BUSINESS

SEC Moves to Re-activate e-dividend Platform

By Tony Obiechina, Abuja

The Securities and Exchange Commission (SEC) said yesterday that efforts are ongoing to rebuild the e-Dividend Management Mandate System (e-DMMS) platform in a sustained effort to drive down unclaimed dividends in the capital market.

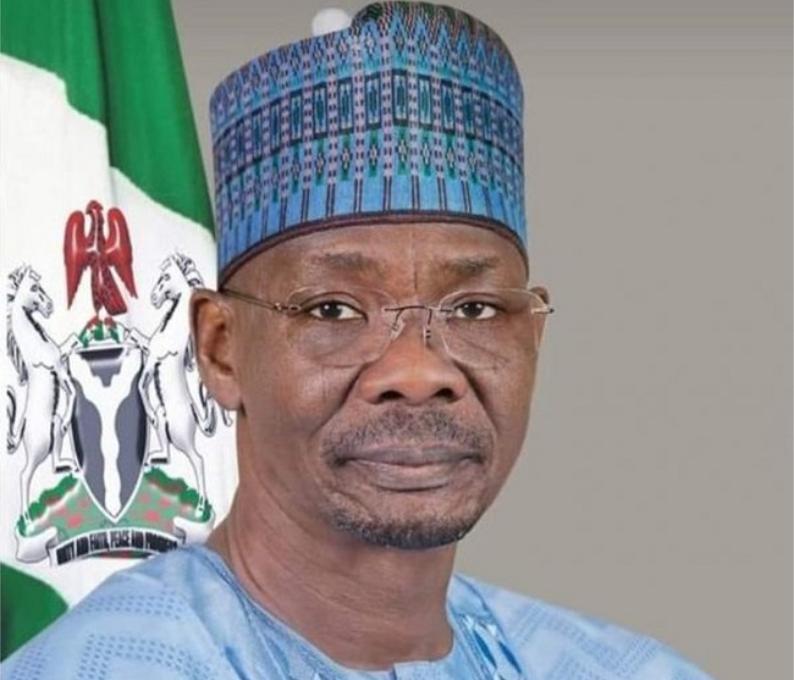

The Director General of the SEC, Mr.

Lamido Yuguda disclosed this during an interview in Abuja.He said members of the Capital Market Committee had adopted some measures to increase the number of mandated investors on the e-DMMS and reduce the quantum of unclaimed dividends in the market adding that the e-dividend Committee had been working on the platform and have concluded plans to have it rebuilt.

The Director General explained that this will involve having a centralized submission of E-dividend mandate forms, Application Programming Interface (API) for Banks and Registrars, and a revamped web interface among others.

Yuguda also disclosed that the SEC has invested a lot of resources as well as embarked on a number of programmes on investor education to ensure that people mandate their accounts to enable them receive the benefits of their investment in the capital market.

“The reason why the number may not be reducing as expected is because a lot of investors have not mandated their accounts. Dividends are now distributed electronically, so dividends go directly into the investors account and if everybody mandates their accounts there would be little unclaimed dividends in the system.

“This process is still open and can be done with the registrars, forms can be obtained from the banks too and it’s a very simple process. We also have on our website a tool that assists the investors to determine any unclaimed dividends that they have. And I would encourage everyone to take advantage of these tools or to directly speak to the complaints section of the SEC and we would guide that person appropriately” he stated.

The SEC DG expressed appreciation to the House of Representatives Committee on Capital Markets and Institutions on Unclaimed Dividends over its efforts to investigate the rising value of unclaimed dividend and unremitted withholding tax on dividends.

While assuring of the Commission’s readiness to provide all the necessary support to the Committee to enable it carry out its assignment, Yuguda also emphasised the need for the stakeholders in the financial sector to collectively work towards the enactment of the Investments and Securities Bill 2022, which will enhance the performance of the Nigerian capital market and align it with global best practices.

Economy

34 States Shunned 35th Enugu Int’l Trade Fair

No Fewer than 34 states in the country failed to honour invitation to attend the just-concluded 35th Enugu International Trade Fair.

Reports says that only the Federal Capital Territory (FCT), Abuja; Ebonyi State and the host state, Enugu State, graced the 11-day international goods, services and idea showcasing fiesta.

The fair, which began on April 5 and ended on Monday, April 15, was themed: “Promoting made-in-Nigeria products for global competitiveness.

”Reacting, the Director-General of Enugu Chamber of Commerce, Mr Uche Mbah, said that the chamber followed due diligence in the invitation of all states to the fair.

Mbah noted that official letters were sent and official follow-up on the letters were made to ensure their presence and availability.

According to him, “we did everything to get them to add colour and increase the showcasing of products from different parts of the country and their investment viability.

