COVER

NASS Approves N10.594trn 2020 Budget

By Orkula Shaagee & Jude Opara, Abuja

The National Assembly yesterday passed N10.594 trillion as the 2020 budget.

The two chambers, the Senate and House of Representatives passed the budget at their various sittings yesterday.

The approved budget is however higher than the N10.

33 trillion presented by President Muhammadu Buhari to the joint session of the National Assembly on October 8, 2019.In the Senate, the passage of the budget followed the adoption of the report of its Committee on Appropriations at plenary.

Presenting the report, the chairman of the panel, Senator Barau Jibrin, said the increase of N264 billion allowed for interventions in critical areas such as national security, road infrastructure mines and steel development, health among others.

Jibrin said the statutory transfer stood at N560.5bn, Recurrent Expenditure-N4.8trn, Capital Expenditure-N2.5trn, Debt Servicing-N2.7trn, Fiscal Deficit-N2.3trn and Deficit to GDP of 1.52 per cent.

He said the daily oil production stood at 2.18m barrels per day, oil benchmark was increased from $55 to $57 per barrel proposed by the Executive, while the exchange rate remained N305 per dollar.

Similarly, the House of Representatives, also adopted the report of its committee on Appropriations presented by the Chairman,

The House had on Wednesday received the final report of the budget from the Appropriation Committee.

The aggregate of the newly passed budget was upped to ₦10.594 trillion, from the ₦10.3 trillion presented to the National Assembly by President Muhammadu Buhari on October 8.

The National Assembly also had a jerk in its budget to ₦128 billion from the proposition of ₦125 billion by the president.

Of the approved budget, ₦560 billion was earmarked for statutory transfers, a special category of fund which the federal government is mandated to release after receiving revenues, before other considerations. The National Assembly, INEC, National Human Rights Commission, and Basic Health Care Fund fall in this category. Others are NJC, NDDC, NEDC, UBEC, and the Public Complaints Commission.

Also, ₦2.7 trillion would be used to service debt in 2020.

In like manner, ₦4.8 trillion is to cater for recurrent (non-debt) expenditure while capital expenditure stands at ₦2.465 trillion.

Recurrent Expenditure is to gulp ₦4,842,974,600,640; the Capital Expenditure takes ₦2,465,418,006,955; while the Statutory Transfers is ₦560,470,827,235.

Debt Service has ₦2,725,498,930,000 and Aggregate Expenditure ₦10,594,362,364,830.

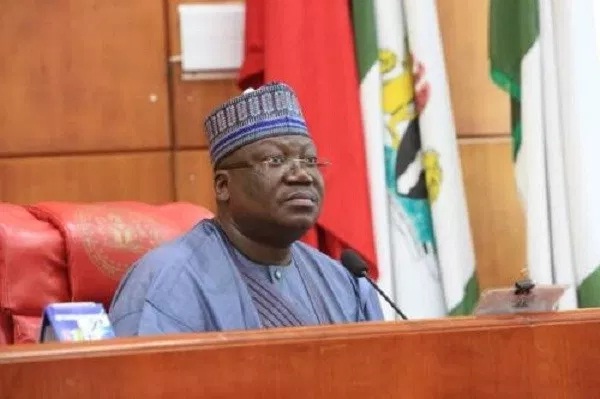

“I hope we continue to work together as colleagues to ensure the 2020 budget is fully implemented,” said Senate President Ahmed Lawan after passing the budget.

Lawmakers increased the budget from the 10.33 trillion-naira spending plan that Buhari presented them in October. The president must agree to the revised plan before signing it into law.

Before the passed bill becomes law, the president has to assent to it.

COVER

Airports: Tinubu Seeks N24.6bn to Reimburse Nasarawa, Kebbi

By Lubem Myaornyi, Abuja

President Bola Tinubu has written to the House of Representatives seeking the preparations and approval of a N24.6 billion Promissory Notes to reimburse Nasarawa and Kebbi States on the costs of their Airports taken over by the Federal Government.

Nasarawa is to be reimbursed N9.5 billion while Kebbi is to be reimbursed to the tune of N15.

1 billion.In the letter read by the Deputy Speaker, Benjamin Kalu, who presided over the Plenary on Thursday, the President said, the takeover of the airports was in line with Item 3 of the Second Schedule of the 1999 Constitution (as amended) which placed the ownership of Airports and other Aviation related infrastructure in the exclusive list.

Similarly, the President in a separate letter presented an Executive Bill, the National Anti-Doping Bill 2024 for the House consideration.

