Economy

World Bank: FG, States Won’t Be Able to Pay Salaries in 2022 If Fuel Subsidy is Retained

The World Bank yesterday sounded the alarm bells to Nigeria, saying further delay in removing the fuel subsidy which had been described as a major drain and waste on the economy could see the federal and state governments unable to pay salaries from 2022.

The Lead Economist, Nigeria Country office of the World Bank, Marco Antonio Hernandez, painted a gloomy picture of Nigeria if the country decides to continue with the controversial fuel subsidy, while unveiling the Nigeria Development Update (NDU), a bi-annual report of the multilateral institution, at an even that held in Abuja as well as virtual.

Also, the Group Managing Director of the Nigerian National Petroleum Corporation (NNPC), Mallam Mele Kyari, during a panel session at the event, lamented the huge burden the continuous retention of the subsidy on petrol had been to the corporation, warning that going forward, “the NNPC may have to start invoicing the federation to be able to maintain subsidy.

”This is just as the Minister of Finance, Budget and National Planning, Mrs. Zainab Ahmed, reiterated that the government was working on introducing measures that would cushion the impact of fuel subsidy removal on vulnerable Nigerians.

Speaking further, Hernandez, in the report, urged Nigeria to remove subsidy on petroleum motor spirit (PMS) in February 2022, as prescribed by the Petroleum Industry Act (PIA), warning that further delay could worsen the precarious revenue situation confronting the country.

The report also warned that the present fiscal condition of the sub-national governments would take a turn for the worse in 2022 with 35 of the 36 states unable to meet their financial obligations.

Hernandez stated that a situation where N250 billion goes into fuel subsidy monthly was unsustainable as the paucity of revenue confronts the country, especially the sub-national governments.

Hernandez who provided insights into the NDU report, titled “Time for Business Unusual,” stated that should the current revenue challenge continue till 2022, only Lagos State would be able to meet its financial obligations.

The report pointed to mounting fiscal pressures due to lower-than-expected revenues in 2021 and the rising cost of PMS subsidy.

It stated: “Because most states rely heavily on inter-governmental transfers, diminished revenue inflows to the Federation Account are jeopardising fiscal sustainability at the state level.

“For example, in the oil-producing State of Bayelsa federal transfers account for 91 per cent of revenues, and declining transfers caused a 22-percent drop in Bayelsa’s revenues per capita during the year.

“Even in the state of Lagos, which relies the least on Federal transfers, transfers accounted for 29 per cent of revenues in 2020. Most State expenditures cover salaries and administrative expenses, and given their rigid (i.e., nondiscretionary) nature, State-level expenditures are difficult to cut.

“Consequently, lower revenues are likely to intensify pressure on states’ debt stocks and undermine their fiscal sustainability.”

According to the report, in contrast to past periods of high oil prices, the Nigerian government has this time not been able to fully benefit from the oil boom because oil production has fallen below Nigeria’s estimated capacity and the Organisation of Petroleum Countries (OPEC) quota due in part to rising insecurity and the higher cost of the PMS subsidy.

It stated: “In 2022 the federal government plans to spend about 3,000 naira (US$7) per person for health, while the cost of the PMS subsidy for next year could reach 13,000 naira (US$32) per person. Not only is the PMS subsidy costly, but it mainly benefits richer households.

“Nigeria has the opportunity to establish a “compact” with citizens that eliminates the subsidy and uses the savings to provide targeted cash transfers to lower-income-households, invest in job-creating programs, and improve its fiscal position.”

It stated that the insufficient supply of foreign exchange (FX) issues related to the predictability of exchange rate management, the unsustainable subsidy on premium motor spirit (PMS), burdensome trade restrictions, and the sizeable fiscal deficit financing by the Central Bank of Nigeria (CBN) are undermining the business environment, compounding underlying constraints on domestic revenue mobilisation, foreign investment, human capital development, and the delivery of public services.

The report noted that despite a strong initial recovery and resurgent global oil prices, Nigeria’s pre-crisis challenges were threatening its post-crisis recovery, highlighting the need to depart from business-as-usual policies.

“Even though Nigeria’s economy exited a pandemic-induced recession, several challenges persist including double-digit inflation, declining incomes, and rising insecurity.

