BUSINESS

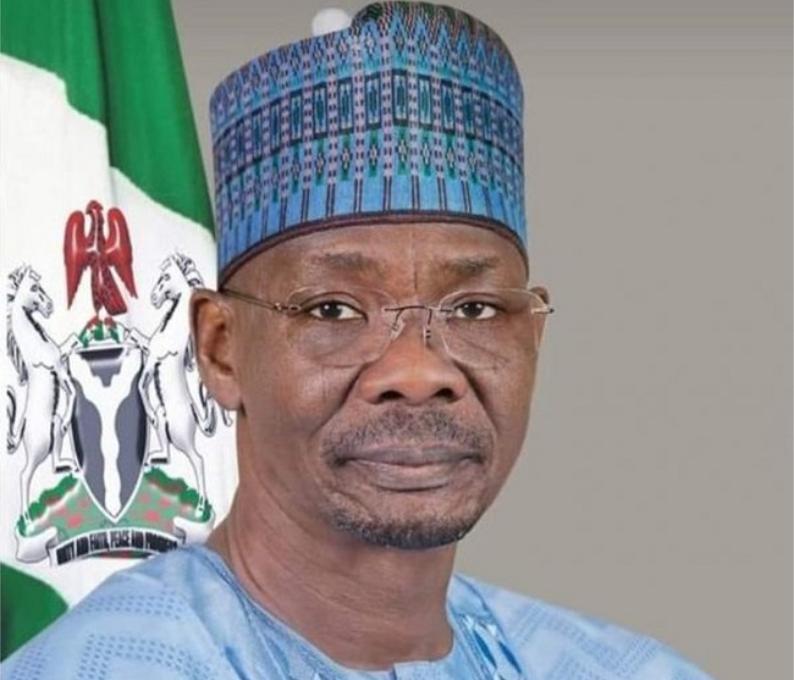

How I Plan to Address Challenges Facing CBN – Yemi Cardoso

By Tony Obiechina, Abuja

The senate recently confirmed the appointment of a new leadership at the Central Bank of Nigeria (CBN), comprising the Governor, Mr Olayemi Cardoso and four Deputy Governors.

This followed their nominations to the Upper Chambers of the National Assembly by President Bola Ahmed Tinubu for consideration for appointments.

The new CBN Governor and his team have since swung into action to turn around the dwindling fortunes of the Apex Bank which the President in his inaugural address

stressed the urgent need to “clean up the CBN and its Monetary Policies”.

As a first step to this task, a special investigator appointed to look into the affairs of the CBN is currently at work.

Further to the clean-up exercise, the President deemed it necessary to bring in new leadership to the helm of affairs at the Central Bank.According to a document obtained from the CBN, the new Governor has mapped out strategies where he enumerated the preliminary challenges confronting the Bank and how he intends to address them.

“I shall outline the challenges facing the Central Bank, introduce high-level proposals to address reformation challenges and discuss the role of a refocused Central Bank in supporting the economic agenda of the President Tinubu Administration.

*What are the current challenges facing the Central Bank of Nigeria? In assessing these challenges, preliminary questions are being raised on addressing them.

*Failure in corporate governance in CBN:

How will issues of governance be addressed?

*Diminished institutional autonomy:

How can public and financial systems’ stakeholder confidence be restored in the autonomy and integrity of CBN?

*Need to refocus CBN back to core functions:

What needs to be in place to revert to evidence-based Monetary policies?

Discontinuation of unorthodox Monetary policies and Foreign Currency management?

*Unorthodox use of Ways and Means spending:

What controls can CBN develop to enforce statutory limits in the use of Ways and Means of financing public sector deficit?

*Backlog of FX demand:

How much of the backlog is real versus speculative/ hoarding?

Are there creative financing options for clearing the short to medium term backlog?

*Lack of clarity in fiscal and monetary relationships – where are the delineations, and what should be the limits in CBN’s fiscal side interventions?

*Inflation and price stability:

What are the causes, and what is CBN’s proposed response to address inflation and price stability issues?

*Access to FX market and FX price discovery:

What mechanisms exist to address FX rate unification under a willing buyer and willing seller arrangement?

