FEATURES

Issues in Africa’s Rising Debt

Debt is part of human life and existence. Debt is also as old as man and so are defaulters.

Most of the time, debt is not a major problem, but sometimes it can become catastrophic.

According to the International Monetary Fund (IMF) database, there is only one country in the world that is debt-free.

That country is Macau Special Administrative Region (SAR) of greater China.Seven of the world’s big economies rank among the 20 countries with the highest external debts.

These are: United States (28.9 trillion dollars), Russia (280.1 billion dollars), United Kingdom (2 trillion pounds), France (3 trillion dollars), Germany (5.9 trillion euros), Japan (12.2 trillion dollars) and China (7 trillion dollars).African countries are not left out. Many of them are collecting loans from the World Bank, the IMF, China and other countries of the world to fund various development projects, but the trend has become a source of great concern among analysts.

The concern among the analysts is borne out of the increasing indebtedness of many countries in the continent.

They are quick to raise questions about the implications of this huge debt on the lives of Africans and future generations.

According to the Economic Times, Africa’s debt to China exceeded 140 billion dollars as at September 2021.

Meanwhile, the IMF estimates that additional financing of up to 285 billion dollars would be needed from 2021 to 2025 by African countries to step up their spending response to the coronavirus pandemic.

Foreign affairs experts say that while China’s role in global trade is highly publicised and politically polarising, its growing influence in international finance has remained more obscure, mostly due to lack of data.

Over the past two decades, China has become a major global lender, with outstanding claims now exceeding more than five per cent of global Gross Domestic Product (GDP).

According to the analysts, research, based on a comprehensive new data set, shows that China has extended more loans to developing countries than previously known.

This systematic underreporting of Chinese loans has created a “hidden debt” problem – meaning that debtor countries and international institutions alike do not have a complete picture of how much countries around the world owe to China and under which conditions.

In total, the Chinese state and its subsidiaries have lent about 1.5 trillion dollars in direct loans and trade credits to more than 150 countries around the world.

This has turned China into the world’s largest official creditor – surpassing traditional, official lenders such as the World Bank, the International Monetary Fund (IMF), or all creditor governments of the Organisation for Economic Cooperation and Development (OECD) combined.

According to the IMF, more than 20 low-income African countries are in debt distress or at risk of debt distress between September and December 2021.

The fund identified Mozambique, Somalia, Sudan and Zimbabwe as some of the countries that have had long track records of development distress and have had to continue to borrow and invest.

The debt of low- and middle-income countries in sub-Saharan Africa increased to a record 702 billion dollars in 2020, according to a new World Bank report released on Oct. 11, 2021.

This is the region’s highest debt in a decade.

In 2010, sub-Saharan Africa’s debt stood at around 305 billion dollars.

According to informed sources, since 2010, Chinese financial institutions have funded an average of 70 projects every year in Africa with an average value of 180 million dollars.

The resource guarantee infrastructure financing has been focused on minerals and hydrocarbon-rich African states including Zambia (copper), Kenya, Nigeria, Ghana, Angola, Algeria, Mozambique, Egypt, Sudan (oil & gas), South Africa and Tanzania (gold).

China currently is a leading bilateral lender in 32 African countries and the top lender to the continent as a whole.

In 2020, the African countries with the largest Chinese debt were Angola (25 billion dollars), Ethiopia (13.5 billion dollars), Zambia (7.4 billion dollars), the Republic of the Congo (7.3 billion dollars) and Sudan (6.4 billion dollars).

As at 2021, the total external public debt in West Africa amounted to around 164 billion U.S. dollars.

Nigeria and Ghana recorded the highest levels of debt in the region, at approximately 79.54 billion dollars and 21.91 billion dollars, respectively.

But the debts have been triggering repayment crisis. China owns around 72 per cent of Kenya’s external debt which stands at 50 billion dollars.

Over the next few years, Kenya is expected to pay 60 billion dollars to the China Exim Bank alone, sources informed.

Mombasa port could be lost if Kenya defaults on the loan re-payment, according to Kenya’s own auditor general.

The National Treasury Cabinet Secretary Ukur Yatani, denied that Kenya had offered the strategic national asset as collateral for the 3.2-billion-dollar loan sourced from the Export Import Bank of China (Exim China) to finance its Standard Gauge Railway (SGR) project.

Although he maintained that the government was servicing the SGR loans, concerns are mounting that runaway public debt could see Kenya default on its loan obligations, a risk that could expose the port to seizure by China.

