BUSINESS

Local Content: NCDMB Holds Knowledge-Sharing Session with Mozambique

From Mike Tayese, Yenagoa

In keeping with Nigeria’s leadership role in the development of Local Content in Africa, the Nigerian Content Development and Monitoring Board (NCDMB) has concluded a two-day Local Content development experience-sharing session with a delegation from Mozambique’s national oil company, Empresa Nacional de Hidrocarbonetos (ENH).

The engagement was held on the sidelines of the 8th Sub-Saharan Africa International Petroleum Exhibition & Conference, in Lagos.

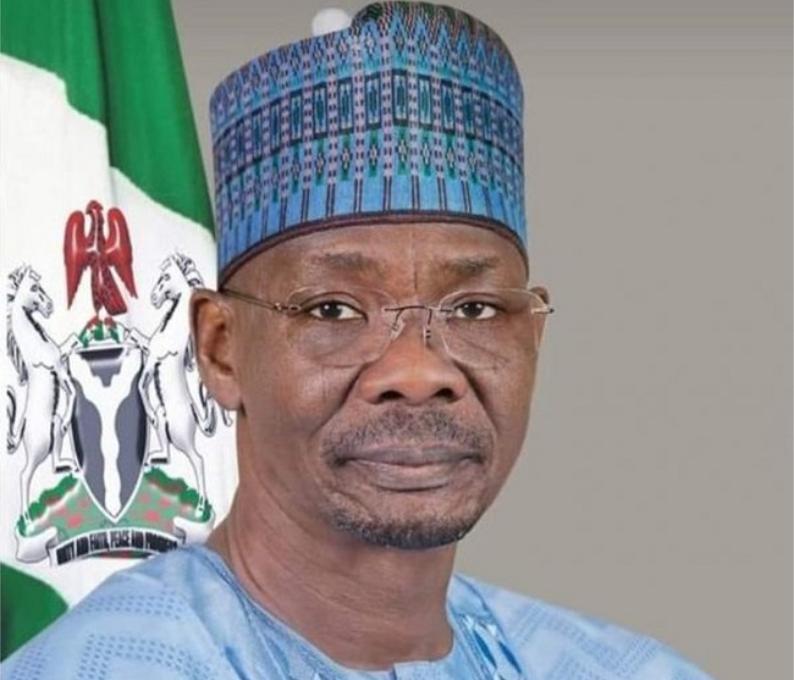

NCDMB’s delegation was led by the Executive Secretary, Engr. Felix Omatsola Ogbe, while Mozambique’s team was led by the Chairman of Empresa Nacional de Hidrocarbonetos, Mr.

Estevao Rafeal Pale.The experience-sharing session was facilitated by Aberdeen Global Strategies & Solutions, under the leadership of Dr. Mark Osa Igiehon, who consults for ENH Mozambique.

In his introductory comments, the Executive Secretary conveyed NCDMB’s commitment to supporting African oil-producing nations in developing and implementing local content policies as a strategy for improving indigenous participation and value optimization from hydrocarbons and mineral resources.

He lauded the giant strides recorded by Mozambique in its gas sector and advised against repeating the mistakes made by Nigeria in the early years of its oil and gas industry.

Represented by the Director of Monitoring and Evaluation, NCDMB, Mr. Abdulmalik Halilu, the Executive Secretary explained that every oil and gas-producing nation must choose to either focus on optimizing revenue generation or maximizing in-country value from the activities of the industry.

He stated that the revenue generation option encourages oil and gas operators to seek the cheapest and fastest route to first oil, while the Government collects maximum revenue in the form of taxes and royalties for development and pays little attention to value addition from industry operations.

He explained that the alternative option focuses on maximizing in-country value and promoting the development and use of local capacities. This model obligates operators in the industry to consider long-term value, while the Government takes lower revenue in exchange for higher in-country value and pays greater attention to life-cycle support for operators.

Speaking further, the NCDMB boss listed key parameters that are critical to in-country value addition and growth of the oil and gas sector on a sustainable basis. These factors are Regulatory Framework, Gap Analysis, Capacity Building, Funding and Incentives, Research and Development, and Access to Market.

He hinted that a Local Content policy backed with appropriate legislation is very fundamental in local content practice, adding that baseline and periodic gap analyses are essential to determine gaps that need to be closed in the areas of skills, facilities and infrastructure.

He also stressed the need to develop in-country capacities and capabilities and utilise them through oil and gas projects.

The knowledge-sharing programme also featured a presentation on Funds and Funding of NCDMB, delivered by the Director of Finance and Personnel Management, NCDMB, Dr. Obinna Ofili.

The Director was represented by the Head, Credit Analysis and Risk Management, Mrs. Chika Enwerem–Okidi, and underlined the need for dedicated funding that would be applied to developing local content in the oil sector.