“We did put in spirited efforts to see that all states participated, as most of them do previously.

“But it is unfortunate that many did not respond after receiving official letters, phone calls and interpersonal follow-ups were made.

“We got clear assurances from Kano State but they did not show up.

“We pushed harder to get Abia State but in the end, we were told that the governor did not approve,” he said.

Reports says that over 100 organisations were at the fair, which included: over 50 private companies as well as over 45 Federal and State government ministries, agencies and departments. (NAN)

BUSINESS

Fidelity Bank Posts N124.3bn Pre-tax Profit in 2023

Fidelity Bank Plc has recorded a profit before tax of N124.3 billion for the year ended Dec. 31, 2023, indicating 131.5 per cent increase from N53.7 billion posted in the 2022 finacial year.

The bank disclosed this in its 2023 full year audited financial statement issued to the Nigerian Exchange Ltd.

(NGX) on Tuesday in Lagos.Fidelity Bank said it would also be paying investors a final dividend of 60k per share and total dividend of 85 kobo per share for the reporting period.

This represents a 70 per cent increase compared to the 50 kobo per share paid to its shareholders in the previous year.

The financial institution stated that this led to an increase in Return on Average Equity (RoAE) of 26.

5 per cent in the year under review, from 15.6 per cent in the corresponding year.According to the financial statement, the bank grew its gross earnings by 64.9 per cent year-on-year, to N555.83 billion.

The bank stated that this was driven by 81.6 per cent growth in net interest income which increased from N152.7 billion in year 2022 to N277.37 billion in the 2023 financial year.

This led to a profit after tax of N99.45 billion, representing a 112.9 per cent annual growth.

Commenting on the performance, Dr Nneka Onyeali-Ikpe, Managing Director, Fidelity Bank, said that the financial institution closed the financial year with strong double-digit growth across key income and balance-sheet lines.

Onyeali-Ikpe stated that the bank’s performance in 2023 was an attestation of its capacity to deliver superior returns to shareholders despite the difficulties in our operating environment.

She said: “A review of the financial performance showed that the bank grew its net interest income by 81.6 per cent to N277.4 billion.

“This was driven by a 55.5 per cent increase in interest income, thus reflecting a steady rise in asset yield throughout the year.

“The average funding cost dropped by 20bps to 4.4 per cent due to increased low-cost funds that grew from 83.6 per ent in 2022 to 97.4 per cent in 2023.

“The combination of higher asset yield and lower funding cost led to an increase in Net Interest Margin (NIM) of 8.1 per cent from 6.3 per cent in 2022 financial year.”

According to her, the total customer deposits crossed the N4 trillion mark, as deposits grew by 55.6 per cent from N2.6 trillion in 2022.

She noted that the increase was driven by 81.1 per cent growth in low-cost funds.

Onyeali-Ikpe explained that despite the challenging operating environment, the bank reaffirmed its devotion to helping individuals grow and inspiring businesses to thrive.

She said the bank also committed to empowering economies to prosper by increasing net loans and advances to N3.1 trillion from N2.1 trillion in 2022 financial year.

The managing director stated that despite the growth in its loan portfolio, regulatory ratios were maintained well above the required thresholds.

Onyeali-Ikpe noted that the bank liquidity ratio stood at 45.3 per cent in the year ended 2023, from 39.6 per cent in the year 2022, while capital adequacy ratio rose to 16.2 per cent, compared to the minimum requirement of 15.0 per cent.

“We recognise the changing dynamics in the Nigerian banking space and the need to monitor and proactively manage evolving risks.

“The proposed final dividend of 60 kobo per share reflects our commitment to strong value creation and returns to our shareholders.

“Fidelity Bank has consistently paid dividend since 2006,” she said.(NAN)

Economy

Nigeria’s Inflation Hit 33.20% in March, says NBS

The National Bureau of Statistics (NBS) says Nigeria’s headline inflation rate increased to 33.20 per cent in March 2024.

The NBS said this in its Consumer Price Index (CPI) and Inflation Report for March, which was released in Abuja on Monday.

According to the report, the figure is 1.50 per cent points higher compared to the 31.

It said on a year-on-year basis, the headline inflation rate in March 2024 was 11. 16 per cent higher than the rate recorded in March 2023 at 22.04 per cent.

In addition, the report said, on month-on-month basis, the headline inflation rate in March 2024 was 3.02 per cent, which was 0.10 per cent lower than the rate recorded in February 2024 at 3.12 per cent.

“This means that in March 2024, the rate of increase in the average price level is less than the rate of increase in the average price level in February 2024.”

The report attributed the increase in the headline index for March 2024 on a year-on-year basis and month-on-month basis to increase in some goods and services at the divisional level.