In a report to parliament, the auditor general said that the assets of Kenya Ports Authority (KPA) and Kenya Railways Corporation (KRC) were used as collateral for the SGR loans.

In 2015, it was reported that there was widespread discontent in Angola because of oil repayment loans from China, leaving Angola with little crude oil to export.

The Ugandan government also had to postpone the construction of ‘Kampala-Entebee expressway after the political opposition raised concerns over the country’s rising debt profile.

In Djibouti, China has provided nearly 1.4 billion dollars which is 75 per cent of the country’s GDP, according to reports.

Between 2010 and 2015, Nigeria’s debt to China grew by 136 per cent from 1.4 billion to 3.3 billion dollars and the country had to spend 195 million dollars in 2020 as debt repayment to China.

Meanwhile, Credit rating agency, Agusto&Co, in its Economic Newsletter January 2022 edition said that Nigeria’s foreign debt could rise from about N15 trillion to N18 trillion if the Central Bank of Nigeria (CBN) devalued the naira at about 20 per cent.

The firm added that Nigeria has assumed a hawkish foreign exchange policy stance since 2015 and this has been elevated from 2020 to date.

“We project foreign debt could rise from about N15 trillion to N18 trillion if the CBN devalues at about 20 per cent.

“However, we note that the Federal Government’s borrowing stance creates a disincentive to review this hawkish foreign exchange policy stance,’’ the firm said.

Today in Nigeria, Socio-Economic Rights and Accountability Project (SERAP), a civil society organisation is demanding probe into the lending practices in the country and calling for a review of ‘sovereign guarantee clause’ in loan agreements with China.

Again, Nigeria has to repay 400 million dollars on a loan provided by China for the ‘Nigerian National Information and Communications Technology Infrastructure Phase – II Project,’ signed in 2018.

Former Chairman of the Senate Committee on Foreign and Local Loans, Sen. Shehu Sani said loans were indispensable in the 21st century economic development but “we should only borrow when it is necessary.

“It is impossible to say you want to develop your country without borrowing, but as a developing country, there is a need to prioritise borrowing.

“It was just a decade and a half ago that Obasanjo’s administration worked hard and gracefully freed Nigeria from the burden of debt and today, we have moved from zero debt to where we are today.

“Economic experts will always argue that we are within the threshold of a safety net, whereby we can still borrow, because we can pay.

“But if you continue to borrow there will be a time when you will not be able to pay.

“This is what is happening to Argentina; this is what is happening to Lebanon. We should borrow only when it is absolutely necessary.

“You want to borrow to build an airport, when you know very well that you can devise a mechanism, where the private sector can build an airport and you concession it to them and collect royalties from them later?

“You want to borrow to build a dam. But have you explored the possibility of foreign or local investors building a dam for electricity or for agricultural purposes and you go in to enter into a partnership with them?

“That is the question, we have what is called debt management Act, where conditions for borrowing are clearly stipulated.

“Before you borrow, we first want to know how much do you want to borrow. What you want to use the loan for, and what are your debt servicing plans?

“If you are heavily indebted and if you still want to borrow, you are strangulating the economy, the state, or the country?,’’ Shehu said.

He added: “Of less concern is the borrowing from China, it is easier to borrow from China than to borrow from the rest because when China lends you money, they will simply be expecting you to pay back.

“But when western institutions are to lend you money, they have to check your finances, financial discipline, stability of your government, impact of the project you are borrowing \for on the community.

“Sometimes they look into your human rights record. But ask yourself, how long will it take to service such loans and at what costs? Lebanon today is strangulated because of a 100-million-dollar loan it took.

Meanwhile, DMO’s Director-General, Mrs Patience Oniha has faulted the IMF report and a similar one by foremost Pan-African Credit Rating Agency, Agusto & Co.

She said that both reports failed to consider the challenges experienced by Nigeria in recent times.

“There were challenges such as two recessions, sharp drop in revenues and security challenges.

“Even more, the analyses do not acknowledge the improvements in infrastructure which have been achieved through borrowing, as well as, the strong measures by the government to boost revenues,” she said.

She reiterated the fact that the Federal Government was already implementing policies towards increasing revenues and developing infrastructure through Public Private Partnership arrangements, both of which will improve debt sustainability.

She noted that the Federal Government had active and regular engagements with the IMF on borrowing and debt management.

