Business News

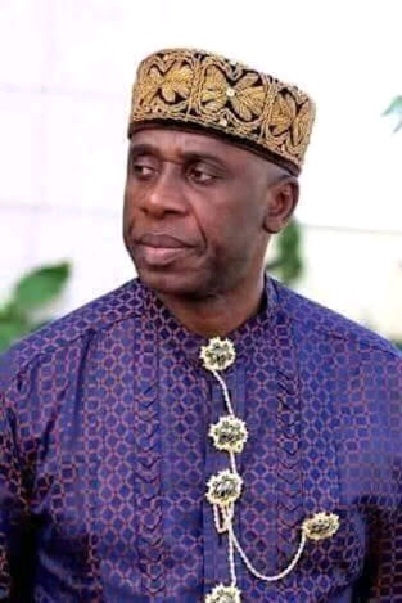

Amaechi Seeks Better Welfare for Seafarers

From Dooyum Naadzenga, Lagos

Minister of Transportation, Rt. Hon. Chibuike Amaechi, has challenged ship-owners and other stakeholders in the Nigerian maritime industry to device creative means of ensuring improved welfare for seafarers, while proffering permanent solutions to issues that affect their work.

Amaechi stated this on Friday in Lagos in his address at the 2021 Day of the Seafarer, with the theme, “Fair Future for Seafarers.

”

The Minister extolled seafarers in Nigeria and the world over for their enormous contributions to global commerce and economy, generally, saying seafarers “contend with perils of the seas and sometimes put their lives on the line just to ensure that goods are safely delivered at designated ports.

Director General of the Nigerian Maritime Administration and Safety Agency (NIMASA), Dr. Bashir Jamoh, spoke in a similar vein in his welcome address.

Jamoh also insisted on a reconsideration of the war risk insurance premium charged on cargo headed for the Gulf of Guinea. He was reacting to the response of the Lloyd’s List Intelligence, a specialist business information service dedicated to the global maritime community, to his earlier call for review of the high insurance based on improved security conditions in the region.

“As we celebrate the seafarers’ day, let us further identify and proffer workable solutions to the issues that will still be relevant to the seafarers after the pandemic, such as fair treatment, living and working conditions of the seafarers, etc.,” Amaechi told maritime stakeholders.

He highlighted the harrowing experiences seafarers endured in the course of their job, especially at the peak of the COVID-19 pandemic last year.

“| am, however, glad to inform you that Nigeria, as a member state of the IMO, was one of the first countries to declare seafarers essential workers in order to ease their sufferings,” the Minister stated. He added,

“The nation through the Federal Ministry of Transportation and its Agencies will continue to ensure that government policies are tailored towards improving the welfare and working conditions of the seafarers in line with international standard and statutory conventions.”

Amaechi reiterated the commitment of the Nigerian government to ensuring that the country’s maritime domain remained safe and secure for seafarers working on ships transiting through the waterways. He identified the Deep Blue Project launched by President Muhammadu Buhari on June 10 as a major effort by the government to curb the hazards of seafaring.

He said the provision of the integrated maritime security architecture was “to help combat these maritime criminalities that hinder the security of crew members.”

Besides, the Minister said, Nigeria now has an antipiracy law, the Suppression of Piracy and Other Maritime Offences Act 2019, to prosecute maritime offenders.

Jamoh restated his call on the international community to reexamine the war risk insurance imposed on Gulf of Guinea-bound ships, saying security conditions in the region are rapidly improving.

“It is significant that critical stakeholders in the world shipping community, like Lloyd’s List, are recognising Nigeria’s efforts to make the Gulf of Guinea safe and secure for seafarers and ships,” the Director General said adding, “but it would be unfair for the world to sidestep such huge investment and commitment to maritime security and retain the high war risk insurance premium on ships bound for our waters.”

He said continuing the war risk insurance would be a disservice to Nigeria and investors in the country’s maritime environment.

Jamoh stated, “Since the world now acknowledges our commitment to maritime security and the recent improvements in security, it is only fair that relevant stakeholders should begin to rethink the charges that predated such efforts by Nigeria.

“The poor masses of this country should not be made to pay for the actions of a few individuals bent on tarnishing Nigeria’s image.”