“While the government took bold policy measures to mitigate the impacts of the COVID-19 crisis, the reform momentum has slowed which hinders Nigeria’s ability to reach its growth potential,” World Bank Country Director for Nigeria, Shubham Chaudhuri said.

The report prescribed policy options for Nigeria, including addressing fiscal pressures.

“Urgent priorities for the next three to six months include reducing inflation, improving exchange-rate management, mobilising additional oil and nonoil revenues, eliminating the PMS subsidy and redirecting expenditures towards targeted cash transfers and other priority investments, fostering competitive markets, and improving infrastructure.

“While Nigeria’s macroeconomic projections have been updated since the previous edition of the NDU, the government’s fundamental policy challenges remain unchanged,” it added.

In his contribution, Kyari, pointed out that while all over the world, subsidies are introduced to bring cost control and less pains to citizens, in Nigeria, fuel subsidy has become a major fiscal burden that must be eliminated.

The NNPC boss explained: “Today, we are evacuating about 60 million litres of gasoline from all the depots in the country. It is not national consumption and it is very understandable because of issues such as cross-border smuggling.

“As long as you have arbitrage, traders don’t see it as a crime, they just take advantage of that and exploit it. What we are dealing with is about N243 billion of fuel subsidy monthly. So, there is no magic around that.

“This is the reality that we are facing. Going forward in 2022, we simply cannot afford this, we just don’t have the resources. As a matter of fact, the NNPC may have to start invoicing the federation to be able to maintain subsidy.

“When you take out N243 billion from your total income every month, you are not able to fund your operations and so you can’t meet your other fiscal obligations. Clearly, there is a challenge in the ability to pay. So, there is a reform going on, particular in the energy sector and no one can stop.”

Also, the Governor of Kaduna State, Mallam Nasir El-Rufai wondered why the country would continue to allocate more monies to fuel subsidy compared with the allocations to education, roads and the health sectors.

“Is subsidising petrol more important than our health as even in a year we spent significant amount on health due to the pandemic, the budget for subsidy was still higher? Does it make sense?

“Is subsidising petrol about thrice as educating our children and preparing them for the future more important? The capital budget for roads is five times less than our budget for subsidy. We have to ask ourselves as Nigerians whether this makes sense at all,” he added.

According to El-Rufai, “this is the first time in Nigeria that oil prices are rising globally, yet, there is no windfall. In fact, we are getting less. Why? Because according to Kyari, subsidy is taking N250 billion per month.”

He disclosed that this month, what the NNPC paid to the federation account, as part of its contribution to the amount to be shared by the Federation Account Allocation Committee (FAAC), was only N14 billion as against the N120 billion stipulated in the budget, and, “with the threat that next month they would ask the federation account to give them a cheque to cover subsidy.”

“So, we have to ask ourselves if this subsidy still makes sense. Who is benefiting from it other than the smugglers and neighbouring African countries and some rich people? We have to stop this thing that will bring Nigeria to its knees,” the state governor added.

Earlier, in her opening remarks, Ahmed expressed optimism that recent developments in the oil sector, such as the Petroleum PIA 2021, the full reactivation of the four public refineries in the country, and the completion and coming on stream of the three private refineries under construction in 2022, would significantly boost contribution from the sector to economic growth.

According to her, subsidies’ regime in the sector remained unsustainable and economically disingenuous.

She disclosed that ahead of the target date of mid-2022 for the complete elimination of fuel subsidies, the government was working with its partners on measures to cushion potential negative impact of the removal of the subsidies on the most vulnerable at the bottom, which she estimated to be 40 per cent of the population.

“One of such measures would be to institute a monthly transport subsidy in the form of cash transfer of N5,000 to between 30 – 40 million deserving Nigerians.

“As a government, we remain committed to our broad objectives of stimulating broad-based growth through diversification and the active participation of the private sector to ensure that our growth is inclusive.

“We will continue to prioritise investment in critical infrastructure needed to unlock production and supply constraints, to create adequate productive employment and preserve jobs, and to ensure macroeconomic stability and promote poverty reduction and equity.

“I agree with the Report that with the expansion of social protection policies during the pandemic, the government has an opportunity to phase out subsidies such as the PMS subsidy while utilising cash transfers to safeguard the welfare of poor and middle-class households.