The DMO explained that the country’s total debt of 92.9 billion dollars, and a debt to Gross Domestic Product (GDP) ratio of 35.51 per cent were within sustainable limits.

The DMO clarified that Nigeria’s loans from China stood at 3.59 billion dollars (or 9.4 per cent) of the country’s total foreign debt stock.

It also clarified that the loans were largely concessional, as no national asset was tagged as collateral.

She explained that before foreign loans were contracted, very sensitive steps were taken by multiple institutions of government to ensure that they were beneficial to the nation.

“Before any foreign loan is contracted, including the issuance of Eurobond, they are approved by the Federal Executive Council and thereafter, the National Assembly.

“An important and extremely critical step is that the loan agreements are approved by the Federal Ministry of Justice.

“An opinion is issued by the Attorney-General of the Federation and Minister of Justice before the agreements are signed.

“Several measures which operate seamlessly have been put in place to ensure that data on debt are available and that debt is serviced as at when due. Provisions are made explicitly for debt service in the annual budgets,’’ she said.

Meanwhile, China’s Foreign Minister Wang Yi has rejected allegations that Beijing was luring African countries into debt traps by offering them massive loans, dismissing the idea as a “narrative” pushed by opponents to poverty reduction.

Wang who spoke ahead of tour of Beijing funded projects in Kenya in January, said China’s considerable lending to Africa was “mutually benefiting” and not a strategy to extract diplomatic and commercial concessions.

“That is simply not a fact. It is speculation being played out by some with ulterior motives,” he told reporters in the Kenyan port city of Mombasa.

“This is a narrative that has been created by those who do not want to see development in Africa.

“If there is any trap, it is about poverty and underdevelopment,” the minister who spoke through an interpreter stressed.

Available records showed that at least 18 African countries have been re-negotiating their debts, while 12 others are in talks with China for restricting an approximate 28-billion-dollar loans.

Emmanuel Yashim

News Agency of Nigeria (NAN)

FEATURES

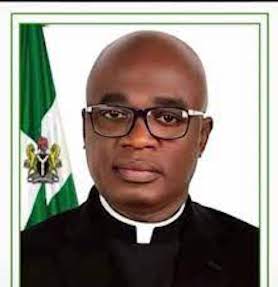

Doctor Mark Ogbodo: A Man Destined for Success

By Paul Ugah

Henry Miller once said, “Every man has his own destiny, the only imperative is to follow it, to accept it, no matter where it leads him.”Doctor Mark Ogbodo followed his destiny from the beginning as a leader and an achiever. His leadership qualities blossomed at his tender age, that was why he was identified and made the compound prefect at Holy Family Primary school, Kanshio, Makurdi in 1994.

