Economy

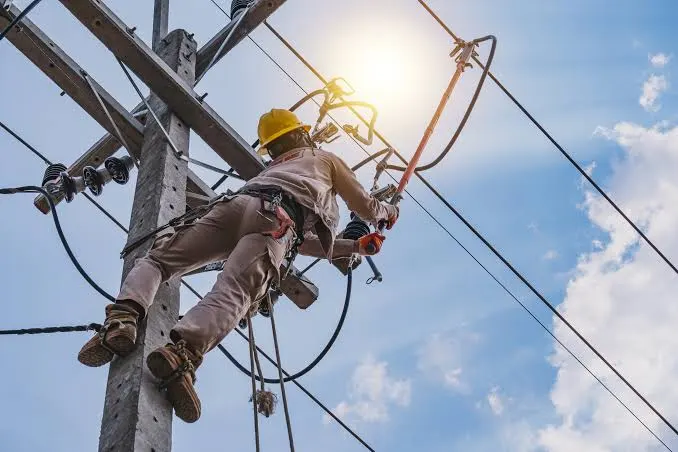

Diesel Suppliers, Generator Dealers Sabotaging Power Supply – Ex-minister, Nnaji

A former Minister of Power, Prof. Barth Nnaji, has alleged that diesel suppliers and generator dealers are sabotaging efforts for Nigerians to enjoy regular power supply.

Nnaji made this known while featuring in a radio programme, captioned: “The South East Political Roundtable” by Flo FM, Umuahia on Wednesday.

Nnaji said that the endless breakdown of the national grid had remained a significant concern among Nigerians.

According to him, this is despite the Federal Government’s claim of spending N7 trillion as direct interventions in the power sector, even after privatising the electricity generation and distribution arms of the industry since November 2013.

Nnaji, who is the Group Chairman of Geometric Power, Aba, identified diesel suppliers and generator sellers as other obstacles for those who are into power generation business.

He said that the sector needed professionals, who understood the Nigeria Electricity Supply Industry to manage it.

“There are two areas when you talk of cabal in the sector – the diesel suppliers and generator users.

“Nigeria is a big user of generator because of our enormous power need and those who are in the business would not want any interruption.

“The diesel suppliers feel that stable power supply would destroy their business,” he said.

Nnaji further alleged that the power sector, just like others, had some cabal, who make gains from the problems of poor power supply.

He said: “A graphic picture of how dangerous the diesel suppliers can be was experienced when we were in government, somewhere in this country, some men cut down 30KVA line to stop electricity supply to thousands of users.

“Unfortunately, the diesel supplying company sponsored the operation.

“Incidentally the power cable fell on one of them, who later confessed to the crime.” (NAN)

Economy

Access Holdings Awards Shares Worth N427.13m to 8 Senior Executives

Access Holdings Plc has awarded 23.8 million ordinary shares worth N427.13 million to its senior executives and those of its subsidiary, Access Bank.

This was disclosed in a notice sent to the Nigerian Exchange Ltd.(NGX) in Lagos.

The notification was sent in line with the disclosure requirements of the Securities and Exchange Commission (SEC) and the NGX.

It is also in pursuant of the terms of its shareholders’ approved Employees Performance Share Plan.

The group said that Ms Bolaji Agbede, Acting Group Chief Executive Officer, Access Holdings, Mr Roosevelt Ogbonna, Managing Director/CEO, Access Bank, and six others were vested with 23,883,790 shares worth N427.

13 million in total.According to the filings, Ogbonna got the highest amount of shares, totalling 12,345,679 and valued at N220.37 million, having been traded at N17.85 per share.

Agbede was vested with 2,216,992 shares, valued at N39.795 million.

Other directors who had shares vested on them include: Mr Seyi Kumapayi, Executive Director, African Subsidiaries, Access Bank, with 1,234,568 shares worth N22.16 million.

Ms Iyabo Soji-Okusanya, Executive Director, Commercial and Investment Banking Division, Access Bank, got 1,691,308 shares at N17.95 per share, valued at N30.36 million.

Mrs Chizoma Okoli, Access Bank’s Deputy Managing Director, Retail South, also got 1,728,395 shares valued at N30.85 million.

Dr Gregory Jobome, Executive Director, Risk Management, and Hadiza Ambursa, Executive Director, Commercial Banking, were vested with 1,728,395 shares each,valued at N30.85 million and N31.02 million respectively.

Also, Access Holdings’ Company Secretary, Mr Sunday Ekwochi, was vested with 1,210,058 shares worth N21.72 milion.

The group stated that the shares were vested on May 3 and May 6.

