NEWS

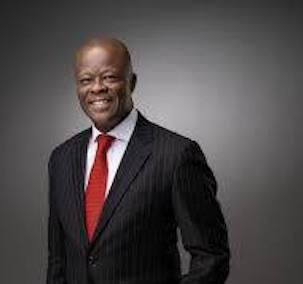

41 African Countries Set for Stronger Economic Growth, Says Edun

Mr Wale Edun the Minister of Finance and Coordinating Minister of the Economy, says 41 African countries are set for stronger economic growth in 2024.

Edun, who doubles as the Chairperson of the African Caucus, said this on Friday at the 2024 African Caucus Meeting in Abuja.

The African Caucus was established in 1963 to strengthen the voice of African Governors in the International Monetary Fund (IMF)/World Bank Group.

The theme of this year’s meeting is : “Facilitating Intra-African Trade: Catalyst for Sustainable Economic Growth in Africa

Edun projected growth of up to 3.8 per cent from about 3.4 per cent in 2022, and rising to 4.3 per cent in 2025.

“These exceed the global average of about 3.2 per cent, ” he said.

In his remarks, the Governor of the Central Bank of Nigeria, Mr Yemi Cardoso, said that Africa stood at a crossroads with unprecedented opportunities for development alongside significant challenges.

According to Cardoso, to navigate this complex landscape and set the continent on the path of sustainable economic growth, we must leverage the support of our global partners.

“In the past few months, the CBN has embarked upon bold reforms to return to the path of monetary

policy orthodoxy as well as remove observed distortions in the foreign exchange market.

“Our efforts have brought some significant outcomes as volatility in the

foreign exchange market has reduced measurably and our inflows have also

increased significantly.

” Interbank market activities have deepened while rates have begun to converge around the standing facilities ban,” he said.

He said that while challenges remained, the direction of travel was clearly positive, adding that the challenges in the operating environment presented significant hurdles.

“It is crucial that monetary and fiscal policies provide robust responses to mitigate the risks of rising inflation and the lingering effects of adverse supply shocks, which have significantly impacted our economies.

” I encourage us to share insights on our respective country experiences, working together in the spirit of unity that defines our continent.

“As we reflect on these issues, let us commit to a deeper understanding of these challenges and collaborate effectively to address them,” he said.

The African Union Commissioner for Economic Development, Trade, Tourism, Industry and Minerals, Ambassador Albert Muchanga, highlighted the importance of domestic resource mobilisation.

“We must see the African market as a viable channel for domestic resource mobilisation to address the issue of the continent’s sustenance,” he said.

Speaking virtually, the Director-General of the World Trade Organisation (WTO), Dr Ngozi Okonjo-Iweala, emphasised the need for greater regional integration.

Okonjo-Iweala said that trade within the continent and with the rest of the world had a crucial role to play in accelerating sustainable economic growth across Africa.

According to her, the global economic context is difficult.

“Many African countries are struggling to cope with tight financing, high borrowing cost and debt pressure.

“More trade and value addition are necessary to create the better jobs that our young people need.

According to UN data for 2021, only 13 per cent of Africa’s goods trade is internal, compared to 21 per cent for Southeast Asia, 39 per cent for the U.S Mexico, and Canada, and 60 per cent for Europe,” she said.

The Deputy Secretary-General of the United Nations, Amina Mohammed, called for trade facilitation, a Pan-African payment and settlement system, as well as increased access to energy and connectivity. (NAN)

NEWS

Dangote Petitions ICPC, Accuses NMDPRA Boss of Corruption, Abuses

By David Torough, Abuja

President of the Dangote Group, Alhaji Aliko Dangote, has petitioned the Independent Corrupt Practices and Other Related Offences Commission (ICPC) over alleged corruption and financial impropriety by the Managing Director of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), Ahmed Farouk, prompting the anti-graft agency to announce an immediate investigation.

In the petition filed yesterday and addressed to the ICPC Chairman, Musa Adamu Aliyu (SAN), Dangote called for Farouk’s arrest, investigation and prosecution, alleging that the NMDPRA chief had lived far beyond his lawful earnings as a public servant.

Dangote alleged that Farouk spent over $7 million within six years on the education of his four children in different schools in Switzerland—an amount he said could not be justified by the official’s legitimate income. The petition reportedly listed the names of the children, their schools and the sums paid to enable the commission verify the claims.

According to Dangote, the NMDPRA boss also used his position to embezzle and divert public funds for personal gain, actions he said had contributed to protests and instability in the downstream petroleum sector. He argued that Farouk had spent his entire adult working life in public service, making the alleged expenditure a clear case of illicit enrichment.

“It is without doubt that the above facts in relation to abuse of office, breach of the Code of Conduct for public officers, corrupt enrichment and embezzlement constitute gross acts of corruption,” Dangote stated, citing Section 19 of the ICPC Act, which prescribes up to five years’ imprisonment without an option of fine upon conviction.