The highlight of the event was the presentation of Certificates of Competency (COC) to cadets of the Nigerian Seafarers Development Programme (NSDP) who recently graduated from the Arab Academy for Science, Technology and Maritime Transport, Alexandra, Egypt, by the NIMASA Director General.

June 25 every year is designated as the Day of the Seafarer by the International Maritime Organisation (IMO) to celebrate seafarers and their contributions to human progress.

There was wide participation by maritime stakeholders in this year’s event.

Business News

Adaora Umeoji Showcases Zenith Bank’s Strong Financial Performance, Targets Over N1 Trillion Profit In 2024

Zenith Bank Plc, Nigeria’s leading financial institution, held its Capital Markets Day last week to showcase the bank’s inherent values as it embarks on its recapitalisation journey. The event, which brought together key market players, focused on the bank’s growth trajectory, strategic objectives, market performance, and consistent, robust dividend payout over the years.

It also provided an opportunity for the bank to inform capital market stakeholders about its robust risk management culture, adherence to regulations, capital adequacy, and maintenance of low non-performing loan levels.Addressing capital market stakeholders, investors, and analysts at the event in Lagos, the Group Managing Director/Chief Executive Officer, Dame Dr Adaora Umeoji, highlighted the financial institution’s tier-1 capital of N1.

8 trillion, shareholders’ funds of N2.3 trillion, market capitalisation of N1.3 trillion, a profit before tax of N796 billion, and a dividend of N4 per share for the year ended December 2023.Providing guidance for 2024, she noted that, given the trend of the bank’s performance and having achieved a profit before tax of N796 billion in 2023 and N320 billion in the first quarter of 2024, the bank is on track to deliver over N1 trillion in profit before tax in 2024. She expressed confidence that, with the quality of the board and management and a strong corporate culture, the bank is well-positioned to deliver superior value to investors and other stakeholders and to navigate the recapitalisation process successfully. She also disclosed some of the bank’s future plans, which include driving financial inclusion, expanding corporate and retail banking through technology and other state-of-the-art digital platforms, and establishing a fintech subsidiary, ZenPay, to drive profitability. Additionally, the bank intends to expand to France and other Francophone African countries.

Dr Umeoji explained, “For us at Zenith, we won’t be left out. We are planning to go to the market to raise capital, and as it stands, Zenith Bank has the least amount of capital to raise. We are looking to raise N230 billion because we are already at N270.7 billion. That is the least capital to raise among our peers. We believe that Zenith Bank has what it takes. We have the capacity, the network, the balance sheet, the human capital, and the track record to achieve that. We are planning for the future, and the technology we have now is the best in the entire industry. It will help us to have a seamless process and integrate.”

Also speaking, the Chief Financial Officer/General Manager, Dr Mukhtar Adam, pointed out that in the last five years, the bank’s Compound Annual Growth Rate (CAGR) in revenue has grown by over 27 per cent. “This continues to grow year-on-year. Within this period, at some point, Nigeria went into recession, but we forged ahead, worked very hard, and continued to deliver growth. Within the last five years, our profit before tax has also grown cumulatively by about 28 per cent. This is a market where, at some point, government instruments – treasury bills – were paying one per cent, two per cent, three per cent. But we forged ahead to grow the numbers and provide stable returns of at least 28 per cent.”

Zenith Bank recently emerged as the Best Commercial Bank, Nigeria, in the World Finance Banking Awards 2024, retaining the award for the fourth consecutive year. The bank was also named Best Corporate Governance, Nigeria, for the third year running in the World Finance Corporate Governance Awards 2024. The awards, published in the Summer 2024 issue of World Finance Magazine, recognise the bank’s robust financial performance, superior customer service, sustainability initiatives, and corporate governance practices.

Commenting on the dual honours, Dr. Umeoji said, “These awards highlight our steadfast dedication to excellence, adherence to global best practices, and our persistent effort to deliver superior value to all stakeholders through innovative products and services. Receiving these awards consecutively for multiple years signifies the commitment of our staff, the loyalty of our customers, and the support of our shareholders. We remain devoted to setting industry benchmarks and driving excellence across all aspects of our operations.”

Dr. Umeoji also expressed delight at the recognition and dedicated the awards to the Founder and Chairman, Dr. Jim Ovia, CFR, for his impactful leadership in establishing a robust and flourishing institution. She also expressed gratitude to the board for their vision and insight, the staff for their unwavering dedication, and the bank’s customers for choosing Zenith as their preferred bank. World Finance is a leading international magazine providing comprehensive coverage and analysis of the financial industry, international business, and the global economy.

