NEWS

FRSC Quivers as Residents of Kaduna, Kano, Katsina Lament Underage Driving

The menace of underage driving in Nigeria is a significant concern that poses risks to the safety of the underage drivers, passengers, and other road users.

The menace is aggravated by the seeming lack of enforcement of age restrictions for driving.

Report says that other factors causing it included accessibility of vehicles to underage individuals.

Other causes are peer pressure and thrill-seeking behaviour and economic necessity, as some underage individuals may drive for livelihood

The obnoxious trend often leads to Increased risk of accidents, injuries, and fatalities as well as damage to property and infrastructure.

It leads results in emotional trauma and psychological distress for victims and families as well as economic burden on families and the healthcare system

Analysts says it can be combated by strengthening enforcement of age restrictions for driving, implementing mandatory driving education and training programmes.

There is also the need for increased public awareness campaigns on road safety and the engagement of parents, guardians, and communities in promoting road safety.

Many experts also urged the provision it alternative transportation options for underage individuals.

They were also of the view that by by addressing the causes and effects of underage driving, Nigeria can reduce the risks associated with this menace.

This, they said, would promote a safer and more responsible driving culture in Nigeria.

The Federal Road Safety Commission (FRSC) Kaduna Sector Command has reiterated its commitment to enforcing the law prohibiting underage driving in Nigeria

The command’s Public Education Officer, Chief Route Commander , Margret Mila, made the commitment in an interview with newsmen in Kaduna.

Mila said that only individuals who were 18 years and above were eligible to drive in by law .

She emphasised that underage driving posed a significant risk to the lives of the drivers and other motorists on the road.

“If caught, underage drivers will be arrested, and their vehicles will be impounded until their parents or guardians are contacted,” Mila said.

She said the command had engaged in public enlightenment programmes to educate the drivers and the public about the dangers of underage driving.

The official said, “Additionally, we will impose fines and penalties on underage drivers and their parents or guardians.”

Mila said the command remainef committed to enforcing the law and ensuring that underage driving wae eradicated in Nigeria.

She said,” Working together with parents, guardians, and the public, the commission aims to reduce the risk of accidents and fatalities on Nigerian roads.”

In Kano State,FRSC has warned the public, especially parents, to desist from allowing their underage children to drive.

The State FRSC Sector Commander, Masa’udu Matazu, disclosed this in an interview in Kano.

He stated that offenders, including parents, guardians, or fleet owners who permitted minors to drive, would be prosecuted, fined, and may have their vehicles impounded.

According to him, entrusting vehicles to underage drivers endangers their lives and those of other road users.

“It is an unacceptable and illegal act that contributes to preventable road crashes.

“Young drivers lack the necessary skills and judgment to react appropriately in complex driving situations, which leads to more accidents.

“Many road crashes involve underage drivers and have fatal consequences, causing immense human and economic losses.

“Driving below the legally stipulated age is a clear breach of the National Road Traffic Regulations (NRTR), and offenders will face legal action,” he said.

Matazu further explained that only mature and qualified individuals should handle vehicles.

He added that to tackle the menace, the command had intensified strict enforcement of driving laws.

“The Clcommand conducts regular patrols, surveillance, and special operations to identify and apprehend underage drivers and their sponsors.

“FRSC has engaged transport unions, fleet owners, schools, religious institutions, and communities to raise awareness about the dangers of underage driving,” the official added.

Matazu added that FRSC was working closely with other law enforcement agencies, traditional rulers, and government bodies to strengthen enforcement efforts.

He stated that awareness campaigns would be conducted in schools to educate students and parents on the dangers and legal consequences of underage driving.

Matazu said, “We will enhance licensing regulations by ensuring that driver’s licenses are issued strictly to individuals who meet the legal age and competence requirements.

“The dangerous trend of minors operating articulated lorries and other vehicles is a serious safety concern.

“The Command is fully committed to eliminating it through collaboration with relevant stakeholders.”

He urged the general public to report cases of underage drivers to FRSC through the emergency toll-free number 122 or at the nearest FRSC office.

“Road safety is a collective responsibility. We remain committed to ensuring safer roads by eliminating underage driving and enforcing compliance with traffic laws.*

On his part, Abubakar Hamza, a driver at Malam Kato Bus Stop, urged parents to desist from encouraging their children to drive.

He emphasised that children should reach the legal driving age before being allowed to use vehicles.

Meanwhile, in Katsina State, FRSC has cautioned parents against underage driving that lead to road traffic crashes.