He urged the ICPC to act decisively, stressing that the matter was already in the public domain, and pledged to provide documentary evidence to support his claims. Dangote added that a thorough probe would help safeguard the image of President Bola Ahmed Tinubu’s administration.

Confirming receipt of the petition, ICPC spokesman, Mr. John Odey, said the commission had received a formal complaint from Dangote through his lawyer against the CEO of the NMDPRA and would investigate the allegations.

“The ICPC wishes to state that the petition will be duly investigated,” Odey said in a terse statement.

Dangote, however, clarified that he was not calling for Farouk’s removal but for accountability. “He should be required to account for his actions and demonstrate that he has not compromised his position to the detriment of Nigerians,” he said, also urging the Code of Conduct Bureau and other relevant agencies to wade into the matter.

Speaking earlier at a press conference at the Dangote Petroleum Refinery, the business mogul accused the leadership of the NMDPRA of frustrating local refining through the continued issuance of petroleum product import licences despite rising domestic refining capacity. He claimed that licences covering about 7.5 billion litres of Premium Motor Spirit (PMS) had reportedly been issued for the first quarter of 2026, sustaining Nigeria’s dependence on imports and discouraging local investment.

Dangote warned that continued importation of refined products was pushing modular refineries to the brink of collapse, while benefiting entrenched interests at the expense of national development.

On fuel pricing, he assured Nigerians of further relief, announcing that PMS would sell at no more than ₦740 per litre from Tuesday, starting in Lagos, following a reduction of the refinery’s gantry price to ₦699 per litre. He said MRS filling stations would be the first to reflect the new price.

He added that the refinery had reduced its minimum purchase requirements to accommodate more marketers and was ready to deploy its Compressed Natural Gas (CNG) trucks nationwide to ensure affordability. Dangote also reiterated plans to list the Dangote Petroleum Refinery on the Nigerian Exchange to enable Nigerians to own shares.

“This refinery is for Nigerians first. I am not giving up,” he said.

As of the time of filing this report, the NMDPRA had yet to issue an official response to the allegations.

ReplyForward

Add reaction

NEWS

NDIC Liquidates Aso Savings, Union Homes, Pays N2m Deposits

By Tony Obiechina, Abuja

The Nigerian Deposit Insurance Corporation (NDIC) exercised its appointment as the liquidator of Aso Savings and Loans Plc and Union Homes Savings and Loans Plc following the revocation of the licenses by the Central Bank of Nigeria (CBN) yesterday.

The corporation stated that its appointment as the liquidator of the defunct mortgage banks was in line with the provisions of Section 12(2) of the Banks and Other Financial Institutions Act (BOFIA) 2020.

It maintained that in view of the development, it had commenced the liquidation process for Aso Savings and Loans Plc and Union Homes Savings and Loans Plc with the verification and payment of insured deposits to depositors based on some processes.

The NDIC stated on Verification and Payment processes that depositors of the two defunct mortgage banks would be paid their insured deposits up to the maximum amount of N2,000,000 per depositor, using the Bank Verification Number (BVN) as a unique identifier to locate their alternate bank accounts, into which the insured sums will be automatically credited.

It clarified that depositors with balances in excess of N2,000,000 would be paid the initial insured amount, while their outstanding balances would be settled as liquidation dividends upon the realisation of the assets and recovery of debts owed to (of) the failed banks.

To ensure this, the NDIC hinted that it would commence the sale of the banks’ assets and continue recovery of outstanding loans in order to expedite payment of uninsured sums.

On submission of claims by depositors, the corporation stated that verification and processing of depositors’ claims may be carried out online or physically.

Specifically, it advised depositors to submit their claims online by visiting the NDIC claims portal at https://ndic.gov.ng/claims-verification-forms/completing the digital claims form with all required information, and clicking the “Submit” button, adding that depositors who prefer physical verification should visit the nearest branch of the closed banks between Tuesday, December 16, 2025 and Thursday, December 30, 2025, where NDIC officials will be available to attend to them.

The NDIC further clarified: “For verification of deposits and subsequent payment of insured sums, depositors are required to present Proof of account ownership; A verifiable means of identification (Driver’s License, Permanent Voter’s Card, or National Identity Card); and Details of their alternate bank account and Bank Verification Number (BVN).

On activation of transaction alerts, it advised the depositors to ensure that transaction alerts are activated for their alternate bank accounts in order to receive notifications of payments. Where alerts are not active, depositors may check their account balances using their bank’s USSD codes or by visiting their bank branches.

This is even as it advised creditors of the closed banks to submit their claims online or by visiting the nearest branch of the banks between Tuesday, December 16, 2025 and Thursday, December 30, 2025, assuring that in accordance with the provisions of the law, payment of liquidation dividends to creditors will commence after all depositors have been fully paid.

