OPINION

Nigeria’s Road to Zimbabwe With Money Printing

By Nick Agule

Within the last week a war of words has ensued over the management of the Nigerian economy with Gov Obaseki of Edo State firing the first salvo by accusing the FG of the catastrophic management of economy alleging that the FG is printing money to fund federal allocations.

Nigeria’s Finance Minister Mrs Zainab Ahmed fired back in these words:

“The issue that was raised by the Edo State Governor, for me, is very sad because it is not a fact.

Gov Obaseki returned fire that as an investment banker he stands by his words. This is how he put his rebuttal of the statement issued by the Finance Minister:

“The Minister of Finance, Budget and National Planning, Mrs. Zainab Ahmed should rally Nigerians to stem the obvious fiscal slide facing our country. Rather than play the Ostrich, we urge the government to take urgent steps to end the current monetary rascality, so as to prevent the prevailing economic challenge from degenerating further. We believe it is imperative to approach the Nigerian project with all sense of responsibility and commitment and not play to the gallery because ultimately, time shall be the judge of us all.”

It became clear that between Gov Obaseki and the Finance Minister, one person was not telling the truth given that their views were diametrically opposed.

All this while as the crossfire raged, the CBN Gov was mute until he was captured on camera issuing threats to Gov Obaseki and other Govs who were bailed out in 2015/16 that recovery action will begin immediately against them if they don’t stop accusing the Govt of printing money! Instructively the CBN Gov did not outrightly deny that the Govt is printing money but did not concede either.

As pressure mounted on the FG specifically on the Finance Minister and the CBN Gov to come clean to Nigerians on what is actually going on, the CBN Gov finally caved in and conceded that Nigeria is printing money in a tweet issued on Friday, 16 April 2021 in the following words:

“The concept of printing of money is about lending money and that is our job…It will be irresponsible for the CBN or any Central Bank or Fed to stand idle and refuse to support its government at a time like this.”

WHAT IS PRINTING OF MONEY

Now that the FG has conceded that they are indeed printing money, let us therefore examine what this means from a layman’s point of view and the impact on our economy.

The CBN prints two types of money:1. Physical money – this is the bank notes and coins we use in buying and selling or saving at home. It’s also called cash.

2. Digital money – this is money in our bank account.Thus you can have N1m with N100k in cash (physical) at home and N900k in your bank account (digital).

The printing of money in dispute here is the digital money not the physical cash. When Central Banks print digital money it is called Quantitative Easing (QE).

WHAT IS QE?

QE is a monetary policy tool that central banks use to inject money directly into the economy. So let us say the FG account at the CBN has a balance of N500 billion deposited by the revenue generation agencies of Govt such as the FIRS, DPR, NNPC, Customs etc. But this money is not enough for Govt to spend so the Govt asks the CBN to print money. The CBN simply credits Govt’s account with say N300 billion thus the balance in the Govt account is now N800 billion which Govt will now spend.

To be clear, there is nothing wrong with using QE. Govts all over the world use QE to jumpstart their economies. The US, UK etc Govts used QE in the 2008 economic crash and even more recently in the pandemic hit economies. So if QE is a known, tested and tried monetary economic policy tool, why was the Govt of Nigeria ashamed to disclose to the citizens that it was using QE? And even when they were exposed by Gov Obaseki, why was the Govt still denying until they were forced to concede?

The plausible answer is that Nigeria was making the wrong use of QE.

There are 2 halves to QE which are printing the money and using the printed money, if you don’t get the balance right then QE instead of helping to jumpstart the economy rather ruins it:1. Printing the money – by crediting the account of Govt at the CBN with money the Govt did not earn. It is just like you own a bank and you have an account with the bank but did not have money to spend, so you just call the MD of the bank and ask him to credit your account with N1 billion and you immediately see an alert of N1 billion and begin to pay your bills! This is the same thing the CBN is doing for the FG! This is one half of QE.

2. The 2nd half of QE is how the money is spent. For QE to be effective, there are only restricted ways the Govt can spend the money on. This is because monies earned by Govt from economic activity is backed up with output. So the oil companies must produce oil for DPR to earn money. Oil must be sold for NNPC to earn money. Imports must be made before customs earn revenue. Companies must pay taxes for FIRS to earn money. All these monies are coming from output based economic activities. The difference with QE money is that it is not backed up with output, Govt just increases money supply by fiat and thus it’s a timebomb and if mishandled it will blow off the economy!

To avoid the QE timebomb from exploding on the economy, traditionally the Govts spend QE money in very restricted ways which include:

a. Buy back bonds – bonds are Govt’s debt instruments used in managing the economy. For instance, if there is high inflation (prices are rising because too much money is chasing too few goods/services), Govt in a bid to reduce the inflation will issue bonds. Those who buy the bonds give Govt money and hold the bonds which attract interest payments from Govt. Thus by Govt mopping money from people’s (individuals and companies) pockets, there is less money to spend and the less money that chases goods/services will result in price drop and thus inflation is contained. The reverse is the case when the economy is down and the Govt wants to boost it. The Govt uses the money from QE to buy back the bonds. So bond holders will surrender the bonds back to Govt and collect their money back. With more money in people’s pockets, they buy more goods/services and this will encourage manufacturers and businesses offering services to produce more to meet up with the demand. The greater output means prices drop as more goods/services are now in the market! The economy is thus brought back to life!

b. Bail out the struggling productive sector of the economy – here the Govt uses the money printed by QE to bail out ailing industries suffering from the downtime in the economy so that with the new cash these industries will fund working capital to bounce back to business and boost their production. A boost in production means more jobs will be created as more factories reopen and service centres return back to life. The economy will then be jumpstarted back to life with increased output and jobs! The US for example used QE to bail out the banks, the auto industry etc during the crash of 2008 and Joe Biden has announced an infrastructure plan of $2 trn are some examples of Govts’ use of QE.