The President said the bill seeks the creation of an agency for Nigeria to achieve world standards and codes on Doping by signatories to the international regulations.

He urged the House to give the Bill a speedy consideration before the commencement of the Olympic Games coming up later in July.

In another letter, the President sought the approval of a supplementary budget for the Federal Capital Territory (FCT) for the 2023 fiscal year.

Tinubu Transmits Bill on Sports Performance Enhancement Drug to Senate

Meanwhile, President Bola Tinubu has forwarded a bill to the Senate seeking to prohibit Nigerian athletes from consuming substances that enhance performance during or after competitions.

The president’s request was contained in a letter read by the Deputy Senate President, Barau Jibrin, who presided over the plenary on Thursday.

The bill titled “National Anti-Doping Bill 2024”, if passed, will regulate substances that can be consumed by athletes during sporting events.

In the letter, Tinubu said the bill would provide a legal framework for the establishment of the National Anti-Doping Organisation to regulate sporting competitions.

He explained that the establishment of the agency was a requirement for Nigeria to achieve compliance with the World Anti-Doping Code.

The World Anti-Doping Code (Code) is the core document that harmonises anti-doping policies, rules and regulations within sports organisations and among public authorities around the world.

Tinubu noted that the law will help Nigeria avoid the imposition of signatory consequences and the inclusion of laws of hosting and participating rights at regional, continental and world championships or major athletic events.

“In accordance with the provisions of section 58 (2) of the Constitution of the Federal Republic of Nigeria, 1999, as amended, I forward herewith the National Anti-Doping Bill 2024 for the kind consideration of the Senate.

“The National Anti-Doping Bill 2024 seeks to create an administratively independent National Anti-Doping organisation, which is a cardinal requirement for Nigeria to achieve compliance with the World Anti-Doping Code and the international standard for code compliance by signatures.

The enactment of this vital legislation will also help Nigeria avoid the imposition of signatory consequences, the inclusion of laws of hosting and participating rights at regional, continental and world championships or major athletic events”, Mr Tinubu added.

The president, however, urged the lawmakers to consider the bill before the Olympic Games seminar scheduled to be held in Paris in July for Nigerians to be part of the competition.

“It is my hope that this submission will receive the humankind expeditious consideration of the distinguished members of the Senate of the Federal Nigeria for passage of the same to law before the Olympic Games seminar in Paris in July 2024.

“Please accept, distinguished president, the assurances of our highest consideration. Regards.”

COVER

Medical Tourism: Senate Mulls Health Infrastructure Development Agency

The Senate at the plenary on Thursday passed through second reading, a Bill seeking for an Act to establish the Health Infrastructure Development Agency to provide a comprehensive framework to guide the planning, financing, construction, maintenance, and regulation of healthcare infrastructure in Nigeria.

The proposed legislation titled; “Bill for an Act to establish Health Infrastructure Development Agency,” was sponsored by the Minority Whip, Senator Osita Ngwu.

Leading the debate on its general principles, Ngwu who represents Enugu West senatorial district explained that the bill seeks to promote development and improvement of healthcare infrastructure so as to enhance healthcare access, quality, and delivery across the country.

He further explained that it seeks to strengthen the healthcare system by focusing on the modernization of healthcare facilities by leveraging public-private partnerships for sustainable infrastructure development.

The lawmaker lamented that the Nigerian healthcare industry faces challenges associated with outbound medical tourism, inadequate medical personnel and deteriorating medical infrastructure.

Making reference to a report by the International Trade Administration, which stated that Nigeria is still underdeveloped, lacks modern medical facilities and its healthcare indicators were some of the worst in Africa, Ngwu recalled that to reverse the trend, the government approved the second National Strategic Health Development Plan (2018-2020).

He pointed out that part of the objective of the plan was to improve availability and functionality of health infrastructure required to optimize service delivery at all levels, saying that it’s against this background that this Bill is proposed.

The lawmaker added that the Bill was a bold attempt at not only reversing the medical tourism of Nigerians to other countries, but also seeks to make Nigeria a medical destination hub within the shortest possible time.

“Healthcare infrastructure constitutes a major component of the structural quality of a health system. It is a key pillar that supports the aim of promoting improved standard of medical care and wellbeing. The Bill outlines the responsibilities and powers of a Board, emphasizes collaboration and coordination among stakeholders, and provides for the issuance of regulations and guidelines to support effective implementation of its objectives.

