BUSINESS

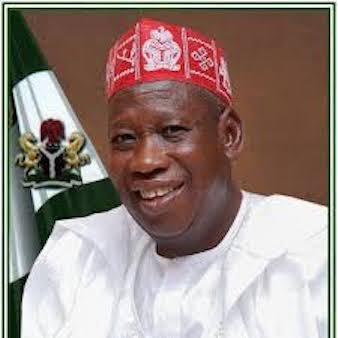

Ganduje Unveils Dala Dry Port Logo

By Joseph Amah, Abuja

Kano State governor, Abdullahi Ganduje has unveiled the Dala Port Investment Summit logo at a brief ceremony in Abuja, the nation’s capital. This is as the governor declared the state’s readiness for economic transformation with the expected completion of the port in the next couple of weeks.

The governor noted that the ancient city of Kano played a unique role as a commercial hub in pre-colonial Nigeria, stressing that the first aeroplane which flew into Nigeria landed in Kano. According to him, Kano also boasted of first-generation billionaires like Alhaji Alhassan Dantata, who in his words was the richest man in West Africa closely followed by Isyaku Rabiu.Ganduje further claimed that Kano has always had a very large commercial settlement even more than Lagos, arguing that even when the colonial masters arrived in the country through the sea, they were able to identify the economic potentials of the city which made them build a railway line to the state, unperturbed by the distance. He said: “The first aeroplane that came to Nigeria, dropped in Kano, the pilot did not identify any settlement in Lagos. There was a large settlement of people already in Kano. The richest man in Africa then, Dantata was from Kano and the second richest, Rabiu was also from Kano. Kano existed before Nigeria was carved out. Kano was able to trade with the world in the pre-colonial era. “When the colonial masters came in through the sea, they built a railway line from Lagos to Kano because of the degree of commerce already in place. You all can remember the groundnut pyramid. “When oil was discovered, everything went upside down but the Buhari administration came in and said that it will no longer be business as usual and reconstructed the railway line. Today, Kano is the largest producer of rice in Nigeria and one of the highest processors of rice in West Africa.”The governor said that with the upcoming Kano Economic and Diaspora investment summit which will take place in May, the port will create an opportunity for the Diaspora community to tap into the rich business potential in the state, promising to provide free land to any member of the Diaspora community willing to invest in the state.

In his keynote address, Minister of Transportation, Hon. Chibuike Amaechi said the dry port when completed will bring shipping facilities closer to the hinterland. Represented by Dr Magdalene Ajani, Permanent Secretary, Federal Ministry of Transportation, Amaechi said: “A state with a sizable number of textiles and agro-allied industries, a motor assembly plant, hides and skin industries and several manufacturing plants deserves an inland dry port”. According to Amaechi, the dry port will among other things, “bring shipping activities closer to shippers in the hinterland and increase cargoes throughput; act as a catalyst for improved trade flows; boost inland trading, revitalize export of agricultural products thus leading to multi-product economy; create employment opportunities that would ultimately stem rural-urban migration and act as a source of Internally Generated Revenue, IGR, to the host state as well as a revenue source to the federal government.”

While assuring the business community and intending investors of the government’s commitment to link all dry ports with rail lines, Amaechi said the Dala port would be linked with the Lagos-Kano standard gauge currently under construction. In his goodwill message, Emir of Kano, Alhaji Aminu Addo-Bayero frowned at the slow speed of the Kaduna-Kano, noting that the emirate has constituted a committee to work with the state government for the completion of the Dala Inland Dry Port. Executive Secretary of Nigerian Shippers Council, Emmanuel Jime in his remarks said the “Dala Dry port” which is among the six dry port projects being executed by the President Muhammadu Buhari administration “will give Nigeria a competitive edge in the African Continental Free Trade Area, AfCFTA.

He added that the Kano state government has already released the sum of N2.5bn which was utilized in the provision of the access road, electricity, perimeter fencing, provision of water facility, among others at the project site. The event was attended by Minister of Trade and Investment Adeniyi Adebayo, Chairman Nigerians in Diaspora Commission, NIDCOM, Hon. Abike Dabiri; Managing Director, Dala Inland Dry Port, Ahmed Rabiu; Chairman Dangote Group Aliko Dangote represented by President, Manufacturers Association of Nigeria Engr. Mansur Ahmed; President BUA Group Abdulsamad Rabiu among others.

BUSINESS

IMF Predicts 0.5% GDP Revenue Loss for Nigeria

Torough David, Abuja

The Federal Government may lose as much as 0.5 percent of the country’s Gross Domestic Product in revenue following its decision not to raise the Value Added Tax rate, the International Monetary Fund has disclosed.

In its latest Article IV Consultation Report on Nigeria, the IMF stated that although the recent tax reforms approved by the National Assembly and President Bola Tinubu represent a major step forward in modernising the VAT and Company Income Tax regimes, the choice to maintain the current VAT rate would lead to an immediate revenue shortfall.

“The decision not to raise the VAT rate now is reasonable, given high poverty and food insecurity, and with the cash transfer system to support the most vulnerable households not yet fully rolled out.

