Oil & Gas

NNPC, JVPs Sign Gas Supply Agreements on NLNG Train 7, Others

The Nigeria National Petroleum Petroleum Corporation (NNPC) and its joint Venture (JV) partners have signed the first basic 20-year term of Gas Supply Agreements (GSAs) for the NLNG Train 7.

They also signed 10-year term of GSAs for Trains 1, 2 and 3.

The JV partners are Shell Petroleum Development Company of Nigeria (SPDC), Total Exploration and Production Nigeria (TEPNG), Nigerian Agip Oil company Limited (NAOC) and Oando PLC.

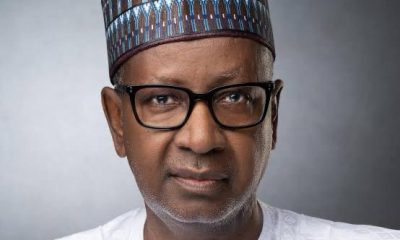

The Group Managing Director of NNPC, Malam Mele Kyari, said that the agreement signalled commitment of all to the gas project in the country.

He said the GSAs bring NLNG closer to taking Final Investment Decision (FID) which signalled the commencement of the project.

He said that with the agreement, the FID on train seven would be taken latest Dec. 20.

“The Train 7 project will ramp up NLNG’s production capacity from 22 Million Tonnes Per Annum (MTPA) to around 30 MTPA.

“The project will form part of the investment of over19 billion dollars including the upstream scope of the NLNG value chain, thereby boosting the much needed FID profile of Nigeria.

“The project is anticipated to create over 10,000 new jobs during its construction phase and on completion help to further mop more gas that would have been flared and diversify the revenue portfolio of Nigeria,” he said.

The Managing Director of Shell, Mr Osagie Okunbor, said that delivering gas to train 7 was an important part of the project.

He said Nigeria at this point should not be talking about train 7 but should be looking at train eight to train 12.

“But what we have done here today is very significant and we believe that more will be done in the future,” he said

Also, Patrick Olima of Total assured that the company would be committed to the supply of gas as signed in the agreement.

“We are committed in doing business in Nigeria just like we have done with Egina FPSO, we will do same with this project,” he said.

Mr Wale Tinubu, Managing Director of Oando, reiterated that his company would be committed to the agreement.

“We are happy to be part of this process,” he said.

In his remarks, Mr Tony Attah, the Managing Director of NLNG, said that signing of the agreement was a great moment for the NLNG.

He said that with FID on train 7, Nigeria was moving in the right direction.

“What we have done today is among the top three things needed before the FID is taken; without this, financiers will not come for train 7.

“We are happy with the commitment of the partners that have signed this agreement today; this agreement will further consolidate our relationship.

“We need to move fast as a country to maintain a strong position in the global space.

“Nigeria at this stage should not be talking only about train 7 but we should be talking about Train 12,” he said.

He added that with full implementation of the GSA would spur NLNG to build more trains.(NAN)

Oil & Gas

PETROAN says Dangote Fuel Plan Threatens Downstream

Petroleum Products Retail Outlets Owners Association of Nigeria (PETROAN) on Monday raised alarm over the plan by Dangote Refinery to start direct nationwide distribution of petrol and diesel.

In a statement issued on Monday, PETROAN spokesperson, Mr Joseph Obele, said the move by Dangote could have consequences on the country’s downstream sector,

According to him, such consequences include widespread job losses and the shutdown of small businesses.

On June 15, Dangote Refinery disclosed its plan to distribute petrol and diesel directly to consumers across Nigeria.

Reacting to this development, PETROAN National President, Dr Billy Gillis-Harry, warned that such strategy could create a monopolistic market structure, stifling competition and threatening thousands of livelihoods in the sector.

“With a production capacity of 650,000 barrels per day, Dangote Refinery should be positioning itself to compete with global refiners rather than engaging in direct distribution within Nigeria’s downstream sector,” Gillis-Harry said.

