BUSINESS

Commodities Exchange Predicts Higher Prices for Maize, Rice, Others

AFEX Commodities Exchange Ltd. has predicted price increase for maize, paddy rice and cocoa as well as sesame and sorghum by the end of 2022.

Mr David Ibidapo, AFEX Head of Market Data and Research made the forecast known while presenting the 2022 Wet Season Crop Production Report yesterday in Abuja.

He said while there was a forecast of an average decline in production of up to 11.

5 per cent across maize, paddy rice, sorghum and cocoa, they were projected to attract higher prices.He said maize, which faced a projected decline in production of up to 14 per cent, was projected to have a higher average price point of between N214, 980 per tonne and N220,000 per tonne.

He said the price of maize in 2022 was higher compared to 2021when it sold at N210, 229 per tonne.

Ibidapo said the price of paddy rice, which witnessed close to 22.47 per cent decline in production volumes, was also projected to rise at the end of the last quarter of the year.

He explained that notwithstanding the decline in production of some food commodities, production level for soybean and sesame increased by about 6.5 per cent in 2022.

He said the increased prices and market changes were largely due to flooding, the Russia-Ukraine war, fluctuating exchange rate, and energy crisis, among other factors.

He also said that soybean price was projected to rise by 6 per cent by May 2023.

“Price and market changes across six key commodities have been affected by predictable seasonality effects, activities in the agricultural value chain and macroeconomic as well as global events.

“The projected price hikes across commodities in the report are also tied to incidences of flooding and effects of the Russia-Ukraine war.

“Increases in the prices of fertiliser are another contributory factor.

“Also, access to reliable data is a recurring limitation for agriculture business on the African continent,” Ibidapo said.

The AFEX head of market data and research said the company had consistently advocated for a food balance sheet for the continent to strengthen productivity while enhancing food security.

He said it was important for Nigeria to build food reserves across key staples, spur production and synchronise effort between government and the private sector to position Nigeria against potential global shocks.

Ibidapo said the 2022 crop production report, which was the third edition, surveyed 20,677 farmers as against 9,117 farmers surveyed in 2021.

On AFEX’s contribution to the commodity subsector, Ibidapo said the company was harnessing Africa’s commodities and talents to build shared wealth and prosperity.

He said AFEX was leveraging on its infrastructure and platform investments work outlook to unlock potentials in Africa’s commodities markets.

“Since its inception in 2014, AFEX has developed a viable commodities exchange model for the West African market.

“It is currently on track to impact one million producers, provide services in productivity and access to finance as well as to markets.

“The company is working towards facilitating trade within Africa worth over 500 million dollars in the next five years.

“AFEX’s vision is to be the reference point for commodities in Africa,’’ Ibidapo stressed.

Some major stakeholders in the agricultural value chain such as Mr Oluwatoba Asana, Country Manager OCP Africa Fertilisers Nigeria Ltd. and Mr Sheriff Balogun, President, National Sesame Seed Association of Nigeria were present at the meeting.

They spoke about the need for capacity-building, accurate data, policies, planning, strategic alliances and infrastructure to reposition the agricultural sector and ensure food security in Nigeria. (NAN)

Agriculture

Tiv Monarchs Give Herders Ten Days Ultimatum To Vacate Tiv Kingdom

By David Torough, Abuja

The Tiv Area Traditional Council during its emergency meeting held yesterday in the palace of the Tor Tiv in Gboko requested the Governor Hyacinth Alia led administration to create an enabling environment to allow herders’ peaceful exit of farmlands in Tiv Kingdom to facilitate resumption of farming activities.

Consequently, the Council directs political and traditional rulers in each local government area of Tiv Kingdom to peacefully engage the herders to ensure their exit from the local government areas to allow farming resumes.

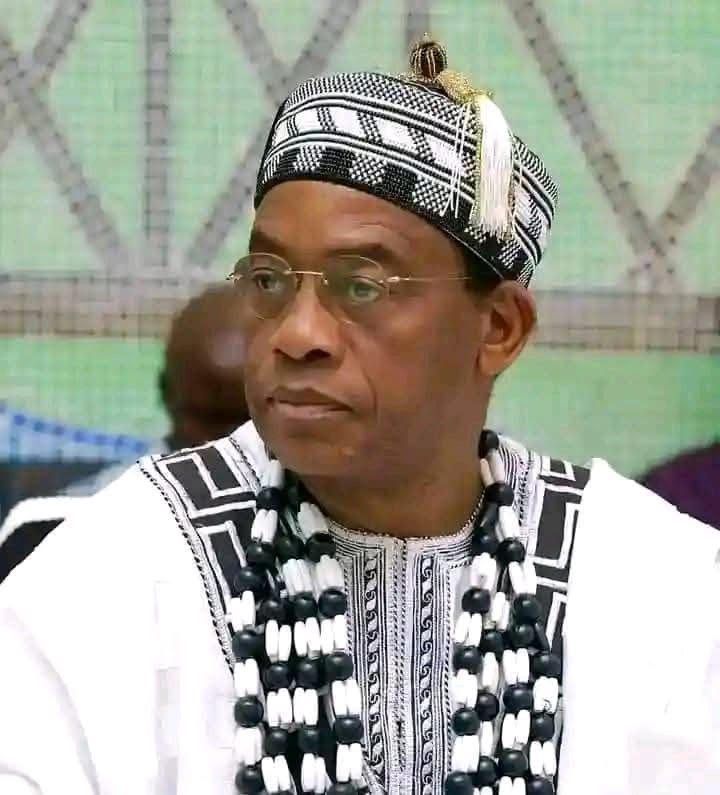

The Council which was chaired by the Tor Tiv himself, HRM Prof James Ortese Iorzua Ayatse CFR equally appealed to all herders in Tiv Kingdom in Benue State to vacate all Tiv lands before the end of May 2025 to allow farmers return and cultivate their farms in order to avoid the looming hunger in Nigeria.