The Director mentioned that the Nigerian Content Development Fund (NCDF) is provided for in section 104 of the Nigerian Oil and Gas Industry Content Development (NOGICD) Act and is contributed by 1% of every contract awarded in the upstream section of the oil and gas industry.

He added that the NCDF has been deployed in several successful projects, including the building of human and material capacities, the $350 million Nigerian Content Intervention Fund, the ongoing development of the Nigerian Oil and Gas Parks Scheme (NOGAPS), the construction of the NCDMB 17-story corporate headquarters, and 3rd party investments, many of which created jobs for Nigerians and yield interest for the Board.

The second day of the knowledge-sharing programme featured presentations on the operating framework for planning, research and statistics, capacity building, projects certification and authorization and monitoring and evaluation.

The Director of Projects Certification and Authorization, Engr. Abayomi Bamidele highlighted NCDMB’s role in the award of contracts for oil and gas projects and how opportunities are captured for the local economy, using the Nigerian Content Plan and the Contracting Strategy submitted by operating companies for the Board’s review and approval.

He underlined that local content should be promoted as a national agenda for every country and the right data must be collected to establish current realities and gaps to the target.

He emphasised the need for in-country capacity building based on areas of strengths and weaknesses as well as continuous projects to keep the developed capacities engaged.

The knowledge-sharing programme was very interactive and the Mozambican officials sought clarifications on the Board’s model of enforcing Local Content Compliance, monitoring projects, supervising third-party investments, and many other areas.

The programme was convened in line with the Sectorial and Regional Market Linkage Pillar of the Nigerian Content 10-year strategic roadmap. The roadmap requires NCDMB to support other African oil-producing countries and to develop new markets and partnership opportunities for the benefit of competent Nigerian operating and oil service companies.

NCDMB has provided similar guidance to numerous African nations, including Senegal, Tanzania, and Uganda.

BUSINESS

Subsidy Removal: Tinubu Kept his Campaign Promise – Akutah

Executive Secretary/CEO, Nigerian Shippers Council (NSC), Pius Akuta said President Bola Tinubu kept to his campaign promise by removing fuel subsidy.

Tinubu announced the removal of subsidy on petrol immediately he was sworn in on May 29, 2023.

“The very first day, he took a very bold initiative to remove fuel subsidies, which many of you have written and condemned in the past.

“We don’t know if other people would have had the courage to go ahead and remove it.

“All the presidential candidates at that time promised to remove the fuel subsidy but, for this President has displayed that capacity to do what he said,” he said.

According to him, Tinubu, in the last two years, took some bold steps, taking some policy directions that are shaping the economy.

He said that the country`s foreign reserves were in a bad shape when the current administration took over the government, adding that now there is significant growth.

Akutah said that the president acknowledged that there was hardship, but he stuck to that policy which has brought a lot of gains in the way of government business today.

“Even at the sub-national levels. You know that state governments have more money now; local governments have more money due to that policy direction.

“We need to commend President Tinubu for that initiative, which has put more money at the sub-national level for capital projects to spring up.

“We are seeing many states executing many projects, capital projects, and huge infrastructural developments going on in so many states,” he said.

He said that for Tinubu to have acknowledged developments in opposition states means he is eager to see the country developed in terms of infrastructure.

“It doesn’t matter whether you are in his party, but the moment you are doing the right thing, he will stand with you, and he acknowledged that publicly.

“The GDP was at one very low and the growth was very slow and sluggish before President Tinubu assumed office,” he said.

BUSINESS

Power Outage Killing Our Businesses, Enugu Residents Cry Out

Residents of Ologo, Coal Camp and Uwani areas of Enugu metropolis have decried persistent power outage in the area spanning over one week, and appealed to relevant authorities to come to their aid.

A cross section of the residents, who spoke in Enugu on Tuesday called for Gov.

Peter Mbah’s intervention to restore power supply to the area.They said that lack of power supply was affecting their businesses, households and means of livelihood.

Recall that the MainPower Electricity Distribution Company Limited (MPECL) on Aug. 4, issued a statement blaming the Enugu Electricity Distribution Company (EEDC), for the development.

According to the company, the reduction followed the decision by the Enugu Electricity Regulatory Commission (EERC) to slash electricity tariff for Band A from N209 per kWh to N160 per kWh.

Since the directive came into effect on Aug. 1, electricity consumers on Band B to E have been thrown into darkness in parts of the city, crippling many economic activities.

A welder at the Mechanic Shop in Coal Camp, Obum Chijioke, said that he had spent a lot of money on fuel to do his job adding that he went home empty handed.