Its Sector Commander, Mr Aliyu Ma’aji, gave the warning through his Public Relations Officer, Shamsudeen Babajo, in an interview with the News Agency of Nigeria.

He said that it was not a show of love or care as some people consider it, adding, “rather it is exposing the children to crashes on the highways.

“By allowing children below 18 years to drive, they are exposing them to the dangers on the highways.

“They can also hit innocent people on the road.$

Ma’aji revealed that some of the implications included the violation of road traffic regulations, like route violation and speeding that most of the times lead to accidents.

The sector commander said,”That is because a child has poor judgement while handling a steering, the situation most atimes lead to accidents.

$According to the law, one is eligible to drive after reaching 18 years for private vehicles.”

He added that a person was qualified to drive a commercial vehicle after reaching 26 years.

Ma’aji revealed,”We normally impound any vehicle being driven by underage children, charge fine and call the parent for public enlightenment before releasing the vehicle.$

He revealed that the FRSC was conducting sensitisation in Mosques, Churches, markets, as well as through roadshows.

The core message, Ma’aji said, was the need to obey traffic regulations and discourage underage driving to reduce road traffic accidents.

Ma’aji, therefore, urged parents and other stakeholders to desist from allowing their underage children to drive.

He said that an underage child was not allowed to drive not only a car, but also a motorcycle.

The sector commander added that a minor was only allowed to ride a bicycle by the law. (NAN)

NEWS

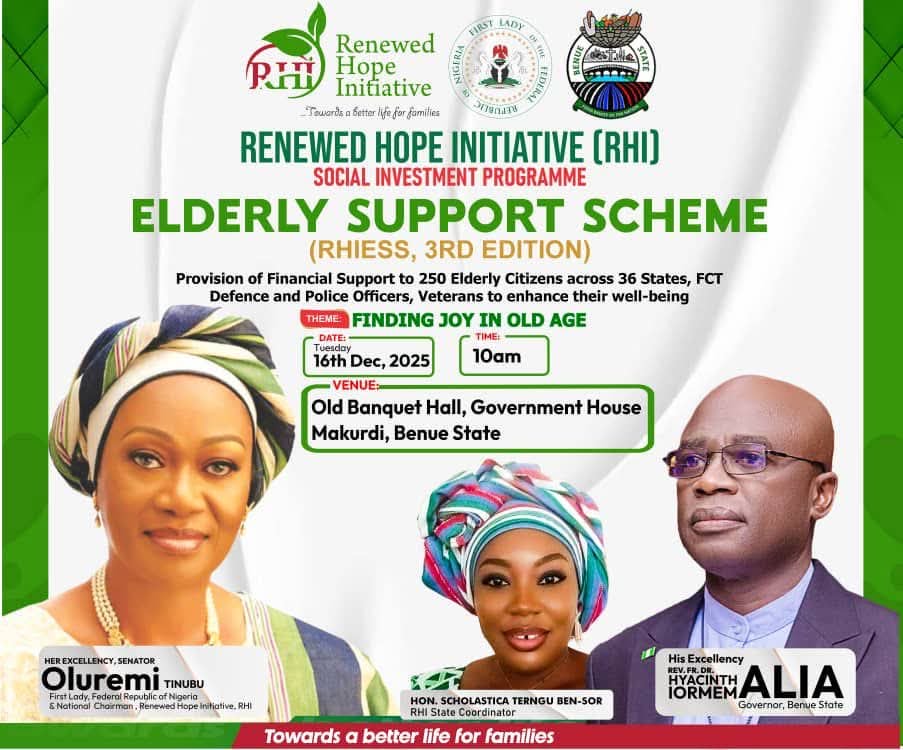

Finding Joy in Old Age: The Renewed Hope Intervention

By Bridget Tikyaa

Getting to the life journey of a senior citizen should ordinarily be a source of pride, a stage of celebration in life, less hassles, basic comfort, and time to savour the fruits of one’s labour. However, the reality is that things don’t turn out to be this way in most climes.

Just like in other parts of the world, in Nigeria, the elderly population are facing numerous challenges ranging from difficulties in accessing affordable, specialized healthcare services to address age-related health issues, irregular pensions and financial support to ensure decent living, improper access to basic amenities like housing, sanitation, and nutrition, emotional support, and many others.These are essentials that can significantly improve the quality of life for elderly individuals. The difficulties in accessing them highlight the need for improved social support systems, healthcare infrastructure, and policies to protect the rights and dignity of elderly individuals in Nigeria.

