have plans to expand avenues for taxation as part of the strategy to meet your set target?

The essence as such is not to further over burden the tax paying or compliant population. Our strategy and emphasis will be on ensuring that those who are not paying, comply with what is provided by law. We are trying to get more people to pay. We are hopeful that we will put some incentives through that will encourage even discount or reductions, rebate in some areas. Like land use charge or land charges generally, so that people are also better encouraged. So we will rather look at a reduction in rates than consider increasing the number of taxable heads or items.

Do you have plans to increase the number of agents based on present criteria?

No, the total number of revenue agents is about 22. Increasing the number is not necessary because in my first tenure we had about 7 agents. Now their responsibilities will be that it is BIRs staff meeting hat will be collecting money and managing the POS. We are using the POS now, that is electronic means of collection. In that way we are seeing real time online what is happening in the field. The agents will help to monitor, more or less be like a check to the activities so that there is some level of control. We hope that with some experience that they have in the field we can depend on this. We also have to work on the rates. I met on ground arbitrary rates being “gifted”,(permit me to use the word) to revenue agents. The revenue board is entitled to 10% as cost of collection, but we see as high as 50% to agents, in some cases I have seen some that is even 70% to the agents. So why do you pay higher than what you are entitled to? So we would address that. No agent will get even 7% of their collection having adopted an electronic means of collection so that will not happen. We will also encourage members of the public to report to us any infraction or any activities that they do not consider professional. Our hotlines are going to be published so you can reach either myself or our team so members of the public may reach us when the need arises.

This is a controversy one, how much comes to Benue State from IGR. It is a polemical issue in most of the states. People allege that what is collected is not declared or what is declared does not reflect the actual, what is the situation with BIRS?

There are standards of measuring collection. The global best practice is consolidated revenue collection. The law setting up agencies here in Benue and generally in Nigeria permit that we either spend a percentage or the entire revenue collections made by these agencies. So in reporting this you always have to take into consideration the total revenues collected regardless of whether or not this is spent by these agencies. BIRs as a revenue agency also have some revenue heads. I am barely a month now and I can only speak for my figures and that will be ready when the state reconciliatory committee meets and ratifies what ever figures we have made, but I can say my figures will certainly be higher than the previous months.

Now looking at the law, the enabling edicts, that empowers BIRS to carry out its activities, I know you got an amendment during your first tenure, many years down the line does that law still give you the legal strength to carry out your operations? Or are there certain areas you feel deserve to be amended?

Well, the law was amended after I left office the first time, maybe it was based on the needs of the time. Laws are not static, they are not stagnant and they are based on human activity which evolves over time, so laws also have to be amended from time to time due to circumstance and the needs of the time. So we will work towards the amendment which is just for the normal because circumstances change over time what we have on ground now is different from what existed may be few months ago, so we will continue to work on the amendment to make sure that Benue gets the best laws especially in our time. Our laws also indicate the rates to be charged and I mentioned earlier that I would rather go for rates reduction in some areas than increasing the revenue heads. Certain circumstance may also encourage different revenue heads or different presentation of the laws for better understanding by the paying publics. So when the need arises, we will approach the State Assembly for such amendment.

Recently the Chairman of the FIRS in response to a query issued him on the performance of the nation’s revenue attributed the low figure of revenue to the state of Nigeria economy, at the micro level of BIRS, to what extent has the overall national economy or in this case the state economy affected the collection efforts. What impact does it have on the operations of BIRS?

One, to the extent that the state depends more largely on federation account, FIRS is major contributor to that national trust or fund from where the Benue and other States derive their funding largely from. To that extent, Benue is impacted. So if something happens to FIRS which is a major contributor to the federation account from where Benue takes, naturally it will affect us. When Benue derives that, pays for services, salaries and all of that from where the state also derives its major source of revenue, the local economy is affected because larger population of organized work population is government workforces so whatever affects that workforce affects the local economy, the purchasing power and all of that. I stumbled at the SMEDAN report which indicate that 275,000 jobs were lost in a space of about 2 years, that has significant effect on BIRS. The personal income tax, land use charge, business premises registration vehicle registrations and all of that, so all of these taxes will be affected when the capacity of the state to pay for goods and services is also affected. So, yes, FIRS situation has a large bearing effect on the state’s economy.