According to a Communique signed by the Secretary of the Council Mr Shinyi Tyozua which deliberated particularly on the security situation in Tiv Kingdom the Council enumerated the communities worst affected to include those in Kwande, Katsina Ala, Logo, Ukum, Guma, Makurdi, Gwer West Gwer East and Buruku Local Government Areas.

The Council lamented that farming activities in the kingdom have ceased due to the occupation of farmlands by herders for grazing and attacks and killings of farmers who fled stressing that if the situation continues it will ultimately result to hunger in Tiv Kingdom and Nigeria as a whole.

Agriculture

Ondo Govt. Destroys 200kg Seized Cocoa Adulterants

The Ondo State Government, on Thursday, destroyed 200kg adulterants used for adulteration of cocoa beans, seized from a merchant in Ondo West Local Government Area of the state.

Mr Segun Odusanya, Permanent Secretary in the Ministry of Agriculture and Forestry (Forestry and produce sub section), supervised the destruction of the 200kg bags of seized adulterants.

Odusanya explained that the destruction was part of government efforts to ensure that the state maintained quality cocoa production in the country.

“Mr governor, Lucky Aiyedatiwa, has reiterated the commitment to ensure the state remains the highest producing state with good cocoa quality

“Anyone caught engaging in illegal activities will be prosecuted accordingly.

“Moreover, this action was embarked on to warn cocoa merchants, who intend to engage in illegal activities, to rethink before getting into it.

“We are going to seal any store caught in such illegal activities, the products will be burnt while the merchant will be prosecuted according to the laws of the land.

“If we are saying we are the highest cocoa producing state and we continue to encounter this scenario, it will give us a bad publicity.

“The bad publicity will be in the country and extend to the international market, and we don’t want that,” he said.

The permanent secretary, therefore, commended Aiyedatiwa for graciously approving the recruitment of 60 new staff to checkmate the activities of cocoa merchants in the state.

“Mr governor has supported us, he has said we should recruit more people to guide against any adulteration and ensure we have a good quality cocoa beans.

“I must commended our task force committee for ensuring that the state holds its position in the country and the international market,” he said.

Earlier, Mr Tunji Akinnadeju, a Director of Produce (DP3) in the Grading and Allied Department of the ministry, said the adulterants were intercepted at Ondo West Local Government Area of the state.

Akinnadeju said that the owner of the adulterants took to his heels at the time of arrest.

“As we all know that cocoa is being sold in weight and after adding all these things, it will be sold at high prices, which is not good enough.

“So, doing that will bring a lot of damage to the image of the state and the country at large in the international market,” he said.

Also, Mr Sunday Adegbola, a Director of Produce Licensing in the ministry, said the merchants’ actions could affect people during consumption of the cocoa products, if care was not taken.

Adegbola, who pledged that the ministry would not rest until the state was free from adulterated cocoa beans, said the nefarious action could be attributed to the price tag at the international market.

“It is the price at the international market and the price is better for the farmers, not for the people who use adulterants.

“With this action, many people will drink cocoa as a chocolate powder and other materials from cocoa beans which has been adulterated.

“The consumption of these chemical products will also affect humans,” he said. (NAN)

Agriculture

NNPC Foundation Empowers Vulnerable Farmers in Oyo, Osun

No fewer than 500 farmers on Tuesday benefited from the NNPC Foundation agricultural training initiative for vulnerable farmers in Osun and Oyo States.

The training, marking the flag-off in the South-West zone of Nigeria, was held at the Ilora Baptist Grammar School, Ilora, Oyo State.

The foundation manages the Corporate Social Responsibility (CSR) initiatives of NNPC Limited, focusing on education, health, environment and energy access to communities nationwide.

The Managing Director of the foundation, Mrs Emmanuella Arukwe, said the initiative demonstrated the commitment to food security and economic empowerment for Nigerian farmers.

Arukwe, who was represented by Dr Bala David, the foundation’s Executive Director, Programme Development, said the project aimed to build resilience, boost productivity and promote sustainable agriculture.

“We are training 6,000 farmers across six zones in climate-smart practices, modern techniques, quality inputs, and market access,” she said.

She, therefore, urged farmers to participate actively and embrace the opportunity to help secure Nigeria’s food and economic future.

Mr Olasunkanmi Olaleye, Oyo State Commissioner for Agriculture and Rural Development, commended NNPC Foundation for the training and empowerment programme.

Olaleye, who was represented by Mr Olusegun Ezekiel, the ministry’s Director of Regulation and Enforcement, said empowering vulnerable farmers was crucial in addressing national food security challenges.

He added that the initiative aligned with Oyo State’s agricultural transformation agenda of Gov. Seyi Makinde.

“We remain committed to supporting initiatives that uplift farmers and improve productivity and livelihoods,” Olaleye said.

He encouraged participants to make the most of the training opportunity to improve their practices.

He also called for future collaboration between the foundation and the ministry to achieve greater impact.

The training consultant, Prof. Daniel Ozok, described vulnerable farmers as smallholders with an under-five-hectare farm size, mainly made up of women, youth, and the elderly.

“These farmers are most affected by climate shocks, hence the need for focused training,” Ozok said.

According to him, training equips them with modern techniques and strategies for improved productivity and market access.

Some of the participants expressed gratitude to NNPC Foundation and promised to apply the knowledge gained from the training.

NAN reports that a medical screening exercise was organised by the foundation for participants on the sidelines of the training.

Training initiative would later be held for farmers in Ekiti and Ondo States on a date different from that of Ogun and Lagos States. (NAN)