COVER

FRC Indicts 32 MDAs over N1.2trn Surplus fund

…How FG Overvalues Telco Security Network by $490m

By Joseph Chibueze and Torkwase Nyiekaa, Abuja

The Fiscal Responsibility Commission (FRC) has accused 32 government agencies of failing to remit their 80 per cent operating surplus to the Consolidated Revenue Fund (CRF).

The revelation came on heels of the House of Representatives recovery that a Federal Government investment to improve security, built with a loan of $490million was valued at just $17 million after an audit by KPMG.

These and other irregularities, according to FRC, have hindered accurate determination of operating surplus liabilities and diminishing accountability and transparency in handling government revenue.

FRC said over N1.2 trillion in revenue was still being withheld by the defaulting agencies, keeping money away from government’s reach for funding of its budget.

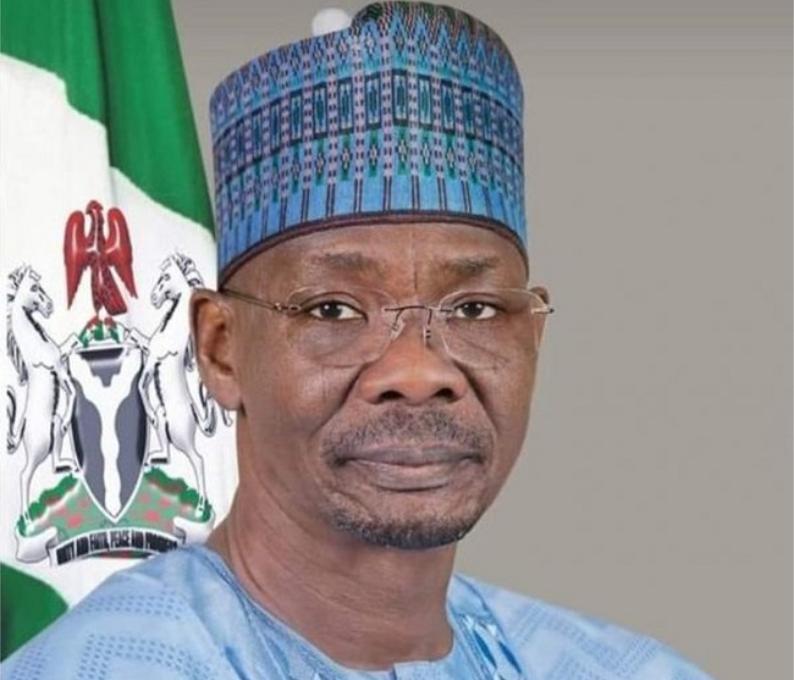

The Chairman of the Commission, Victor Muruako, who spoke while briefing National Assembly correspondents yesterday, said the agencies failed to submit their audited account to the commission to enable it calculate their operating surplus which is supposed to be paid into the Consolidated Revenue Fund of the Federation.

Murako said over 60 per cent of the agencies have always failed to associate their annual budget with the Medium Term Expenditure Framework, the template for which annual federal government budgets is prepared.

The agencies are ”the National Drug Law Enforcement Agency (NDLEA),

Nigeria Security and Civil Defence Corps (NSCDC), Bank of Agriculture,

Bank of Industry (BoI), Federal Radio Corporation of Nigeria (FRCN),

National Broadcasting Commission (NBC), Standard Organisation of

Nigeria (SON), Nigeria Immigration Service (NIS), Nigeria Content

Development and Monitoring Board (NCDMB), National Integrated Water

Resources Management Commission, National Sports Commission (NSC),

Administrative Staff College of Nigeria and National Business and

Technical Examination Board (NBTEB).”

Others are ”Cement Technology Institute of Nig, Centre for Black

African Arts & Civilization, Chad Basin National Park, Gashaka Gumti

National Park, Gurara Water Management Authority, Hadejia-Jamaare

River Basin Development Authority, Kainji Lake National Park, National

Food Reserve Agency, National Lottery Trust Fund, National Theatre

Iganmu Lagos, National Troupe Iganmu Lagos, Nigeria Agricultural

Quarantine Service (NAQS), Nigerian Copyright Commission, Nigerian

Railway Corporation and Small & Medium Enterprises Development Agency

of Nigeria.”

Muruako explained that by the provisions of the Fiscal Responsibility

Act 2007, government-owned enterprises and corporations are supposed

to remit 80 per cent of their operating surplus to the CRF at the end

of every year to make money available for government to fund the

annual budget.