So why was the Nigerian Govt ashamed to admit they were using QE? Does it mean the Finance Minister was not aware of the sources of inflow into the federation account upon which she presides by saying the money was from the FIRS, NNPC, Customs etc and not from QE? Or was she fully aware that the federation account was being funded by QE but set out to deceive Nigerians and pull wool over faces? Either option does not look good on the Finance Minister.

The plausible reasons the Govt was ashamed to admit the use of QE is because while they are printing digital money which is the 1st half of QE, they are totally mismanaging the 2nd half because Govt is neither buying back bonds nor bailing out ailing industries with QE. Instead Govt is sharing the money to the 3 tiers/arms of Govt. And we know that the FG, States & LGs are not using the QE to buy bonds or bail out the ailing industries. The States and LGs are not even paying workers! Huge part of these monies end up being looted!

THE CATASTROPHE OF MISMANAGING QE

Let me illustrate what happens when QE is managed well and when it is mismanaged as follows:1. If QE is used rightly – it is a veritable economic management tool that jumpstarts comatose economies back to life. So let us say our economy produces 1,000 yams and money supply is N100,000, all the money will buy all the yams at N100 per tuber. Now if Govt adopts QE and prints N900,000 so that money supply is now N1 million and Govt uses the money to boost the agricultural sector by clearing the land, buying farm equipment and building processing plants, there will be a sharp rise in output to 20,000 yams. N1m will buy 20,000 yams at N50 per yam so price has crashed (inflation tamed) and jobs created because the workforce that will produce 20,000 yams will be more than the one that produced 1,000 yams! This is the beauty of QE when used for economic growth!

2. However and tragically too, if QE is mismanaged, it spells a death sentence to an economy. Nigeria is mismanaging QE by distributing it to the 3 tiers/arms of Govt. These Govts are neither buying back bonds nor bailing out industries. The money is not committed to infrastructure either. Instead the money is used for consumption with a huge chunk looted into the private pockets of those with access to the treasury. This portends danger to the Nigerian economy because the scenario above is reversed in the case of the Nigerian economy.

Let us say that our economy produces 1,000 yams. Money supply was N100,000. All the money used in buying all the yams, a tuber of yam will cost N100. Let us say that through QE money supply has increased to N1,000,000 without an increase in the quantity of yams produced, it means a tuber of yam will cost N1,000. As Govt continues to print money without commensurate increase in output of goods/services, prices will continue to rise until one day you will need a bag to carry the money to buy a tuber of yam! This is what happened to Robert Mugabe’s Zimbabwe’s currency where at a point one needed 35 million Zim dollars to buy a loaf of bread!!! And the shops were even empty as not goods were being produced! This is where Nigeria is heading if the Govt continues on the trajectory they are on right now of printing money without boosting output. Already the impact of the mismanagement of QE is showing with Nigeria’s annual inflation reported to have climbed to a more than four-year high in March 2021, rising 82 basis points from a month earlier to 18.17%. Notably food inflation rose to 22.95% which is making it increasingly impossible for families to feed their children!!!

SOLUTION TO NIGERIA’S ECONOMY

Constructive criticism is the one that comes with viable suggested solutions. When individuals or organisations are struggling financially, there are two ways open to them to drive out of the economic jam! First is to reduce cost and secondly is to increase revenue. This is like a double dose of vaccine to give Govt a fighting chance against infection of financial troubles. Therefore the following are the top 5 suggested economic management tools that are available to the Nigerian Govt to adopt to jumpstart the economy:1. Reduction in cost of governance – The Nigerian Govt must take immediate action to reduce the cost of governance. The Orosanye Committee which turned in an 800-page report with far-reaching recommendations on how Govt will reduce cost of governance must be immediately given full implementation. The Committee recommended the MDAs that should be scraped, those to be merged and those to become self-funding, thereby freeing funds for the much-needed capital projects across the country. The Committee also recommended the discontinuance of government funding of professional bodies and councils. Govt expenditure on things like sponsorship of pilgrimages must also be stopped immediately. The salaries of legislators, ministers and other top functionaries of Govt must be scaled down as with their convoys and other pecks of office. Govt must implement full e-govt to cut down on costs of travels, printing etc. Efficiencies in procurement activity must be generated to obtain best value for the least cost etc.

2. Taxation of the rich – Nigeria is a country where the billionaires don’t pay taxes. All the market women, okada riders, farmers, artisans etc are made to pay taxes daily. Employees who are captured under PAYE also pay taxes monthly. The Billionaires with private jets are paying little or nothing. The FG at the highest level must summon all the billionaires in Nigeria to a meeting in the Villa and ask them nicely to go and pay their taxes else there will be enforcement action. This step alone which only requires an investment of 30 minutes of the President’s time will shore up Nigeria’s revenue by at least N5 trn!

