NEWS

Two Men Drown While Swimming In Ogun River

While attending a program at a Cherubim and Seraphim Church in Onikoko located in Ogun State, two young men from Lagos tragically lost their lives by drowning in a river at Itori.

The tragedy reportedly happened on Monday.

Ogun State Police Command Public Relations Officer in Ogun, Omolola Odutola, disclosed that a member of the church, Adebayo Adeosun, had reported at the station at about 6:30 pm, “that some boys numbering seven who came from Lagos on the 27th of August for his church inauguration, left the church premises to swim, and got drowned in the process.”According to Odutola, the two victims were Femi Akinola, 32, of Odo Eran, Itire, and Tunde Falade, 35, of Kola Alagbado, both in Lagos.Their bodies were recovered from the tides and rushed to the health centre in Itori, Ewekoro Local Government Area of Ogun State, “where they were unfortunately confirmed dead by a medical doctor on duty.”The Divisional Police Officer, CSP Olayemi Jacob, had detailed his team to visit the scene upon receipt of the report and ascertained that there were no signs of violence or foul play suspected.“Their remains have since been evacuated to Ifo General Hospital for autopsy reports and later deposited in the same mortuary,” she explained.NEWS

SPEAKER NAMES REP. UGBOR CHAIRMAN COMMITTEE ON SINGLE-USE PLASTIC BAN

Speaker House of Representatives Rt. Hon. Tajudeen Abbas has appointed Hon. Terseer Ugbor as Chairman Ad-hoc Committee on Single-Use Plastic Ban in Nigeria.The committee is mandated to access the preparedness, coordination, and roles of relevant federal agencies in implementing the planned ban on single-use plastics in Nigeria, with a view to ensuring effective enforcement, public awareness, and environmental sustainability.

The committee will also engage with the private sector stakeholders to access their preparedness to eliminate single-use plastics from their operations. The bold initiative to ban single-use plastics is a significant stride towards combating plastic pollution in Nigeria. According to reports, Nigeria ranks as the ninth-largest contributor to plastic pollution globally, generating approximately 2.5 million tonnes of plastic waste annually. Alarmingly, over 70% of this waste is discarded into landfills, waterways, or the ocean, posing hazards to both the environment and public health.The Deputy Chairman Committee on Environment will assume the notable role of heading the committee and ensuring the effective implementation of a single-use plastic ban in Nigeria. Hon. Ugbor has been an advocate for better environmental laws and policies. He sponsored the Endangered Species Conservation and Protection Bill, which has passed in the House of Representatives. He also sponsored the Environmental Impact Assessment (EIA) Ammendement Bill. He is also responsible for the End-of-Life Vehicle Regulations amongst others.Previously, Hon. Ugbor served as Chairman of the Ad-hoc Committee on Student Loans and Access to Higher Education, where he organised the first legislative summit on student loans in the National Assembly and proposed extensive ammendments to the students loans bill which was eventually passed into law. Hon. Terseer Ugbor is a thorough professional and a consultant in the area of environmental sustainability, resource recovery, and climate change.Dagu FredS.A Media and Publicity to Hon. Terseer Ugbor.24th July, 2025.NEWS

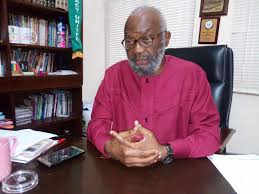

Return to PDP, Damagum Begs Defected Members

By Johnson Eyiangho, Abuja

The Peoples Democratic Party (PDP) has called on its founding members and others, who have left the party for reason or the other, to return, assuring it is willing to welcome them back to the fold.

Acting National Chairman of the PDP, Amb.

Umar Damagum, made the appeal at a meeting convened by the founding members of the party in Abuja on Wednesday as part of efforts to resolve lingering internal crisis within the party.Damagum said, “Let it be said and known that our doors remain open to those who wish to return, and it is my earnest prayers that in their return, they may rediscover themselves. After all, we are still the party that gave many their first political home.

“But we must also confront the hard truth, much of the injury the PDP has suffered has been self-inflicted. From the Obasanjo era to this moment, we have too often jettisoned ideology in favour of personal ambition.