One of the headaches and I think it is not Benue State alone, most of the States have is revenue generation efforts at the local government level. There seems to be lack of accountability, lack of transparency and even lack of capacity. Is there any relationship between BIRs and local government areas in the state in terms of partnerships for revenue and even in terms of building capacity and what specific area or technical support can BIRs give the LGAs?

The Law provide for a joint revenue committee which should be chaired by the Chairman of BIRs. We also note with concern that the activities of revenue collection seem to be inconsistent and maybe a non- challant attitude towards it. There are no records kept and all of that. The interesting thing is that the state Assembly is responsible for laws including revenue laws of the local governments. So to that extent, the powers to regulate is still vested with BIRS, but how much power is exercised is what has left a lot to be desired. Over the years, I don’t think BIRS has really stepped up to take control of what or has being involved in what happens at the local government level. The laws also provide for certain items to be exclusively collected by the local government, but where the state is able to harmonize this for the good of the state and local government it will be better. I cite examples in Lagos, Kaduna and to some extent, Rivers, Delta. So some of this local Governments are considered to be in urban areas and so some of their activities fall within the purview of the state and their agencies. When that happens, you see stronger synergy that enhances revenue administration activities. We hope to achieve that and we have started holding the joint revenue committee meetings. We hope that we will meet them quarterly and over time we will look at how to strengthen the administration at the local government levels, enhance transparency in the process and make the local government and the state a better place for revenue administration generally.

One issue that tends to give BIRS a negative image is the activities of revenue check points, sometimes one is not sure whether these are staff or agents of BIRs or they are just taking laws into their hands, so what really is BIRS policy on this issue of blocking high ways and forcing people to stop for the purpose of collecting revenue?

Thank you for bringing this up. That has being my biggest challenge since assumption of office at least for this second time. All manner of touting and highpoint robbery goes on at the roads in Benue State. Benue has over the last few years earned a very bad name as being one of the bad places to do business, particularly businesses that involve the use of roads. Since assuming office, I have engaged relevant security agencies. The Governor is not happy about this and he has charged us to do all that we can to reduce this to the barest minimum. We have a situation where people just take laws into their hands, print all manner of receipts, largely illegal to extort money from unsuspecting members of the public on the roads employing all manner of crude tactics and means. For the records, Benue State has only 10 gazzetted inspection points largely for produce and Vertinary inspection. There are 10 points. But we met on ground a situation of about 200 inspection points to count, existing in the State. So I have worked out measures in clearing that. In the news recently about 12 people are in imprison already on account of operating illegal points. We have also mandated all our staff and agents to use only POS as a means of collection, we hope that when we do this, those who are engaged in these activities will not be patronized and would have to naturally leave our roads. That is combined with the Police and Military patrols that have been instituted. You find a situation where a truck of lets say 911, not a very big truck, it loaded with oranges from Ushongo Local Government, before they leave kadarko, they would have spent more than 200,000 on largely illegal fees and charges. So we leave the buyers with no option than to price down the produce from Benue farmers , so the farmers don’t get value for their products. So in the last two years plus, oranges were not sold for more than 500 naira a bag and in some places 300 naira. And that is very unfair to a large population as a result of those actions being perpetrated by just a few persons. In the Usongo axis we have been able to significantly clear that. Am happy to say that for the first time in three years oranges are being sold at more than 3000 naira and that is just because of this action that we have taken. So you see how some activities of just a few people impact negatively on a larger population of the state. With 3000 naira per bag, they are more able to meet their personal expenses, depend less on government activities which may not be enough to pay their bills. So we are hoping that we continue to do this and if sustained, Benue people will get more value for their products and hopefully someday, some processing facilities will come to Benue necessitating the supplies locally instead of selling raw materials outside the State.

I imagine that this action may have put you in a collision course with some of these people involved in these illegal activities, do you feel unsafe carrying out this assignment?

The threats are there. That is the reality of the times, but I think I have more overwhelming zeal to succeed, and I think the support and the good will overwhelms the threats at least in current times. Like I said these are activities carried out by few elements to the detriment of the larger society. So I believe the larger society agrees with me, BIRS and their prayer and goodwill is with us and am encouraged more by that. The threats will continue to hold the poor farmer to ransom, which a few others would want us to encourage.