It said these increases were observed in food and non-alcoholic beverages, housing, water, electricity, gas, and other fuel, clothing and footwear, and transport.

Others, it said, were furnishings, household equipment and maintenance, education, health, miscellaneous goods and services, restaurants and hotels, alcoholic beverage, tobacco and kola, recreation and culture, and communication.

It said the percentage change in the average CPI for the 12 months ending March 2024 over the average of the CPI for the previous corresponding 12-month period was 27.13 per cent.

“This indicates a 6.76 per cent increase compared to 20.37 per cent recorded in March 2023”, it said.

The report said the food inflation rate in March 2024 increased to 40.01 per cent on a year-on-year basis, which was 15.56 per cent higher compared to the rate recorded in March 2023 at 24.45 per cent.

“The rise in food inflation on a year-on-year basis is caused by increases in prices of Garri, Millet, Akpu (uncooked fermented, which are under bread and cereals class), Yam Tuber, and Water Yam.

“Others are Dried Fish Sadine, Mudfish Dried, Palm Oil, Vegetable Oil, Beef Feet, Beef Head, Liver, Coconut, Water Melon, Lipton Tea, Bournvita, and Milo”, NBS said.

It said on a month-on-month basis, the food inflation rate in March was 3.62 per cent, which was a 0.17 per cent decrease compared to the rate recorded in February 2024 at 3.79 per cent.

“The fall in food inflation on a month-on-month basis was caused by a decrease in the average prices of Guinea corn flour, Plantain Flour etc (under Bread and Cereals class); Yam, Irish Potato, and CocoYam.

“Others are Titus fish, Mudfish Dried, Lipton, Bournvita, and Ovaltine”, it said.

The report said that “all items less farm produce and energy’’ or core inflation, which excludes the prices of volatile agricultural produce and energy, stood at 25.90 per cent in March on a year-on-year basis.

“This increased by 6.26 per cent compared to 19.63 per cent recorded in March 2023.’’

“The exclusion of the PMS is due to the deregulation of the commodity by removal of subsidy.”

It said the highest increases were recorded in prices of bus journey within the city, actual and imputed rentals for housing, consultation fee of a medical doctor, etc.

The NBS said on a month-on-month basis, the core inflation rate was 2.54 per cent in March 2024.

“This indicates a 0.37 per cent increase compared to what was recorded in February 2024 at 2.17 per cent.”

“The average 12-month annual inflation rate was 22.26 per cent for the 12 months ending March 2024, this was 5.04 per cent points higher than the 17.22 per cent recorded in March 2023”, it said.

The report said on a year-on-year basis in March 2024, the urban inflation rate was 35.18 per cent, 12.11 per cent higher compared to the 23.07 per cent recorded in March 2023.

The report said on a year-on-year basis in March 2024, the rural inflation rate was 31.45 per cent, which was 10.37 per cent higher compared to the 21.09 per cent recorded in March 2023.

“On a month-on-month basis, the rural inflation rate was 2.87 per cent, which decreased by 0.20 per cent compared to February 2024 at 3.07 per cent’’, it said.

On states’ profile analysis, the report showed that in March, all items inflation rate on a year-on-year basis was highest in Kogi at 39.97 per cent, followed by Bauchi at 38.34 per cent, and Kwara at 38.10 per cent.

It, however, said the slowest rise in headline inflation on a year-on-year basis was recorded in Borno at 25.78 per cent, followed by Benue and Taraba at 28.12 per cent, and Katsina at 28.32 per cent.

The report, however, said in March 2024, all items inflation rate on a month-on-month basis was highest in Zamfara at 3.90 per cent, followed by Abia at 3.89 per cent, and Ondo at 3.75 per cent.

“Borno at 1.46 per cent, followed by Yobe at 1.84 per cent and Adamawa at 1.85 per cent recorded the slowest rise in month-on-month inflation”, NBS said.

The report said on a year-on-year basis, food inflation was highest in Kogi at 48.46 per cent, followed by Kwara at 46.18 per cent, and Akwa Ibom at 45.18 per cent.

“Nasarawa at 33.76 per cent, followed by Borno at 34.28 per cent and Bauchi at 34.38 per cent recorded the slowest rise in food inflation on a year-on-year basis’’, it said.

The report, however, said on a month-on-month basis, food inflation was highest in Abia at 5.17 per cent, followed by Cross River at 5.14 per cent, and Bayelsa at 4.75 per cent.

“Cross River stood at 1.59 per cent, followed by Yobe at 2.08 per cent and Adamawa at 2.12 per cent, recorded the slowest rise in inflation on a month-on-month basis”, it said. (NAN)