Business News

World Bank Raises the Alarm on Nigeria’s Rising Debts

- Debt Stock of Developing Countries Hits $7. 8trl

By Mathew Dadiya, Abuja

The World Bank has warned that global debt burden is rising revealing that total external debt of low and middle-income countries climbed 5.3 percent to $7.8 trillion in 2018 while net debt flows (gross disbursements minus principal payments) from external creditors tumbled 28 percent to $529 billion.

The disclosure is contained in the World Bank’s International Debt Statistics 2020 released on Thursday.

Although on average, the external debt burden of low- and middle-income countries was moderate, several countries have been on a deteriorating debt trajectory since 2009, the report indicated.

The share of low- and middle-income countries with debt-to-GNI ratios below 30 percent has shrunk to 25 percent, down from 42 percent ten years ago. Similarly, the share of countries with high debt-to-export ratios has climbed.

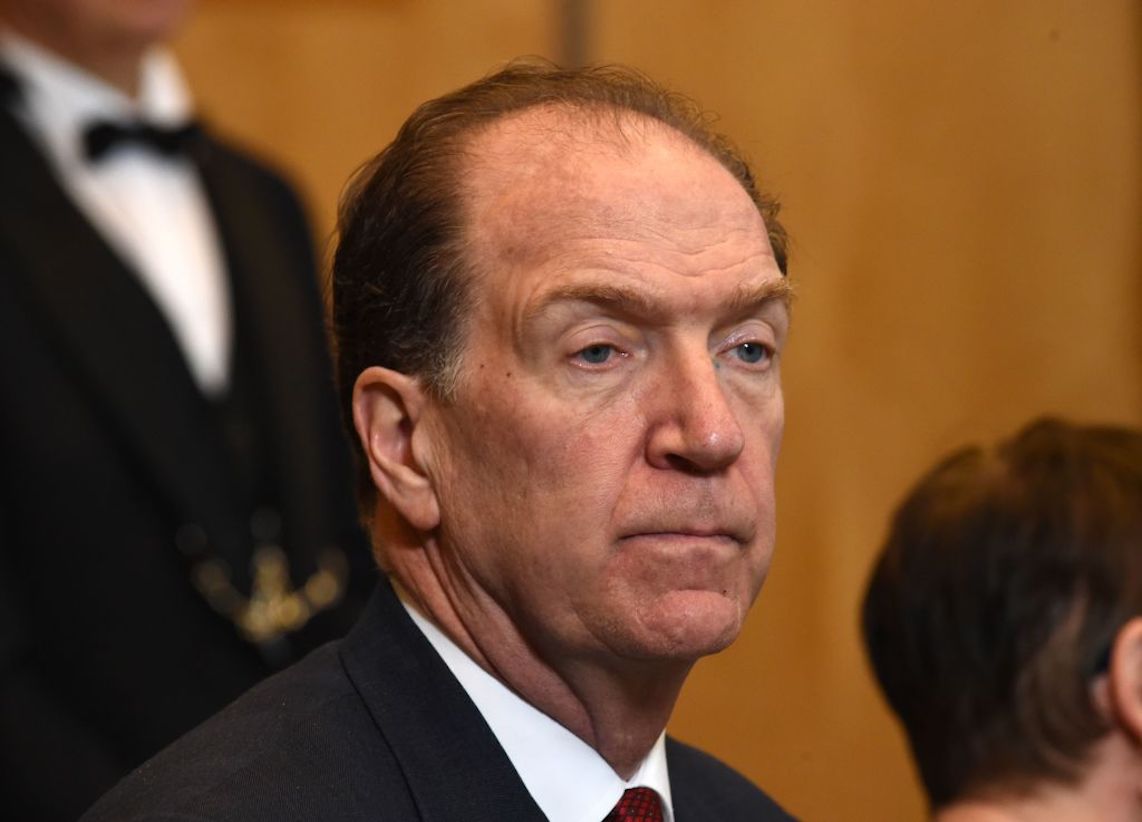

World Bank Group President, David Malpass, said that to grow faster, many developing countries need more investment that meets their development goals.

Malpass said, ”debt transparency should extend to all forms of government commitments, both explicit and implicit. Transparency is a critical part of attracting more investment and building an efficient allocation of capital, and these are essential in our work to improve development outcomes.”

