Economy

World Bank, IMF Call for Debt Relief for Poor Countries to Stem Covid-19

By Mathew Dadiya, Abuja

The World Bank Group and the International Monetary Fund, Friday, urged official bilateral creditors to provide immediate debt relief to the poorest countries facing COVID-19.- This, the World Bank group and other international creditors believed would enable these 56 poor nations to prioritize their spending to curtailing the spread of the novel Coronavirus otherwise called Covid-19.

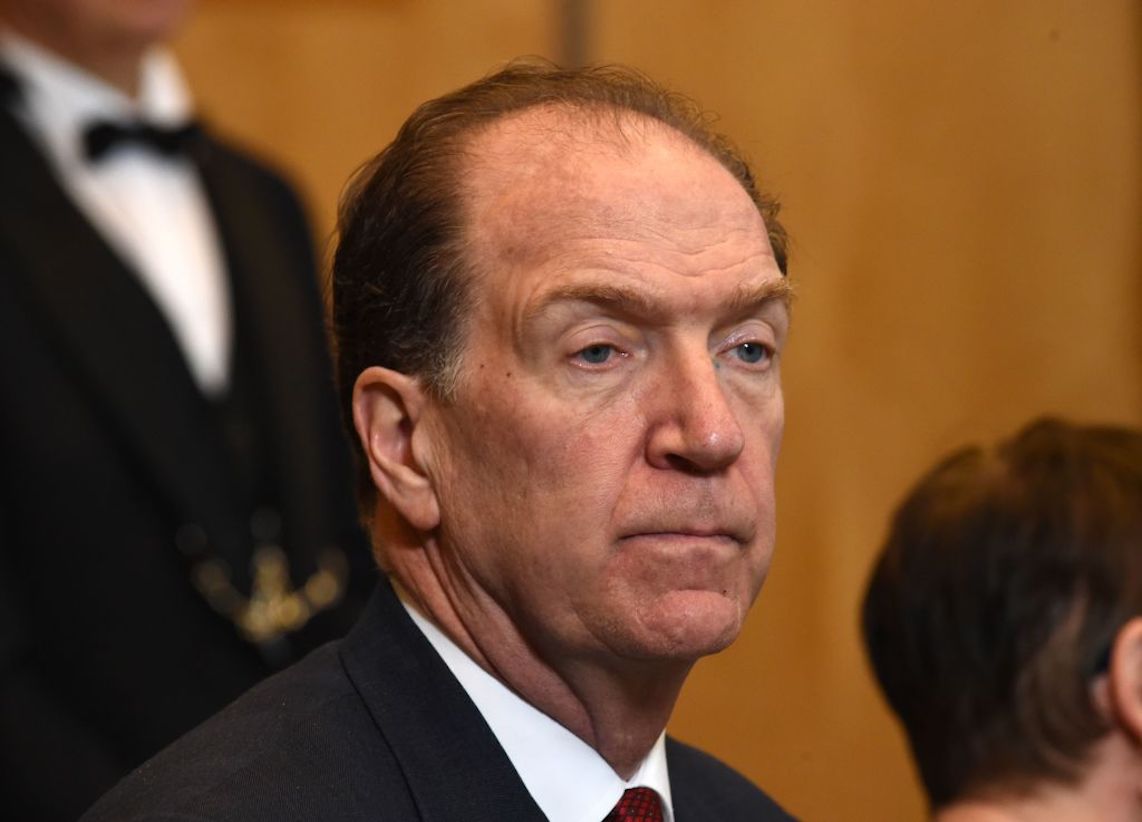

- World Bank Group President, David Malpass who joined the G20 Virtual Leaders Summit Friday, morning to highlight ongoing World Bank Group efforts to respond to the COVID-19 pandemic, said a final decision would be taken in April during the Spring meetings in Washington DC, United States.

- “We have new COVID-related projects underway in 56 countries and we’re encouraging other MDBs to co-finance follow-up tranches,” said Malpass. “In 24 countries, we’re restructuring existing projects in order to direct funds to the health emergency,” the World Bank President said.

- He added that private sector support is critical. “IFC, our private sector arm, is already working on new investments in 300 companies and extending trade finance and working capital lines to clients.Malpass said: “The World Bank Group has worked to take broad swift action to respond to the coronavirus pandemic.

- On March 17, our Board approved a $14 billion package, focused on the immediate health and social consequences of the outbreak. “We’re now finalizing an additional package that will focus on the broader economic consequences.