In the words of an American writer, Casey Stengol, “There are three kinds of people, those who make things happen, those who watch things happen, and those who ask, what happened?” Doctor Mark Ogbodo obviously belongs to the first group in Stengol’s classification. Humble and unassuming, Doctor Ogbodo is a man of integrity, discipline, focus and composure. His mien is a delight.Indeed, the Medical Doctor cum creative writer has endeared himself to his colleagues and people of good minds across the country as a man who makes things happen positively.Though he is not among the richest people in the country but the little he has he always uses it to touch lives across diverse tribes. He also demonstrated this through commitment to community and nation building by organizing several free medical outreaches in the rural areas, sponsoring literary competitions for schools and building of a standard health centre at the rural area to provide good healthcare services at the grassroot.Today Doctor Ogbodo, the Chief Medical Director of Lydia Memorial Hospital, Ugbokolo, has become a celebrity in the medical field and educational sector because of his contributions to the development of the sectors in the country.According to Allen Fred, “a celebrity is a person who works hard all his life to become known”Francis Bacon corroborated the above fact when he rightly asserted that, “fame is like a river that beareth up things light and swollen and drown things weighty and solid”. Little wonder, Longfellow posits, “the heights great men reached and kept were not attained by sudden flight but while their companions slept, they were toiling upward in the night.”In fact, beside Doctor Ogbodo’s hard-work over the years, his life seemed to be destined for success and greatness.This may be the reason why he is succeeding in all his endeavours.Like Doctor Wole Okediran, a Medical Practitioner turned Literary giant, Doctor Ogbodo, aside from his exploits in the medical field, has written creative books that have been recommended for students in secondary schools and other levels of education by the Ministry of Education and Knowledge management and Nigerian Educational Research and Development Council.The works include The Journey- A Flight to Greatness After a Long Walk CA Novel, 2017, Amour Matenel (Novella, 2021), and Untold Novella, 2023.Doctor Ogbodo hails from Obi Local Government Area of Benue State.He started his early education at Holy Family Primary School, Kanshio, Makurdi, Benue State and proceeded to Unique Secondary School in New GRA, Makurdi and got admission into Igbinedion University Okada, Edo state, where he obtained a Bachelor of Medicine and Bachelor of surgery (MBBS).Apart from his natural leadership endowment, the Chief Medical Director, Lydia Memorial Hospital, acquired other numerous training which include certification in leadership and management in Health, University of Washington which made him a leader with difference, Certificate of Achievement by British Council: Ideas for a Better World, Leading Change through Policy Making among others.Some of the positions of responsibilities held by Doctor Ogbodo from past to present includes; Secretary, Fellowship of Christians Students, Unique Secondary School, Makurdi: 2002 to 2003, Secretary Lay Reader Association, STAMS Makurdi: 2003 to 2021, Pioneer Headboy, Unique Secondary School, Makurdi; 2004, Editor-In-Chief (Disciplinary head), Igbinedion University Press Club: 2009 to 2010, Secretary, Federation of Catholic Medical and Dental Students, Igbinedion University, Okada: 2013-2015, National President, Unique Secondary School Old Students Association: 2006-2017, Focal Doctor, Yellow Fever (under NCDC), Ogbadibo LGA: 2020, Assistant Secretary Association of Nigeria Authors, Benue State Chapter: 2021-2022, Secretary, Association of Nigeria Authors, Benue State Chapter: 2022 to 2024.Others are Public Relations Officer, Nigerian Medical Association, Benue State Branch: 2022 till date, Chairman Publication Committee, NMA Benue: 2022 till date, Ambassador National Association of Polytechnic Students: 2023 till date, Ambassador, Federal University of Health Sciences Otukpo: 2024, and Medical Director, Lydia Memorial Hospital, Benue State: 2022 till date.Business Analysis

A Peep Into Dangote’s Refinery, The World’s Engineering Wonder

By Cletus Akwaya

Call it Dangote Republic and you would not be wrong, for that is what it means in real sense.

The ultra-modern Dangote Refinery and Petrochemical complex located at the Lekki Free Trade Zone in Lagos is the World’s Engineering wonder.

A guided tour for top Media executives in the country by the President, Dangote Industries Group himself, Alhaji Aliko Dangote on July 14, provided a rare privilege and opportunity to appreciate the project that has emerged as the World’s largest single train petroleum refinery.

Dangote, the Kano-born business mogul and Africa’s richest man, whose vision for the industrial transformation of Nigeria led to the initiation of this project is certainly a fulfilled person, having accomplished such a gargantuan task in the spelt of just about 10 years.

The refinery, which is built and equipped with the latest technology in the industry. It is a behemoth sitting on a huge land space of 2, 735 hectares, approximately seven times, the size of Victoria Island, the octane section of Lagos, which has become the abode for the very rich in the nation’s commercial nerve – centre over the decades.

The land was provided by the Lagos state government after the payment of $100million dollars by the Dangote Group as cost of the land.

The edifice didn’t come easy as the engineers had to reclaim 65million cubic metres of sand through dredging of the Atlantic coastline to pave way for the construction of the refinery and its accompanying facilities especially the Jetty.

The Dangote refinery is not a stand-alone project as it has a coterie of associated industries and infrastructure making it a self-reliant complex.

For instance, the company has a fully developed port (jetty)for maritime operations for both in-take of crude and discharge of refined products. This perfectly compliments the huge pipeline network that lands into the Atlantic for intake of crude and loading of refined products to ships. Its Jetty, which stretches 9KM into the international waters in the Atlantic Ocean and 12.5 KM from the refinery is perhaps one of the most modern in the world built with sand piles that shield the final landing points from the violent oceanic waves, thus providing for safety and stability of ships, barges and oil tankers.

The complex is accessed by 200KM network of concrete under-lay and well asphalted road network to ease vehicular traffic. The refinery has its dedicated steam and power generation system with standby units to adequately support operations of the various plants in the complex.