He said that some of the agencies have also developed the habit of

writing to withdraw their audited account after the commission must

have calculated their operating surplus which is done after the

agencies has submitted such audited account.

He said while the Fiscal Responsibility Act provide for offences, it

however failed to make provision for sanction and punishment, thereby

making implementation difficult.

According to him, ”From our records, the total figure paid as

Operating Surplus since the establishment of the PRC to date is beyond

N2.15 trillion, which by the way, could not have been possible without

the Act and the commission, given that there would have been no law,

rule, regulation or institution requiring such returns. These figures

are confirmed from our analysis of the annual audited financial

reports submitted to our commission by the concerned agencies.

”Much more is yet out there in the hands of MDAs that either have

failed to dutifully audit their accounts or that have done so but

choose not to forward copies of their audited financial reports to the

commission as required by law.”

The chairman further said that from the agency’s verification of

government capital projects, it was discovered that 60 per cent of

government agencies often undertake more projects than they can handle

because they fail to abide by the approved MTEF.

He added that the penchant of approving new contracts by government to

the detriment of existing contracts, as well as inadequate funding has

led to several abandoned projects across the country.

How FG Overvalues Telco Security Network by $490m

The House of Representatives learnt this on the second day of a two-day investigative hearing by the House ad-hoc committee to investigate the governing lease of Federal Government owned assets.

The investment, which is network of about 700 base stations is called the National Public Securities Communications Systems (NPSCS) and was started around 2008 and commissioned in 2012.

Its objective was said to be make provide advanced communications capabilities for the police and other security agencies.

Members of the committee led by Daniel Asuquo could not hold their shock as Director for Projects of MTS Technologies, who are to run the project through a concession agreement, Mathew Udanogh, disclosed this during the investigative hearing.

Udanogh said by the agreement they are to manage the network for 33 years of which the first three years would be to get it up and running before operating for profit.

The concession agreement calls for is a minimum investment of $100 million towards a rehabilitation of the network, he added

It is a security network, a telecommunications network that was built and commissioned approximately 2012. It was built with a technology called CDMA. The sponsoring Ministry is the Ministry of Police Affairs. It is a network of about 700 base stations and towers built around the country,He said

He also said the original intention was that the network would be operated using government subventions and allocations from the National Assembly, but the government decided that was not going to be feasible and decided to concession it.

He said the the concession process started in 2014 which they won and got the necesary approvals.

He said the Federal Executive Council gave approval to the concession in 2019 with the condition that an audit needed to be performed on the network first to ascertain a fair value which would be used as a input for the concession agreement.

He said, “So thereafter they appointed a committee to select one of the top four accounting companies, KPMG, to do a nationwide audit of all the assets associated with this NPSCS. They conducted that audit and the conclusion of that audit, that led us to a full business case using the ICIC process and all of that information was resubmitted to the FEC and gave its approval for it to be entered to. This was in December 2020. In January 2021, the concession agreement was signed.

“And our job is to rehabilitate a network with this investment and make services available to the police and other security agencies so they can have advanced communications capabilities. We provide the services to the police but also provide it in a more limited way to commercial customers.

“There would be a three year rehabilitation period to bring up the network. All the equipment have to be replaced as it is an older technology. Network technologies have advanced since that time. So in fact we want to implement the latest technologies available. We would be launching with an advanced technology. After the three years, we engage fully in commercial services.

“An audit was performed on that network to bring up what is its current value today and it came to approximately $17 million. This network was not used so all the base stations have to be totally replaced and it cannot be used for any other thing.

COVER

Cardoso Named African Central Banker of the Year

By Tony Obiechina, Abuja

Governor of the Central Bank of Nigeria, Olayemi Cardoso was named Central Bank Governor of the Year at the 2025 African Banker Awards Gala, held recently in Abidjan, Côte d’Ivoire.The award, presented by African Banker magazine, recognizes Cardoso’s “Bold and strategic” leadership in steering monetary and regulatory reforms that have restored stability and confidence in Nigeria’s financial system, according to event organizers.

