BUSINESS

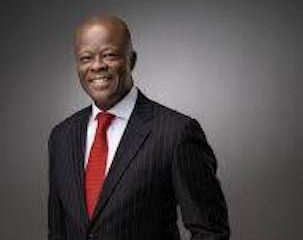

ABCON Boss Canvasses Monetary, Fiscal Policies to Salvage Naira

The Association of Bureaux Des Change Operators of Nigeria (ABCON) has urged the Central Bank of Nigeria (CBN) and the Federal Government to embrace practical solutions to salvage the Naira.

Alhaji Aminu Gwadabe gave the advice in an interview yesterday in Lagos.

Gwadabe said there should be a convergence of monetary and fiscal policies to rescue the naira in view of the wide gap between the official and the parallel market rates.

“It is pertinent for both the apex bank and the incoming administration to prioritise and embrace practical solutions.

“That will help turn the fortune of the local currency from one of the worst performing currencies in the world to an effective, stronger performing currency.

“Our members have the capacity that the apex bank and the incoming government can leverage in establishing a market clearing rates realignment, thereby demystifying the existing wastage of our scarce foreign exchange revenues,” Gwadabe said.

The ABCON boss said it was reported that over N8 trillion had been lost to fiscal and monetary policy mismatch of the economy that bred currency substitution and rent seeking.

According to him, BDCs continue to provide tools for the authorities to stop the wastage and ensure exchange rate stability for future planning.

He said it was important to diversify the nation’s foreign exchange inflows through the securitisation of Diaspora remittances.

He noted that remittances remained the only hanging fruits and fastest way to boost liquidity in the market.

The ABCON chief said remittances should be channeled through the BDC sub sector: “It is convenient, competitive and breaks the existing monopolistic structures of the current market regime.

“We can borrow a leaf from other climes like India, China, Kenya, and South Africa.”

He said it was important for the government to overhaul the nation’s trade policies to reflect its import dependent economy through incentivised and concrete import substitution programmes that would empower local productive capacity.

He said the building of critical infrastructure would encourage foreign capital investments thus shoring up the value of the naira

“Our moribund infrastructure in electricity, roads and energy supply is a monster in our desires for a rapid development and growth.

“In the same vein there is the need for stronger joint venture capital institutions to complement the conventional banking systems in accessing cheaper credits, loans and capital by the small scale industries.

“The incoming government should also have a paradigm shift from import of capital to import of knowledge and galvanise the growing youth of our nation,” Gwadabe said.

The ABCON chief said a robust stakeholder’s engagement and collaboration on reforms and corporate governance were key to boosting the effectiveness of the BDC sub sector.

“We, therefore, urge the incoming government to first make their number one agenda a National Discourse on Foreign Exchange Challenges,” Gwadabe said. (NAN)

Economy

NGX: BUA Cement, Tier-1 Banks Shed N394bn from Market Cap

Selloffs in BUA Cement and Tier-one banking stocks on Tuesday dragged the Nigerian Exchange Ltd. (NGX) market capitalisation down by N394 billion, a 0.66 per cent decline.

Specifically, the market capitalisation, which opened at N59.812 trillion, closed at N59.418 trillion.

Similarly, the All-Share Index dropped by 0.

66 per cent, shedding 651 points to close at 98,058. 07, compared to 98,708. 90 on Monday.This dip also reduced the Year-to-Date (YTD) return to 31.14 per cent.

Market breadth was negative, with 32 losers declining and 26 gainers on the Exchange.

On the losers’ table, Cadbury Nigeria led by 9.89 per cent to close at N16.40 per share, while Northern Nigeria Flour Mill(NNFM) led the losers’ table by 10 per cent to close at N37.

40 per share.However, analysis of the market activities showed trade turnover settled higher relative to the previous session, with the value of transactions up by 96.08 per cent.

A total of 399.32 million shares valued at N8.93 billion were exchanged in 9,547 deals, compared to 353.18 million shares valued at N4.55 billion transacted in 9,417 deals posted previously.

Meanwhile, UBA led the activity chart in volume and value with 90.41million shares worth N2.61 billion.(NAN)

Economy

NGX: Analysts Predict Sustained Positive Trends as Investors Gain N836bn

In the just concluded week, equity investors gained N836 billion or 1.41 per cent, week-on-week.

The Nigerian Exchange Ltd.(NGX) All-Share Index and Market Capitalisation appreciated by 1.41 per cent to close the week at 99,448.91 and N60.261 trillion respectively.

This is against 98,070.

28 and N59.425 trillion respectively posted in the previous week.Similarly, all other indices finished higher, with the exception of NGX Consumer Goods and NGX Lotus II which depreciated by 0.

84, 1.19 per cent respectively, while the NGX ASeM index closed flat.Fifty-eight equities appreciated in price during the week, higher than 33 equities in the previous week.

Eighteen equities depreciated in price lower than 43 in the previous week, while 76 equities remained unchanged, same as 76 recorded in the previous week.