It noted that the vesting of the shares was not a purchase or sale transaction in the context of the Exchange’s rules.(NAN)

Economy

CBN’s Cybersecurity Levy Ill-timed, Negates Financial Inclusion – Expert

CBN Governor, Yemi Cardoso A financial expert, Prof. Uche Uwaleke says the newly introduced 0.5 per cent charges on electronic transactions as cybersecurity levy by the Central Bank of Nigeria (CBN) is ill-timed.

Uwaleke, a professor of capital market and the president of the Capital Market Academics of Nigeria, said this in an interview on Tuesday in Abuja.

According to him, the cybersecurity levy is ill-timed, coming at a time when the CBN is concerned about the high rate of financial exclusion and the increasing rate of currency circulating outside the banks.

He said that it carried the downside risk of discouraging financial intermediation as well as complicating the transmission of monetary policy with more people shunning the banks due to high charges.

“The end result is that it makes difficult effort by the CBN to tame inflation.

“So, I think the circular should be withdrawn, especially against the backdrop of assurances by the government that its plan to increase revenue would not include introducing new taxes or increasing tax rates.

“To this end, the government should suspend the policy while getting set to implement the recommendations of the Presidential Committee on Fiscal Policy and Tax Reforms,” he said.

He said that the mandate of the committee included streamlining multiple taxes and levies currently inhibiting the growth of businesses in Nigeria.

NAN reports that the CBN had on Monday directed all banks to commence charging a 0.5 per cent cybersecurity levy on all electronic transactions within the country.

The direcve was contained in a circular jointly signed by the Director, Payments System Management Department, Chibuzo Efobi; and the Director, Financial Policy and Regulation Department, Haruna Mustafa.

The circular was directed to all commercial banks, merchant banks, non-interest banks, and payment service banks.

It announced that the implementation of the levy would start two weeks from May 6.

“The levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution.

“The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy,’” the circular said.

However, some 16 banking transactions were exempted from the new cybersecurity levy.

They include loan disbursements and repayments, salary payments, intra-account transfers within the same bank or between different banks for the same customer, intra-bank transfers between customers of the same bank among others.

By the calculations of the new levy, five Naira will be charged on a transaction of N1,000, while N50 will be charged on a transaction of N10,000.

Others are N500 charge on a transaction of N100,000, N5,000 charge on a transaction of N1,000,000, and N50,000 charge on a transaction of N10,000,000.

The cybersecurity levy will now be added to already existing bank charges like transfer fee, stamp duty, charges on SMS, and Vat .(NAN)

Economy

Trading on NGX Increases by 28%, Investors Gain N467bn

The Nigerian Exchange Ltd. (NGX) on Friday recorded 28.14 per cent increase in the value of equity transactions, resulting in investors gaining N467 billion.

Specifically, 446.57 million shares valued at N7.10 billion were exchanged in 9,297 deals, in contrast to 665.20 million shares valued at N5.

54 billion in 8,446 deals on Thursday.Consequently, the market capitalisation, which opened at N55.

856 trillion, gained 0. 83 per cent or N467 billion to close at N56.323 trillion.The All-Share Index also added 0.83 per cent or 825 points to close at 99,587.25, as against 98,762.78 recorded in the previous session.

As a result, the Year-To-Date (YTD) return rose to 33.

18 per cent.Renewed interest in MTN Nigeria, alongside Tier-one banks, Presco Plc, UACN, United Capital, among other leading stocks, sustained the market’s positive trend.

Also, market breadth closed positive with 27 advanced equities outnumbering 20 declined ones.

On the gainers’ chart, Presco led by N22.90 to close at N252.80, Dangote Sugar followed closely by N4.25 to close at N47, while Ellah Lakes Plc gained 30k to close at N3.32 per share.

Jaiz Bank also advanced by 21k to close at N2.35 and Flour Mill rose by N3.25 to close at N36.80 per share.

Conversely, Conoil and Tantalizers led the losers chart by N10.80 and 4k each to close at N97.20 and 36k per share, respectively.

McNichols Plc lost 12k to close at N1.14, Linkage Assurance trailed by 9k to close at 86k and Guinea Insurance shed 3k to close at 30k per share.

Meanwhile, Access Corporation led the activity chart in volume and value with 151.80 million shares worth N2.68 billion, followed by Veritas Kapital with 49.88 million valued at N30.91 million.

United Bank of Africa(UBA) traded 32.89 million worth N845.74 million, Universal Insurance sold 27.14 million shares valued at N9.76 million and Transnational Corporation transacted 21.82 million share worth N310.32 million. (NAN)