In a statement, the Awards Committee praised the Central Bank of Nigeria under Cardoso for implementing key policy measures aimed at stabilising the naira, improving transparency in the foreign exchange market, and re-establishing policy credibility.The Committee noted that these efforts have laid the groundwork for long-term macroeconomic resilience and renewed investor confidence.Adviser to the Governor on Stakeholder Engagement and Strategic Communication, Dr. Nkiru Balonwu accepted the award on his behalf. She was accompanied on stage by the Bank’s Director, Monetary Policy Department, Dr. Victor Oboh and the Director of the Banking Supervision Department, Dr. Olubukola Akinwumi. They were later joined by a member of the Bank’s Monetary Policy Committee (MPC), Dr. Aloysius Uche Ordu.“The award reflects the Committee’s recognition of Governor Cardoso’s recent achievements and the Central Bank’s critical role in addressing market imbalances and repositioning the Nigerian economy for sustainable growth,” organisers said.Now in its 19th year, the African Banker Awards are organised by African Banker magazine with the African Development Bank Group as its official patron. The annual event draws senior figures from government, banking, and development finance institutions across the continent to celebrate excellence in African finance.COVER

President Directs Comprehensive Civil Service Personnel Audit

By David Torough, Abuja

President Bola Tinubu yesterday, in Abuja described the Nigerian civil service as the backbone of any effective administration, extolling the invaluable roles they play as the engine room through which the government is able to deliver public goods and programmes.

Tinubu spoke as he declared open the maiden International Civil Service Conference in Abuja as part of the 2025 Civil Service Week, organized by the Office of the Head of the Civil Service of the Federation.

The President said it was imperative for the government to ensure that the right people with the right competencies were put in positions for an efficient public service.

“Civil servants, you are not just the backbone of effective administration across borders but the very essence of it. Your role as the quiet architects of stability, innovation, and public trust is invaluable.

“The Civil Service, as the vehicle through which the government delivers public goods, has steered us through economic cycles, constitutional transitions, and social democratic consolidation. Today, we stand on the sturdy foundation our predecessors built, and your leadership and stakeholder roles remain crucial and integral in modernising and fortifying the Civil Service for generations unborn.

“We can only guarantee the high-performance culture our country deserves by placing the right people in the right roles. To this end, I have authorised a comprehensive Personnel Audit and Skills Gap Analysis across the Federal Civil Service to deepen capacity. I urge all responsible stakeholders to prioritise the timely completion of this critical exercise to begin implementing targeted reforms and realise the full benefits of a more agile, competent, and responsive Civil Service, “the President stated.

Tinubu said that the Civil Service Conference resonates with the administration’s vision for a public service that aligns with global best practices and conforms with today’s digital transformation.

“This maiden conference, with the theme “Rejuvenate, Innovate & Accelerate” is timely, apt and compelling. It captures our collective ambition to reimagine and reposition the Service. In today’s rapidly evolving world of technology, innovation remains critical in ensuring that the Civil Service is a dynamic, digital, ethical, and globally competitive institution. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“This vision aligns with our Renewed Hope Agenda, a comprehensive roadmap for building a secure, inclusive, and prosperous Nigeria. At the heart of this Agenda is a Public Service that works efficiently and effectively for every Nigerian. A revitalised Civil Service is not a supporting actor but the central platform for delivering national transformation and the Renewed Hope Agenda, a future we can all look forward to with optimism. Your role in this transformation is indispensable,” he said.

On his administration’s effort towards an enhanced and vibrant workforce, the President declared that the administration had prioritised key welfare policies to improve the wellbeing of staff. He added that the new national minimum wage, the consequential adjustments to salaries arising from the new minimum wage, and the approval of the Pension Bond Scheme, were some of the instruments to boost morale of the workforce.

Tinubu spoke on the imperative of data gathering and management by Ministries, Departments and Agencies for people – centred and evidence- based governance.