In its audited results for the year ended December 31, 2023, Zenith Bank achieved a remarkable triple-digit growth of 125 per cent in gross earnings, from N945.6 billion reported in 2022 to N2.132 trillion in 2023. The impressive growth in gross earnings resulted in a year-on-year increase of 180 per cent in profit before tax (PBT), from N284.7 billion in 2022 to N796 billion in 2023, while profit after tax (PAT) also recorded triple-digit growth of 202 per cent, from N223.9 billion to N676.9 billion for the period ended December 31, 2023.

The increase in gross earnings was primarily due to growth in interest and non-interest income. Specifically, its interest income increased by 112 per cent, from N540 billion in 2022 to N1.1 trillion in 2023, while non-interest income grew by 141 per cent, from N381 billion to N918.9 billion in the same period. The rise in interest income was attributed to the growth in the size of risk assets and their effective repricing, alongside the increase in yield of other interest-bearing instruments over the year. Growth in non-interest income was driven by significant trading gains and an increase in gains from the revaluation of foreign currencies.

Zenith Bank’s cost of funds also grew from 1.9 per cent in 2022 to three per cent in 2023 due to the high interest rate environment, while interest expense increased by 135 per cent, from N173.5 billion in 2022 to N408.5 billion in 2023. Notwithstanding the 32 per cent growth in operating expenses in 2023, the Group’s cost-to-income ratio improved significantly from 54.4 per cent in 2022 to 36.1 per cent in 2023 due to improved top-line performance. Return on Average Equity (ROAE) increased by 118 per cent, from 16.8 per cent in 2022 to 36.6 per cent in 2023, underpinned by improved gross earnings, as the Group sought to deliver better shareholder returns. Return on Average Assets (ROAA) also grew by 95 per cent, from 2.1 per cent to 4.1 per cent in the same period.

Zenith Bank was established in May 1990 and commenced operations in July of the same year as a commercial bank. The bank became a public limited company on June 17, 2004, and was listed on the Nigerian Stock Exchange (NSE) on October 21, 2004, following a highly successful Initial Public Offering (IPO). In 2013, the bank listed $850 million worth of its shares at $6.80 each on the London Stock Exchange (LSE). Headquartered in Lagos, Nigeria, Zenith Bank Plc has more than 400 branches and business offices in prime commercial centres across all states of the federation and the Federal Capital Territory (FCT).

Zenith Bank Plc, founded by Jim Ovia, CFR, in 1990, has since grown to become one of the leading financial institutions in Africa. The underlying philosophy is for the bank to remain a customer-centric institution with a clear understanding of its market and environment. Zenith Bank’s track record of excellent performance has continued to earn the brand numerous awards. These latest accolades follow several recognitions, including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the 14th consecutive year in the 2023 Top 1000 World Banks Ranking, published by The Banker Magazine; Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020 and 2022; and Most Sustainable Bank, Nigeria, in the International Banker 2024 Banking Awards, among several others.

Zenith Bank Plc has blazed the trail in digital banking in Nigeria, achieving several firsts in the deployment of Information and Communication Technology (ICT) infrastructure to create innovative products that meet the needs of its customers. The bank is a leader in the deployment of various channels of banking technology, and the Zenith brand has become synonymous with state-of-the-art technologies in banking. Driven by a culture of excellence and strict adherence to global best practices, the bank has combined vision, skilful banking expertise, and cutting-edge technology to create products and services that anticipate and meet customers’ expectations, enable businesses to thrive, and grow wealth for customers.

Business News

AMCON Records Over N108bn in 2023 Financial Year

By Tony Obiechina, Abuja

Amidst challenging macroeconomic conditions coupled with economic headwinds, Asset Management Corporation of Nigeria (AMCON) achieved a remarkable triple-digit growth of 202% from NGN34.730 billion in the previous year to NGN108.433 billion in 2023.

This was contained in the a statement made available by Jude Nwauzor, Head of Corporate Affairs Department in Abuja on Wednesday.