On the gainers’ table, Eunisell Interlinked Plc, led 47 advanced equities by 20.69 per cent to close at N3.50 per share.

Also, Dangote Sugar Refinery Plc, led 17 declined equities on the losers’ table by 10.13 per cent to close at N31.50 per share.

A total turnover of 2.142 billion shares worth N85.946 billion in 41,217 deals was traded this week by investors on the floor of the Exchange, in contrast to 1.447 billion shares valued at N73.889 billion that exchanged hands last week in 39,546 deals.

The Financial Services Industry, measured by volume led the activity chart with 1.176 billion shares valued at N23.739 billion traded in 19,570 deals; thus contributing 54.91 and 27.62 per cent to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 366.923 million shares worth N4.672 billion in 4,004 deals.

Third place was the Oil and Gas Industry, with a turnover of 228.439 million shares worth N52.635 billion in 7,547 deals.

Trading in the top three equities, namely: United Bank for Africa Plc, Champion Breweries Plc and Japaul Gold and Ventures Plc measured by volume accounted for 828.822 million shares worth N12.319 billion in 5,080 deals.

This contributed 38.70 and 14.33 per cent to the total equity turnover volume and value respectively.

Reacting, analysts at Cowry Financial Market Research stated that the recent positive quarterly corporate earnings reports, further buoyed market sentiment.

The analysts noted that this was particular in the banking, industrial goods, and consumer goods sectors, delivering strong performances from key players.

They stated that the market sentiment also drove the benchmark index closer to the 100,000 points threshold.

“Notably, we think the current rally is likely to persist, though cautious profit-taking activities may create intermittent dips,” they said.

Looking ahead, the analysts predicted that the stock market was poised for further gains.

According to them, this is as investors look forward to the upcoming macroeconomic data releases and corporate earnings reports, which are anticipated to influence short-term trading dynamics.(NAN)

Economy

Global Growth Remains Unchanged at 3.2%, as Inflation Recedes- IMF

The International Monetary Fund (IMF),, says global growth is projected to remain unchanged at 3.2 per cent in 2024 and 2025, as Inflation recedes.

This is according to the IMF’s latest World Economic Outlook (WEO) Update Report for October 2024: “Policy Pivot, Rising Threats,” released on Tuesday during the IMF/ World Bank Meetings in Washington D.

C.The report said though the projection was in line with the July and April 2024 WEO, there had been notable revisions beneath the surface since the April WEO.

According to the report, some low-income and developing economies have seen sizable downside growth revisions, often tied to disruptions to production and shipping of commodities, especially oil, conflicts, civil unrest, and extreme weather events.

“These have been compensated for by upgrades to the forecast for emerging Asia, where surging demand for semiconductors and electronics, driven by significant investments in artificial intelligence has bolstered growth.”

It said in advanced economies, growth in the United States was strong, at 2.8 per cent in 2024 but will revert toward its potential in 2025.

The report said for advanced European economies, a modest growth rebound was expected in 2025, with output approaching potential.

For emerging markets and developing economies, it said the growth outlook was very stable around 4.2 per cent in 2024 and 2025, with continued robust performance from emerging Asia.

“Five years from now, global growth should reach 3.1 per cent, a mediocre performance compared with the prepandemic average.”

The report showed that there was global disinflation even though service price inflation persists in some countries.

“After peaking at 9.4 per cent year-on-year in the third quarter of 2022, we now project headline inflation will fall to 3.5 per cent by the end of next year.

“ This is slightly below the average during the two decades before the pandemic.

“In most countries, inflation is now hovering close to central bank targets, paving the way for monetary easing across major central banks.”

The report said the return of inflation near central bank targets paved H the way for a policy triple pivot which would provide the much-needed macroeconomic breathing room, at a time when risks and challenges remain elevated.

“The first pivot on monetary policy is underway already. Since June, major central banks in advanced economies have started to cut policy rates, moving toward a neutral stance.

“This will support activity at a time when many advanced economies’ labor markets are showing signs of cooling, with rising unemployment rates.

‘Lower interest rates in major economies will ease the pressure on emerging market economies, with their currencies strengthening against the U. U. S dollar and financial conditions improving.

“This will help reduce imported inflation, allowing these countries to pursue their own disinflation path more easily.”

The report said the second pivot was on fiscal policy and would require countries to stabilise debt dynamics and rebuild much-needed fiscal buffers.

“The more credible and disciplined the fiscal adjustment, the more monetary policy can play a supporting role by easing policy rates while keeping inflation in check.

“The pace of adjustment should be tailored to country-specific circumstances.”

It said the third pivot and the hardest was towards growth-enhancing reforms.

The report said structural reforms were necessary to lift medium-term growth prospects, but support for the most vulnerable should be maintained

It said for reforms to be successful and socially accepted, there was a need to build trust between government and citizens.

“ Building trust between government and citizens, a two-way process throughout the policy design and the inclusion of proper compensation to offset potential harms, are essential features.

The report said that multilateral cooperation was needed more than ever to accelerate the green transition and to support debt-restructuring efforts. (NAN)