Debt stocks were driven up by a 15 percent jump in China, fueled by investor appetite for renminbi-denominated assets.

Excluding the 10 largest borrowers (Argentina, Brazil, China, India, Indonesia, Mexico, the Russian Federation, South Africa, Thailand, and Turkey), external debt stocks rose 4 percent.

Sub-Saharan countries excluding South Africa saw debts stocks swell by 8 percent on average in 2018, and over half the countries in the region have seen external debt stocks double since 2009.

Net debt inflows to low- and middle-income countries from multilateral creditors surged 86 percent, principally due to the International Monetary Fund’s support for Argentina.

Excluding that loan, net inflows from multilateral creditors to other low- and middle-income countries were unchanged from the previous year. Lending from non-Paris Club creditors to countries eligible to borrow from the World Bank’s International Development Association (IDA), its fund for the poorest countries, slowed.

The share of new commitments from non-Paris Club bilateral creditors fell to 17 percent (a continued decline from 43 percent in 2010) while the share held by Paris Club bilateral creditors remained steady at 12 percent.

This edition of International Debt Statistics features for the first time a breakdown of public and publicly guaranteed debt – government and other public sector debt, as well as private debt that is government guaranteed.

Also, World Bank Development Economics Data Group Director, Haishan Fu said

“Borrowing patterns and debt instruments have changed over time, and so has the depth and scope of International Debt Statistics.

What has not changed is the core objective of the report: providing comprehensive, timely data on the external debt of low- and middle-income countries to support debt management and related policy decisions.”

Bond issuance by low- and middle-income countries – a primary source of external financing for some countries fell 26 percent to $302 billion in 2018 amid heightened global uncertainty, tighter capital markets, and credit ratings downgrades.

However, Sub-Saharan countries excluding South Africa issued a record-high $17 billion in bonds.

Issues in 2018 were characterized by longer maturities and all were oversubscribed.

Net financial flows to low- and middle-income countries – including both debt and equity – slipped 19 percent in 2018 to $1 trillion.

The reports shown that excluding China, which accounts for half of net debt flows and 43 percent of net equity flows, net financial flows to low- and middle-income countries tumbled 28 percent.

Business News

Afreximbank Closes $282 million India-focused Club Deal

By Tony Obiechina, Abuja

The African Export-Import Bank (Afreximbank) has announced the successful completion of a first-of-its-kind India-focussed club deal for US$282.00 million.

Initiated for the exclusive participation of Indian lenders, and arranged by Bank of Africa UK PLC, the primary syndicated club deal saw participation from Indian lenders through their overseas branches and subsidiaries in the Dubai International Financial Centre in the United Arab Emirates, Singapore and Mauritius.

The facility, which was backed by six participating banks and financial institutions, including five that joined as first-time lenders to Afreximbank, helping the Bank achieve its objective of diversifying its funding sources, carries a three-year tenor.

At a commemorative event held in Dubai, U.A.E., to mark the conclusion of the deal, Haytham ElMaayergi, Executive Vice President at Afreximbank, said that the conclusion of the initiative represented a major milestone for the Bank as it sought to fulfil the key objectives of its funding programme.

Highlighting the importance of investing in, and for, Africa, Mr. ElMaayergi said: “this facility will help Afreximbank to continue to play a major role in the development of intra-African trade and trade between Africa and the rest of the world, particularly with India.

It is a testament to the rapid growth in Africa’s economic relationship with India and is evidence of Afreximbank’s growing ability to harness resources into Africa and to fund trade finance related investments that would have a positive impact on trade between Africa and India.”

Chandi Mwenebungu, Director and Group Treasurer of Afreximbank, reviewing the Bank’s vision for Africa, said that its funding objectives included achieving the diversification of its liability book by geography, investor type and tenor.

Also addressing guests at the event were Said Adren, CEO of Bank of Africa UK PLC, who thanked the lenders for their participation, and Zineb Tamtaoui, General Manager of Bank of Africa, Dubai Branch, who expressed appreciation for the opportunity to put together “a landmark deal that would be a stepping stone to many India-focused club deals going forward.”