“This has cost us dearly. Yet, there is still a beauty that exists only in the PDP; our founding vision, our commitment to internal democracy, our enduring mechanisms for dialogue and reconciliation, and our true national outlook. These are not ordinary attributes. They are the very pillars that made and have sustained the PDP as the bedrock of Nigeria’s democratic journey, and they remain our guiding strength today.”

However, former Governor of Niger State, Babangida Aliyu, countered the PDP Acting National Chairman, describing the party members who had defected as nomadic politicians, who cannot remain in the fold.

Aliyu said, “I heard both the (acting) chairman and the chairman of Governors Forum have been very diplomatic and saying, come back, come back. No, you don’t invite nomadic politicians back to your place. These were people with a history of nomadism.

“In nomadic life, your own selfish interest becomes more important than the interest of the people. So we need to understand that the lack of discipline has created this problem.

“We cannot continue like this, knowing that the black sheep in the family keep on destroying whatever we are building. And then you say, come back. In fact, the most shocking time, the most shocking period was 2019.

“Our constitution is specific. You leave the party; you join the queue. The party is not just to win elections. The party is also to ensure the culture of selling real, principled politics. So even if we don’t win elections, but we are one united, principled party, we will be recognized. Please, let us pay attention to what we should be doing, rather than looking at those people who will never, never, ever think of you, but only think of themselves.”

NEWS

As Nigerian Youths Rise against Tobacco Abuse

By Abiemwense Moru

By happenstance, 16-year-old Blessing Obiabo found herself on the frontline of a national movement.

Obiabo, a student of Lyngra Private Montessori School in Karu, Nasarawa State, found her voice the day Cedars Refuge Foundation (CRF) brought its anti-tobacco campaign to her school.

“We are not fools; this is our future, and we are taking it back,” she said.

Obiabo’s declaration mirrors a growing wave of youth-led resistance sweeping across Nigeria, fueled by the CRF’s Students Congress Against Tobacco (SCAT) initiative.

The programme, inaugurated under the banner of a “Tobacco-free Revolution,” is a response to what CRF describes as a calculated and aggressive invasion by the tobacco industry into the lives of young Nigerians.

The Executive Director of CRF, Mr Peter Unekwu-Ojo, minced no words at the campaign inauguration in Karu.

“The tobacco industry is a well-dressed cartel selling flavoured slavery.

“They are not selling lifestyle; they are selling addiction, bubble-wrapped in mango flourish and influencer smiles.”

According to Unekwu-Ojo, the tactics of the tobacco industry have become more deceptive than ever.

“Gone are the days of plain cigarettes; in their place are brightly-packaged e-cigarettes, vapes, and other nicotine products, flavoured, flashy, and dangerously appealing to teenagers.

“It is the same poison, just packaged in sleek tech and tropical flavours.

“These flavoured products, often promoted through digital marketing and pop culture influencers, create the illusion of harmless fun, masking the reality of addiction and long-term health consequences.”

The SCAT programme, now active in several schools across Nasarawa and Abuja, was created to expose and counter these tactics.

It promotes in-school advocacy, peer-led clubs, creative campaigns, and dialogues with teachers, parents, and community leaders.

Unekwu-Ojo emphasised the call for urgent reforms, including a nationwide ban on flavoured tobacco and nicotine products, higher tobacco taxes, strict penalties for marketing to minors, and the enforcement of school-based prevention programmes.

“If we do not protect the future in classrooms, we will be fighting addiction in clinics,” he warned.

Mr Abba Owoicho, CRF’s Programme/Operations Officer, weighed in.

“We are witnessing a silent epidemic thriving on ignorance and regulatory loopholes.

“SCAT is not just a campaign; it is a counter-offensive,” he said.

At the school level, educators are stepping up.

Mrs Blessing Onu, Head Teacher at Lyngra, welcomed the initiative.

“Our students will not be left defenceless in the face of such a manipulative industry,” she said, announcing the establishment of a Tobacco-Free Club in the school.

Mr Pius Nnaemeka, a senior teacher, appealed directly to national authorities.

“If we continue to play soft while our children inhale poison, history will not forgive us.

“The government must outlaw flavoured tobacco, fund preventive education, and support civil society groups championing this cause,” he said.

