Economy

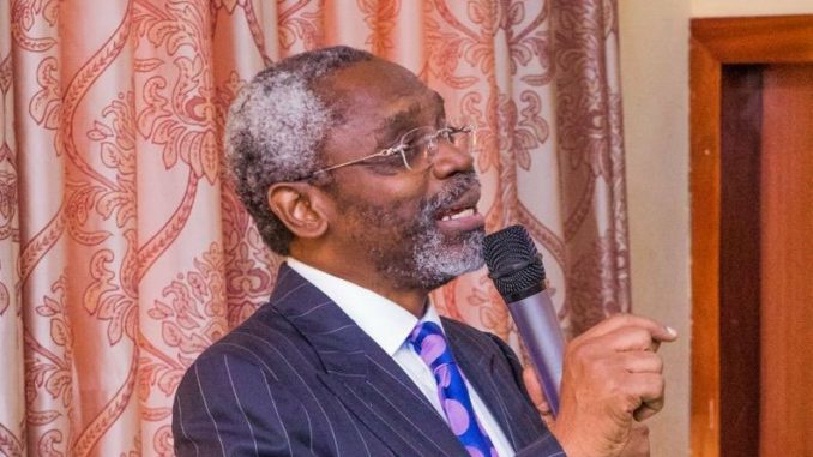

Buhari to Present 2020 Budget September Ending

By Mathew Dadiya, Abuja

Speaker of the House of Representatives, Femi Gbajabiamila on Friday, disclosed that President Muhammadu Buhari may present the 2020 budget to the National Assembly by the end of September to enable the lawmakers pass the appropriation bill early and return the nation’s budget circle to January.

The Speaker said this while briefing State House correspondents after meeting with President Buhari behind closed doors at the Presidential Villa, Abuja.

He reassured that the government of Nigeria would always stand with her citizens.

Gbajabiamila said the only way to bring the budget circle back to January to December was for an early presentation of the budget adding that he discussed the matter with President Buhari.

The speaker however, said that he would not give a definite answer whether the National Assembly would get the 2020 budget proposal this month or early next month.

“I cannot give a definite answer but I know the budget is going to come as early as possible. It maybe the end of this month or shortly thereafter, but I cannot give you a definite date.

“But it’s going to be an early presentation so that we can pass the budget before the end of the year and return to the January to December circle,” he said.

He also revealed that the issue of the $9.5 billion defaulted gas contract judgment awarded against Nigeria by a British court in favour of an Irish firm P&ID was discussed during his meeting with the President.

“The issue of the recent $9 billion award against Nigeria. I say that with a smile but not really smiling. Clearly we are in opposition to that and steps will be taken,” he added.

On the xenophobic attacks on Nigerian citizens and the looting and burning of their shops in South Africa, the lawmaker said that Nigeria may cut her bilateral relations with South Africa.

Asked if there were moves to severe bilateral ties with South Africa, Gbajabiamila said, “We are not there yet, nothing is off the table, we will take each day as it comes. As of now Mr. President has taken proactive steps in evacuating our citizens, recalling the High Commissioner, and other things will follow.

“I believe we will stand with and by Nigerians. The leadership of the House has issued a statement and it is in tandem with what the executive is doing. We stand by our citizens that is our priority, to protect the constitution, to protect the welfare of the citizens and that is exactly what we are doing and that is what the president is doing.”

He said he was at the State House to engage with the President on the burning issues, stressing that in the last few days, Nigeria had witnessed unfortunate incidents involving her citizens in South Africa.

“As you are aware, I cut my trip to Tanzania short and came home with the hope of reconvening the House, where we are going to address this very important issue. We have called that off because events have overtaken it; the government has taken proactive steps, the same steps we would have asked for.

“We are all on the same page with the president and the government. So I came to fully discuss that with Mr. President. We discussed the issue of security, what has been happening in South Africa and other national issues that require the attention of both the legislature and the executive, and we had very fruitful discussions on those issues.”

On the insistence of the South African government not to pay compensation to the victims of the xenophobic attacks because payment of compensation was not contained in the country’s laws, the Speaker said that he had not heard such statement from the South African government.

He said, “Well I haven’t heard that statement from South Africa, I don’t know if it is official or off the cuff statement by somebody. When it’s made official, we will take further steps. I am sure we will be on the delegation process in South Africa and probably other avenues that are international that we can pursue.”

Economy

Selloffs in Banking Stocks Dip Market Capitalisation by N68bn

The Nigerian Exchange Ltd. (NGX) market capitalisation declined further on Wednesday by 0.12 per cent or N68 billion, following selloffs in Tier-one banking stocks.

The market capitalisation, which opened at N56.898 trillion, closed at N56.830 trillion.

The All-Share Index also shed 0.

12 per cent or 121 points to settle at 100,365. 17, compared to 100,486.12 recorded on Tuesday.Consequently, the Year-To-Date (YTD) return declined to 34.

23 per cent.Sell pressure in FBN Holdings, Guaranty Trust Holding Company (GTCO), United Bank of Africa (UBA), Access Corporation, Fidelity, among other declined equities, were the main drivers of the negative performance.

Meanwhile, the market breadth closed negative with 21 losers and 18 gainers on the floor of the Exchange.

Secure Electronic Technology Plc led the losers’ chart by 9.43 per cent to close at 48k, RT Briscoe followed by 8.22 per cent to close at 67k per share.

UBA lost 5.07 per cent to close at N21.22, Livestock shed 4.56 per cent to close N2.30, United Capital dropped 4.27 per cent to close at N37 per share.

On the other hand, International Breweries and Sovereign Trust Insurance led the gainers’ chart by 10 per cent each to close at N4.07 and 55k per share respectively.