According to him, it has not been easy for us in the past one week as we spend the little we make on fuel.

Chijioke appealed to the relevant authorities to look into the problem urgently and restore the energy.

A cleric in a church on Zik Avenue, who spoke anonymously, said that the church had been using diesel for its activities including services and it was taking a toll on them.

“We spend between N25,000 and N30,000 on diesel daily for our activities and it is not easy at all,”.

A retail shop operator, Chika Alejim, decried the situation, saying that it had affected her business.

She said she had not been able to chill her drinks and sachet water, which were the mainstay of her business.

According to her, the business was no longer booming unlike before, thereby, affecting her profits and incurring more expenses.

“I buy fuel of N20, 000 daily; I spend N10, 000 on fuel in the morning and another N10,000 at night and all these expenses eat deep into my profits.

“Also, the ice fish and meat, which I sell to support the provision store, got spoiled due to power outage,” she said.

In the same vein, Charles Ako, a business centre operator said that he no longer cope with the huge cost of keeping the centre functional.

“I have stopped those undergoing computer training due to absence of power supply.

“I use little fuel. I have to do photocopy and printing when a customer comes.

“I don’t know when the power issue will be sorted out; I am appealing to those concerned to help Enugu people because we are suffering,” he said.

Also speaking, a housewife, Ukamaka Ugwu described the effect of lack of power supply as serious, saying that it had pushed up the family’s daily expenses.

She said she had stopped cooking in large quantities because there was no electricity to preserve the food.

Meanwhile EERC, in a statement on Aug. 10, said steps were being taken to resolve the power shortage.

The commission revealed that it had met with both EEDC and Main Power in a bid to restore normalcy.

BUSINESS

Nigeria Requires $120bn to Build Federal Roads – TUC

The Trade Union Congress of Nigeria has stated that the country would need an estimated $120bn to construct its federal road network, a sum that is roughly four times the size of its annual budget.

The union described the gap between Nigeria’s infrastructure needs and available resources as alarming, accusing much of the political leadership of lacking the vision and innovation required to revive the economy.

Speaking at the second edition of the TUC South-West Summit 2025 in Lagos, TUC President-General Festus Osifo cited a 2013 study that put the cost of constructing all federal roads at $120bn.

He noted that Nigeria’s current budget, which stands between $30bn and $35bn, is already heavily committed to salaries, education, healthcare, defence, and other essential services.

“If constructing all our roads will cost $120bn, and the size of our budget is $30bn, it means we need four times our budget just to fix roads, without paying salaries, funding education, or providing healthcare,” Osifo told delegates. “This is why we must grow our revenue base and stop pretending that oil alone can sustain this country.”

He criticised successive governments for failing to diversify the economy in any meaningful way despite Nigeria’s vast opportunities in agriculture and solid minerals. According to him, the chronic underfunding of infrastructure is not only due to low revenue generation but also stems from weak political leadership.

“Most of our political heads, from governors to local government chairmen, are relatively lazy. In some rural councils, you will not see the chairman until allocations arrive,” Osifo said. “We cannot continue with leaders who wait for monthly allocations before doing anything. They must think beyond the obvious and work for the people.”

He contrasted Nigeria’s performance with that of countries with smaller landmasses and fewer natural resources, which earn more from agriculture than Nigeria currently generates from oil exports. “We have arable land, we have human capital, yet we leave them idle while relying on a single commodity that the world is steadily moving away from,” he added.

Representing Lagos State Governor Babajide Sanwo-Olu, Commissioner for Establishments and Training Afolabi Ayantayo acknowledged the validity of the TUC President’s concerns. He called for stronger partnerships between government and organised labour, noting that Nigeria’s diplomatic missions abroad were underutilised and often failed to secure export markets for local produce and manufactured goods.

“Collaboration is key. We must invest in skills development, fair wages, and policies that address inflation and the rising cost of living,” Mr Ayantayo said. “In Lagos, we are committed to workers’ welfare and timely salary payments, but we also recognise the need to push productivity and innovation.”

The summit, themed Collaborate to Transform: Building Capacity for Regional Excellence and Workers’ Welfare, gathered labour leaders, government representatives, and private sector experts to discuss strategies for driving economic growth in the South-West. Panel sessions explored topics such as agriculture, leadership, communication, emotional intelligence, and the role of artificial intelligence in the workplace.

In his closing remarks, Osifo reiterated that unless Nigeria’s leaders adopt more proactive and resourceful approaches, the country will remain trapped in a cycle of inadequate budgets, deteriorating infrastructure, and wasted opportunities.

“The $120bn needed to fix our roads is not just a number but a reflection of how far behind we are. Only bold and innovative leadership can bridge that gap,” he concluded.

| ReplyReply allForwardAdd reaction |