3. Stop the $1.5 billion PH refinery repair – Govt must stop immediately the planned rehabilitation of the PH refinery with a sum of $1.5 billion. Knowing that Govt projects are never delivered within budget, this rehabilitation may end up costing Nigeria $3-5 billion! The refinery can be sold as scrap for $1 (one dollar) to allow the buyers to bring in $1.5 billion to repair it. Govt must then convert the $1.5 billion into N570 billion (at N380/$) and invest the full money into agriculture in all the 774 LGs in Nigeria. N570 billion is N736 million for each of the 774 LGs in Nigeria. If Govt sinks N736 million into agriculture in every LG in Nigeria, so much food and cash crops will be produced, there will be plenty of jobs for the teeming youths too. Thus the economy will be jumpstarted and begin to grow astronomically as an output based economy and not QE which is like steroids!!!.

4. Power – it is a shame that Nigeria as a nation well-endowed with one of the world’s richest deposits of gas reserves, takes pains to produce the gas and then sets the gas on fire instead of harnessing it for electricity generation. Qatar a country with 2.8 million people is generating 8,500 MW of electricity and Nigeria a country with 200 million people is generating only 4,000 MW of electricity. The minimum electricity generation required to support the Nigerian economy is 100,000 MW!!! Thus the huge power supply gap in Nigeria can never jumpstart the economy no matter the economic policies we put in place and no matter the qualification/experience of the economic managers we appoint. QE will not help an economy that is this abysmally poorly powered with electricity! The FG must immediately read the riot act to the oil companies to stop flaring Nigeria’s gas else they must shut down oil production. Govt must also take immediate steps to fully privatise the power sector to allow for investments to boost power supply and close the electricity gap!

5. Rail – no economy will do well with the poor transport infrastructure that is obtained in Nigeria. The roads are not motorable but most importantly there is no rail transport in Nigeria. There is no reason not to have all the 36 capitals connected by rail today just for a start! The FG must take immediate steps to fully privatise the rail sector to allow investments to build and operate rail transportation to link all the cities, towns and villages in Nigeria. This will be a huge boost to the economy by making the movement of goods and people less cumbersome and far cheaper across the nation. It will also create millions of well paying and sustainable jobs for the teeming population of our unemployed youths.

NIGERIA’S ECONOMY MUST BE SAVED!!!

If the FG follows the suggested solutions, the Nigerian economy will begin to explain astronomical growth and this will be real growth and not steroids which QE is. But if the Govt continues on the trajectory of printing money (QE) without output backed, we will be sure on the road to Zimbabwe and a catastrophic end to our economy. This must be avoided at all costs!!!

OPINION

New Wave of Malnutrition and the Road to 2027

By Dakuku Peterside

As the political season begins in Nigeria ahead of the 2027 elections, we are beginning to see another round of promises, slogans, and declarations of vision. Billboards will soon rise, rallies will be held, and political actors jostle for public attention.