How are you going to tackle the issue of multiple taxation to ensure that the people are not over burdened?

Well, through sensitization. We have continued to sensitize the people as to what to pay, where to pay and how to pay. When a tax payer is informed as to their responsibility and what to do, they know how to confront some of these challenges better. We also have the hotlines, we are also training our staff to also know what to do out there on the field to engage with tax payers.

So most importantly is the tax payer education, because tax payer is the target both for multiple taxes as well as the genuine and legitimate taxes. So they are the ones to face the approach and when they do not fall, the system stands stronger. So they need the information to be able to confront these challenges.

How much cooperation does BIRS enjoy from Federal Institutions or agencies and some of the institutions like Banks in the State? How is the compliance?

I think now it is enormous. With the introduction of the IPPIS, payments are deducted and made to the office of the Accountant General of the Federation. So that makes it largely seamless. We are hoping that as more agencies enroll on the IPPIS, the better for us. Recently some reconciliations were done and returns were made by the federal government it will be ongoing until we reach a near perfect destination. But as it stands, the cooperation is okay and is improving.

Yes, the compliance is significantly improving and is very near up to date.

COVER

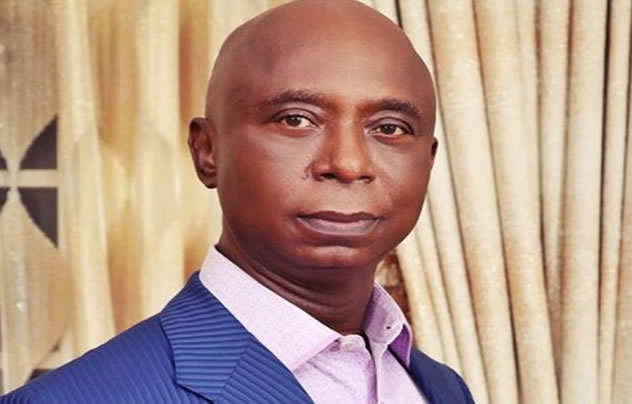

Nigeria Customs Generates over N1.75trn Revenue in 2025

By Joel Oladele, Abuja

The Nigeria Customs Service (NSC) has generated an impressive N1,751,502,252,298.05 in revenue during the first quarter of 2025.

The Comptroller-General (CG) of the Service, Bashir Adeniyi, disclosed this yesterday, during a press briefing in Abuja.

According to Adeniyi, the achievement not only surpasses the quarterly target but also marks a substantial increase compared to the same period last year, reflecting the effectiveness of recent reforms and the dedication of customs officers across the nation.

“This first quarter of 2025 has seen our officers working tirelessly at borders and ports across the nation.

I’m proud to report we’ve made real progress on multiple fronts—from increasing revenue collections to intercepting dangerous shipments,” Adeniyi stated.He attributed this success to the reforms initiated under President Bola Tinubu’s administration and the guidance of the Honourable Minister of Finance and Coordinating Minister of the Economy, Olawale Edun.

The CG noted that the revenue collection for Q1 2025 exceeded the quarterly benchmark of N1,645,000,000,000.00 by N106.5 billion, achieving 106.47% of the target. This performance represents a remarkable 29.96% increase compared to the N1,347,705,251,658.31 collected in Q1 2024.

Adeniyi highlighted the month-by-month growth, noting that January’s collection of N647,880,245,243.67 surpassed its target by 18.12%, while February and March also showed positive trends.

“I’m pleased to report the Service’s revenue collection for Q1 2025 totaled N1,751,502,252,298.05.

“Against our annual target of N6,580,000,000,000.00, the first quarter’s proportional benchmark stood at N1,645,000,000,000.00. I’m proud to announce we’ve exceeded this target by N106.5 billion, achieving 106.47% of our quarterly projection. This outstanding performance represents a substantial 29.96% increase compared to the same period in 2024, where we collected N1,347,705,251,658.31.

“Our month-by-month analysis reveals even more encouraging details of this growth trajectory,” Adeniyi said.

In addition to revenue collection, Adeniyi said the NCS maintained robust anti-smuggling operations, recording 298 seizures with a total Duty Paid Value (DPV) of ₦7,698,557,347.67.