These school-based actions are mirrored across other institutions.

At Klinnicaps Academy in Koroduma, another CRF outreach event themed “Exposing Lies, Protecting Lives” engaged students in interactive sessions that peeled back the façade of flavoured products.

Unekwu-Ojo told the students that the industries were setting young people up against their future.

“They sandwich their products with glamorous colourful packaging and high-profile adverts, hiding the dangerous consequences of addiction.”

He described the educational sessions as a wake-up call.

“Tobacco use is not a fashion statement; it is a death sentence disguised in shiny colours,” he said.

Mr John Egla, Executive Director of Development Initiatives for Societal Health, reinforced the message: “There is no safe level of smoking.”

He cited global statistics from the 2018 Tobacco Atlas, noting that more than 942 million men and 175 million women worldwide smoke, with rising usage among African youth.

In response, CRF is establishing Tobacco-Free Clubs in at least 10 more schools in Nasarawa State, equipping students with peer leadership and advocacy tools.

The message is resonating beyond classrooms.

In Katsina State, the Commissioner for Health, Alhaji Musa Adamu-Funtua, recently stressed the importance of school-based campaigns.

Speaking during World Tobacco Day celebrations, he warned that a society that allowed the exploitation of its youth by profit-driven tobacco companies is a society at risk.

Adamu-Funtua urged joint efforts among government agencies, civil society, parents and youths.

“Let us choose health over harm, strength over addiction,” he said.

The Civil Society Legislative Advocacy Centre (CISLAC) has also thrown its weight behind tobacco control.

At a recent workshop in Bauchi, its Senior Programme Officer, Mr Solomon Adoga, highlighted tobacco’s role in multiple cancers and reproductive health challenges.

“Tobacco significantly contributes to Nigeria’s cancer burden,” he said.

CISLAC’s Executive Director, Auwal Rafsanjani, called for urgent policy reforms, stronger laws, and intensified awareness campaigns to stem tobacco-related deaths.

Beyond the halls of policy and classrooms, the anti-tobacco wave is being carried by mothers.

In Ilorin, Kwara, a march led by Bundies Care Support Initiative and other groups amplified maternal voices demanding action.

Mrs Funmilayo Osiegbu, Executive Director of the initiative, sounded a note of warning.

“We cannot stand by while our children are exposed to harmful tobacco products.

“We are urging the government to enact policies that shield young people.”

Inspired by international campaigns such as Tobacco-Free Jordan, the Kwara mothers demanded full implementation of Nigeria’s National Tobacco Control Act.

“This includes stricter enforcement of bans on advertising and sponsorship, and stronger measures to prevent youth access,” she said.

Kwara’s Commissioner for Women Affairs, Mrs Afolashade Opeyemi, reaffirmed government’s support.

“The administration has zero tolerance for smoking any substance,” she said.

Also, health experts lend their support.

Prof. Abiodun Afolayan, Chair of the Nigeria Cancer Society in Kwara, warned that lung cancer had become the most common cancer worldwide, driven largely by smoking.

“Often, the damage only appears when it is too late,” he said.

Mr Lekan Mikail, Special Adviser on Drug Abuse to the Kwara Governor, urged parents to stay vigilant.

“We must protect our children from this slow and silent killer,” he said.

As the SCAT initiative prepares to expand to 30 schools by 2025, it is clear that a national youth-driven movement is taking root.

From Obiabo’s defiance to policymakers’ endorsements, Nigeria is witnessing a shift in its tobacco control landscape.

But for CRF’s Unekwu-Ojo, the work is far from over.

“Every child deserves a future free from the industry’s traps, flavoured nicotine, flashy adverts, and peer-induced pressure,” he said.

His words echo in classrooms, streets, and government chambers across the country; the call is no longer just to awareness, but to action.

Mrs Precious Ojiaku, Dean of Studies at Klinnicaps Academy, said tobacco had no place in the future of Nigerian youth.

“Living a morally grounded life and rejecting these traps is the strongest resistance we can teach,” she said.

With the ongoing concerted efforts, stakeholders believe the threat posed by tobacco can be contained.(NAN)

| ReplyReply allForwardAdd reaction |