However, amidst these challenges, an organisation committed to better welfare for Nigerians has significantly focused on rendering vital support to vulnerable elderly Nigerians, giving them hope, comfort, and a new lease of life. This is the Renewed Hope Initiative (RHI), through its Elderly Support Scheme.

The Renewed Hope Initiative is the flagship programme of Nigeria’s First Lady Oluremi Tinubu, focusing on women, youth, children, and the elderly. The RHI is where every Nigerian’s dream of a better life is reached and has been creating real, lasting change by focusing on families, dignity, and opportunities.

Since 2023, the Renewed Hope Initiative has consistently celebrated elderly citizens every December as a mark of appreciation for their sacrifices. On Tuesday, December 16, 2025, the RHI held the third edition of such intervention – the Elderly Support Scheme – in Benue State at the Old Banquet Hall, Government House, Makurdi, with the theme “Finding Joy in Old Age”.

It is not just an RHI agenda but part of the Nigerian government broader social investment efforts aimed at promoting the dignity, comfort, and well-being of elderly Nigerians.

During the third edition of the Elderly Support Scheme, 250 vulnerable elderly citizens aged 65 years and above were supported by the RHI in Benue State. Significantly, the same number of elderly citizens in all the states of the Federation and the Federal Capital Territory received similar support.

Each beneficiary received N200,000 during the ceremony in Makurdi, while Governor Hyacinth Iormem Alia gave each beneficiary a bag of rice. There was also a free medical outreach for the elderly, during which beneficiaries received basic health checks, consultations and medical support, underscoring the holistic approach of the initiative to both financial and health needs of senior citizens.

Benue State Coordinator of the Renewed Hope Initiative, Hon. Scholastica Ben-Sor said the initiative, a pet project of Nigeria’s First Lady Remi Tinubu, reflects a resolute determination to honour senior citizens who have contributed immensely to nation-building.

She noted that since 2023, the Renewed Hope Initiative has consistently celebrated elderly citizens every December as a mark of appreciation for their sacrifices, with a total of 9,500 beneficiaries nationwide each receiving ₦200,000, totalling N1.9 billion.

“As we approach the festive season, it is our moral duty and indeed our joy to ensure that our elderly live their twilight years in comfort, good health and dignity,” the First Lady said in the message to the event.

The purpose is to make the senior citizens remain active, find purpose in community life, and embrace joy in old age.

For Hon. Scholastica Ben-Sor, valuing elderly citizens is absolutely necessary. “What you are today is not forever. Life may take you through certain curves you don’t know. The least person you see today may be the person you will look up to tomorrow,” she said, calling on society to treat the elderly with dignity, respect, and compassion.

She hailed all those impacting lives including Governor Hyacinth Iormem Alia, whom she described as a man of integrity, sacrifice and uncommon commitment to service, who has positively impacted families, homes and society at large, stressing that family, church and school form the bedrock of any society.

Although the governor did not attend the event, Hon. Ben-Sor disclosed that he directed that each of the 250 beneficiaries receive a bag of rice through the State Emergency Management Agency (SEMA), in addition to facilitating the free medical outreach conducted for the elderly during the programme.

Goodwill messages were delivered by several dignitaries, including a representative of the wife of the Deputy Governor of Benue State, Hon. Mrs. Christy Ode, who praised the First Lady for sustaining the initiative and applauded Governor Alia for his visible developmental strides across the state while the Commissioner for Women Affairs and Social Development, Mrs Teresa Odachi Ikwe, represented by the Director of Finance and Accounts, Hon. Ifa Celestine commended the transparency of the RHI and advised beneficiaries to use the funds judiciously to improve their standard of living. Similarly, the Benue State Women Leader of the All Progressives Congress, Hon. Mrs. Helen Agaigbe appreciated the First Lady for her remarkable traits of compassion displayed through consistent support for the vulnerable in the society.

NEWS

CBN Revokes Licenses of Aso Savings, Union Homes Savings, Loans

By Tony Obiechina, Abuja

The Central Bank of Nigeria (CBN) has revoked the operational licences of Aso Savings and Loans PLC and Union Homes Savings and Loans PLC.

This was contained in a statement issued on Tuesday by the CBN Acting Director of Corporate Communications, Hakama Sidi-Ali.

According to the Apex Bank, the two mortgage institutions violated various Sections of BOFIA 2020 and the Revised Guidelines for Mortgage Banks in Nigeria.