He stated that this move undermines the survival of independent marketers, truck owners, filling station operators, and modular refinery operators who rely on the existing supply chain structure.

Gillis-Harry noted that Dangote’s dominance could lead to higher fuel prices due to reduced competition and business closures across the fuel retail landscape.

The president said that the situation could also lead to massive job losses among truck drivers, petroleum product suppliers, and station operators

He cautioned that the introduction of 4,000 new Compressed Natural Gas (CNG)-powered tankers by Dangote, which might lower transportation costs, could pose a threat to the jobs of traditional tanker drivers and owners.

“Filling station operators, truck owners, telecom diesel suppliers, and modular refineries are all at risk.

“Dangote’s approach could trigger a pricing penetration strategy aimed at capturing market share and forcing competitors out of the market,” Gillis-Harry added

The PETROAN boss said that Dangote’s market influence might allow for price setting that could disadvantage consumers, noting similar patterns in other industries where the conglomerate operates.

Gillis-Harry, therefore, urged the Executive Director of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) and the Minister of State for Petroleum Resources to urgently introduce price control mechanisms and enforce fair competition policies.

“Competition must be protected and encouraged to safeguard consumers, preserve jobs, and maintain a healthy petroleum distribution ecosystem,” he stressed. (NAN)

Oil & Gas

NNPC Ltd. Records N5.8bn revenue, N748bn PAT in April

The Nigerian National Petroleum Company Limited (NNPC Ltd.) has announced a revenue of N5.89 billion and a Profit After Tax (PAT) of N748 billion for the month of April.

The NNPC Ltd. disclosed this in its Monthly Report Summary for April, released on Thursday.

The report highlights key statistics, including crude oil and condensate production, natural gas output, revenue, profit after tax and strategic initiatives during the period.

The report said that NNPC Ltd made statutory payments of N4.

22 billion between January and March.According to the report, crude oil and gas figures are provisional and reflect only NNPC Limited’s data.

It said that It excluded volumes of independent operators reported by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

“Crude oil and condensate production averaged 1.606 million barrels per day (bpd) in April, while natural gas production was 7.354 million standard cubic feet daily.

“Petrol availability at the NNPC Ltd. retail stations recorded 54 per cent during the month under review, while upstream pipeline reliability was 97 per cent,” it said.

On its strategic efforts, it said that the company was collaborating with Venture Partners to accelerate Sustainable Production Enhancement.

It said that it completed the implementation of relevant presidential directives and Executive Orders for its upstream operations.

The report listed some Technical Interventions on Ajaokuta-Kaduna-Kano (AKK) pipeline and the Obiafu-Obrikom-Oben (OB3) gas pipelin to resolve challenges of River Niger crossings.

It said that the OB3 gas pipeline project was 95 per cent completed in the month, while the AKK pipeline was 70 per cent completed.

The report said that Turnaround Maintenance (TAM) was completed in several Oil Mining Leases (OML), including OML 18, OML 58, OML 118, and OML 133.

On Refineries Status, it said that the Port Harcourt Refinery Company (PHRC), as well as the Warri and Kaduna refineries were currently under review.

According to the report, all financial figures are provisional and unaudited, and all operational and financial data are for April unless indicated otherwise. (NAN)

Oil & Gas

NNPC Ltd. Disclaims Fake Financial Scheme

The Nigerian National Petroleum Company Limited (NNPC Ltd.) has disowned a fake AI-generated video circulating on social media featuring a cloned voice of the Group CEO, Mr Bayo Ojulari, promoting a fictitious poverty alleviation scheme.

The Chief Corporate Communications Officer, NNPC Ltd.

, Olufemi Soneye in a statement on Thursday clarified that the company had no such investment initiative.Soneye urged the public to disregard the video, originally shared by an account named Mensageiro de Cristo on Facebook.

“NNPC Ltd. has warned the perpetrators to cease their fraudulent actions or face legal consequences,” he said. (NAN)