What should be the role of the Central Bank in the FX market?

Is there a need for interest rate realignment to money supply, inflation, and market realities?

*Current Financial System Stability:

What is the current state of the financial system?

Are CBN surveillance frameworks being updated proactively to track the expanding use of electronic payment systems by Fintech and Telcos?

These problem statements need in-depth review by the new Central Bank leadership team to determine what mechanisms are currently working, what can be tweaked or dispensed with and what new tools need to be introduced.

*How a refocused CBN can support economic growth.

Size Matters”

“The economic policy proposals of the Administration identify a set of fiscal reforms and growth targets that will achieve $1.0 TN GDP within eight years. In reviewing selected BRICS and MINT countries, with large populations and similar developmental characteristics as Nigeria, it is interesting to identify macro-economic indices that point to Nigeria’s economic trajectory, given the faithful implementation of the proposed economic reforms. In economies bigger than $1.0TN, these indicators include moderate inflation, sizable foreign reserves, and the capacity to quickly rebound from a cyclical economic downturn.

“Advisory role of CBN

Much has been made of past CBN forays into development financing, such that the lines between monetary policy and fiscal intervention have blurred. In refocusing the CBN to its core mandate, there is a need to pull the CBN back from direct development finance interventions into more limited advisory roles that support economic growth.

“These advisory roles could include, for instance:

*Act as a catalyst in the propagation of specialised institutions and financial products that support emerging sectors of the economy.

*Facilitate new regulatory frameworks to unlock dormant capital in land and property holdings.

*Accelerate access to consumer credit and expand financial inclusion to the masses.

De-risking instrumentation to increase private sector investment in housing, textiles and clothing, food supply chain, healthcare, and educational supplies.

“These verticals have huge demand patterns, with the potential for high local inputs and value retention, and can be the basis for rapid industrialisation.

Exercise CBN’s convening power to bring key multilateral and international stakeholder participation in government and private sector initiatives.

Conclusion

Cardoso said, “It must be emphasised that CBN does not have a magic wand that can be waved at the current economic challenges. The problems facing the bank are large and complex. However, with focused leadership and sustained reforms, it is expected that over time, the country will gain open economic spaces, attract new investments, create employment, and give our hardworking and talented compatriots an opportunity for a more prosperous future”.

Agriculture

NNPC Foundation Empowers Vulnerable Farmers in Oyo, Osun

No fewer than 500 farmers on Tuesday benefited from the NNPC Foundation agricultural training initiative for vulnerable farmers in Osun and Oyo States.

The training, marking the flag-off in the South-West zone of Nigeria, was held at the Ilora Baptist Grammar School, Ilora, Oyo State.

The foundation manages the Corporate Social Responsibility (CSR) initiatives of NNPC Limited, focusing on education, health, environment and energy access to communities nationwide.

The Managing Director of the foundation, Mrs Emmanuella Arukwe, said the initiative demonstrated the commitment to food security and economic empowerment for Nigerian farmers.

Arukwe, who was represented by Dr Bala David, the foundation’s Executive Director, Programme Development, said the project aimed to build resilience, boost productivity and promote sustainable agriculture.

“We are training 6,000 farmers across six zones in climate-smart practices, modern techniques, quality inputs, and market access,” she said.

She, therefore, urged farmers to participate actively and embrace the opportunity to help secure Nigeria’s food and economic future.

Mr Olasunkanmi Olaleye, Oyo State Commissioner for Agriculture and Rural Development, commended NNPC Foundation for the training and empowerment programme.

Olaleye, who was represented by Mr Olusegun Ezekiel, the ministry’s Director of Regulation and Enforcement, said empowering vulnerable farmers was crucial in addressing national food security challenges.

He added that the initiative aligned with Oyo State’s agricultural transformation agenda of Gov. Seyi Makinde.

“We remain committed to supporting initiatives that uplift farmers and improve productivity and livelihoods,” Olaleye said.

He encouraged participants to make the most of the training opportunity to improve their practices.

He also called for future collaboration between the foundation and the ministry to achieve greater impact.