Business News

Geregu Power Earns N50.4bn From Electricity Sales, Capacity Charges

By Tony Obiechina, Abuja

Geregu Power Plc has generated N50.4bn on electricity sales and capacity charges to Nigerians in the first quarter of 2024.

The power company which is the first listed power company of the Nigerian Exchange Ltd disclosed the performance in its Q1, 2024 financial statement.

The company grew its Q1 revenue by 225 per cent from N14.

2bn in 2023 to N50. 4bn in 2023.A breakdown reveals that Geregu Power sold energy worth N31bn and received N19bn as revenue from capacity charge.

Recall that the power company posted an annual revenue of N82.9bn in the full year of 2023 but it has covered half of the amount in Q1.

The revenue was above the company’s forecast for Q1 2024 when it projected its revenue to rise to N31.24bn.

Geregu Power recorded a profit before tax of N21.9bn up from the N5.3bn recorded in Q1 of last year, reflecting 307.8 per cent growth.

During the period underreview, the company saw its profit after tax rose by 307.3 per cent to N14.46bn from N3.54bn recorded in Q1 of last year. In the full year 2023, the company made N16.1bn net profit.

The net profit was above the company projection of N5.5bn.

Geregu Power took an income tax charge of N7.43bn, up from the N1.8bn in Q1 2023. The tax charges were higher than the N2.7bn projected for Q1 2024.

The company also spent N21.5bn on the cost of sales involving gas supply and transportation, up from the N6.6bn spent on gas supply and transportation in Q1 2023.

Business News

CBN Shakes Up Banking Sector: A Paradigm Shift Unveiled

By Ademola Oyetunji

In a surprising turn of events on Wednesday, the Central Bank of Nigeria (CBN) dissolved the boards of three prominent commercial banks – Keystone, Polaris, and Union Bank. This move, although unanticipated, transpired despite the Central Bank’s recent endorsement of these banks’ financial soundness.

Governor Olayemi Cardoso, at his inaugural address during the Chartered Institute of Bankers of Nigeria (CIBN) annual dinner last year, had lauded Nigeria’s financial sector’s resilience in 2023.

Stress tests conducted on the banking industry indicated its strength under various economic scenarios. However, Cardoso highlighted the need for banks to reassess their responsible banking framework, a sentiment echoed by President Tinubu.President Tinubu’s evident discontent with the Godwin Emefiele-led CBN triggered a comprehensive review of the financial system. A special investigator, Jim Obazee, was appointed to conduct a forensic investigation into Emefiele’s tenure, with damning revelations emerging. Recent developments suggest the initiation of a full-blown financial system reform.

The CBN’s dissolution announcement and the subsequent appointment of new executives for the affected banks, including Yetunde Oni, Mannir U. Ringim, Hassan Imam, Chioma A. Mang, Lawal M. Omokayode, and Chris Onyeka Ofikulu, might mark the beginning of implementing the investigation’s recommendations – a significant cleanup of the financial sector.

Allegations surfaced during the investigation, suggesting non-cooperation from some bank executives and Emefiele’s questionable acquisitions through proxies and cronies. Cardoso may have secured presidential approval for the CBN’s decisive action.

The CBN cited various infractions by the banks, including regulatory non-compliance, corporate governance failures, and activities threatening financial stability. Despite the challenges, the CBN assured the public of depositors’ fund safety and its commitment to upholding a safe, sound, and robust financial system.

The Special Investigator’s report revealed documents pointing to Emefiele’s involvement in Titan Trust Bank and Union Banks’ acquisitions with ill-gotten wealth. The CBN’s swift replacement of the ousted chief executives received widespread commendation, especially from high-net-worth stakeholders aiming to avert a crisis of confidence within the affected banks.

Adewale Aderounmu, an industrialist, applauded the CBN for implementing effective policies under Olayemi Cardoso’s leadership, despite detractors’ actions against the Naira. Ayomide Deepak, an Abuja-based stockbroker, welcomed the action but emphasized the need for caution in handling revelations from the investigation to prevent further economic challenges.

As the CBN wields its regulatory hammer on these banks, the hope is that other bank executives and investors will learn valuable lessons for the sake of the economy. The CBN’s action is perceived as a strategic move aimed at revitalizing the economy and financial system, not a mere vendetta.

*Ademola Oyetunji writes from Ibadan.