Economy

Global Money Week: SEC Highlights Savings, Personal Finance

By Tony Obiechina, Abuja

As the world celebrates the Global Money Week from March 20-26 2023, the Securities and Exchange Commission has again emphasized the need for children and young people to develop sound financial habits, knowledge, attitudes, and behaviours from a young age.

According to the Commission, this will help them to know how to manage their personal finances throughout their lives and be empowered to make better financial decisions for their future.

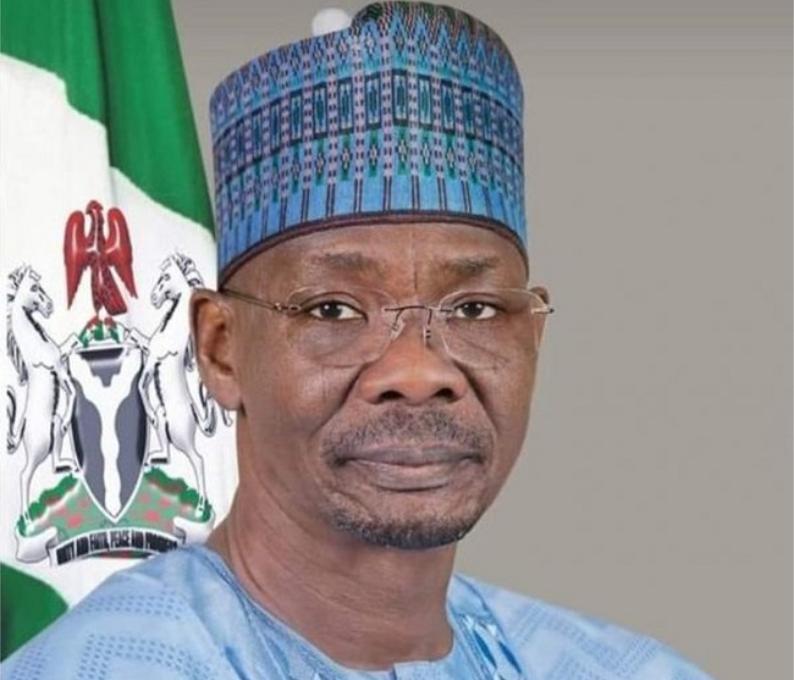

Director General of the SEC, Mr. Lamido Yuguda commenting on the weeklong commemoration of the event, stated that the earlier children & youth learn about money, saving, investment and budgeting the better they will manage their personal finances throughout their lives.

The GMW is an event organized by the Organisation for Economic Co-operation and Development (OECD)International Network on Financial Education with the Central Bank of Nigeria responsible for coordinating the event in Nigeria. It is an annual global awareness-raising campaign on the importance of ensuring that young people, from an early age, are financially aware, and are gradually acquiring the knowledge, skills, attitude and behaviors necessary to make sound financial decisions.

The DG said, “Plan your money, plant your future” is the official theme of GMW2023. This theme aims at raising awareness about the importance of adopting a responsible, informed and forward-looking approach in making financial decisions. It also recognises that future individual financial well-being is strictly linked to the health of the planet and of the society as a whole.

“This year’s Global MoneyWeek2023 GMW2023 is a great opportunity for everyone to engage children, youth & young people in activities around the theme.

Yuguda stated that the celebration of the weeklong event by the Commission will include visits to schools in Nassarawa and Gwagwalada, a visit to the NGX by 150 students and ringing of the bell at the NGX among other activities.

Global Money Week (GMW) promotes efforts aimed at improving the financial literacy of young people. The ultimate goal of the campaign is to ensure that all children and young people have access to high-quality financial education, they learn about money matters and are able to take smart financial decisions that can improve their future financial resilience and financial well-being.

The week is the world’s largest money awareness campaign for children youth to learn about money managing skills through fun events and activities in over 100 countries worldwide adding that the earlier children & youth learn about money, saving, investment and budgeting the better they will manage their personal finances throughout their lives.

“We are proud to be part of this annual financial awareness campaign highlighting the importance of teaching children & youth about financial education & financial literacy. These sensitisations to Gwagwalada and Nasarrawa to directly speak to the children and youths is another way of highlighting how important this is to the SEC.” he stated.