A breakdown of this impressive achievement showed that AMCON, which is currently led by Gbenga Alade as Managing Director/Chief Executive Officer achieved a Year-on-Year (YoY) growth in profit of 212% from N34.730 billion in the financial year, which ended on December 31, 2022, to N108.

433 billion in the period ended December 31, 2023.The report disclosed that fair valuation gains on Eligible Bank Assets (EBAs) increased to N40.9 billion in 2023 from a loss of N187.9 billion in 2022. Equity portfolio recorded 82% growth in 2023 amounting to N43 billion as compared with N7.9 billion in 2022. The significant trading gains is as result of an improved performance in the stock market.

The Corporation achieved a favourable reduction in total liabilities, from N6.282 trillion in 2022 to N5.739 trillion in 2023, primarily due to repayments of the N500 billion Central Bank of Nigeria (CBN) loan. It also recorded 89% achievement of its revenue budget in 2023 as the total recovery in 2023 stood at N125.2 billion.

A breakdown of the recovery showed that AMCON achieved N81.65 billion in collections from various obligors, N17.8 billion from share sales, N15.5billion reinvestment income, N6 billion as proceed from sale of properties, N3.8 billion dividend income and N0.5 billion from rental income despite the country’s challenging economic environment, occasioned by the removal of subsidy and floatation of the naira.

The executive management said AMCON is strategically positioned to continue with the positive trajectory achieved in the year 2023, with special emphasis on improved recoveries and efficient realization of value from disposal of forfeited assets in furtherance of the Corporation’s mandate.

The summary of the AMCON’s Financial highlight is presented below:

*Profit for the year Dec 31, 2022 – N34,730bn

*Profit for the year Dec 31, 2023 – N108,433bn

*Total comprehensive income for the year, net of tax – (2023) N106,385bn

N30,963bn (2022)

Total Assets

N1,076,144bn (2023)

N1,513,304bn (2022).

Recapitalization ‘ll Create Stronger, more Resilient Banks – Cardoso

By Tony Obiechina, Abuja

The Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, has said that the Bank will continue to collaborate with relevant financial institutions, the fiscal authorities and the National Assembly to ensure a successful recapitalisation exercise, including providing adequate protection of property rights and interests of minority shareholders.

Mr. Cardoso made the pledge in London on while speaking to stakeholders on “The Impact of the Recapitalization of Nigerian Banks” at the UK-Nigerian Chamber of Commerce.

The Governor, represented by the Bank’s Deputy Governor, Financial Systems Stability, Mr. Phillip Ikeazor, emphasised the event’s significance and restated the CBN’s commitment to fostering stronger, healthier, and more resilient banks capable of withstanding economic shocks and supporting the Government’s goal of achieving a GDP of US$1 trillion by 2030.

According to him, the anticipated impact of the recapitalisation programme will include an increase in banks’ lending capacity, a boost in the volume of foreign direct investment (FDI), and an increase in foreign exchange liquidity.

He said the exercise would also contribute to GDP growth, better risk management, improved credit ratings, a diversified ownership base, better governance and strategic decisions, and increased market volume and value, leading to a more vibrant equity market.

“With the recapitalisation programme, our goal is to trigger the emergence of stronger, healthier and more resilient banks,” he added.

He noted that several factors influenced the new minimum capital requirements, including macroeconomic conditions, stress test outcomes, and the need for improved risk management.

“We will rigorously enforce our “fit and proper criteria” for prospective new shareholders, senior management, and board members of banks, and proactively monitor the integrity of financial statements, adequacy of financial resources, and fair valuation of banks’ post-merger balance sheets,” Cardoso assured.

He noted the significant opportunity it presents to engage investors, policymakers, and technocrats on the critical issue of bank recapitalisation in Nigeria.

Mr Cardoso explained that since assuming of office in October 2023, his priorities at the CBN have included achieving monetary and price stability, maintaining a stable exchange rate, controlling inflation, and creating an enabling environment for businesses.

He explained that the recapitalisation directive excluded retained earnings from the minimum capital requirement to simplify capital calculations and enhance transparency. He explained that the decision, rooted in the BOFIA Act 2020, aligns with international standards like Basel III and emphasises core capital elements to improve financial stability.

Reflecting on the successful 2004/5 Banking Sector Reforms, which consolidated the industry, increased capital bases, and boosted resilience against the global financial crisis, the Governor assured that the current recapitalisation initiative aims to build on these achievements.