- “The goals are to shorten the time to recovery; create conditions for growth; support small and medium enterprises; and help protect the poor and vulnerable. Yesterday, I presented to our Board a program that could provide as much as $160 billion in financial support over the next 15 months. “As I was speaking, the crisis hit very close to home with the news that a former U.S. Executive Director Carole Brookins had just died of coronavirus. I’m particularly concerned about poor, densely populated countries such as India, where weak health systems need massively scalable investments in human capital, supplies and infrastructure. We are working hard to provide support through our public and private sector tools.“We have new COVID-related projects underway in 56 countries, and we’re encouraging other MDBs to co-finance follow-up tranches. In 24 countries, we’re restructuring existing projects in order to direct funds to the health emergency. Private sector support is critical. IFC, our private sector arm, is already working on new investments in 300 companies and extending trade finance and working capital lines to clients.“Regarding the proposals by some members, we can support the call for more funding for CEPI to finance vaccine development.“International cooperation is critical in these times. We’ve been working closely with the IMF and WHO, among others, to determine needs assessments of client countries.

- “The IMF Managing Director and I have convened heads of MDBs twice to discuss each institution’s response, specific opportunities for co-financing, procurement, and debt reduction. We’ll continue to push forward with the strongest possible international effort. Lastly, I want to highlight the importance of addressing debt vulnerabilities.

- This crisis will hit hardest poor countries that have high levels of indebtedness. A broad and equitable debt relief process is urgently needed, so IDA countries can concentrate their resources on fighting the pandemic and its economic and social consequences.

- “On Tuesday night, Kristalina Georgieva and I issued a joint IMF/WB call for debt relief in IDA countries. We urged many of you and other official bilateral creditors to suspend debt payments due from IDA countries, effective immediately. This would allow time to assess the crisis’ impact and financing needs for each IDA country, and to determine what kind of debt relief or restructuring is needed.

- The World Bank Group and the IMF are working quickly to flesh out an approach for Debt Relief for Poorer Countries. We will present it to our Governors for endorsement by the Spring Meetings of our organizations in April and would welcome your strong support.”

Business News

CBN Unveils Strategy to Boost Remittances, Grants AIP To 14 New IMTOs

By Tony Obiechina, Abuja

The Central Bank of Nigeria (CBN) has activated plans to double foreign-currency remittance flows through formal channels by granting 14 new International Money Transfer Operators (IMTOs) Approval-in-Principle (AIP).

This was disclosed in Abuja on Wednesday, by the Bank’s Acting Director of Corporate Communications, Mrs.

Hakama Sidi Ali, who stated that the initiative will help increase the sustained supply of foreign exchange in the official market by promoting greater competition and innovation amongst IMTOs to lower the cost of remittance transactions and boost financial inclusion.She said, “This will spur liquidity in Nigeria’s Autonomous Foreign Exchange Market (NAFEX), augmenting price discovery to enable a market-driven fair value for the naira.

“It will be recalled that the CBN Governor, Mr. Olayemi Cardoso, had recently declared: “We’ve set ourselves a target to double remittance flows into Nigeria within a year, a goal I firmly believe is within reach.

“We are wasting no time driving progress to remove any bottlenecks hindering flows through formal channels permanently. We have a determined pathway and a sequenced approach to tackling all challenges ahead, working hand in hand with key stakeholders in the remittance industry,” she stated.

Continuing, Sidi Ali, said that the CBN viewed increasing formal remittance flows—one of the major sources of foreign exchange, accounting for over 6% of GDP—as a means of reducing the historical volatility in Nigeria’s exchange rate caused by external factors, such as fluctuations in foreign investment and oil export proceeds.

The increase in the number of IMTOs is one of the primary actions initiated by the CBN’s remittance task force, overseen by Governor Cardoso as a collaborative unit pulling together specialists to work closely with the private sector and market operators to facilitate the ease of doing business in the remittance ecosystem in Nigeria.

The task force was established as a direct result of an executive learning session with IMTOs during the World Bank/IMF Spring Meetings held in Washington DC, United States of America, in April 2024. The task force will meet regularly to implement strategy and monitor the impact of its measures on remittance inflows.

Economy

FG Vows To Ensure Continuous Flow of Tax Revenue – Madein

By Tony Obiechina, Abuja

The Federal government is committed a tax culture that will ensure the continuous flow of revenues into government coffers, the Accountant General of the Federation, Dr Oluwatoyin Madein has said.

Madein stated this at the 26th Annual Tax Conference of the Chartered Institute of Taxation of Nigeria (CITN) in Abuja, with the theme: “Sustainable Tax Culture and Economic Roadmap for Nation Building”.

Madein said, “Like the CITN, the Office of the Accountant-General of the Federation is committed to a sustainable tax culture that will ensure the continuous flow of revenues even at an improved level.

