Business News

Infrastructural Deficit, Border Closure Thwart Q1 Growth

Joy Okeke, Lagos

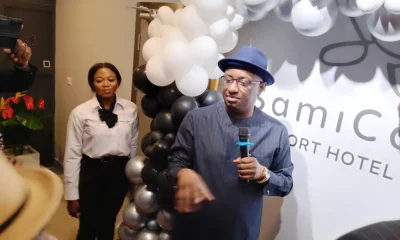

A member of the Presidential Economic Advisory Council and Managing Director, Financial Derivatives Company Limited, Mr Bismarck Rewane has said that the infrastructural deficit and border closure were major constraints to the nation’s economic growth in the first quarter of this year.

Rewane said this in Lagos at LBS breakfast session adding that first quarter growth typically slowed down owing to lull in economic activities and lower consumer spending in January.

He said that growth outlook would be affected by reduced consumer disposable income through hike in value added tax (VAT) and rising inflation.

The economist explained that with implementation of new VAT rate of 7.5 per cent in February and increase in electricity tariff in April, inflation will continue in an upward trend but at a slower pace.

Rewane stated that there was decline in revenue shared in February due to lower statutory and VAT revenues and it would likely go down further in the coming months owing to fall in average oil price.

For instance, he said , oil price which stood at $63 per barrel in January decreased to $55.48 per barrel in February, while oil production grew by 1.71 per cent to 1.78 milliion barrel per day in January despite decline in operational rigs by 17.6 per cent to 14 at the first month of this year.

Stating the impact of outcome of OPEC’s meeting on Nigeria, he said nation’s oil production could fall to 1.5 mbpd as OPEC mulls additional output cuts.

He said that this could put government revenue under severe pressure while gross external reserves could fall towards $34 billion.

He stated that for the country to maintain growth profile there is need to have more aggressive tax policies to boost internally generated revenues.

In his explanation , he said amid soft demand , power shortages and scarcity of primary materials for production, Federal government would need to incentivised the manufacturing sector to increase productive capacity.

Highlighting some of IMF article IV recommendations, he said structural reforms remains essential to boosting inclusive growth, execute the much delayed power sector recovery plan,implement the anti-curruption and financial inclusion strategy, address infrastructure and gender gaps.

The article also called for introduction of risk-based minimum capital requirements to strengthen banking resilience.

Business News

Afreximbank Closes $282 million India-focused Club Deal

By Tony Obiechina, Abuja

The African Export-Import Bank (Afreximbank) has announced the successful completion of a first-of-its-kind India-focussed club deal for US$282.00 million.

Initiated for the exclusive participation of Indian lenders, and arranged by Bank of Africa UK PLC, the primary syndicated club deal saw participation from Indian lenders through their overseas branches and subsidiaries in the Dubai International Financial Centre in the United Arab Emirates, Singapore and Mauritius.

The facility, which was backed by six participating banks and financial institutions, including five that joined as first-time lenders to Afreximbank, helping the Bank achieve its objective of diversifying its funding sources, carries a three-year tenor.

At a commemorative event held in Dubai, U.A.E., to mark the conclusion of the deal, Haytham ElMaayergi, Executive Vice President at Afreximbank, said that the conclusion of the initiative represented a major milestone for the Bank as it sought to fulfil the key objectives of its funding programme.

Highlighting the importance of investing in, and for, Africa, Mr. ElMaayergi said: “this facility will help Afreximbank to continue to play a major role in the development of intra-African trade and trade between Africa and the rest of the world, particularly with India.

It is a testament to the rapid growth in Africa’s economic relationship with India and is evidence of Afreximbank’s growing ability to harness resources into Africa and to fund trade finance related investments that would have a positive impact on trade between Africa and India.”

Chandi Mwenebungu, Director and Group Treasurer of Afreximbank, reviewing the Bank’s vision for Africa, said that its funding objectives included achieving the diversification of its liability book by geography, investor type and tenor.

Also addressing guests at the event were Said Adren, CEO of Bank of Africa UK PLC, who thanked the lenders for their participation, and Zineb Tamtaoui, General Manager of Bank of Africa, Dubai Branch, who expressed appreciation for the opportunity to put together “a landmark deal that would be a stepping stone to many India-focused club deals going forward.”

Business News

Geregu Power Earns N50.4bn From Electricity Sales, Capacity Charges

By Tony Obiechina, Abuja

Geregu Power Plc has generated N50.4bn on electricity sales and capacity charges to Nigerians in the first quarter of 2024.

The power company which is the first listed power company of the Nigerian Exchange Ltd disclosed the performance in its Q1, 2024 financial statement.

The company grew its Q1 revenue by 225 per cent from N14.

2bn in 2023 to N50. 4bn in 2023.A breakdown reveals that Geregu Power sold energy worth N31bn and received N19bn as revenue from capacity charge.

Recall that the power company posted an annual revenue of N82.9bn in the full year of 2023 but it has covered half of the amount in Q1.

The revenue was above the company’s forecast for Q1 2024 when it projected its revenue to rise to N31.24bn.

Geregu Power recorded a profit before tax of N21.9bn up from the N5.3bn recorded in Q1 of last year, reflecting 307.8 per cent growth.