He stated that rice was the most seized commodity, with 135,474 bags intercepted, followed by petroleum products and narcotics.

“From rice to wildlife, these seizures show our targeted approach,” Adeniyi remarked, noting the NCS’s commitment to combating smuggling and protecting national revenue.

Adeniyi also highlighted key initiatives, including the expansion of the B’Odogwu customs clearance platform and the launch of the Authorized Economic Operators Programme, which aims to streamline processes for compliant businesses. The NCS’s Corporate Social Responsibility Programme, “Customs Cares,” was also launched, focusing on education, health, and environmental sustainability.

Despite these achievements, the CG noted that the NCS faced challenges, including exchange rate volatility and non-compliance issues. Adeniyi acknowledged the need for ongoing adaptation and collaboration with stakeholders to address these challenges effectively.

Looking ahead, the NCS aims to continue its modernization efforts and enhance service delivery, ensuring that it remains a critical institution in Nigeria’s economic and security landscape.

“Results speak louder than plans; faster clearances through B’Odogwu, trusted traders in the AEO program, and measurable food price relief from our exemptions. We’ll keep scaling what works,” he concluded.

COVER

IMF Lowers Nigeria Economic Growth Forecast to 3.0%

By David Torough, Abuja

The International Monetary Fund (IMF) has downgraded its economic growth forecast for Nigeria in 2025 to 3.0%, citing a decline in global crude oil prices.

The revised projection was contained in the IMF’s April 2025 World Economic Outlook (WEO) report, released on the sidelines of the ongoing Spring Meetings of the IMF and the World Bank in Washington, DC.

The new forecast represents a 0.

2 percentage point reduction from the Fund’s previous projection of 3.2%.“For sub-Saharan Africa, growth is expected to decline slightly from 4.0% in 2024 to 3.8% in 2025, before recovering modestly to 4.2% in 2026.

“Among the larger economies, the growth forecast for Nigeria is revised downward by 0.

2 percentage point for 2025 and 0.3 percentage point for 2026, owing to lower oil prices,” according to the report.The IMF also noted similar economic pressures affecting other major African economies: “In South Africa, the growth forecast is revised downward by 0.5 percentage point for 2025 and 0.3 percentage point for 2026, reflecting slowing momentum from a weaker-than-expected 2024 performance, deteriorating sentiment due to heightened uncertainty, intensification of protectionist policies, and a deeper slowdown in major economies.”

In a more drastic revision, the IMF also slashed South Sudan’s 2025 forecast: “South Sudan has a downward revision of 31.5 percentage points for 2025 due to delays in resuming oil production following damage to a key pipeline.”

COVER

Fresh Attack on Benue Community Claims 11 More Lives

From Attah Ede, Makurdi and Dan Amasingha, Minna

Fresh attack in Afia, Ukum local government area of Benue state yesterday left no fewer than 11 more persons killed by suspected armed herders.

This is coming few days after a similar attack killed over 72 persons in Ukum, Logo and Katsina-Ala local government areas of the state.

Tor Sankera, rue First Class King in the area, Chief David Sevav disclosed this while addressing the NSA at Government House Makurdi.

The Tor, Sankera, who was represented by the Ter Ukum, Chief Iyorkyaa Kaave said ‘the number is still counting’.

He asked the President to ensure that the killer herdsmen are chased away as they do not want to live murderers.

Meanwhile, the National Security Adviser to President Bola Tinubu, Mallam Nuhu Ribadu yesterday said his principal, inherited an extremely bad nation and government coupled with insecurity.

Ribadu however, maintained that, despite the situation, Tinubu administration is working very hard to fix the damage done by the previous administrations.

He stated this while speaking at Government House Makurdi during his official visit to the State to commiserate with the people and government over the recent killing of over 72 persons by suspected armed herders in Ukum Logo and Katsina-Ala local government areas of the state

The NSA, who frowned at the incessant killings, describing it as a tragedy and evil that has befell the state and the country at large.

“When such evil occurs, good people must come together and fight it.

“We will defeat it. The entire country is with Benue. I commiserate with Benue People and assure you this is a trying period for all of us, we are 100 percent with you.