Yuguda emphasised that the Commission is encouraging capital market operators to develop technology so that the market will become more attractive to youths adding, “That is why we are improving our Know Your Customers; we are improving so many things to make it easier for them. That is why we are introducing these fintechs. We are allowing these fintechs to come because we see the fintech as an important gateway for youths to enter the market. We are conscious of that and we are working towards it.”

According to him, the commission is implementing various initiatives to ensure that products and offerings in the market are accessible to both the young and old which will further deepen the market.

He furthernoted that, “The average age of that account holder was over 50, and that made us realise that the young people were not participating in this market and when young people are not participating in any market, that market is doomed to fail.

“And young people today prefer to do things on their phones; if you have to fill a stack of forms manually young people won’t do it. We want to make investing in the capital market a fun experience.”

Economy

34 States Shunned 35th Enugu Int’l Trade Fair

No Fewer than 34 states in the country failed to honour invitation to attend the just-concluded 35th Enugu International Trade Fair.

Reports says that only the Federal Capital Territory (FCT), Abuja; Ebonyi State and the host state, Enugu State, graced the 11-day international goods, services and idea showcasing fiesta.

The fair, which began on April 5 and ended on Monday, April 15, was themed: “Promoting made-in-Nigeria products for global competitiveness.

”Reacting, the Director-General of Enugu Chamber of Commerce, Mr Uche Mbah, said that the chamber followed due diligence in the invitation of all states to the fair.

Mbah noted that official letters were sent and official follow-up on the letters were made to ensure their presence and availability.

According to him, “we did everything to get them to add colour and increase the showcasing of products from different parts of the country and their investment viability.

“We did put in spirited efforts to see that all states participated, as most of them do previously.

“But it is unfortunate that many did not respond after receiving official letters, phone calls and interpersonal follow-ups were made.

“We got clear assurances from Kano State but they did not show up.

“We pushed harder to get Abia State but in the end, we were told that the governor did not approve,” he said.

Reports says that over 100 organisations were at the fair, which included: over 50 private companies as well as over 45 Federal and State government ministries, agencies and departments. (NAN)

Economy

Nigeria’s Inflation Hit 33.20% in March, says NBS

The National Bureau of Statistics (NBS) says Nigeria’s headline inflation rate increased to 33.20 per cent in March 2024.

The NBS said this in its Consumer Price Index (CPI) and Inflation Report for March, which was released in Abuja on Monday.

According to the report, the figure is 1.50 per cent points higher compared to the 31.

It said on a year-on-year basis, the headline inflation rate in March 2024 was 11. 16 per cent higher than the rate recorded in March 2023 at 22.04 per cent.

In addition, the report said, on month-on-month basis, the headline inflation rate in March 2024 was 3.02 per cent, which was 0.10 per cent lower than the rate recorded in February 2024 at 3.12 per cent.

“This means that in March 2024, the rate of increase in the average price level is less than the rate of increase in the average price level in February 2024.”

The report attributed the increase in the headline index for March 2024 on a year-on-year basis and month-on-month basis to increase in some goods and services at the divisional level.

It said these increases were observed in food and non-alcoholic beverages, housing, water, electricity, gas, and other fuel, clothing and footwear, and transport.

Others, it said, were furnishings, household equipment and maintenance, education, health, miscellaneous goods and services, restaurants and hotels, alcoholic beverage, tobacco and kola, recreation and culture, and communication.

It said the percentage change in the average CPI for the 12 months ending March 2024 over the average of the CPI for the previous corresponding 12-month period was 27.13 per cent.

“This indicates a 6.76 per cent increase compared to 20.37 per cent recorded in March 2023”, it said.

The report said the food inflation rate in March 2024 increased to 40.01 per cent on a year-on-year basis, which was 15.56 per cent higher compared to the rate recorded in March 2023 at 24.45 per cent.

“The rise in food inflation on a year-on-year basis is caused by increases in prices of Garri, Millet, Akpu (uncooked fermented, which are under bread and cereals class), Yam Tuber, and Water Yam.

“Others are Dried Fish Sadine, Mudfish Dried, Palm Oil, Vegetable Oil, Beef Feet, Beef Head, Liver, Coconut, Water Melon, Lipton Tea, Bournvita, and Milo”, NBS said.

It said on a month-on-month basis, the food inflation rate in March was 3.62 per cent, which was a 0.17 per cent decrease compared to the rate recorded in February 2024 at 3.79 per cent.