During the period underreview, the company saw its profit after tax rose by 307.3 per cent to N14.46bn from N3.54bn recorded in Q1 of last year. In the full year 2023, the company made N16.1bn net profit.

The net profit was above the company projection of N5.5bn.

Geregu Power took an income tax charge of N7.43bn, up from the N1.8bn in Q1 2023. The tax charges were higher than the N2.7bn projected for Q1 2024.

The company also spent N21.5bn on the cost of sales involving gas supply and transportation, up from the N6.6bn spent on gas supply and transportation in Q1 2023.

Business News

CBN Shakes Up Banking Sector: A Paradigm Shift Unveiled

By Ademola Oyetunji

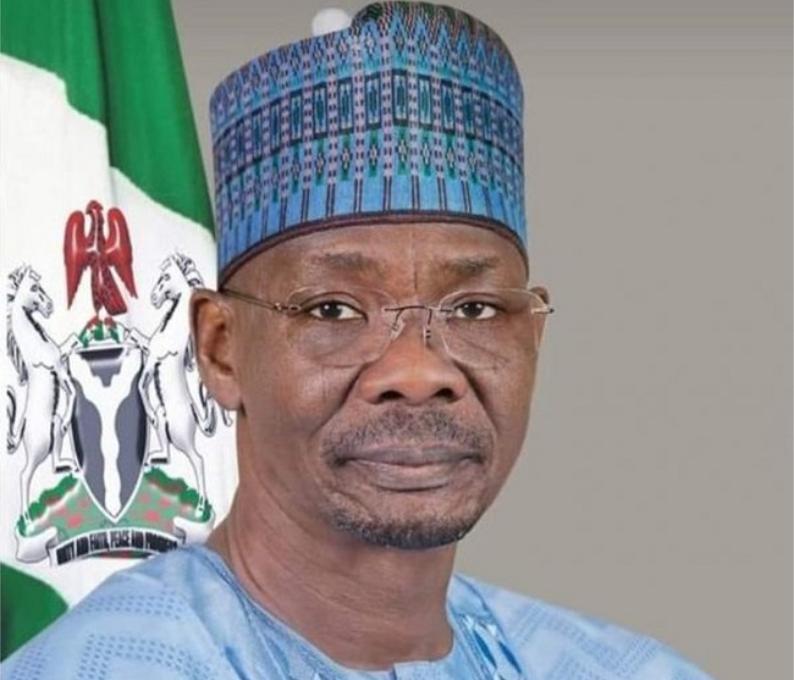

In a surprising turn of events on Wednesday, the Central Bank of Nigeria (CBN) dissolved the boards of three prominent commercial banks – Keystone, Polaris, and Union Bank. This move, although unanticipated, transpired despite the Central Bank’s recent endorsement of these banks’ financial soundness.

Governor Olayemi Cardoso, at his inaugural address during the Chartered Institute of Bankers of Nigeria (CIBN) annual dinner last year, had lauded Nigeria’s financial sector’s resilience in 2023.

Stress tests conducted on the banking industry indicated its strength under various economic scenarios. However, Cardoso highlighted the need for banks to reassess their responsible banking framework, a sentiment echoed by President Tinubu.President Tinubu’s evident discontent with the Godwin Emefiele-led CBN triggered a comprehensive review of the financial system. A special investigator, Jim Obazee, was appointed to conduct a forensic investigation into Emefiele’s tenure, with damning revelations emerging. Recent developments suggest the initiation of a full-blown financial system reform.

The CBN’s dissolution announcement and the subsequent appointment of new executives for the affected banks, including Yetunde Oni, Mannir U. Ringim, Hassan Imam, Chioma A. Mang, Lawal M. Omokayode, and Chris Onyeka Ofikulu, might mark the beginning of implementing the investigation’s recommendations – a significant cleanup of the financial sector.

Allegations surfaced during the investigation, suggesting non-cooperation from some bank executives and Emefiele’s questionable acquisitions through proxies and cronies. Cardoso may have secured presidential approval for the CBN’s decisive action.

The CBN cited various infractions by the banks, including regulatory non-compliance, corporate governance failures, and activities threatening financial stability. Despite the challenges, the CBN assured the public of depositors’ fund safety and its commitment to upholding a safe, sound, and robust financial system.

The Special Investigator’s report revealed documents pointing to Emefiele’s involvement in Titan Trust Bank and Union Banks’ acquisitions with ill-gotten wealth. The CBN’s swift replacement of the ousted chief executives received widespread commendation, especially from high-net-worth stakeholders aiming to avert a crisis of confidence within the affected banks.

Adewale Aderounmu, an industrialist, applauded the CBN for implementing effective policies under Olayemi Cardoso’s leadership, despite detractors’ actions against the Naira. Ayomide Deepak, an Abuja-based stockbroker, welcomed the action but emphasized the need for caution in handling revelations from the investigation to prevent further economic challenges.

As the CBN wields its regulatory hammer on these banks, the hope is that other bank executives and investors will learn valuable lessons for the sake of the economy. The CBN’s action is perceived as a strategic move aimed at revitalizing the economy and financial system, not a mere vendetta.

*Ademola Oyetunji writes from Ibadan.