It has successfully completed a 435 MW power generating plant for its operations. The power generated from this plant surpasses the entire distribution capacity of Ibadan Electricity Distribution company, which supplies electricity to five states of the Federation including Oyo, Osun, Ondo, Ekiti and Kwara.

The Dangote refinery with a capacity of 650,000 bpd of crude oil is designed to handle the crude from many of the African countries, the Middle East and the US light crude. Its petrochemical plant is designed to produce 77 different high-performance grades of polypropylene, which is the major raw material for numerous industries and other refineries. With a huge refining capacity, Alhaji Dangote said the products from the refinery company would easily meet 100 per cent the needs of Nigeria’s demand for gasoline, diesel, Petrol and Aviation Jet with 56 per cent surplus for export, from which the company projects to earn a princely $25billion per annum from 2025.

The company has facility to load 2,900 trucks with its various products in a day by land and millions of litres of products through the waters depending on where the orders come from. The $25million projected revenue in 2025 could translate to a huge relieve for the nation in dire need of foreign earnings to shore-up the value of the nation’s currency.

The associated industry, the Dangote Fertilizers Limited also situated in the complex utilises the raw materials from petrochemicals to produce different varieties of fertilzers especially Urea, NPK and Amonia grades of fertilizers. Apart from the local market, Dangote is already exporting its fertilizers to other countries including Mexico, a testament to its high quality that meets world standards.

This feta, the President of Dangote industries explained was possible because of the high quality, the company has opted to pursue. In between the refinery and the fertilizers complex lies a 50,000 housing estate, which provided accommodation for the construction workers at the time of construction especially during the COVID-19 lockdowns of 2020, when workers remained encamped on the project site to continue with the work.

What stands out the Dangote Refinery is perhaps not in its sheer size and capacity but in the fact that it is perhaps the only of such projects whose Engineering, Procurement and construction(EPC) was done directly by the company without engaging the world renowned refinery constriction companies like Technip Bechtel (USA)Technip (France)Aker Solutions (Norway)Chiyoda Corporation (Japan)SNC-Lavalin Group (Canada)J. Ray McDermott (USA)JGC Corporation (Japan)Hyundai Heavy Industries (South Korea)Foster Wheeler (USA) and Daelim Industrial Company (South Korea)

“The design of the refinery was handled by dozens of Engineers and technical experts assembled in India and Houston, Texas, USA to execute engineering designs of the refinery,” said Edwin Kumar, the Executive vice President, Oil and Gas for the Dangote Group who midwifed the birth of the refinery complex.

“We didn’t give out contracts to anybody, we bought every single bolt and equipment ourselves and had it shipped into the country,” Dangote explained to his guests.

Part of the equipment imported into the country was the procurement of over 3,000 cranes to handle the evacuation of huge consignments of machinery from the wharf and for subsequent installation at the construction site. The cranes have become an unusual assemblage of such equipment to be found in one place on the African continent.

If there was any doubt that Alhaji Aliko Dangote is Africa’s richest man, the successful completion of the refinery and petrochemical complex at the cost of about $20billion has further confirmed his status as Africa’s leading businessman and entrepreneur.

However, Dangote does not really accept that he is the richest man on the continent,

“When you are rich, you accumulate cash, but when you wealthy, you create wealth” he told the top Media executives on tour of the huge project, explaining that he would rather prefer to be referred to as a “Wealthy man.”

And consistent with his business philosophy, Dangote hinted of plans to list the refinery on the Nation’s stock exchange by the first quarter of 2025. His vision is to avail the public of 20 per cent of the shares so as to ensure participation by Nigerians and even international portfolio investors.

The refinery company and the entire of Dangote Group at the moment provides direct employment to about 20,000 Nigerians and much indirect jobs to Nigerians, making it the highest employer of labour outside the government.

Most interestingly, the highly technical operations of Dangote refinery is operated by over 70 per cent of local manpower who work in the refinery control, centre, the numerous production and quality control laboratories among others. Some of the staff who explained their tasks to the visiting media executives said they were graduates of Engineering and allied disciplines recruited mostly from Nigerian universities and trained in various institutions abroad for periods ranging from sixth months – one year to master refinery operations. Through this strategy, Dangote has ensured transfer of technology to thousands of Nigerian youths.

“We don’t know where they come from as long as they are Nigerians and if they decide to leave and join international oil companies for better job opportunities, we have no problem with that,” Dangote responded to a question on the strategy to retain the technical manpower for stability of the refinery’s operations.

