BUSINESS

Remove VAT on Diesel to Curtail Price Hike, MAN Tells FG

The Manufacturers Association of Nigeria (MAN) has asked the federal government to remove the value-added tax (VAT) on diesel as an instant stimulus for an immediate price reduction.

Director General, MAN, made the call in a statement issued on Saturday in Lagos.

The association also called on the federal government to avert the total shutdown of production operations, adding that industries were being converted to warehouses of imported goods and event centres.

“MAN is greatly concerned about the implications of the over 200 per cent increase in the price of diesel on the Nigerian economy and the manufacturing sector in particular,” the statement reads.

“More worrisome is the deafening silence from the public sector as regards the plight of manufacturers.

“As a matter of urgency, the government should address the challenge of repeated collapses of the national grid which is causing acute electricity shortage, especially for manufacturers.”

The group also urged the government to develop a response strategy to address challenges emanating from the armed conflict between Russia and Ukraine.

“In light of the gravity of the precarious situation that we have found ourselves as a nation and the looming dangers ahead, the expectations of manufacturers in Nigeria are as follows: that government should urgently allow manufacturers and independent petroleum products marketing companies to also import AGO (diesel) from the Republic of Niger and Chad by immediately opening up border posts in that axis to cushion the effect of the supply gap driven the high cost of AGO (Automotive Gas Oil),” it said.

The association also requested the government to “issue licences to manufacturing concerns and operators in the aviation industry to import diesel and aviation fuel directly to avert the avoidable monumental paralysis of manufacturing activities arising from total shut down of production operations and movement of persons for business activities.”

“More worrisome is the deafening silence from the public sector as regards the plight of manufacturers. Four obvious questions that readily come to mind that are seriously begging for answers are: What can we do as a nation to strengthen our economic absorbers from external shocks? Should manufacturing companies that are already battered with multiple taxes, poor access to foreign exchange, and now over 200 per cent increase in the price of diesel be advised to shut down operations? Should we fold our arms and allow the economy to slip into the valley of recession again? Is the nation well equipped to manage the resulting explosive inflation and unemployment rates?” it added.

It also implored the government to continue to support manufacturing to accelerate recovery from COVID-19 and previous bouts of recession.

MAN said this was to avert the complete shutdown of factories nationwide with a multiplier effect on employment.

The MAN also asked the federal government to “as a matter of priority develop a National Response and Sustainability Strategy (NRSS) to address challenges emanating from the ongoing invasion of Ukraine by Russia”.

The MAN also called on the government to “address the challenge of the repeated collapse of the national grid (twice within a week), which is causing acute electricity shortage in the country, especially for manufacturers”.

It demanded that the government should “remove VAT on AGO as an instant stimulus for an immediate price reduction and expedite action in reactivating or privatising the petroleum products refineries in the country.”

It also demanded that the government should “restrict the export of maize, cassava, wheat, food-related products and other manufacturing inputs available in the country; and grant concessional foreign exchange allocation at the official rate to manufacturers for the importation of productive inputs that are not locally available”.

The association represents over 3,000 manufacturers across 10 sectors, 76 sub-sectors, and 16 industrial zones.

Economy

Organise Informal Sector, Tax Prosperity Not Poverty, Adedeji Tasks Officials

The Chairman, Joint Tax Board (JTB), Dr Zacch Adedeji, has urged officials of the board to organise traders and artisans into a formal body before capturing them in the tax net.

Adedeji said that this was in line with the agenda of President Bola Tinubu not to tax poverty but prosperity.

The chairman stated this at the 157th Joint Tax Board meeting held in Ibadan, on Monday.

The theme of the meeting “Taxation of the Informal Sector: Potentials and Challenges”.

Speaking on the theme of the event, Adedeji stressed the need to evolve a system that would make the informal sector formal before it could be taxed.

Adedeji, who also doubles as the Chairman, Federal Inland Revenue Service, (FIRS), said “What I would not expect from the JTB meeting is to define a system that would tax the informal sector.