“The Bill proposes the establishment of an Agency to administer the framework for policy direction, standards, guidelines, efficient construction processes, and quality control measures. The Agency would also ensure that healthcare facilities are designed, constructed, and maintained to meet the highest standards and support the delivery of quality healthcare services.

“The Bill emphasizes the importance of rural healthcare access and outlines strategies for addressing healthcare disparities in rural areas. By implementing these strategies, Nigeria can enhance healthcare access and delivery in rural communities, improving health outcomes and reducing disparities. Provision is also made to accommodate the importance of public-private partnerships (PPPs) and the types of PPP models that can be employed. By implementing these guidelines, Nigeria can effectively leverage the expertise and resources of the private sector to improve healthcare access, affordability, and quality,” Ngwu said.

Thereafter the Bill was put to a voice vote by the President of the Senate; Godswill Akpabio who presided over the session and it was passed and referred to the Committee on Health Institutions.

Senate Passes North West Development Commission Establishment Bill

Similarly, the Senate on Thursday passed the North West Development Commission (NWDC) establishment bill, to address challenges facing the seven states in the zone.

This followed the adoption of the report of the Senate Committee on Special Duties, on the NWDC (Establishment) at Thursday’s plenary.

Presenting the report, the Chairman of the Committee, Sen. Shehu Kaka from Borno State said the purpose of the bill was well structured and strategically streamlined, for the socio-economic development of the North West zone of the country.

He added that the commission’s establishment would bring the federal government closer to the north western states, and meet the yearnings and aspirations of the people.

Kaka, therefore, urged the Senate to pass the bill.

The lawmakers unanimously passed the bill when it was put to a voice vote by the deputy senate president, Barau Jibrin who presided over the plenary.

In his remarks, Barau commended his colleagues for supporting the bill’s passage.

He said the commission would address the challenges, facing the zone and, by extension, the country.

Describing the North West as the food basket of the country, he said the commission would also work toward the restoration of infrastructure, destroyed by Boko Haram insurgents and bandits in the zone.

“So if we are serious about ensuring we have food, and for food security to be attained in this country, we must provide the necessary infrastructure for all our key sectors to thrive well.

“This commission is needed. I commend you all for supporting this; no one said no. Everybody supported this idea. So, now we are pushing the Bill to the House of Representatives for their approval and then, to Mr President for assent,” he said.

COVER

Herdsmen Kill Pregnant Woman, 10 Others in Benue

From Attah Ede, Makurdi

Suspected armed herdsmen again reportedly killed a pregnant woman, 10 other persons during attack on Akilo community in Usha council ward in Agatu West of Agatu Local Government Area (LGA) of Benue State.

It was gathered that the victims were killed in their homes by the marauders who invaded the community at about 3:30pm on Sunday.

The caretaker chairman of Agatu LGA, Mr.

Yakubu Ochepo, who confirmed the killings, said that “11 people were killed. ”Ochepo said of the number of deaths recorded, seven corpses have been recovered.

According to him, A pregnant woman corpse, an elderly man and that of five youths have been recovered, adding that the community members were able to achieve this through the aid of soldiers and Air force personnel deployed to the area.

“Soldiers and Air Force went there yesterday (Sunday), to recover the corpses. There were gunshots and they were running away only to regroup again.

“I’m in Makurdi now to report to Operations Whirl Stroke. We need more hands. We hear they captured some alive and threw some into the river but we are still waiting for more reports from the area.

“We have not been able to recover the remaining four corpses yet,” he explained.

Ochepo appealed to both the state and Federal Governments to take drastic action towards ending the carnage by deploying more security personnel to Agatu to check the activities of the killer herdsmen in the LGA.

When contacted, the Benue State Command Police Public Relations Officer, Catherine Anene said she was yet to get information about the fresh attack in Agatu.

It would be recalled that three farmers were reportedly killed by gunmen suspected to be herdsmen at Ogbaulu community in Agatu LGA.

The victims were working on their farms when the herders came to slaughter them.

Similarly, on April 9, 15 persons were killed after suspected herders attacked same Ogbaulu community.

It was gathered that the attackers conducted relentless attacks on the area for two weeks, invading all the villages the area.

The Chairman of Agatu listed some of the communities currently under siege by armed herders in Agatu LGA as: Olegomakwu, Onahe, Ocholonya, Okokolo, Ugboju, Olegobidu, Odugbeho, Odejo, Ogbaulu, Imwenyi, Adana, Ologba-Gishu, Iwarri, Ejima-gope, Ejima-gochi, Ikpele and Okpokpolo.