“Accurate, secure, and sovereign data is the lifeblood of every reform we pursue. Data is the new oil, but unlike oil, its value increases the more it is refined and responsibly shared. I therefore direct all Ministries, Extra-Ministerial Departments, and Agencies to capture information rigorously, safeguard it under the Nigeria Data Protection Act 2023, and release it swiftly for public value, ensuring the highest data protection and privacy standards. “We must let our Data speak for us. We must publish verified datasets within Nigeria and share them in internationally recognised repositories. This will allow global benchmarking organisations to track our progress in real-time and help us strengthen our position on the world stage,” he further stated.President Tinubu commended the Head of the Civil Service of the Federation, Mrs Didi Esther Walson – Jack, for organizing the conference, noting that its theme aligned with his administration’s commitment to transforming all sectors of the Nigerian economy.He lauded her dogged pursuit of the implementation of the Federal Civil Service Strategy and Implementation Plan 2021-2025, marked by milestones such as digitalising work processes, continuous learning initiatives, and launching Service-Wise GPT as hallmarks of outstanding leadership.The President also appreciated international partners, especially, the United Nations, the Government of the United Arab Emirates and the United Kingdom for their continued support in capacity development, affirming their impact on Nigeria’s public service.In her address, Didi Esther Walson – Jack noted that the Civil Service was central to national development, arguing that “if Nigeria must lead Africa, then our Civil Service must lead the way; this is our purpose for gathering today, declaring that she was “proud to say that this conference is already a model of innovation fully self -funded through collaborations, strategic partnership, resourcefulness with the overwhelming support from the corporate bodies and individuals.”There were goodwill messages from Rt Hon. The Lord O’Donnell, former Cabinet Secretary and Head of the UK Civil Service, Amina Mohammed, United Nations Deputy Secretary General, David DaCosta Archer Jnr, Deputy Governor of the Virgin Island, and Dr Richard Montgomery, British High Commissioner to Nigeria.…Signs Tax Reform Bills, Three Others into LawPresident Bola Tinubu has signed into law four tax reform bills on key areas of Nigeria’s fiscal and revenue framework.Tinubu signed the bills at a ceremony held at the Aso Rock Presidential Villa, yesterday in Abuja.The four bills include: the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.They were passed by the National Assembly after months of consultations with various interest groups and stakeholders.“When the new tax laws become operational, they are expected to significantly transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments,” Onanuga said.The presidential assent to the bills was witnessed by the Senate President, Speaker of the House of Representatives, Senate Majority Leader, House Majority Leader, chairman of the Senate Committee on Finance, and his House counterpart.The Chairman of the Governors Forum, Abdulrahman Abdulrazaq of Kwara State; the Chairman of the Progressives Governors Forum, Hope Uzodinma of Imo State; the Minister of Finance and Coordination Minister of the Economy, Wale Edun; and the Attorney General of the Federation, Lateef Fagbemi, were also at the ceremony.One of the four bills is the Nigeria Tax Bill (Ease of Doing Business), which aims to consolidate Nigeria’s fragmented tax laws into a harmonised statute.“By reducing the multiplicity of taxes and eliminating duplication, the bill will enhance the ease of doing business, reduce taxpayer compliance burdens, and create a more predictable fiscal environment,” said the Presidency in a statement Wednesday night.The second bill, the Nigeria Tax Administration Bill, will establish a uniform legal and operational framework for tax administration across federal, state, and local governments.The Nigeria Revenue Service (Establishment) Bill, the third bill, repeals the current Federal Inland Revenue Service Act and creates a more autonomous and performance-driven national revenue agency— the Nigeria Revenue Service.It defines the NRS’s expanded mandate, including non-tax revenue collection, and lays out transparency, accountability, and efficiency mechanisms.The fourth bill is the Joint Revenue Board (Establishment) Bill.It provides for a formal governance structure to facilitate cooperation between revenue authorities at all levels of government. It introduces essential oversight mechanisms, including establishing a Tax Appeal Tribunal and an Office of the Tax Ombudsman.…Rejects NDLEA Bill over Crime Proceeds ClausePresident Bola Tinubu has declined to sign the National Drug Law Enforcement Agency Bill, 2025 into law.The President’s decision not to sign the bill passed by both chambers of the National Assembly was contained in a letter read in the Green Chamber on Thursday during plenary.The President, citing Section 58(4) of the 1999 Constitution (as amended), explained that the proposed law seeks to empower the NDLEA to retain a portion of the proceeds from drug-related crimes, a move he said contradicts existing financial regulations.He noted that under the current system, “All proceeds of crime are paid into the government’s Confiscated and Forfeited Properties Account. Disbursements to any recovery agency, including the NDLEA, can only be made by presidential approval, subject to the consent of the Federal Executive Council and the National Assembly.”The President maintained there was no compelling reason to alter a process designed to uphold accountability through executive and legislative oversight.

COVER

Benue Attacks: CDS Orders Clampdown on Illegal Arms Bearers

From Attah Ede, Makurdi

The Chief of Defence Staff, General Christopher Musa, has ordered the immediate arrest of anyone in possession of illegal arms in Benue State.Gen. Musa also warned that anyone who attacks security personnel with such illegal arms would be neutralised.