But beneath this loud, choreographed performance, a quieter tragedy unfolds in the country’s northern belt — children are wasting away, not in war, not in displacement, but in silence. The contrast is jarring while politicians vie for airtime, a grave, slow-motion emergency is eroding the potential of an entire generation. Across northeast and northwest geopolitical zones, severe acute malnutrition has reached levels comparable to what is often seen in war times. Yet no formal war is raging. Instead, an absence of attention, of priority, of leadership is doing the damage.I first sensed the scale of that dissonance on a sweltering July afternoon in my visit to one of the northern states. A nurse at a community health post held up a measuring tape — green for health, red for danger — around the twig‑thin arm of a three‑year‑old girl. The dial fell deep into crimson. “We see wartime numbers,” the nurse whispered, shaking her head, “but there is no war.” That single sentence captures the moral puzzle now facing Nigeria: How can such devastation grow in the relative calm of peacetime?In clinics scattered across the North, community health workers continue their daily rituals: measuring the circumference of toddlers’ arms, documenting weight loss, and trying, with limited resources, to stem a tide of hunger that has outpaced both state responses and national outrage.According to the International Committee of the Red Cross, over 3.7 million people are acutely food insecure in northern Nigeria. However, this figure, as dire as it is, likely underestimates the accurate scale of the crisis. Many remote villages receive no formal visits, no surveys, no clinical screenings — only the steady arrival of hunger and poverty. Factor them in, and the count edges toward five million. Even these aggregates blur the lived reality. In Zamfara’s dusty hamlets, entire households survive on a single meagre meal; in Yobe’s IDP camps, mothers dilute porridge to stretch one cup for three children.The UN Office for the Coordination of Humanitarian Affairs (OCHA) had warned that in 2024 alone, more than 700,000 children in the region suffered from severe acute malnutrition (SAM), with over 100,000 of them at imminent risk of death without urgent medical intervention.The figures in 2025 will be even more staggering, given the recent evidence of malnutrition in the area. Médecins Sans Frontières (MSF), also known as Doctors without Borders, has raised alarm over the growing number of malnourished children in Nigeria, revealing that it admits more than 400 cases daily in Kebbi State alone.Malnutrition is rarely dramatic — it arrives in shrunken bellies and dulled eyes, in children too tired to cry and mothers too weak to breastfeed. It creeps in through drought, displacement, conflict, food inflation, and broken systems. And because it does not explode, it often does not make headlines. Unlike terrorism or natural disasters, it is quiet. But it is just as deadly. Every single day in Nigeria, approximately 2,300 children under five die, and malnutrition is a contributing factor in nearly half of these deaths.The painful truth about this crisis is its preventability. Hunger in northern Nigeria is not a natural disaster, but a consequence of a system that values political optics over structural reform. During campaigns, politicians often launch food drives and cash transfers with great fanfare — short-term gestures that provide immediate relief and long-lasting headlines.However, these interventions are rarely part of a long-term strategy. They do not enhance food production, maternal health, access to clean water, or early detection systems. There are no incentives to invest in reforms that take years to show results. Why build resilience when elections are won by what people can see now?The cost of ignoring malnutrition is profound and enduring. A stunted child is not just a personal tragedy but a national one. Nigeria has the second-highest burden of stunted children globally, with an estimated twelve million under the age of five affected by chronic undernutrition.Nearly one in three Nigerian children is stunted, which means their physical and mental growth is permanently impaired. These children will likely do worse in school, earn less over their lifetimes, and face greater risks of chronic illness. The World Bank estimates that malnutrition can reduce a country’s GDP by up to 11 per cent when you account for lower productivity, higher health costs, and lost potential.Every untreated case of malnutrition is an invoice deferred to the future. Neuroscientists remind us that the first 1,000 days of life shape the brain’s wiring. A stunted child may never fully catch up cognitively, no matter the quality of later schooling. Economists convert those impairments into lost productivity, estimating that Nigeria could be forfeiting 2 to 3 per cent of its GDP annually.Public‑health accountants tally the hospital admissions for pneumonia and diarrhoeal disease that soar when immune systems are starved of zinc, iron, and vitamin A. Sociologists track the link between food scarcity and unrest, noting how hunger can erode social trust faster than any televised grievance. Put differently: malnutrition is not just a humanitarian concern — it is a stealth saboteur of national security, economic diversification, and educational reform. Ignore it, and every other development target becomes more complex and more expensive to hit.Children who come to school hungry are less likely to concentrate, more likely to drop out, and far less likely to escape poverty in adulthood. In northern states like Kebbi and Zamfara, school absenteeism is often directly linked to hunger. According to UNICEF, 70 per cent of school-age children in food-insecure households miss more than three days of school a month. The cycle is cruel and self-reinforcing: hunger leads to poor learning, which in turn leads to unemployment and poverty; poverty then feeds back into hunger.And yet, there are glimmers of what is possible when leadership is guided by vision and conscience. A state in the southeast has introduced a “one balanced diet a day” policy for all school-age children, recognising the devastating effects of hunger on education, health, and long-term human capital.This singular act, although modest in scale, presents a transparent and replicable model that other states should adopt urgently. It shifts nutrition from being an emergency response to a daily, institutionalised commitment, integrating school feeding with agricultural and health systems.Already, early evaluations show improved school attendance, weight gains in children, and even local economic stimulation through the sourcing of produce from nearby farms.Dr Ali Pate, Nigeria’s Coordinating Minister of Health and Social Welfare, is leading a comprehensive national effort to combat malnutrition as a public health emergency. His multi-sectoral approach combines immediate treatment with long-term prevention strategies.Treatment centres equipped with locally produced, ready-to-use therapeutic foods (RUTF) have been established in the northeast and northwest, achieving recovery rates of up to 90%. Funding has significantly increased, with $11 billion allocated by the federal government and an additional $60 million from UNICEF to support healthcare infrastructure and nutrition programs.Community-level early detection systems using MUAC tapes are being scaled up, and over 40,000 health workers are being trained to identify and manage malnutrition. Through the National Strategic Plan of Action on Nutrition and the N774 programme, nutrition services now reach most local government areas.Nationwide implementation of standardised guidelines, micronutrient supplementation, food fortification, and public nutrition education campaigns has reached many caregivers. Crucially, Dr. Pate has unified efforts across ministries and sectors through a central coordination platform, accompanied by new accountability mechanisms, to track progress and ensure sustainability.What is a pragmatic roadmap between now and 2027? Make nutrition politically contagious. Party manifestos must feature explicit, budgeted nutrition targets — malnutrition cannot survive the scrutiny of voters. Scale what already works.Community Management of Acute Malnutrition (CMAM) programmes, when fully funded, can treat a child for less than the daily cost of a campaign rally. Mandatory fortification of flour, cassava, and cooking oil can reach millions silently and efficiently — re-engineer agriculture for climate reality. Drought‑tolerant millet varieties, solar‑powered boreholes, and warehouse‑receipt systems to curb post‑harvest loss will outlast any campaign poster. None of these actions requires reinventing the wheel. They demand, instead, a political imagination wide enough to see past the next podium.Still, the work ahead remains monumental. These initiatives, while promising, must be scaled aggressively and protected from the shifting winds of politics. If Nigeria is to stand any chance of reversing the tide of child malnutrition, this moment—this narrow window between now and 2027 — must become the tipping point.Every state must follow the example set by Anambra. Every governor must internalise that a child fed today is a citizen empowered tomorrow. Every candidate must treat child nutrition not as a talking point but as a policy cornerstone.If Nigeria’s political class decides that malnutrition is not a side issue but the central test of stewardship, the nascent election season for the 2027 elections could mark the start of a renaissance in child survival and, by extension, national renewal. The road is narrow, the window short. Yet history is replete with moments when political will, once awakened, turned statistics into stories of recovery.The children of northern Nigeria deserve that pivot — deserve to swap the colour red on a measuring tape for the bright green of health, growth, and possibility. If Nigeria’s political class truly wishes to build a country that works for all, it must start by ensuring no child falls through the cracks of neglect. Let the road to 2027 be paved not just with promises, but with full bellies, thriving children, and a generation finally given a fair start.Dakuku Peterside, a public sector turnaround expert, public policy analyst and leadership coach, is the author of the forthcoming book, “Leading in a Storm”, a book on crisis leadership.OPINION