The training consultant, Prof. Daniel Ozok, described vulnerable farmers as smallholders with an under-five-hectare farm size, mainly made up of women, youth, and the elderly.

“These farmers are most affected by climate shocks, hence the need for focused training,” Ozok said.

According to him, training equips them with modern techniques and strategies for improved productivity and market access.

Some of the participants expressed gratitude to NNPC Foundation and promised to apply the knowledge gained from the training.

NAN reports that a medical screening exercise was organised by the foundation for participants on the sidelines of the training.

Training initiative would later be held for farmers in Ekiti and Ondo States on a date different from that of Ogun and Lagos States. (NAN)

Economy

Customs Zone D Seizes Contraband Worth N110m

The Nigeria Customs Service (NCS), Federal Operation Unit (FOU), Zone D, has seized smuggled goods worth over N110 million between April 20 till date.

The Comptroller of Customs, Abubakar Umar, said this at a news conference on Tuesday in Bauchi.

He listed the seized items to include 11,200 litres of petrol; 192 bales of second hand clothing, 140 cartons of pasta, 125 pairs of jungle boots, 47 bags of foreign parboiled rice and 9.

40 kilogramme of pangolin scales.Umar said the items were seized through increased patrols, intelligence-led operations, and strengthened inter-agency collaboration.

The comptroller said the pangolin scales would be handed over to the National Environmental Standards and Regulations Enforcement Agency (NESREA) for appropriate action, while the seized petrol would be auctioned, and the proceeds remitted to the federation account.

He attributed the decrease in smuggling activities of wildlife, narcotics, and fuel to the dedication and professionalism displayed by the personnel in line with Sections 226 and 245 of the NCS Act 2023.

The comptroller enjoined traders to remain law abiding, adding the service would scale up sensitisation activities to combat smuggling.

“We remain resolute in securing the borders and contributing to Nigeria’s economic development,” he said.

The FOU Zone D comprises Adamawa; Taraba, Bauchi, Gombe, Borno, Yobe, Plateau, Benue and Nasarawa. (NAN)

Economy

Trade Tensions: Global Economy Stands at Fragile Turning Point -UN

The UN Department of Economic and Social Affairs (UN DESA) has said that the global economy stands at a fragile turning point amid escalating trade tensions and growing policy uncertainties.UN DESA, in a report published on Thursday, stated that tariff-driven price pressures were adding to inflation risks, leaving trade-dependent economies particularly vulnerable.

It stated that higher tariffs and shifting trade policies were threatening to disrupt global supply chains, raise production costs, and delay key investment decisions – all of this weakening the prospects for global growth. The economic slowdown is widespread, affecting both developed and developing economies around the world, according to the report.For instance, in the United States, growth is projected to slow “significantly”, as higher tariffs and policy uncertainty are expected to weigh on private investment and consumer spending.Several major developing economies, including Brazil and Mexico, are also experiencing downward revisions in their growth forecasts.China’s economy is expected to grow by 4.6 per cent this year, down from 5.0 per cent in 2024. This slowdown reflects a weakening in consumer confidence, disruptions in export-driven manufacturing, and ongoing challenges in the Chinese property sector.By early 2025, inflation had exceeded pre-pandemic averages in two-thirds of countries worldwide, with more than 20 developing economies experiencing double-digit inflation rates.This comes despite global headline inflation easing between 2023 and 2024.Food inflation remained especially high in Africa, and in South and Western Asia, averaging above six per cent. This continues to hit low-income households hardest.Rising trade barriers and climate-related shocks are further driving up inflation, highlighting the urgent need for coordinated policies to stabilise prices and protect the most vulnerable populations.“The tariff shock risks hitting vulnerable developing countries hard,” Li Junhua, UN Under-Secretary-General for Economic and Social Affairs, said in a statement.As central banks try to balance the need to control inflation with efforts to support weakening economies, many governments – particularly in developing countries – have limited fiscal space. This makes it more difficult for them to respond effectively to the economic slowdown.For many developing countries, this challenging economic outlook threatens efforts to create jobs, reduce poverty, and tackle inequality, the report underlines. (NAN)