“We will confront it. Benue is an extremely important state to Nigeria. We must fight and maintain Benue as a peaceful state. The Governor is doing well and we will support him. It is unfortunate but it happens sometime.

“Our armed forces are doing well. It is impossible to post soldiers or police to every hamlet. Give us chance and stop politicizing the killings. This will help us to restore peace. Issue of security is relative.

“We inherited an extremely bad government and things have improved and we will address all these issue cropping up. It is a matter of time, to do the harm is easy but to solve it is difficult. We have reduced considerably the number of violence we met. This one too, we will confront it”.

“We acknowledge the Governor’s efforts to combat insecurity. However, those exploiting this situation for personal gain should cease their actions.

“We’re committed to supporting the Governor in tackling insecurity and we promise to continue our support to defeat this menace. The President has instructed me to convey his determination to bring an end to insecurity”, Ribadu stated.

On his part, Benue State Governor Rev. Fr. Hyacinth Alia said it is a sobering moment for the state as it has come under intense siege with loss of lives of unimaginable figure since 2011.

He noted that there have been skirmishes of killings from these terrorists, bandits and militia who have destroyed the economy of ‘our land’.

“These people do not have any reason to live with normal people. We are faced with series of loss of lives, farmlands and property. We have 17 IDPs camps in the State. It becomes difficult to get our IDPs back to their ancestral homes.

“Sankera is our headquarter of food. The attacks have been persistent and continous. Instead of a good Friday, we have a black Friday with venomous attack on Katsina-Ala, Ukum and Logo.

“It is quite devastating. It is telling on us. 72 lives lost. It is a terrible moment for us. I have always established contact with the NSA. Our security agencies have worked assiduously to curtail the attacks. We need help like yesterday. The President have been very supportive and hope that support will come.

“We have bought 100 hilux to support conventional security agencies, bought 600 motorcycle. This is a carnage. Attack is more of onion layer, it is vicious. We ask that support should be upped.

“We will collaborate with the FG to stop the killings. It is evident that what we are experiencing is a bare face attack as the attackers speak Fulani and Hausa. It is a troubling trend. It is deliberate attempt, they disbalance the people, kill a good number of them and occupy.

“The attacks are not under reported. We are helpless. We do not have AK47. We are defenseless. We tell the people to be law abiding and the attackers take advantage of this. We are not in a banana Republic,” the governor said.

Bago Imposes Dusk-to-dawn Curfew in Minna

From the unabated breach of public peace within Minna metropolis, Governor Mohammed Umar Bago has imposed curfew on the operation of Okada and Keke from 6am to 6pm.

The curfew which is to take effect yesterday was personally announced by the Governor after an expanded security and state executive council meeting at Government house in Minna.

The Governor who was flanked by the Emir of Minna, Alhaji Umar Farouk Bahago and Deputy Governor, Yakubu Garba was aimed at curtailing the escalating security challenge and thuggery plaguing Minna.

The Governor stated that “Let me warn nobody is above the law, the responsibility of Government is to enhance and restore security.

“I will lead the operation to out into the streets and fish out all the miscreants troubling the peace of our state.”

He identified some flash point within the State capital to include Maitumbi, Sabongari and Barkinsale areas.

Bago while calling on the people to partner his administration to restore peace to the street s of Minna reminded them that security is a collective responsibility, but vowed that government has zero tolerance for what he called “Rascality in Niger State”

“Anyone found with weapon should be dealt with, parents should warn their wards, it is now fire for fire and anyone whose child becomes a casualty will pay for the bullet before being allowed to claim the body.

“Let me sound it clear, we are coming with full force, anyone who harasses security agents will have himself to blame,” Bago stated.

Bago said the take back the street operation will also target drug peddlers and thugs, warning that any premises that is found to be harboring such individuals risk been demolished.

“We are clamping down on drug dealers as well, Minna and Niger State is not for useless people, we are setting up special court to deal with them

“If (parents) you cannot take care of your Children, we will take care of them for you”

On Barkin-Sale community, the Governor threatened to demolish the settlement and relocate them if youths from the axis do not desist from Acts of criminality and thuggery.

“If Barkin-Sale is the problem, mark, demolish and relocate them to the outskirts and if we found you are not from Niger State and you are troubling us we will take you back to your State.”