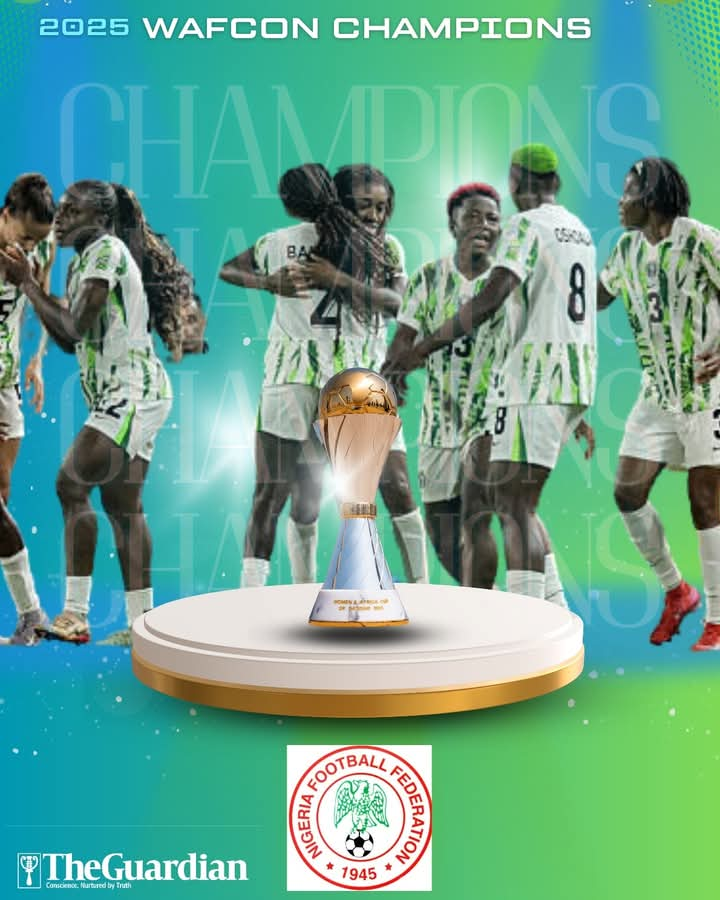

Super Falcons: Queens of Africa

By Reuben Abati

Nigeria’s senior female soccer team, the Super Falcons are the Queens of Africa given their superlative, dominant and creative performance, their resilience, and agility at the just concluded Women’s African Cup of Nations (WAFCON) organised by the Confederation of African Football (CAF) in Morocco, 5–26 July.