The Dangote Refinery is a Republic of some kind, at least an economic or industrial Republic.

But the man who presides over this ‘industrial empire’, Alhaji Dangote says his only ambition is to boot the nation’s economy and ensure netter life for Nigerians.

“When you import any product into Nigeria, you are importing poverty and exporting our jobs to those countries from where you are importing” Dangote said adding “this is why I want economic nationalism in Nigeria.”

Dangote’s vision even goes beyond Nigeria as he has cement factories and other business concerns in about 13 African countries including Ghana, Ethiopia, Tanzania, Uganda, etc. This signifies his continent-wide dream to transform Africa’s economies.

There has been attempts by some international oil companies to frustrate the successful take-off of the refinery, through over pricing and in some instances outright denial of crude supplies for processing. This made Dangote to commence importation of crude from the US. However, the cheering news that the Nigerian National Petroleum Company Limited (NNPC) has finally approved a supply arrangement has raised hopes that full operations will commence and that the long-awaited Dangote oil products will reach consumers around the country from August.

At last, the Dangote Group may have achieved its objective to serve as the elixir to Nigeria’s industrialisation effort. This is perhaps the greatest legacy of Africa’s richest man to his country of birth.

FEATURES

Benue: Turning Trash to Economic Boom

By Bridget Tikyaa

Amidst challenges of unemployment and environmental degradation, the Benue State Government is taking new initiatives to not only create jobs but also provide comprehensive sustainable solutions to the threats posed to public health and the environment by the huge quantum of waste across the state.

The innovative solutions are part of a deliberate policy of the government to turn trash to wealth and generate a boom for the economy.

The government began by setting up an agency to drive the initiatives. The Bureau of Entrepreneurship and Wealth Creation, which has Benita Shuluwa as pioneer Director General, has the mandate to initiate, develop, and execute wealth creation initiatives in alignment with the state government’s vision across the entire value chain, in collaboration with relevant government agencies, and promote innovative entrepreneurship programmes by forging partnership with the organised private sector, potential investors and technology hubs.

The Bureau is also to compile data and statistics related to employment and wealth creation, establish job registration centers and skills acquisition and capacity building programmes to advance entrepreneurship.

Its mandate also include: accelerating intergovernmental cooperation on business development, ensuring ease of doing business and developing inclusive and sustainable partnerships with Community Based Organizations, the Legislature, Development Partners, Organised Private Sector, Central Bank of Nigeria, Bank of Industry, Nigerian Investment Promotion Commission, among others.

The government was also well intentional as it mandated the Bureau to support indigenous innovative and skilled individuals and groups to stimulate the innovation ecosystem.

Thus, one key step taken to realise this dream was the partnership agreement signed by the government with Sector Lead Limited to execute a comprehensive Waste-to-Wealth Project in the state. It is a move that will make trash from households useful, an economic treasure and a source of providing massive employment.

According to Shuluwa, the partnership will bring in more than $194 million to be spent over the coming years on enhancing environmental sustainability, creating jobs, boosting revenue, and generating 35MW electricity, biofertilizer and biogas among other derivatives.

In addition to these derivatives, the project will enable the government to be issuing Carbon Credit, reclaim and vegetate dump sites and landfills for agricultural and infrastructural gains.

No doubt, the Waste-to-Wealth project is a legacy project that will boost the economy of Benue state by turning trash into wealth thereby creating an economic boom for many residents.

The partnership is in continuation of the decisive interventions made by the government in streamlining the mining sector and its degenerative effect on the environment.

The government through the entrepreneurship Bureau began by restructuring the mining sector to derive maximum benefit from the vast mineral deposits being tapped by registered and illegal miners across the state.

It also collaborated with the Federal Ministry of Interior through the Nigerian Fire Extinguisher Scheme (NFES) to employ 1,450 with a prospect of employing up to 10,000 youth across the state, a move that has reduced unemployment.

Also important to note is the rehabilitation of ICT hubs and tailoring workshops at BENCEDI Skills Acquisition Centre to provide youth in the state with appropriate training to effortlessly key into the 21st century digital economy.

The administration of Governor Alia is no doubt pushing the boundaries, taking bold and decisive steps to make a huge difference by streamlining the Benue economy for the benefit of all, thereby advancing the state’s GDP to the top of the chart from the current 12th position in the country.

Bridget Tikyaa is the Principal Special Adviser to the Governor on Media, Publicity/Communications Strategy.