Deap Capital Management and Trust Plc gained 9.80 per cent to close at 56k, The Initiative Plc rose by 7.50 per cent to close at N2.15.

FCMB appreciated by 5.26 per cent to close at eight Naira per share.

On market activities, trade turnover settled higher relative to the previous session, with the value of transactions up by 137.35 per cent.

A total of 497.84 million shares valued at N8.61 billion were exchanged in 8,412 deals, against, 280.92 million shares valued at N3.63 billion exchanged in 8,403 deals posted in the previous session.

First City Monument Bank(FCMB) led the activity chart in volume with 133.92 million shares valued at N1.4 billion, Access Corporation followed by 72.82 million shares worth N1.41 billion.

Zenith Bank sold 60.06 million shares worth N2.19 billion to lead the chart in value, UBA transacted 29.08 million shares valued at N639.55 million and Universal Insurance traded 22.92 million shares worth N7.68 million. (NAN)

Economy

Bankable Projects will Empower Youth, Women in Agriculture – Speaker

The Speaker of the House of Representatives, Rep. Tajudeen Abbas, says Nigeria can empower youth and women in Agriculture with the development and implementation of bankable business proposals.

Abbas said this at the Second Interactive Session and Workshop on Developing Bankable Business Proposals/Business Plans for Youths and women in Agriculture on Monday in Abuja.

The Speaker, who was represented by his Deputy, Rep.

Benjamin Kalu, said youth and women are the most vital demographics in the society.The event was organised by the African Development Bank (AfDB) Group.

While acknowledging the bank and its partners for their contribution and interventions in the sector, Abbas said the need to diversify Nigeria’s economy could not be over emphasised.

According to him, our over-reliance on oil as primary resource has become neither sustainable nor profitable as the global community shifts towards greener, more sustainable energy sources.

“This reality makes it not just necessary, but urgent for us to explore and invest in alternative sectors.

“By focusing on developing and implementation of bankable business proposals, we can empower our youth and our women, to become key players in these sectors.

“Their active participation is not only essential for economic diversification, but also for ensuring food security and sustainable development through agriculture and technological advancements through high safety,” he said.

Abbas recognised AfDB’s hi-5 priorities to empower, feed, industrialise, integrate and improve the quality of life for the people of Africa.

He expressed the commitment of the legislators to support youth and women development through various projects and programmes.

He urged for more collaboration of the AfDB and other stakeholders to advance initiatives that could drive significant progress in the country and across the continent.

“Through this, we will certainly build a better, more resilient future for Nigeria and for the world,” he said.

Earlier, the Minister of Agriculture and Food Security, Sen. Abubakar Kyari, said any workable concept on youth and women in agriculture would contribute to sustainable agricultural development across the continent.

Kyari said the country was committed to work closely with bilateral and multilateral development partners, in advancing the engagement of youth and women in agriculture.

“Notably, agriculture remains the singular sector with the highest potential for mass job creation.

Youth participation will further bridge the gap for aging farm population.

“It will take development back to the rural communities, cause a significant improvement in production and overall productivity and offer a veritable platform to accentuate the poverty reduction drive of government,” he said.

Kyari said President Bola Tinubu’s Renewed Hope Agenda for Food Security was poised to change the narrative of agriculture of a way of life.

“And agriculture as a wealth creating sector with sustainable, marketable, and bankable business prospects for youth and women engagement.’’

Similarly, the Minister of Youth Development, Dr Jamila Ibrahim, said it was crucial to build capacity of youth and women to see agricultural beyond subsistent but as an enterprise.

Ibrahim expressed the commitment of the ministry to work with stakeholders to co-create initiatives to support women and youth.

“We are open to working with partners to strengthen what we are doing. By doing so, we will build a brighter future for Nigeria,” she said.

For the Minister of Communications, innovation and Digital Economy, Dr Bosun Tijani, innovation is key to solve most challenges we face in Nigeria and the continent.

Tijani said that this innovation could not be done without including the young people including women, thus the need to invest in them.

Also speaking the Director-General, West Africa Region of AfDB, Mr Lamin Barrow, said the event was part of activities to celebrate the bank’s 60 years anniversary.

According to the director-general, Africa’s progress will be driven by young dynamic workforce, thus the importance to boost investment in them.(NAN)

Economy

SEC Approves Commencement of Access Holdings N351bn Rights Issue

The Securities and Exchange Commission (SEC) has approved the commencement of the N351 billion rights issue capital raising programme of Access Holdings Plc.

A statement made available by the Holdings to newsmen on Sunday in Lagos confirmed this.

The group said that the approval marked a significant milestone in its previously announced capital raising programme, which aimed to generate up to $1.

5 billion.It also said that the rights issue was strategically structured to boost Access Holdings’ financial position and support ongoing working capital needs.

According to the holdings, the programme will also provide funding for organic growth across its banking and non-banking subsidiaries.

“The approved rights issue offers 17,772,612,811 ordinary shares of N0.50 each at a price of N19.75 per share.

“The offer will be issued on the basis of one new ordinary share for every two existing ordinary shares held as of June 7, 2024,” it said.

The lead issuing house for Access Holdings’ rights issue is Chapel Hill Denham Advisory Ltd., while Atlas Registrars Ltd. will serve as the Registrars to the offer.

The offer will open on July 8 and close on Aug. 14.

It noted that the rights circular would be distributed to shareholders by Atlas Registrars Ltd., and application forms would also be available on its various websites.

The holding company advised its shareholders to contact their stockbrokers for more details about the offer.

Access Holdings said that it remained committed to its strategic vision of expanding its footprint and delivering exceptional value to all its stakeholders.

It noted that the successful execution of the rights Issue would further solidify the group’s position as a leading financial services provider in Africa and beyond.(NAN)