Since the inception of the tournament in 1998, the Super Falcons have won 10 times out of the 13 times that the event has held: 1998, 2000, 2002, 2004, 2006, 2010, 2014, 2016, 2018, and now 2024, missing the trophy only thrice in 2008, 2012 – won by Equatorial Guinea, and in 2022 – South Africa. Ahead of the 2024 WAFCON in Morocco, the manager of the team, Justin Madugu had declared that they were going on a Mission X, that is to win the trophy for a record 10th time.Their victory is the accomplishment of that dream, and a reaffirmation of Nigeria’s supremacy in female football. But the road to that moment was in no way easy. The Falcons beat Tunisia, 3-0 in their opening match, and further defeated Botswana 0-1 to get to the competitions’ knock-out stage.The next match against Algeria was a goalless draw, but the Falcons had enough points to go through to the quarter finals, having led Group B. Their next opponent was the Copper Queens of Zambia, who had led Group A, and were supposed to be something of a threat.The Super Falcons trounced them 5–0. Then they got to the semi-finals to face defending Champions, and a rival team, the Banyana Banyana of South Africa. It was a nail-biting, nerve-wracking, tension-soaked match. The South Africans were determined.Nigeria scored through a spot kick in the 45th minute converted by team captain Rasheedat Ajibade. In the 60th minute, the South Africans also levelled the score through a penalty kick making the match 1-1. It looked as if the game was heading for extra time, until Michelle Alozie scored in the 94th minute turning a pass from Esther Okoronkwo into a dramatic win for the Falcons.The final match on Saturday, 26 July was no less stunning. The Falcons were trailing 2-0 down by the end of the first half, in front of a crowd of Moroccans solidly behind their home team. It was a different ball game, however, in the second half.The Falcons returned to the pitch fighting as if their lives were at stake. Esther Okoronkwo scored against the Moroccans in the 63rd minute, Folashade Ijamilusi followed up with another goal in the 71st minute, and in the 88thminute Jennifer Echegini, settled the matter with a Nigerian goal that was celebrated across the country.It was an amazing comeback, reminiscent of the Miracle of Damman in 1989, when during the quarter final match between Nigeria’s U-20 football team, the Flying Eagles came back from four goals down to beat the USSR team and went on to win the match subsequently on penalties, 3-5. Women’s football has grown in Africa, and Nigeria’s Super Falcons are the Queens.It is instructive that the individual and collective talent of the Super Falcons is now being rated against the capability of the Super Eagles. Failure is an orphan; success has many parents. This is in part the trite lesson of the Miracle of Rabat.The Falcons returned home yesterday, touching down at the Nnamdi Azikiwe International Airport, Abuja at approximately 2:26 pm. to a well-appointed celebration in the Federal Capital Territory, Abuja, in an open-bus parade across the city before presenting the trophy to President Bola Ahmed Tinubu, his wife and other senior government officials at the Presidential Villa.The President had told the Super Falcons that he was waiting to receive the trophy, and he played his part by ensuring that bonuses and allowances for the Falcons were duly paid, but this team didn’t play for money. They played for glory and they brought honour home. They brought history home too, creating a significant moment of celebration. They are Champions, the tenth time. They are also the first to win the newly redesigned WAFCON trophy. They won a title prize of one million dollars.The ladies were exceptional on the field of play: four of them made it to the WAFCON Best XI list. Rasheedat Ajibade was crowned Player of the Tournament, having won Player of the Match thrice, Esther Okoronkwo was Player of the Match in the final against Morocco, Chiamaka Nnadozie was recognised as Goalkeeper of the Tournament having conceded only three goals.Michelle Alozie was also a standout star. The team manager, Justin Madugu, from. Adamawa state, was recognized as the Coach of the Tournament. He was just appointed an interim coach of the Super Falcons in September 2024, and now he has proven that he is a man of pedigree. Other members of the team were just as brilliant: Asisat Oshoala (who says she is not retiring by the way, and nobody should carry fake news), Rinsola Babajide, Chinwedu Ihezuo, Osinachi Ohale, Folashade Ijamilusi, Chioma Okafor.Two members of the team – Ashleigh Plumptre, and Chioma Okafor deserve special praise. Plumptre is a British-Nigerian, Chioma Okafor’s mother is from Malawi. At a time when the likes of Kemi Badenoch and Favour Ofili are rejecting Nigeria, these two ladies opted to stand up for Nigeria.President Tinubu showed a nation’s appreciation by bestowing the National Honour of OON on the Super Falcons and the entire technical team. He also gave a three-bedroom apartment in Abuja to each of the players and the technical crew and the naira equivalent of $100,000 (N153 million) to each of the 24 players and $50,000 to the 11-man technical crew.Great. But can we possibly extend this honour to those who won the WAFCON nine times earlier and are no longer in the Super Falcons team? They deserve to be appreciated too.The South African team won the fair play award for their on-and-off-field behaviour as well as respect for opponents and officials. They were composed. They were disciplined. They certainly deserve the recognition, but the spirit of sportsmanship that was generally demonstrated at the tournament should be remarked upon and underlined.During the Nigeria-South Africa semi-final, Gabriela Salgado, South African winger was injured in the 87th minute and had to be stretchered off the field, and rushed to the Mohammed VI University Hospital where she underwent surgery in the left leg.The entire Falcons team visited Salgado, the following day at the hospital and presented her with a signed Nigerian jersey and a statement expressing solidarity and wishing her speedy recovery. Salgado also received solidarity messages from Ghana’s Black Queens, CAF, other teams at the tournament, and