“Towards this end, we intend to accelerate our structural reforms, particularly in the power sector, in governance, in business environment to unlock the huge potentials of the economy, scale up social safety net and deepen financial inclusion to reduce poverty and inequality gaps. We will carefully calibrate the sequencing of these reforms to manage their attendant political fallouts,” she added.

Ahmed pointed out that digital revolution was looming in Nigeria and waiting to happen spontaneously.

“I agree that Nigeria’s digital economy can transform economic activities by unleashing new productivity gains, offering new services, and improving the government’s efficiency. We see enormous opportunity for our theming youth population in this sector which has largely remained unharnessed with isolated progress and possibilities.

“We need greater investments in newer and competitive technologies to be made for the provision of critical infrastructure in the telecoms sector to unleash potentials.

“To protect such investments, government has been mobilising national security outfits, and even local ‘vigilantes’ to provide added layers of security for the infrastructure, while at same time engaging local communities towards addressing the likely root causes of cases of infrastructure vandalisation,” she added.

Economy

We’ll Continue Borrowing Within Sustainable Limits- FG

The Federal Government says it will continue to borrow within manageable and sustainable limits in accordance with the Debt Management Office (DMO) debt sustainability framework.

This is contained in a statement by the Director, Information and Public Relations in the Ministry of Finance, Mr Mohammed Manga, in Abuja on Wednesday.

President Bola Tinubu recently requested the approval of the 2024 – 2026 external borrowing rolling plan from the National Assembly.

Tinubu has requested the National Assembly’s approval to secure external loans of 21.5 million dollars and 15 billion Yuan, along with a grant of 65 million Euro, as part of the federal government’s proposed 2025–2026 external borrowing plan.

Manga said that the proposed borrowing plan was an essential component of the Medium-Term Expenditure Framework (MTEF) in accordance with both the Fiscal Responsibility Act 2007 and the DMO Act 2003.

“The plan outlines the external borrowing framework for both the federal and sub-national governments over a three-year period, accompanied by five detailed appendices on the projects, terms and conditions, implementation period, etc.

“By adopting a structured, forward-looking approach, the plan facilitates comprehensive financial planning and avoids the inefficiencies of ad-hoc or reactive borrowing practices.

“This strategic method enhances the country’s ability to implement effective fiscal policies and mobilise development resources,” he said.

According to the statement, the borrowing plan does not equate to actual borrowing for the period.

“The actual borrowing for each year is contained in the annual budget. In 2025, the external borrowing component is 1.23 billion dollars, and it has not yet been drawn.

“This is planned for H2 2025, the plan is for both federal and several state governments across numerous geopolitical zones including Abia, Bauchi, Borno, Gombe, Kaduna, Lagos, Niger, Oyo, Sokoto, and Yobe States.

“Importantly, it should be noted that the borrowing rolling plan does not equate to an automatic increase in the nation’s debt burden.

“The nature of the rolling plan means that borrowings are split over the period of the projects, for example, a large proportion of projects in the 2024–2026 rolling plan have multi-year drawdowns of between five to seven years which are project-tied loans,” Manga said.

He said that these projects cut across critical sectors of the economy, including power grids and transmission lines, irrigation for improving food security, fibre optics network across the country, fighter jets for security, rail and road infrastructure.

According to him, the majority of the proposed borrowing will be sourced from the country’s development partners, like the World Bank, African Development Bank, French Development Agency, European Investment Bank, JICA, China EximBank, and the Islamic Development Bank.

Manga said that these institutions offer concessional financing with favourable terms and long repayment periods, thereby supporting Nigeria’s development objectives sustainably.

He said that the government seeks to reiterate that the debt service to revenue ratio has started decreasing from its peak of over 90 per cent in 2023.

Manga said that the government has ended the distortionary and inflationary ways and means.

According to him, there is significant revenue expectations from the Nigerian National Petroleum Corporation Limited (NNPC Ltd), technology-enabled monitoring and collection of surpluses from government owned enterprises and revenue-generating ministries, departments, and agencies and legacy outstanding dues.

“Having achieved a fair degree of macroeconomic stabilisation, the overarching goal of the federal government is to pivot the economy onto a path of rapid, sustained, and inclusive economic growth.

“Achieving this vision requires substantial investment in critical sectors such as transportation, energy, infrastructure, and agriculture.