“The only thing is to formalize the informal sector, not to design a system on how to collect tax from market men and women.

“As revenue administrator, our goal is to organise the informal sector so that it can fit into existing tax law.”

Citing a report of the National Bureau of Statistics (NBS) in the first quarter of 2023, the chairman said that the nation’s unemployment index was attributable to recognised informal work.

Adedeji stated that workers in that sector accounted for 92.6 per cent of the employed population in the country as at Q1 2023.

“JTB IS transiting to the Joint Revenue Board with expanded scope and functions.

“We are hopeful that by the time we hold the next meeting of the Board, the Joint Revenue Board (Establishment) Bill would have been signed into Law by the President.

“The meetings of the board provide the platform for members to engage and brainstorm on contemporary and emerging issues on tax, and taxation,” he said.

In his address, Gov. Seyi Makinde of Oyo State, said the theme of the meeting was apt and timely, stressing that it coincides with the agenda of the state to improve on its internally generated revenue.

According to him, the meeting should find the best way forward in addressing the issue of the informal sector and balance the identified challenges.

“Nigeria is rich in natural resources, but it is a poor country because economic prosperity does not base on natural resources,”

Makinde also said that knowledge, skill and intensive production were required for economic prosperity, not just the availability of natural resources.

He stressed the need to move from expecting Federal Allocations to generating income internally.

“We are actively ensuring that people are productive and moving the revenue base forward,” Makinde said.

The governor said that tax drive should be done by simplifying tax processes, incentives for compliance like access to empowerment schemes and loans.

He urged JTB to deepen partnership and innovation in using data on tax to track and administer it.

Earlier, the Executive Chairman, Oyo State Board of Internal Revenue, Mr Olufemi Awakan, said the meeting was to address tax-related matters, evolve a workable, effective and

efficient tax system across the states and at the Federal level.

He urged participants to find amicable solutions to challenges of tax jurisdiction, among others.

Tax administrators from all the 36 states of the federation, who are members of JTB, were in attendance. (NAN)

Agriculture

Tiv Monarchs Give Herders Ten Days Ultimatum To Vacate Tiv Kingdom

By David Torough, Abuja

The Tiv Area Traditional Council during its emergency meeting held yesterday in the palace of the Tor Tiv in Gboko requested the Governor Hyacinth Alia led administration to create an enabling environment to allow herders’ peaceful exit of farmlands in Tiv Kingdom to facilitate resumption of farming activities.

Consequently, the Council directs political and traditional rulers in each local government area of Tiv Kingdom to peacefully engage the herders to ensure their exit from the local government areas to allow farming resumes.