South African President Cyril Ramaphosa. This show of humanity is noteworthy. There are perhaps lessons that male footballers can learn from women footballers both in Africa and worldwide, and the Libyan Football Federation in particular which maltreated the Super Eagles in October 2024 has lessons to learn too.There may have been instances of on-pitch fights and intense altercations in women’s football but they are relatively less frequent. Football should not turn into war by other means, which is why it is shocking that after the WAFCON, Morocco has now reportedly lodged a protest with CAF questioning the nationality of two Nigerian players: Ashleigh Plumptre and Michelle Alozie.Morocco wants Nigeria to lose the title. They don’t have a case. They were beaten fair and square. Plumptre’s grandfather is from Lagos, Nigeria; Alozie’s parents are Nigerians. Nigerians born and raised abroad have a right to Nigerian citizenship under Section 25 of the 1999 Constitution of Nigeria.CAF deserves commendation for organising a successful 2024 WAFCON, with the quality of officiating, deployment of technology and Morocco for being good hosts (let them not ruin that though by lodging frivolous and vexatious complaints against Nigeria).The weekend that just passed was, altogether, a special moment for women’s football, with the WAFCON final played at Rabat on Saturday, followed by the Euro 2025 final between Spain and England in Basel, Switzerland on Sunday. While the Super Falcons were arriving Abuja yesterday, the Lionesses of England were also touching down in London to a similar heroes’ welcome.They had successfully defended their European title on Sunday, beating Spain on penalties, 3-1. They would have an open-bus parade on Tuesday after they were received by the Deputy Prime Minister Angela Rayner at No. 10. There were anxieties and doubts about the capability of the Lionesses to defend their European title. Many wrote them off.Mary Earps and Fran Kirby had retired a few weeks before Euro 2025. Millie Bright also withdrew from the selection. When the Tournament began, England lost their opening game to France. But as if it was a fairy-tale unfolding, they went on to beat the Netherlands and then, Wales. During the quarter-final against Sweden, the Lionesses were two goals down but luck was on England’s side.They went on to win on penalties. During the semi-finals against Italy, they were also 1-0 down, until Michelle Agyeman scored an equaliser in the 96th minute, and Kelly Chloe put in the winner for England in the 119th minute.Spain led 1-0 in the final match on Sunday, but England still came back to win a penalty shoot-out 3-1. The English ladies were driven by determination, faith and belief. Hannah Hampton who kept the goal, emerged from the shadows of Mary Earps and saved four penalties for England during the tournament, two during the quarter final against Sweden and the other two during the final match against Spain, winning Player of the Match in both instances.Michelle Agyeman was the Best Young Player of the Tournament. Each time she was introduced as a sub, the flow of the game changed. Lucy Bronze played with a fractured leg. At 37, she was the oldest player at Euro 2025, and yet she played for a total of 598 minutes. The Lionesses have given England what has been described as “the greatest achievement in English football” – the first time England has won a major trophy on foreign soil.The Lionesses are the Queens of Europe. Sarina Wiegman, the manager, has won two finals back-to-back reinventing the glorious days of Emma Carol Hayes, former manager of the Lionesses, who is now the head coach of the United States women’s national team. Wiegman has been a head coach in five successive European finals.What is common to both the Falcons and the Lionesses was their sheer determination, focus, defiance and a sense of purpose. The ladies were self-motivated, they wanted to win, they fought for national pride, and they worked together as a team.The two head coaches also knew their onions. Each time Madugu or Wiegman substituted a player, the replacement proves to be just the tonic that the side needs, be it Deborah Abiodun in the 81st minute of Nigeria’s semi-final against South Africa, or Christy Ucheibe, Esther Okoronkwo and Chiwendu Ihezuo or Jennifer Echegini in the final against Morocco. England came from behind in three of the knock-out stage matches in Euro 2025 (against Sweden, Italy, Spain) but Wiegman used substitutes to telling effect, notably Chloe Kelly, Ella Toone and Michelle Agyeman.Football coaching has become more technical than ever, and the modern manager must be a tactician. Both teams displayed the Never-Say-Die spirit to overcome adversity. Men’s football may still be ahead of women’s football in terms of salary, compensation and eyeballs, but without doubt the future of female football is assured.The aggregate attendance at Euro 2025 was over 600, 000, far more than the aggregate of 574, 875 in 2022. More people worldwide are showing interest in female football, and a future generation of girls will be inspired by current examples to take to the game.Football glory is always a source of unity and faith for the average Nigerian. The men’s national team, the Super Eagles should draw inspiration from the Super Falcons. The main challenge before them is how to qualify for the 2026 World Cup in the US, Mexico and Canada.The next phase of the qualifying series would soon commence with Nigeria having four matches at hand: beginning with the Amavubi of Rwanda on September 6 at home, an away march in South Africa on 9 September, and two last games against Lesotho and the Benin Republic in October.The country is currently fourth in the qualifying Group C with seven points, six points behind South Africa who lead the group with 13 points. The Super Eagles have had a new head coach since March 2025, the French-Malian Eric Chelle, whose main charge is to take the Super Eagles to the next World Cup.The last time Nigeria qualified for the World Cup was as far back as 2018 in Russia, a very long time ago. Nigerians have high expectations. The Super Eagles must not disappoint them.Reuben Abati, a former presidential spokesperson, writes from Lagos.OPINION