However, this will reduce consolidated government revenue by up to ½ per cent of GDP in the authorities’ estimates,” the report noted.While the Federal Government is expected to be largely insulated from the fallout—thanks to expected gains from improved CIT compliance—the blow will be felt most by state and local governments.

According to the Fund, unless alternative financing options are found, subnational governments may be forced to either scale back spending or ramp up their own revenue efforts.

The IMF, however, acknowledged the government’s justification for delaying a VAT hike, particularly at a time of worsening poverty and food insecurity.

With only 5.5 million of the targeted 15 million households reached under the federal cash transfer programme, the Fund noted that raising VAT at this stage could further strain vulnerable households.

Nonetheless, it cautioned that the cost of delaying reform would fall on already stretched public finances, especially at the subnational level.

“Assuming no alternative financing sources, they [states and LGAs] would have to raise additional revenue or reduce spending, which is assumed in the baseline,” the report said.

Despite this challenge, the IMF welcomed the tax reform agenda being driven by the Presidential Committee on Fiscal Policy and Tax Reforms, describing it as critical to reversing Nigeria’s poor revenue-to-GDP ratio, one of the lowest globally.

The reforms aim to boost compliance and enforcement, and the Fund believes they hold “significant medium-term revenue potential” once fully implemented.

Measures include modernising the VAT and CIT frameworks, tightening exemptions, and introducing digital tools to monitor compliance. Total revenue and grants reached 14.4 per cent of GDP in 2024, up from 9.8 per cent in 2023, buoyed by currency depreciation and improved administration.

However, public debt also rose, hitting 52.9 percent of GDP last year, with interest payments consuming 41.1 percent of Federal Government revenue. The IMF advised the government to maintain a neutral fiscal stance in 2025, stressing that revenue shortfalls should not lead to excessive borrowing.

It also urged the authorities to clearly set out a medium-term revenue plan, including timelines for further tax policy changes, to restore investor confidence and ensure policy credibility.

The report stated, “Pre-committing to an implementation timeline for further policy measures in an updated medium-term framework would support fiscal sustainability and provide guidance on available fiscal space for development spending and support for the most vulnerable households.”

Nigeria’s decision not to raise VAT comes at a time of heightened global and domestic uncertainty. Lower oil prices, rising financing costs, and mounting social pressures have narrowed the government’s fiscal space.

The IMF observed that while reforms since 2023—including fuel subsidy removal and the liberalisation of the foreign exchange market—have improved macroeconomic stability, their benefits have yet to trickle down to most Nigerians.

With inflation still elevated at 22.9 per cent as of May 2025, and poverty levels worsening, the government appears to be prioritising stability over revenue acceleration, for now.

However, the IMF warned that the long-term cost of inaction could be higher if reforms stall or if subnational governments struggle to adjust.

In the meantime, the IMF continues to support Nigeria’s reform efforts, including through capacity development and the deployment of a resident advisor to assist with revenue mobilisation strategies.

The Nigeria Economic Summit Group warned that the Federal Government could face revenue shortfalls if it does not increase the value-added tax rate as part of the ongoing tax reform process.

The Chief Executive Officer of NESG, Dr. Tayo Aduloju, made this statement during an interactive media session in Abuja. He emphasised that while reforms in the VAT system are essential, maintaining the current VAT rate without an increase could lead to a significant loss of revenue for the government.

Speaking on the issue, Aduloju said, “Without those rate hikes, it means that the government might lose some revenue.” Aduloju explained that the current tax reform process must strike a balance between simplifying the tax system and increasing the VAT rate to maintain revenue stability.

According to him, simply reducing the number of taxes without adjusting the VAT rate could weaken the government’s revenue base.

| ReplyReply allForwardAdd reaction |

BUSINESS

Dangote Submits Paper Work for Largest Seaport, Plans Gas Export

Torough David, Abuja

The President/Chief Executive of Dangote Group, Aliko Dangote, has commenced the process to develop what he described as Nigeria’s biggest and deepest seaport in Olokola, Ogun State, a move that signals the expansion of his multibillion-dollar industrial empire and a strategic push into maritime logistics.

Speaking during an interview in Lagos on Monday, Dangote disclosed that he submitted the necessary paperwork for the seaport project in late June.

The planned port, located about 100 kilometres from his Lekki-based refinery and fertilizer complex in Lagos, is expected to ease the export of goods such as fertilizer, petrochemicals, and liquefied natural gas, while enhancing access for imported equipment and raw materials.

“It’s not that we want to do everything by ourselves, but I think doing this will encourage other entrepreneurs to come into it,” Dangote said, expressing optimism that the project would attract more private investment into Nigeria’s underdeveloped port infrastructure.

Dangote currently exports urea and fertilizer through an on-site jetty he built, that also receives heavy equipment for the refinery.

The proposed Atlantic seaport, if approved, will rival existing ports in Lagos, including the recently completed Lekki Deep Sea Port, which was funded by Chinese investors and began operations in 2023.

It also marks a return to the Olokola site for Dangote, who had previously shelved plans to site his massive refinery and fertilizer plant there due to conflicts with local authorities.

Those disputes, however, appear to have been resolved under the current administration.