“The fall in food inflation on a month-on-month basis was caused by a decrease in the average prices of Guinea corn flour, Plantain Flour etc (under Bread and Cereals class); Yam, Irish Potato, and CocoYam.

“Others are Titus fish, Mudfish Dried, Lipton, Bournvita, and Ovaltine”, it said.

The report said that “all items less farm produce and energy’’ or core inflation, which excludes the prices of volatile agricultural produce and energy, stood at 25.90 per cent in March on a year-on-year basis.

“This increased by 6.26 per cent compared to 19.63 per cent recorded in March 2023.’’

“The exclusion of the PMS is due to the deregulation of the commodity by removal of subsidy.”

It said the highest increases were recorded in prices of bus journey within the city, actual and imputed rentals for housing, consultation fee of a medical doctor, etc.

The NBS said on a month-on-month basis, the core inflation rate was 2.54 per cent in March 2024.

“This indicates a 0.37 per cent increase compared to what was recorded in February 2024 at 2.17 per cent.”

“The average 12-month annual inflation rate was 22.26 per cent for the 12 months ending March 2024, this was 5.04 per cent points higher than the 17.22 per cent recorded in March 2023”, it said.

The report said on a year-on-year basis in March 2024, the urban inflation rate was 35.18 per cent, 12.11 per cent higher compared to the 23.07 per cent recorded in March 2023.

The report said on a year-on-year basis in March 2024, the rural inflation rate was 31.45 per cent, which was 10.37 per cent higher compared to the 21.09 per cent recorded in March 2023.

“On a month-on-month basis, the rural inflation rate was 2.87 per cent, which decreased by 0.20 per cent compared to February 2024 at 3.07 per cent’’, it said.

On states’ profile analysis, the report showed that in March, all items inflation rate on a year-on-year basis was highest in Kogi at 39.97 per cent, followed by Bauchi at 38.34 per cent, and Kwara at 38.10 per cent.

It, however, said the slowest rise in headline inflation on a year-on-year basis was recorded in Borno at 25.78 per cent, followed by Benue and Taraba at 28.12 per cent, and Katsina at 28.32 per cent.

The report, however, said in March 2024, all items inflation rate on a month-on-month basis was highest in Zamfara at 3.90 per cent, followed by Abia at 3.89 per cent, and Ondo at 3.75 per cent.

“Borno at 1.46 per cent, followed by Yobe at 1.84 per cent and Adamawa at 1.85 per cent recorded the slowest rise in month-on-month inflation”, NBS said.

The report said on a year-on-year basis, food inflation was highest in Kogi at 48.46 per cent, followed by Kwara at 46.18 per cent, and Akwa Ibom at 45.18 per cent.

“Nasarawa at 33.76 per cent, followed by Borno at 34.28 per cent and Bauchi at 34.38 per cent recorded the slowest rise in food inflation on a year-on-year basis’’, it said.

The report, however, said on a month-on-month basis, food inflation was highest in Abia at 5.17 per cent, followed by Cross River at 5.14 per cent, and Bayelsa at 4.75 per cent.

“Cross River stood at 1.59 per cent, followed by Yobe at 2.08 per cent and Adamawa at 2.12 per cent, recorded the slowest rise in inflation on a month-on-month basis”, it said. (NAN)

Economy

Naira Makes Huge Recovery, Gains 7.2% Against Dollar

The Naira on Friday experienced huge appreciation at the official market, trading at N1,142.38 to the dollar.

Data from the official trading platform of the FMDQ Exchange, a platform that oversees the Nigerian Autonomous Foreign Exchange Market (NAFEM), revealed that the Naira gained N88.

23.This represents a 7.16 per cent gain when compared to the previous trading date on Monday, April 8, exchanging at N1,230.

61 to a dollar before the Sallah holiday.The total daily turnover increased to $281.34 million on Friday up from $125.55 million recorded on Monday.

Meanwhile, at the Investor’s and Exporter’s (I&E) window, the Naira traded between N1,265 and N1,100 against the dollar.

Economic experts have continued to praise both fiscal and monetary policies of President Bola Tinubu’s administration responsible for the steady Naira appreciation.

The CBN, during its policy meetings held in February and March, implemented a total of 600 basis points in interest rate increases.

This helped tackle dollar scarcity, reduced volatility, and decreased reliance on parallel markets. (NAN)