Advancing Nigeria’s Security Strategies through Unmanned Aerial Systems

By Patricia Amogu

In the face of Nigeria’s deepening security crisis, marked by terrorism, banditry, kidnapping, and communal violence, a glimmer of hope is on the horizon as homegrown security innovations gain momentum.These indigenous initiatives are gradually taking centre stage, lifting the spirits of millions and giving balance to the lives of many vulnerable and displaced communities across the country.

Recently, a groundbreaking collaboration between the Nigerian Military and Briech Unmanned Aerial Systems (UAS) birthed the first and largest indigenous attack drones and bomb systems in Nigeria and Africa. Unveiled at the company’s Abuja headquarters, this cutting-edge technology is being hailed by stakeholders as a potential game changer in the fight against insurgency and organised crime.According to Mr Bright Echefu, Chairman of EIB Group and founder of Briech UAS, the innovation became imperative as extremist groups like Boko Haram and ISWAP increasingly weaponised commercial drones to spy on troops, coordinate ambushes, and conduct aerial attacks.“Our enemies are adapting fast; they are using off-the-shelf drones to launch crude but deadly strikes.“We cannot afford to rely on outdated tools anymore,” he said.Echefu said that as Nigeria continued to invest in indigenous defense manufacturing, the country might potentially become a player in defence and security issues of many countries.Of interest, the European Union Agency for Asylum (EUAA) characterises Nigeria’s security situation as complex and deteriorating, citing armed banditry and widespread kidnappings as the leading causes of instability.Available data indicates that in 2023 alone, more than 75 per cent of conflict-related deaths were reported in the northern region.Attacks by Islamist groups, counter-insurgency operations, separatist tensions, and herder-farmer clashes continue to fuel widespread displacement and humanitarian distress.The North-East, in particular, has seen entire communities fleeing for safety as armed groups impose levies and destroy essential infrastructure.According to EUAA figures, more than 21,000 Nigerians applied for asylum in the EU+ between January 2023 and March 2024, signaling a troubling trend of migration driven by insecurity.A security expert said Briech UAS’s new technology promised to enhance Nigeria’s ability to detect, deter, and respond to security threats in real-time.“For the fast rising tech company, some features stand out an advanced surveillance and thermal imaging for wide-area monitoring, real-time intelligence gathering to support on-ground tactical operations, rapid response capabilities to intercept or neutralise threats before escalation and cost-effective, scalable solutions for ongoing border and community surveillance“These drones also have potential applications beyond combat, such as disaster response, infrastructure inspection, and search-and-rescue efforts.“As traditional security methods struggle to match the speed and complexity of modern threats, indigenous technological solutions like Briech’s are increasingly vital.“The partnership with the Nigerian Army reflects a broader strategic shift—one that embraces innovation, local expertise, and adaptive warfare tactics to restore safety and rebuild public confidence.“As Briech UAS positions Nigeria at the forefront of drone-powered security innovation in Africa, citizens and stakeholders alike are watching with cautious optimism there is a dim light at the end of the tunnel,’’ he said.The Chief of Defence Staff (CDS), Gen. Christopher Musa, described the initiative as a significant step in Nigeria’s journey toward self-reliance in defence technology and national security enhancement.He said that the innovation was a game-changer in an era of complex and asymmetric security threats, emphasising the significance of producing local military solutions, especially in the face of global politics and procurement challenges.“These force multipliers will play a vital role in enhancing the operational effectiveness of our military, particularly in a world where global politics surrounding the procurement of advanced military hardware have become more intricate.’’The CDS said that countries that did not produce such solutions faced bureaucratic bottlenecks and diplomatic hurdles when acquiring the critical platforms.“We are facing such challenges directly, if you do not produce what you need, you will be at the mercy of others, even when you have the financial resources to acquire them,” he said.He said that the drones would help Nigeria respond swiftly to security challenges, cutting down on dependence on foreign equipment.In his submission at the unveiling, Gov. Caleb Mutfwang of Plateau said that homegrown solutions had great impact for the country’s security needs.He emphasised on the importance of protecting national sovereignty and safeguarding the country from activities of non-state actors.“We have made a mistake by allowing non-state actors to acquire capabilities that rival those of state actors,” Mutfwang said.He said that Plateau was actively working with local manufacturers like Briech UAS, with drones already deployed in the state, improving the effectiveness of security operations.Deserving no less attention, Echefu, during a media tour of the firm’s security facilities, said that through innovation and advanced technology, Nigeria could handle its security challenges.According to him, the company provides intelligence support for Nigeria’s security agencies though digital forensics, tracking and critical assets as well as supply of combat and surveillance drones.He said it manufactured Arginin Reconnaissance Drones configured for high-performance reconnaissance and surveillance missions.“The company also produces Arsenio BFLY and Xander Reconnaissance drones among other super precise attack drones that can navigate difficult environments.“These systems are crucial in combating insurgent groups, adopting different drones for reconnaissance and attack missions.“The primary purpose was to demonstrate the capabilities of the security apparatus deployed to fight insurgency, its potential is to enhance counter-insurgency operations and mitigate the threats posed by insurgent groups.“The significance of this effort lies in stressing the potential of the equipment to enhance intelligence, surveillance, and reconnaissance (ISR) capabilities.’’Echefu said the tools would also improve force protection and reduce troop casualties by minimising reliance on manned reconnaissance missions.According to him, the use of commercial drones by insurgent groups presents significant challenges for security forces.“To address this, the security apparatus is leveraging technologies like drone detection and jamming systems, improved intelligence gathering, and counter-drone systems.“The system will generate insights from the collected data, allowing for better decision-making and improved resource allocation.“This system will provide at-a-glance dashboards showing the status and location of monitored items, including parameters like satellite imagery and intelligence gathering capabilities to support security agencies,’’ he said.Echefu said with the right support and increased investment, indigenous companies had the capacity to provide the needed logistics support to the military in the fight against insecurity.He acknowledged the support from government to the indigenous security firms and called for more policies to foster Nigerian companies’ growth, especially those in defence and security sector.“I can tell you that I am not the only one that is into supporting the various sectors, by local activities, local productions; there is a lot going on. People are even producing tractors in Nigeria now.“Nigeria has 100 per cent capacity right now to end this urgency with the number of local companies that are investing heavily.“The Nigerian military strongly supports local manufacturers through research collaboration and support,” Echefu said.Security analysts are of the view that more states should embrace drones for comprehensive surveillance, especially for hard-to-reach areas.They say collaboration between the Nigerian Military and Briech will boost cross-border counter-terrorism operations and strengthen internal control over weapons systems and logistics. (NAN)