He issued the directive Thursday after holding a closed-door meeting with their Royal Majesties, the Tor Tiv, Prof. James Ayatse, the Och’Idoma, John Odogbo and other traditional rulers in the state. Gen. Musa emphasised the sincerity of the federal government and military leadership in resolving the security challenges confronting Benue State. He recalled previous consultations, including the recent visit by President Bola Tinubu, as part of ongoing efforts to secure the state and ensure that the displaced citizens return to their communities.He said, “We have a challenge in Benue State, and I believe working together, we will find a solution. When we sit down and talk sincerely, bringing out all that is affecting us, we will be able to find the solution.”Gen. Musa expressed appreciation to the Tor Tiv and Och’Idoma for their candid contributions and called for continued collaboration between the communities and security agencies. He urged the royal fathers to regard the military as partners and “sons” working towards peace in a region with shared history and struggles.The CDS warned that the military would not condone illegal arms possession or criminal activities, regardless of the perpetrators’ identity or affiliation “and anyone bearing arms illegally will be arrested. If he threatens security forces, he will be neutralised. That is the mandate.”He assured that the military was committed to replicating peace-building successes recorded in other troubled parts of the country and cautioned military personnel against complacency and reminded them of their constitutional duty to protect lives, their colleagues, and host communities.Gen. Musa also disclosed that the outcome of the meeting would be relayed to the President for further action.On the Yelewata attack, the CDS confirmed the arrest of some suspects, adding that prosecution would now follow a development he said was long overdue.“We are committed to ending the era where crimes go unpunished. There will be no sacred persons. Anyone involved in violence must face justice.”On the resettlement of displaced persons, the CDS said Yelewata was now secured with additional forces deployed ahead of the return of the displaced persons.He pointed out that “the true measure of our success is when IDPs leave the camps and return home. That is our goal, and we are working hard to achieve it.”Responding, the Tor Tiv acknowledged significant improvements in the state since the last engagement with the CDS and expressed optimism that the renewed dialogue would permanently address the state’s security challenges.He said, “Our people also have some roles. We are taking responsibility and working to bring our people under control to prevent further attacks.”The monarch urged security forces to apprehend and prosecute any criminal elements within his domain.The Och’Idoma, on his part, stressed the need to differentiate between peaceful Fulani residents and armed herders responsible for violence.He said, “We are not saying all Fulani should leave. The known, peaceful ones have been with us for years. We are asking only those carrying arms and causing terror, killing, raping, and destroying our farms to leave. Benue people must be able to return to their farms and feed the nation as the Food Basket of the Nation.”IGP Orders Investigation after Retired Officer Rejected N2m PensionThe Inspector-General of Police, Kayode Egbetokun has ordered a thorough investigation into the claims made by a retired Superintendent of Police in a viral video concerning the welfare and retirement benefits of police pensioners.The retired officer, who served in the force for 35 years, reportedly rejected a retirement benefit of N2 million.In the widely circulated video, the officer, who retired on October 1, 2023, expressed deep frustration over what he described as a meagre payout.He said the Nigeria Police Pension Board recently informed him that his total retirement benefits had been approved at N3 million.According to him, the amount includes N1 million in arrears covering the period from October 2023 to date, and N2 million as his full terminal benefit.In a statement on Thursday by the Force Public Relations Officer, ACP Olumuyiwa Adejobi, the IGP directed the NPF Pensions Limited to urgently look into the claims, identify any possible lapses, and ensure appropriate actions are taken to address the issues raised.The police chief emphasised that while efforts have been made to improve the police pension system over the years, constructive feedback, such as that highlighted in the viral video, remains crucial in identifying gaps and initiating reforms.“The IGP has ordered a thorough investigation into the allegations raised in a viral video by a retired Superintendent of Police concerning the welfare and retirement benefits of police pensioners. The IGP has tasked the NPF Pensions Limited to urgently examine the claims, identify any possible lapses, and ensure that appropriate action is taken to address the concerns raised.“The Nigeria Police Force is not insensitive to the plight of its pensioners, many of whom dedicated their lives to the service and safety of our nation. The IGP views the welfare of both serving and retired officers as a priority and recognises that timely and adequate pension administration is crucial to sustaining morale and institutional integrity. While efforts have consistently been made to improve the pension system, the IGP acknowledges the importance of constructive feedback in prompting necessary reforms.”Egbetokun assured both serving and retired officers, along with their families, of the Force’s unwavering commitment to improved welfare and a pension system that honours their years of sacrifice.“The IGP, therefore, reassures all officers, both serving and retired, and their families of the Force’s commitment to improved welfare, and to building a system that honours their sacrifices. He urges stakeholders to remain calm and patient as the NPF Pensions carries out its investigations and engages relevant agencies to ensure lasting solutions”, Adejobi concluded.