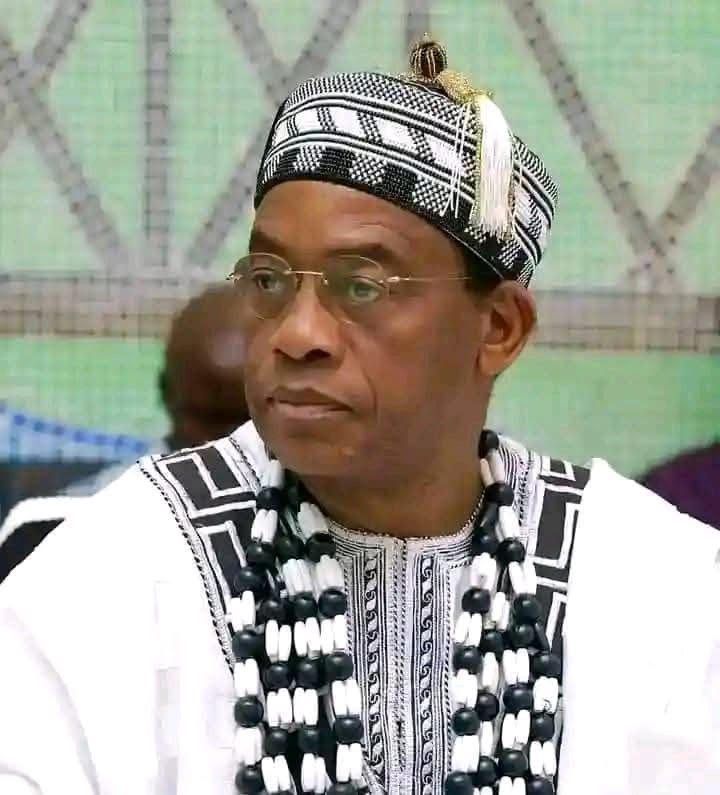

The Council which was chaired by the Tor Tiv himself, HRM Prof James Ortese Iorzua Ayatse CFR equally appealed to all herders in Tiv Kingdom in Benue State to vacate all Tiv lands before the end of May 2025 to allow farmers return and cultivate their farms in order to avoid the looming hunger in Nigeria.

According to a Communique signed by the Secretary of the Council Mr Shinyi Tyozua which deliberated particularly on the security situation in Tiv Kingdom the Council enumerated the communities worst affected to include those in Kwande, Katsina Ala, Logo, Ukum, Guma, Makurdi, Gwer West Gwer East and Buruku Local Government Areas.

The Council lamented that farming activities in the kingdom have ceased due to the occupation of farmlands by herders for grazing and attacks and killings of farmers who fled stressing that if the situation continues it will ultimately result to hunger in Tiv Kingdom and Nigeria as a whole.

Agriculture

Ondo Govt. Destroys 200kg Seized Cocoa Adulterants

The Ondo State Government, on Thursday, destroyed 200kg adulterants used for adulteration of cocoa beans, seized from a merchant in Ondo West Local Government Area of the state.

Mr Segun Odusanya, Permanent Secretary in the Ministry of Agriculture and Forestry (Forestry and produce sub section), supervised the destruction of the 200kg bags of seized adulterants.

Odusanya explained that the destruction was part of government efforts to ensure that the state maintained quality cocoa production in the country.

“Mr governor, Lucky Aiyedatiwa, has reiterated the commitment to ensure the state remains the highest producing state with good cocoa quality

“Anyone caught engaging in illegal activities will be prosecuted accordingly.

“Moreover, this action was embarked on to warn cocoa merchants, who intend to engage in illegal activities, to rethink before getting into it.

“We are going to seal any store caught in such illegal activities, the products will be burnt while the merchant will be prosecuted according to the laws of the land.

“If we are saying we are the highest cocoa producing state and we continue to encounter this scenario, it will give us a bad publicity.

“The bad publicity will be in the country and extend to the international market, and we don’t want that,” he said.

The permanent secretary, therefore, commended Aiyedatiwa for graciously approving the recruitment of 60 new staff to checkmate the activities of cocoa merchants in the state.

“Mr governor has supported us, he has said we should recruit more people to guide against any adulteration and ensure we have a good quality cocoa beans.

“I must commended our task force committee for ensuring that the state holds its position in the country and the international market,” he said.

Earlier, Mr Tunji Akinnadeju, a Director of Produce (DP3) in the Grading and Allied Department of the ministry, said the adulterants were intercepted at Ondo West Local Government Area of the state.

Akinnadeju said that the owner of the adulterants took to his heels at the time of arrest.

“As we all know that cocoa is being sold in weight and after adding all these things, it will be sold at high prices, which is not good enough.

“So, doing that will bring a lot of damage to the image of the state and the country at large in the international market,” he said.

Also, Mr Sunday Adegbola, a Director of Produce Licensing in the ministry, said the merchants’ actions could affect people during consumption of the cocoa products, if care was not taken.

Adegbola, who pledged that the ministry would not rest until the state was free from adulterated cocoa beans, said the nefarious action could be attributed to the price tag at the international market.

“It is the price at the international market and the price is better for the farmers, not for the people who use adulterants.

“With this action, many people will drink cocoa as a chocolate powder and other materials from cocoa beans which has been adulterated.

“The consumption of these chemical products will also affect humans,” he said. (NAN)