The statement reads in part, “As part of its efforts to re-position the mortgage sub-sector and promote a culture of compliance with relevant laws and regulations, the Central Bank of Nigeria, in exercise of the powers conferred on it under Section 12 of BOFIA 2020, and Section 7.

3 of the Revised Guidelines for Mortgage Banks in Nigeria has revoked the licenses of Aso Savings and Loans Plc and Union Homes Savings and Loans Plc.“The affected institutions had violated various Sections of BOFIA 2020 and the Revised Guidelines for Mortgage Banks in Nigeria, including: Failure to meet the minimum paid-up share capital requirement for the category of the bank licence granted to them by the CBN:

Having insufficient assets to meet their liabilities; Being critically undercapitalised with a capital adequacy ratio below the prudential minimum ratio as prescribed by the CBN; and; Failure to comply with several directives and obligations imposed upon them by the CBN.

“The CBN remains committed to its core mandate of ensuring financial system stability”.

NEWS

Dangote Petitions ICPC, Accuses NMDPRA Boss of Corruption, Abuses

By David Torough, Abuja

President of the Dangote Group, Alhaji Aliko Dangote, has petitioned the Independent Corrupt Practices and Other Related Offences Commission (ICPC) over alleged corruption and financial impropriety by the Managing Director of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), Ahmed Farouk, prompting the anti-graft agency to announce an immediate investigation.

In the petition filed yesterday and addressed to the ICPC Chairman, Musa Adamu Aliyu (SAN), Dangote called for Farouk’s arrest, investigation and prosecution, alleging that the NMDPRA chief had lived far beyond his lawful earnings as a public servant.

Dangote alleged that Farouk spent over $7 million within six years on the education of his four children in different schools in Switzerland—an amount he said could not be justified by the official’s legitimate income. The petition reportedly listed the names of the children, their schools and the sums paid to enable the commission verify the claims.

According to Dangote, the NMDPRA boss also used his position to embezzle and divert public funds for personal gain, actions he said had contributed to protests and instability in the downstream petroleum sector. He argued that Farouk had spent his entire adult working life in public service, making the alleged expenditure a clear case of illicit enrichment.

“It is without doubt that the above facts in relation to abuse of office, breach of the Code of Conduct for public officers, corrupt enrichment and embezzlement constitute gross acts of corruption,” Dangote stated, citing Section 19 of the ICPC Act, which prescribes up to five years’ imprisonment without an option of fine upon conviction.

He urged the ICPC to act decisively, stressing that the matter was already in the public domain, and pledged to provide documentary evidence to support his claims. Dangote added that a thorough probe would help safeguard the image of President Bola Ahmed Tinubu’s administration.

Confirming receipt of the petition, ICPC spokesman, Mr. John Odey, said the commission had received a formal complaint from Dangote through his lawyer against the CEO of the NMDPRA and would investigate the allegations.

“The ICPC wishes to state that the petition will be duly investigated,” Odey said in a terse statement.

Dangote, however, clarified that he was not calling for Farouk’s removal but for accountability. “He should be required to account for his actions and demonstrate that he has not compromised his position to the detriment of Nigerians,” he said, also urging the Code of Conduct Bureau and other relevant agencies to wade into the matter.

Speaking earlier at a press conference at the Dangote Petroleum Refinery, the business mogul accused the leadership of the NMDPRA of frustrating local refining through the continued issuance of petroleum product import licences despite rising domestic refining capacity. He claimed that licences covering about 7.5 billion litres of Premium Motor Spirit (PMS) had reportedly been issued for the first quarter of 2026, sustaining Nigeria’s dependence on imports and discouraging local investment.

Dangote warned that continued importation of refined products was pushing modular refineries to the brink of collapse, while benefiting entrenched interests at the expense of national development.

On fuel pricing, he assured Nigerians of further relief, announcing that PMS would sell at no more than ₦740 per litre from Tuesday, starting in Lagos, following a reduction of the refinery’s gantry price to ₦699 per litre. He said MRS filling stations would be the first to reflect the new price.

He added that the refinery had reduced its minimum purchase requirements to accommodate more marketers and was ready to deploy its Compressed Natural Gas (CNG) trucks nationwide to ensure affordability. Dangote also reiterated plans to list the Dangote Petroleum Refinery on the Nigerian Exchange to enable Nigerians to own shares.

“This refinery is for Nigerians first. I am not giving up,” he said.

As of the time of filing this report, the NMDPRA had yet to issue an official response to the allegations.

ReplyForward

Add reaction