In addition, the Corporation stated payment to the defunct banks’ staff would be made after the full payment to all depositors, from the proceeds of the sale of the banks’ assets, as liquidation dividends.

On payments to the affected banks’ shareholders, the NDIC promised that after the full payment to depositors and creditors, the shareholders shall subsequently be paid from further realisation of the banks’ assets and the recovery of outstanding debts, as liquidation dividends.

It advised debtors of the defunct banks to visit the Corporation’s Asset Management Department to ensure the settlement of their indebtedness in full.

NEWS

Reps Launch Nationwide Probe into Drug Abuse, Trafficking Crisis

By Ubong Ukpong, Abuja

The House of Representatives has commenced a nationwide investigation into Nigeria’s worsening drug abuse and trafficking crisis, pledging to expose systemic failures, hold erring institutions and corporate actors accountable, and recommend sweeping reforms to protect public health and national security.

The probe formally began yesterday in Abuja with the inauguration of an investigative hearing by the House Ad hoc Committee on Drugs, Trafficking, Alcohol and Tobacco Abuse.

Chairman of the committee, Rep. Oluwatimehin Adelegbe, described the scale of substance abuse in the country as a “National emergency,” warning that it now threatens the very fabric of Nigerian society.

“Today, we gather under the mandate of the Nigerian people and under the solemn weight of a crisis that threatens the soul of our nation,” Adelegbe said. “Drug abuse and illicit trafficking are no longer isolated problems; they have become a clear and present danger to our health, security and collective future.”

He said the committee was constituted to uncover the truth behind the growing crisis, identify institutional lapses, and propose far-reaching corrective measures capable of reversing what he called a deeply disturbing trend.

According to the lawmaker, cannabis is now smoked openly on the streets, methamphetamine use is spreading rapidly, and codeine-based cough syrups are sold almost as casually as soft drinks. He added that tramadol 200mg is trafficked with the same sophistication as hard narcotics, while cheap and hazardous alcoholic mixtures are destroying young lives in motor parks, campuses and marketplaces nationwide.

Adelegbe also accused some tobacco companies of exploiting regulatory loopholes to target minors through flavoured products, informal retail channels and misleading marketing practices. He further decried the influx of substandard pharmaceuticals, fake spirits and unregistered products into the country, blaming weak enforcement at ports, airports and land borders, which he said trafficking syndicates routinely exploit.

“Entire communities have been crippled by addiction, crime and preventable deaths. Nigeria is losing too many lives, too many futures, too many families,” he said, stressing that the investigation was not a witch-hunt or an anti-business move.

“We support industries and value investment, but no business model can be allowed to thrive at the expense of Nigerian lives. No profit margin can justify the destruction of our youth,” Adelegbe declared, adding that all stakeholders must cooperate fully with the committee.

Meanwhile, the United Nations Office on Drugs and Crime (UNODC) raised fresh alarm over the scale of drug use in Nigeria, describing the situation as significantly above the global average.

In a memorandum submitted to the committee, the UN agency cited the 2018 Nigeria Drug Use Survey conducted with the National Bureau of Statistics (NBS) and the European Union, which found that 14.4 per cent of Nigerians aged 15 to 64 use drugs. Cannabis was identified as the most commonly used drug, with an estimated 10.6 million users, followed by about seven million users of pharmaceutical opioids such as tramadol and codeine-based cough syrups.

The survey also revealed that nearly three million Nigerians suffer from drug use disorders requiring counselling or medical treatment, with women and girls disproportionately affected by stigma and limited access to care.

UNODC warned that drug use in Africa could rise by 40 per cent by 2030, a trend that could push Nigeria’s drug-using population beyond 20 million, posing what it described as an extreme threat to public health and public security.

Citing findings from the 2025 World Drug Report, the agency noted that cannabis remains the most widely used drug globally, accounting for about 42 per cent of drug use disorder cases, while opioids remain the deadliest, responsible for nearly two-thirds of drug-related deaths worldwide.

To stem the tide, UNODC recommended a balanced, evidence-based approach combining intelligence-led law enforcement with expanded prevention, treatment and harm-reduction services. Its proposals include legislative reforms, defined decriminalisation of possession for personal use, strengthened asset forfeiture and financial investigations, modernised precursor controls, and alternatives to incarceration for low-level, non-violent drug offences.

Also presenting a memorandum, the National Drug Law Enforcement Agency (NDLEA) reaffirmed its commitment to safeguarding Nigeria from illicit drugs and substance abuse. The agency commended the House for its proactive intervention and pledged technical support toward strengthening the National Drug Control Master Plan, while calling for improved legislation, tighter regulation, expanded treatment systems and increased operational resources.