The development also comes four months after he disclosed readiness of the company to return to the Olokola Free Trade Zone in Ogun Waterside Local Government Area of the state.

Dangote also plans to export liquefied gas from Lagos, a project that will involve constructing pipelines from Nigeria’s oil-rich Niger Delta., vice-president of the group Devakumar Edwin said in another interview.

“We want to do a major project to bring more gas than what NLNG is doing today,” he said, referring to Nigeria LNG Ltd., a joint-venture between the government, Shell Plc, Eni SpA and TotalEnergies SE, which is currently the continent’s largest exporter of LNG.

“We know where there is a lot of gas, so run a pipeline all through and then bring it to the shore.”

Dangote already sources natural gas from the Niger Delta to supply his fertilizer plant, where it’s used as feedstock to produce hydrogen for ammonia, a key component in the production of the crop nutrient.

The billionaire also plans to start distributing fuel to retailers in Nigeria from August, using a fleet of 4,000 gas-powered trucks, a move that has drawn criticism from some groups accusing him of attempting to monopolise the oil sector, which he has denied.

Dangote, valued at $27.8bn according to the Bloomberg Billionaires Index, also owns cement manufacturing and sugar plants in Africa.

Oil & Gas

Lawyers Integral to Optimal Regulatory Compliance in Oil Business – NMDPRA

The Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) said the role of legal practitioners is critical across the midstream and downstream energy business value chain in the promotion of optimal regulatory compliance.

Chief Executive, NMDPRA, Farouk Ahmed said this on Monday in Abuja at its 2025 General Counsel and Legal Advisers Forum for Midstream and Downstream Petroleum Companies in Nigeria.

The forum has its theme as ‘Advancing a Collaborative Compliance Culture in Nigeria’s Midstream and Downstream Petroleum Sectors’.

Ahmed was represented by Ogbugo Ukoha, Executive Director, Distribution System, Storage and Retailing Infrastructure, NMDPRA.

He said that the sector’s complexity required a unified compliance culture, rooted in robust and enabling legal frameworks, transparency, accountability and shared responsibility.

“The scope of operations of the sector covers hydrocarbon processing, wholesale marketing, transportation, storage, distribution and retail, and its complexity requires more than technical efficiency.

“The role of legal practitioners is critical across the midstream and downstream energy business value chain.

“They help to promote optimal regulatory compliance to set rules and standards of operations in our complex operational and volatile market environment,’’ he said.

Ahmed said that strategic and pragmatic solutions would be established from the forum to enhance performance of the sector towards creation of shared value for investors and the extensive market of Nigeria and the region.

He said that the Petroleum Industry Act (PIA 2021) had fundamentally restructured Nigeria’s petroleum industry by delineating regulatory responsibilities of the industry into the Upstream, midstream and downstream Petroleum operations.

According to him, the Act prescribed that all operations in the midstream and downstream sectors could only be conducted under appropriate licenses, permits and authorisations granted by the NMDPRA.

He said the PIA also mandated NMPDRA to make regulations concerning midstream and downstream petroleum operations in consultation with its licensees and stakeholders.

“As a result of the feedback received from our stakeholders on the need to strengthen regulatory compliance through simplified regulations, NMDPRA is implementing an inclusive stakeholder process of streamlining the gazetted and published regulations.

“This process will mitigate the complexities of navigating and implementing numerous regulations; eliminate inconsistencies and repetitions across multiple regulations; streamline regulatory processes for ease of business; and encourage investments in the industry.

“Kindly use this forum to critically review and make recommendations on the above.

This will enable us to improve the overall compliance of operators and the performance of the regulatory instruments (Legal frameworks and licenses) in the midstream and downstream sectors,” He said.

He said that NMDPRA would continue its commitment to effective stakeholder collaborations that would foster ease of doing business, investor confidence and sustainable operations.

Deputy Speaker, House of Representatives, Benjamin Kalu said that the PIA as a testament to the foresight and dedication of the National Assembly, had fundamentally reshaped Nigeria’s petroleum sector.

Kalu was represented by Ugochinyere Ikenga, Chairman, House Committee on Petroleum Resources, Downstream.

He said that the act had proven how strategic legislation could serve as a potent catalyst for compliance, investment attraction, and robust sector growth.

“For the PIA to remain truly effective, adapting to a dynamic global energy landscape and addressing unforeseen challenges, there must be an institutionalised robust mechanism for its continuous refinement.

“This is precisely where the invaluable insights of our nation’s petroleum experts and our general counsels, the legal architects and navigators of this complex framework, become indispensable.

“For or further synchronisation and effective post-legislative scrutiny, we must actively solicit and integrate your concerns.

“We envision a future where the National Assembly’s specialised committees regularly invite you professionals to public hearings and dedicated technical working groups,” he said.

Kalu said that this proactive engagement would transform abstract legal principles into tangible operational realities, furnishing us with the real-world data and case studies needed to truly understand the PIA’s strengths and weaknesses.

“Your feedback will illuminate where the PIA might be technically challenging, where legal interpretations create bottlenecks, or where new global trends necessitate legislative evolution,’’ he said.