“Tax revenue as at today is the highest source of revenue accruing to the federation.

Therefore at the Federation Account Allocation Committee meetings we eagerly await the numbers coming from the FIRS because the performance keeps on increasing and brings succour to all tiers of government.”She charged tax practitioners to work harder in getting more revenue from taxes, stressing that tax revenue is currently the highest income source for the federation.

The government noted that based on the current high revenue from taxes, members of the Federation Accounts Allocation Committee were always looking forward to the figures from the Federal Inland Revenue Service every month, in order to have funds to share to the three tiers of government.

“Tax revenue as at today is the highest source of revenue accruing to the federation. Therefore at the Federation Account Allocation Committee meetings we eagerly await the numbers coming from the FIRS because the performance keeps on increasing and brings succour to all tiers of government”, she added.

FIRS exceeded its 2023 revenue target by N816bn, as its total actual revenue collection for last year stood at N12.37tn, outperforming the N11.56tn target.

This is contained in a presentation by Amina Ado, Coordinating Director of Special Tax Operations Group at the FIRS.

The accountant-general tasked tax practitioners to step up efforts in collecting taxes, so as to shore up more revenue for the government to provide infrastructure and other amenities.

Madein said, “Let us remain steadfast in our commitment to building a better future for all. Together we can harness the transformative power of taxation to create a more prosperous, equitable and sustainable world.

“Like I said earlier, at FAAC we eagerly look forward to tax numbers because at the moment revenue from non-oil has been a great revenue source to the federation.

“Therefore, to tax practitioners, you are doing so well, but we need more of this to be able to deliver on all the areas that the citizens are looking forward to, because for even infrastructure development, it is only through funds that we can get it done.”

She further stated that it was her strong belief that “the conference will go a long way to deepen the collaboration between our organisations in building capacity for all the professionals, experts and tax payers for better understanding of the tax laws, rules and regulations.”

In his remarks, the President/Chairman of Council, CITN, Samuel Agbeluyi, pointed out that the withdrawal of subsidies on fuel and electricity had reduced the purchasing power of the masses.

He noted that raising electricity tariff for a selected band after fuel subsidy was withdrawn “is going to reduce the purchasing power of the masses. So we urge govt to consider these actions on the masses.

He, however, stated that the institute was happy to know that President Bola Tinubu had asked the Central Bank of Nigeria to slow down on the recent cybersecurity levy that was approved by the apex bank.

“We will continue to advise the govt on its policies, considering how these polices affect the citizens,” Agbeluyi stated.

Economy

Access Holdings Awards Shares Worth N427.13m to 8 Senior Executives

Access Holdings Plc has awarded 23.8 million ordinary shares worth N427.13 million to its senior executives and those of its subsidiary, Access Bank.

This was disclosed in a notice sent to the Nigerian Exchange Ltd.(NGX) in Lagos.

The notification was sent in line with the disclosure requirements of the Securities and Exchange Commission (SEC) and the NGX.

It is also in pursuant of the terms of its shareholders’ approved Employees Performance Share Plan.

The group said that Ms Bolaji Agbede, Acting Group Chief Executive Officer, Access Holdings, Mr Roosevelt Ogbonna, Managing Director/CEO, Access Bank, and six others were vested with 23,883,790 shares worth N427.

13 million in total.According to the filings, Ogbonna got the highest amount of shares, totalling 12,345,679 and valued at N220.37 million, having been traded at N17.85 per share.

Agbede was vested with 2,216,992 shares, valued at N39.795 million.

Other directors who had shares vested on them include: Mr Seyi Kumapayi, Executive Director, African Subsidiaries, Access Bank, with 1,234,568 shares worth N22.16 million.

Ms Iyabo Soji-Okusanya, Executive Director, Commercial and Investment Banking Division, Access Bank, got 1,691,308 shares at N17.95 per share, valued at N30.36 million.

Mrs Chizoma Okoli, Access Bank’s Deputy Managing Director, Retail South, also got 1,728,395 shares valued at N30.85 million.

Dr Gregory Jobome, Executive Director, Risk Management, and Hadiza Ambursa, Executive Director, Commercial Banking, were vested with 1,728,395 shares each,valued at N30.85 million and N31.02 million respectively.

Also, Access Holdings’ Company Secretary, Mr Sunday Ekwochi, was vested with 1,210,058 shares worth N21.72 milion.

The group stated that the shares were vested on May 3 and May 6.

It noted that the vesting of the shares was not a purchase or sale transaction in the context of the Exchange’s rules.(NAN)