“These investments will lay the groundwork for long-term economic diversification and encourage private sector participation.

“Our debt strategy is therefore guided not solely by the size of our obligations, but by the utility, sustainability, and economic returns of the borrowing,” he said.(NAN)

The Federal Government says it will continue to borrow within manageable and sustainable limits in accordance with the Debt Management Office (DMO) debt sustainability framework.

This is contained in a statement by the Director, Information and Public Relations in the Ministry of Finance, Mr Mohammed Manga, in Abuja on Wednesday.

President Bola Tinubu recently requested the approval of the 2024 – 2026 external borrowing rolling plan from the National Assembly.

Tinubu has requested the National Assembly’s approval to secure external loans of 21.5 million dollars and 15 billion Yuan, along with a grant of 65 million Euro, as part of the federal government’s proposed 2025–2026 external borrowing plan.

Manga said that the proposed borrowing plan was an essential component of the Medium-Term Expenditure Framework (MTEF) in accordance with both the Fiscal Responsibility Act 2007 and the DMO Act 2003.

“The plan outlines the external borrowing framework for both the federal and sub-national governments over a three-year period, accompanied by five detailed appendices on the projects, terms and conditions, implementation period, etc.

“By adopting a structured, forward-looking approach, the plan facilitates comprehensive financial planning and avoids the inefficiencies of ad-hoc or reactive borrowing practices.

“This strategic method enhances the country’s ability to implement effective fiscal policies and mobilise development resources,” he said.

According to the statement, the borrowing plan does not equate to actual borrowing for the period.

“The actual borrowing for each year is contained in the annual budget. In 2025, the external borrowing component is 1.23 billion dollars, and it has not yet been drawn.

“This is planned for H2 2025, the plan is for both federal and several state governments across numerous geopolitical zones including Abia, Bauchi, Borno, Gombe, Kaduna, Lagos, Niger, Oyo, Sokoto, and Yobe States.

“Importantly, it should be noted that the borrowing rolling plan does not equate to an automatic increase in the nation’s debt burden.

“The nature of the rolling plan means that borrowings are split over the period of the projects, for example, a large proportion of projects in the 2024–2026 rolling plan have multi-year drawdowns of between five to seven years which are project-tied loans,” Manga said.

He said that these projects cut across critical sectors of the economy, including power grids and transmission lines, irrigation for improving food security, fibre optics network across the country, fighter jets for security, rail and road infrastructure.

According to him, the majority of the proposed borrowing will be sourced from the country’s development partners, like the World Bank, African Development Bank, French Development Agency, European Investment Bank, JICA, China EximBank, and the Islamic Development Bank.

Manga said that these institutions offer concessional financing with favourable terms and long repayment periods, thereby supporting Nigeria’s development objectives sustainably.

He said that the government seeks to reiterate that the debt service to revenue ratio has started decreasing from its peak of over 90 per cent in 2023.

Manga said that the government has ended the distortionary and inflationary ways and means.

According to him, there is significant revenue expectations from the Nigerian National Petroleum Corporation Limited (NNPC Ltd), technology-enabled monitoring and collection of surpluses from government owned enterprises and revenue-generating ministries, departments, and agencies and legacy outstanding dues.

“Having achieved a fair degree of macroeconomic stabilisation, the overarching goal of the federal government is to pivot the economy onto a path of rapid, sustained, and inclusive economic growth.

“Achieving this vision requires substantial investment in critical sectors such as transportation, energy, infrastructure, and agriculture.

“These investments will lay the groundwork for long-term economic diversification and encourage private sector participation.

“Our debt strategy is therefore guided not solely by the size of our obligations, but by the utility, sustainability, and economic returns of the borrowing,” he said.(NAN)

Economy

Organise Informal Sector, Tax Prosperity Not Poverty, Adedeji Tasks Officials

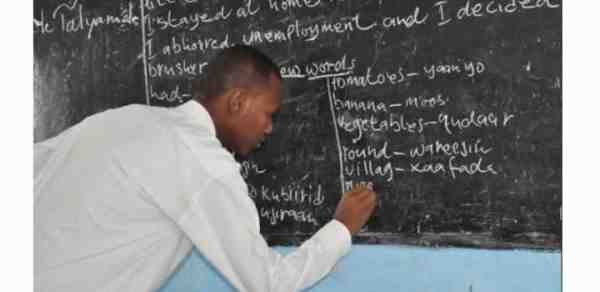

The Chairman, Joint Tax Board (JTB), Dr Zacch Adedeji, has urged officials of the board to organise traders and artisans into a formal body before capturing them in the tax net.

Adedeji said that this was in line with the agenda of President Bola Tinubu not to tax poverty but prosperity.

The chairman stated this at the 157th Joint Tax Board meeting held in Ibadan, on Monday.

The theme of the meeting “Taxation of the Informal Sector: Potentials and Challenges”.

Speaking on the theme of the event, Adedeji stressed the need to evolve a system that would make the informal sector formal before it could be taxed.

Adedeji, who also doubles as the Chairman, Federal Inland Revenue Service, (FIRS), said “What I would not expect from the JTB meeting is to define a system that would tax the informal sector.

“The only thing is to formalize the informal sector, not to design a system on how to collect tax from market men and women.

“As revenue administrator, our goal is to organise the informal sector so that it can fit into existing tax law.”

Citing a report of the National Bureau of Statistics (NBS) in the first quarter of 2023, the chairman said that the nation’s unemployment index was attributable to recognised informal work.

Adedeji stated that workers in that sector accounted for 92.6 per cent of the employed population in the country as at Q1 2023.

“JTB IS transiting to the Joint Revenue Board with expanded scope and functions.

“We are hopeful that by the time we hold the next meeting of the Board, the Joint Revenue Board (Establishment) Bill would have been signed into Law by the President.

“The meetings of the board provide the platform for members to engage and brainstorm on contemporary and emerging issues on tax, and taxation,” he said.

In his address, Gov. Seyi Makinde of Oyo State, said the theme of the meeting was apt and timely, stressing that it coincides with the agenda of the state to improve on its internally generated revenue.

According to him, the meeting should find the best way forward in addressing the issue of the informal sector and balance the identified challenges.

“Nigeria is rich in natural resources, but it is a poor country because economic prosperity does not base on natural resources,”

Makinde also said that knowledge, skill and intensive production were required for economic prosperity, not just the availability of natural resources.

He stressed the need to move from expecting Federal Allocations to generating income internally.

“We are actively ensuring that people are productive and moving the revenue base forward,” Makinde said.

The governor said that tax drive should be done by simplifying tax processes, incentives for compliance like access to empowerment schemes and loans.

He urged JTB to deepen partnership and innovation in using data on tax to track and administer it.

Earlier, the Executive Chairman, Oyo State Board of Internal Revenue, Mr Olufemi Awakan, said the meeting was to address tax-related matters, evolve a workable, effective and

efficient tax system across the states and at the Federal level.

He urged participants to find amicable solutions to challenges of tax jurisdiction, among others.

Tax administrators from all the 36 states of the federation, who are members of JTB, were in attendance. (NAN)

Economy

Customs Zone D Seizes Contraband Worth N110m

The Nigeria Customs Service (NCS), Federal Operation Unit (FOU), Zone D, has seized smuggled goods worth over N110 million between April 20 till date.

The Comptroller of Customs, Abubakar Umar, said this at a news conference on Tuesday in Bauchi.

He listed the seized items to include 11,200 litres of petrol; 192 bales of second hand clothing, 140 cartons of pasta, 125 pairs of jungle boots, 47 bags of foreign parboiled rice and 9.

40 kilogramme of pangolin scales.Umar said the items were seized through increased patrols, intelligence-led operations, and strengthened inter-agency collaboration.

The comptroller said the pangolin scales would be handed over to the National Environmental Standards and Regulations Enforcement Agency (NESREA) for appropriate action, while the seized petrol would be auctioned, and the proceeds remitted to the federation account.

He attributed the decrease in smuggling activities of wildlife, narcotics, and fuel to the dedication and professionalism displayed by the personnel in line with Sections 226 and 245 of the NCS Act 2023.

The comptroller enjoined traders to remain law abiding, adding the service would scale up sensitisation activities to combat smuggling.

“We remain resolute in securing the borders and contributing to Nigeria’s economic development,” he said.

The FOU Zone D comprises Adamawa; Taraba, Bauchi, Gombe, Borno, Yobe, Plateau, Benue and Nasarawa. (NAN)